Displaying items by tag: Norske Skog

Norske Skog's accounts for the first quarter of 2013

The accounts of Norske Skog for the first quarter of 2013 will be published on Thursday 25 April at 7:00 AM CET.

There will be a presentation of the accounts at DnB's offices in Oslo, Bjoervika at 8:30 a.m. CET. The presentation will be transmitted live through a link on Norske Skog's website www.norskeskog.com. A recording of the presentation will be made available.

An international telephone conference will further be held at 1:00 PM CET. A podcast of the conference will be made available. Details for the telephone conference below:

|

+44(0)20 7136 2055 |

Confirmation code: 3074890 |

We kindly ask participants to dial in before 12:55 PM CET.

The President and CEO, Sven Ombudstvedt, and other members of corporate management will participate in both events.

Please observe that Norske Skog now has entered a "silent period" ahead of the results.

Norske Skog - Covenant reset

Norske Skog has reached an agreement with its bank syndicate resetting first quarter 2013 covenants related to the revolving credit facility (RCF). The new covenants are a leverage ratio of 5.75:1 and an interest cover ratio of 1.75:1.

The size of the RCF was reduced to EUR 70 million, from EUR 140 million, a size more in line with actual back-up liquidity requirements of the group. Norske Skog is working on refinancing the bank facility, and has a continuous dialogue with its four relationship banks regarding possible covenant resets for later quarters.

Norske Skog, Communications and Public Affairs

Norske Skog: recommendations of the election- and remuneration committee

Norske Skog's election- and remuneration committee recommends Ingelise Arntsen as a new member of the board of directors. Dag J. Opedal is recommended as new chair of the election- and remuneration committee, and Olav Veum is recommended as a new member of the election- and remuneration committee.

- The proposals of the committee regarding the new board member and new members of the election- and remuneration committee are unanimous. Ingelise Arntsen has extensive experience from industry and the energy industry, both through operational management and a number of directorships, says chair of the committee, Tom Ruud.

Board of directors

The committee proposes the re-election of Eivind Reiten as chair of the board. The committee also proposes the re-election of the remaining directors Eilif Due, Finn Johnsson, Siri Beate Hatlen, Jon-Aksel Torgersen and Karen Kvalevåg. In line with last year, no deputy chair is proposed.

Ingelise Arntsen (46) has extensive board and management experience from Norwegian and international activities in the industrial and energy sectors. She is currently CEO of Sway Turbine AS and a board member of Multi Consult AS, EAM Solar ASA and Grieg Seafood ASA. She has previous experience from companies including Kvaerner and Statkraft. She has a Bachelor of Science in Economics from the Copenhagen Business School.

In addition to the seven shareholder-elected board members, three board members will be elected by and among the employees of the company.

Election- and remuneration committee

Dag J. Opedal is proposed as new chair, replacing Tom Ruud. Olav Veum is proposed as a new member, replacing Ole H. Bakke. It is proposed that Helge Leiro Baastad and Kirsten Idebøen are re-elected as members of the election- and remuneration committee.

Dag J. Opedal is a graduated economist and has a Master of Business Administration (MBA) from INSEAD. He has previously held the position of CEO in Orkla ASA. He is Chairman of Vizrt Ltd. and Meltwater B.V. and a board member of Telenor ASA, Nammo AS and Norwegian Church Aid.

Olav Veum is a forest owner and has previously held positions including that of general manager in the Western Telemark Business Forum and business manager in Fyresdal municipality. He is currently chair of the Norwegian Forest Owners' Association, AT Skog SA and a board member of the Norwegian Agricultural Cooperative.

Overview

If the proposals of the election- and remuneration committee are adopted, the governing bodies in Norske Skog will have the following shareholder-elected composition following the annual general meeting:

|

Board of directors |

Election committee |

|

Eivind Reiten (chair) Ingelise Arntsen Eilif Due Finn Johnsson Karen Kvalevåg Jon-Aksel Torgersen |

Dag J. Opedal (chair) Helge Leiro Baastad Kirsten Idebøen Olav Veum |

Norske Skog: Challenging market and lower debt

Norske Skog continues to reduce debt and fixed costs despite challenging markets. Net loss was significantly influenced by non-cash items such as impairments and change in value of energy contracts.

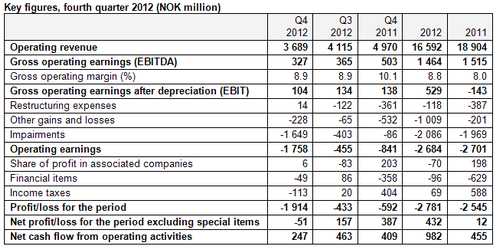

Norske Skog had gross operating earnings (EBITDA) in the fourth quarter of 2012 of NOK 327 million, down from NOK 365 million in the third quarter. This decline was due to weak seasonal effects and NOK appreciation. Gross operating earnings for the full year 2012 were NOK 1 464 million, a reduction of NOK 51 million from 2011, mainly due to lower production capacity after the closure of Norske Skog Follum, sale of Norske Skog Bio Bio and Norske Skog Parenco.

Net profit before special items were NOK 432 million in 2012 compared to NOK 12 million in 2011. The net loss of NOK 2.8 billion for 2012 was heavily influenced by NOK 3.2 billion in impairments, change in value of energy contracts and restructuring expenses. Impairments reflect increased uncertainty about sales price expectations. In addition, reassessment of Norske Skog's business in Australasia and reduction in the expected useful life of Norske Skog Walsum influenced impairments.

Cash flow from operating activities was NOK 382 million before net financial payments in the quarter. Underlying interest expenses in 2012 fell from 2011 in line with the reduction of net debt.

- Our operating earnings before special items have improved in 2012. Although our mill portfolio was reduced by three mills in 2012, we have made profitability improvements through cost input efficiencies and reduced working capital and fixed costs. We have actively managed capacity to counter market imbalances, says Sven Ombudstvedt, President and CEO of Norske Skog.

- The main task ahead is to create a better balance between supply and demand, improve productivity and cut expenses to improve margins, says Ombudstvedt.

Net interest-bearing debt was reduced by NOK 1.8 billion in 2012, totalling NOK 6.0 billion at the year end. Net interest-bearing debt was reduced by NOK 264 million in the fourth quarter. Net interest-bearing debt has been reduced from NOK 14 billion at the beginning of 2009 to NOK 6.0 billion in 2012, a decrease of NOK 8 billion over the last four years.

- We have strengthened the company's financial position considerably through a substantial reduction in our net interest bearing debt in recent years, says Ombudstvedt.

Markets

The prices for our products remained relatively stable throughout 2012.

Newsprint Europe

Year-to-date demand for newsprint in Europe declined by 9% in 2012 compared to 2011. Gross operating margin was relatively stable in Europe, but negatively impacted by exports and an appreciating NOK.

Newsprint outside Europe

Demand for newsprint in Oceania was weak, with a year-to-date decline of 13% in 2012 compared to 2011. Latin America saw a more modest decrease of 3%.

Magazine paper

An appreciating NOK adversely affected the export business. Year-to-date demand for magazine paper in Europe declined by 6% in 2012 compared to 2011. A somewhat better development for the smaller SC (uncoated) segment (minus 3%) compared to the larger LWC (coated) segment (minus 8%) was largely due to product substitution.

Active capacity management

Norske Skog ceased production at Norske Skog Follum in 2012 and one of two machines at Norske Skog Tasman in January 2013. Norske Skog sold Norske Skog Bio Bio and Norske Skog Parenco in 2012. As a consequence of these restructuring activities, the total annual production capacity is reduced from 4.4 to 3.7 million tonnes (18%).

Capacity utilisation for the group in the fourth quarter was 87% compared to 90% in the third quarter with active capacity management. For 2012, capacity utilisation was 88% (87% for 2011).

- The closures of five machines during 2012 have been difficult but necessary decisions due to declining demand for our products. Unfortunately, these decisions negatively affect the lives of our employees and their families. We believe in our industry. Therefore, we are investing AUD 84 million in the conversion of one machine at Norske Skog Boyer from newsprint to catalogue paper. In addition, we invest NOK 220 million at Norske Saugbrugs that will reduce energy consumption and fixed costs, says Ombudstvedt.

Outlook for 2013

Norske Skog expects that the operating environment will remain challenging, with weak demand in both Europe and Australasia. Relatively stable costs and already announced industry-wide capacity closures will be supportive. Active capacity management will lead to low utilisation rates in the short term. Further NOK appreciation remains an additional risk.

- The market is still challenging, but we maintain our efforts to improve the group's competitive position and financial headroom. We will also work on improving regulatory framework in Norway, says Ombudstvedt.

Follow these links to the full presentations

Q4 2012 Norske Skog quarterly report

Q4 2012 Norske Skog presentation

Relocation of Norske Skog's headquarters to Oslo

The President and CEO, Sven Ombudstvedt, has signed a lease contract for Norske Skog's new headquarters at Skøyen. The headquarters will be located centrally at Skøyen in Fram Eiendom's new building in 49 Karenslyst Allé in Oslo. The move will take place in early June 2013.

The President and CEO, Sven Ombudstvedt, has signed a lease contract for Norske Skog's new headquarters at Skøyen. The headquarters will be located centrally at Skøyen in Fram Eiendom's new building in 49 Karenslyst Allé in Oslo. The move will take place in early June 2013.

Norske Skog has undergone a major reorganisation and downsizing in recent years, reducing the need for the large premises at Oxenøen.

- Norske Skog is a very different company today than it was just a few years ago. Our intention is to have timely, efficient and pleasant premises, adapted to the number of employees and our current business, says Ombudstvedt.

Norske Skog has had its headquarters at Oxenøen in the municipality of Bærum since 1998. Norske Skog and the landlord of the head office at Oxenøen (OBOS and Aspelin-Ramm) have agreed to terminate the current lease contract during June 2013.

- We have been very pleased with the premises at Oxenøen, and wish to thank the landlord for good cooperation during the lease period, says Ombudstvedt.

DNB Næringsmegling has assisted Norske Skog in the efforts to find new premises.

Bellona and Norske Skog are working for a better environment

Norske Skog and the environmental foundation Bellona have signed a partnership agreement to create a more environmentally-friendly supply chain. During the last 20 years, Norske Skog has made significant investments to rationalise energy consumption and reduce greenhouse gas emissions. For many years, the company has received recognition from the international Carbon Disclosure Project (CDP) for social responsibility through its reporting of greenhouse gas emissions and targets for emission reductions.

Norske Skog and the environmental foundation Bellona have signed a partnership agreement to create a more environmentally-friendly supply chain. During the last 20 years, Norske Skog has made significant investments to rationalise energy consumption and reduce greenhouse gas emissions. For many years, the company has received recognition from the international Carbon Disclosure Project (CDP) for social responsibility through its reporting of greenhouse gas emissions and targets for emission reductions.

The collaboration aims to reduce the environmental impact of current production, utilising logs in a better way and finding the right commercial environmental solutions for production of bio-energy and bio-waste.

- Paper is environmentally friendly. It is based on a renewable resource, and paper is recycled to a large extent. Bark and other waste products are used for bio-energy. We want a partnership to examine possibilities for creating better commercial environmental solutions than we have today. A concrete example of the cooperation is that we hope to find good and environmentally friendly uses of ash that occurs as a by-product at Norske Skog's mills in Skogn and Halden, says President and CEO in Norske Skog, Sven Ombudstvedt.

Bellona acknowledges that environmental organisations can not drive forward environmental solutions on their own. Therefore, the environmental foundation has had a cooperation programme with industrial companies since 1998. The reason for this is that Bellona would like to team up with the players in the industry who take the environment seriously, so that we can develop tomorrow's environmental solutions together. To realise these environmental ambitions, great emphasis is placed on the long term. This partnership agreement gives the parties room to develop shared visions and strengthen each other's expertise. In addition, the company will contribute an agreed annual amount to Bellona.

- For a long time, we have been working intensively in Norske Skog to drive in an even more environmentally friendly manner, and we have defined and quantified targets for cuts in greenhouse gas emissions. To achieve these, we need to use energy more efficiently. For example, we are investing in a new and more energy efficient pulp plant at Norske Skog Saugbrugs in Halden. Furthermore, we see that we must do even more in the future, and we have great expectations for our cooperation with Bellona, says Ombudstvedt.

- Industry must take responsibility for environmental and climate-related matters. Bellona's vision is that we have a sustainable land-based industry in Norway. Together, Norske Skog and Bellona can find and implement solutions that are in line with our vision and simultaneously provide a viable industry, said Frederic Hauge, technical manager at the Bellona Foundation.

- We need manufacturing jobs, and the industry produces goods we depend on. At the same time, all manufacturing operations lead to increased use of energy and emissions to our environment. The goal must be to reduce these drawbacks as much as possible, and we in Bellona wish to contribute to Norske Skog being a pioneer in this area, says Frederic Hauge.

Norske Skog, Third quarter 2012: Good cash flow and lower debt

Good capacity utilisation, with high export levels and lower costs, counteracted the effects of the weak market development in Europe and Australia. The significant reduction in debt was a result of strong cash flow.

Good capacity utilisation, with high export levels and lower costs, counteracted the effects of the weak market development in Europe and Australia. The significant reduction in debt was a result of strong cash flow.

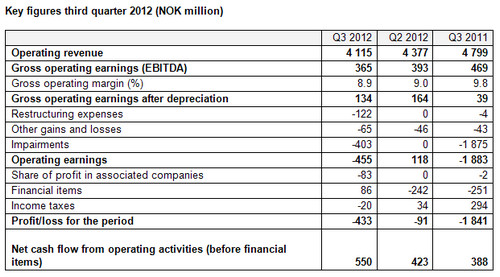

Gross operating earnings in the third quarter were NOK 365 million, compared to NOK 393 million in the previous quarter. The weak markets in Europe and Australasia were offset by lower variable- and fixed costs and effective production adjustments.

- Despite very challenging markets, we have been able to implement effective production adjustments, considerable cost reductions and a significant debt reduction this year, says President and CEO in Norske Skog, Sven Ombudstvedt.

Cash flow from operating activities (before financial items) was NOK 550 million, an improvement of NOK 162 million from the same quarter last year. The good cash flow for the period was a result of an effective realisation of trade receivables and reduction of inventories. Net interest-bearing debt during the quarter decreased from NOK 6.9 billion to NOK 6.3 billion, and has decreased by NOK 1.6 billion this year, primarily due to cash flow from operating activities and asset sales.

- We have had a significant decrease in debt of NOK 1.6 billion so far this year. This helps to strengthen our financial position going forward, says Ombudstvedt.

The net loss for the period was NOK 433 million, compared with a loss of NOK 1 841 in the corresponding quarter last year. Operating revenue was NOK 4 115 million, compared with NOK 4 799 million in the same quarter last year. The decrease was due to reduced production capacity after the divestment of Bio Bio and the closure of Follum, combined with lower sales volumes in a weak market.

The sale of the Parenco mill to H2 Equity Partners in the Netherlands was completed on 2 October.

During the quarter, Norske Skog announced the closure of a newsprint machine at the Tasman mill in New Zealand, and conversion of a newsprint machine to magazine paper production at the Boyer mill in Australia. This will result in a total closure of around 250 000 tonnes of newsprint capacity in Australasia.

Norske Skog expects relatively stable volumes and margins for the rest of the year, when the Parenco transaction is taken into account. The company will actively adapt production to match market demand and will continue its efforts to reduce fixed costs and net interest-bearing debt.

Norske Skog invests AUD 84 mill in Australia

Norske Skog will convert a machine at the Boyer mill in Australia to the production of coated grades, and close one newsprint machine at the Tasman mill in New Zealand.

Norske Skog will convert a machine at the Boyer mill in Australia to the production of coated grades, and close one newsprint machine at the Tasman mill in New Zealand.

- We are committed to the future in Australia, and we therefore invest AUD 84 million. With substantial funding support from the Australian government, we strengthen the operations at Boyer. This will create future growth opportunities for the Norske Skog group, said Norske Skog President and CEO Sven Ombudstvedt.

The machine conversion project will see AUD 84 million invested at Norske Skog's Boyer Mill in Tasmania over the next two years to enable the production of coated grades among other things suitable for catalogues. The Australian Federal Government will contribute AUD 28 million in grants to help fund the project, and the Tasmanian State Government is providing an AUD 13 million loan. Completion is targeted for the first quarter of 2014.

- The permanent closure of 150,000t of capacity at the Tasman mill in New Zealand is required to create a better balance between demand and supply for newsprint in the region. There is today considerable surplus capacity of newsprint in the region. Despite years of great efforts of the staff, the decision is unfortunately unavoidable. The implementation arrangements and timeframes will be subject to consultation with employees and other stakeholders, Mr Ombudstvedt said.

The final costs of the restructuring will be determined once the consultation process at the Tasman mill is completed.

SOURCE: Norske Skog

Norske Skog sells Follum to Viken Skog

Norske Skog has entered into an agreement to sell the Follum site to Viken Skog, which has ambitious, future plans.

After the decision to close the mill at Follum, Norske Skog has worked to find relevant stakeholders to create new activities on the site. Norske Skog considers it a good solution that others can now take over the further development.

- Norske Skog is very pleased that Viken Skog will now take over the work to create new activities at Follum. It has been important for us to find a buyer with ambitions for the future, with support from Buskerud county Council, Ringerike municipality Council and regional businesses, and not least from the trade unions at Follum. I wish Viken Skog and the Ringerike region luck with the exciting development work, says president and CEO in Norske Skog, Sven Ombudstvedt.

- Viken Skog will develop a new, future-oriented forest-based industry cluster at Follum. The location and the existing infrastructure, in the heart of Norway's richest forest areas make Follum a natural centre for an offensive strategy. It will be a milestone for the Ringerike region that Follum will now become a centre for sustainable development of environmentally friendly products from the forest. We have had good cooperation with the Ministry of Trade and Industry in the process of forging our long-term industrial plans. We now expect the government to implement measures to promote innovation and research in forest-based industries, in order to contribute to the huge effort we now face, says managing director Ragnhild Borchgrevink.

The net sales proceeds are in the order of NOK 60 million. The sales price will be payable upon acquisition. The acquisition will take place in the second quarter of 2012. The sale will be implemented through Viken Skog purchasing Norske Skog Follum AS and Follum Industripark AS, as well as all properties related to the mill site, including Årbogen. Norske Skog will disassemble and retain parts of the technical production equipment. Norske Skog will discontinue production at Follum on Friday 30 March.

Sale of the Follum site will generate a total accounting gain in the order of NOK 30 million. This will be recognised in the first quarter of 2012. DHT Corporate Services and Advokatfirmaet Haavind AS acted as Norske Skog's financial advisors.

Norske Skog divests its operations in Chile

Norske Skog has agreed to sell Norske Skog Bio Bio in Chile to Group BO, a consortium of Chilean investors, for USD 56 million. Group BO plans to continue producing newsprint at the mill.

- The divestment is a part of our strategy to improve Norske Skog's cash flow and financial position. We are very pleased to be able to sell the Chilean operations to an industrial player with long-term plans for the mill, says Sven Ombudstvedt, president and CEO of Norske Skog.

The Bio Bio mill has a total newsprint production of approximately 125 000 tons, and is one of total four newsprint mills in South America.

The investors participating in Group BO are already partners in BO Packaging, which is one of the leading companies in the Chilean and Peruvian packaging business. The investor consortium is headed by the Pathfinder Group, former owners of Masisa, and has interests in packaging, glass products, building products, agribusiness and real estate.

Closing of the transaction is expected to take place in second quarter.

DNB Markets acted as Norske Skog's financial adviser.