Displaying items by tag: Stora Enso

Stora Enso in Ethisphere Institute’s list of the World’s Most Ethical Companies

Stora Enso has been included in Ethisphere Institute’s 2013 list of the World’s Most Ethical Companies. The Ethisphere list recognises companies’ ethical leadership, compliance practices and corporate social responsibility. This is now the sixth time running that Stora Enso has been selected for the list, and it is the only Finnish company and one of only five Nordic companies in the 2013 list.

“Not only did more companies apply for the World’s Most Ethical Companies recognition this year than any year in the past, which demonstrates that ethical activity is an important part of many of these companies’ business models, but we are also seeing more companies be proactive and create new initiatives that expand ethics programmes and cultures across entire industries, such as industry-based ethics associations and other activities,” says Alex Brigham, Executive Director of Ethisphere. “We are excited to see the 2013 World’s Most Ethical Companies take these leadership positions, and embrace the correlation between ethical behaviour and improved financial performance.”

The record number of nominations and applications this year is evidence of increasing regard for the list of the World’s Most Ethical Companies among various stakeholder groups and the desire of companies to be recognised for their integrity and ethical culture. The 2013 list is the largest since the award’s inception in 2007.

“We are happy to receive this recognition again this year. Our commitment to global responsibility and ethical business practices will be further strengthened with the establishment of a Global Responsibility and Ethics Committee of the Board of Directors following our Annual General Meeting in April this year,” says Stora Enso’s Head of Global Responsibility Terhi Koipijärvi.

Through in-depth research and a multi-step analysis, Ethisphere reviewed nominations from companies in more than a hundred countries and 36 industries. The methodology for the World’s Most Ethical Companies list includes reviewing codes of ethics, litigation and regulatory infraction histories; evaluating the investment in innovation and sustainable business practices; looking at activities designed to improve corporate citizenship; and studying nominations from senior executives, industry peers, suppliers and customers.

Read about the methodology and view the complete 2013 list of the World’s Most Ethical Companies at http://ethisphere.com/wme.

New coarse screen to Stora Enso, Finland

Noss will supply a new RADISCREEN-C coarse screen to Stora Enso, Oulu Mill, Finland. The screen shall be installed after the bleached eucalyptus kraft bale pulper for protection of downstream equipment. Start-up is scheduled for June 2013.

RADISCREEN-C is a highly energy-efficient protection system for a great variety of applications in the pulp and paper industry, covering a wide range of flows and consistencies with only one unit.

Stora Enso CEO Jouko Karvinen comments on fourth quarter and full year 2012 results

“Strong cash flow, earnings stable in fourth quarter - clearly deteriorating paper outlook requires further permanent capacity reductions

“Stora Enso finished the fourth quarter with continued strong cash flow and operating earnings slightly up year-on-year, but slightly down on the previous quarter. This is the result of our ever-continuing focus on improving costs and working capital, and it demonstrates that we can and will continue on this path into the future as well. I want to give full credit for this to the Stora Enso people throughout the world.

“Stora Enso finished the fourth quarter with continued strong cash flow and operating earnings slightly up year-on-year, but slightly down on the previous quarter. This is the result of our ever-continuing focus on improving costs and working capital, and it demonstrates that we can and will continue on this path into the future as well. I want to give full credit for this to the Stora Enso people throughout the world.

“I also want to highlight that the first two of our growth investments – the investments at Skoghall and the new board machine at Ostrołęka – have been completed on time. In fact Ostrołęka's new light-weight container board machine started up six weeks ahead of schedule and the focus is now on successful ramp up, which is expected to take couple of months. In Uruguay everybody from Stora Enso and our partners is fully focused on hitting our mid 2013 start-up target and, even more important, a successful ramp-up after that.

“The darker side of our news today is that the decline in consumer demand in paper-based media in Europe has continued in the fourth quarter. Whereas the structural trend in total paper demand has been about -5% per year since 2007, we now read the demand in the two largest media-driven segments, newsprint and coated magazine paper, decreased in 2012 by about 9%. As before, the unfavourable supply and demand balance has led to further pressure on margins.

“That means we must accelerate capacity reduction plans to avoid running cash zero or even negative businesses. We plan to close one newsprint machine at Kvarnsveden and another one at Hylte, which just had to adjust to closure of a paper machine at the end of 2012. Separately, in the Building and Living Business Area we do not expect any significant improvement to the depressed European construction activity or high raw material costs. To combat the continued inadequate profitability in the very weak market environment, we are launching a cost improvement plan to adjust our cost structure and improve our competitiveness. These difficult actions are essential not only to safeguard the stronger parts of Printing and Reading and Building and Living, but also to be able to invest in our high-return growth-market businesses.

“After many years of restructuring, I do realise that the announced plans, which are all subject to local co-determination negotiations, will be very difficult for the employees to accept. I can only ask that we all try to understand that a reduction in consumer demand for printing paper and the impact of continued poor market conditions in Building and Living must be addressed. We will do our utmost to support the employees affected by these plans.

“The past six years have been persistently challenging in some of our markets, with both structural deterioration and cyclical economic weakness. We are determined to stay on our path, a continuing path of strong cash generation financing transformation into a global renewable materials company.”

Stora Enso plans restructuring and profitability improvement actions

Permanent shutdown of 475 000 tonnes of newsprint capacity planned

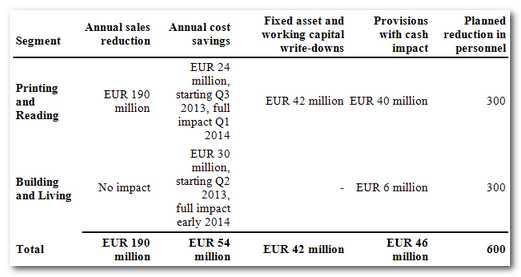

Stora Enso plans to restructure its operations through the permanent shutdown of two newspaper machines in Sweden. Stora Enso also plans efficiency improvements in the Printing and Reading customer service and the Building and Living Business Area. The profitability improvement actions are planned to reduce annual costs by EUR 54 million and reduce the number of employees by approximately 600 altogether.

Printing and Reading plans to close capacity in Sweden and reorganise its Customer Service Centres

Printing and Reading plans the permanent shutdown of paper machine (PM) 2 at Hylte Mill in Sweden with annual capacity 205 000 tonnes of newsprint and PM 11 at Kvarnsveden Mill in Sweden with annual capacity 270 000 tonnes of newsprint in the second quarter of 2013. This represents 3.4% of European newsprint capacity. The plans to shut down capacity are due to continuing structural weakening of newsprint demand in Europe.

In addition, Stora Enso plans to create a common platform for all its Printing and Reading sales desk, order handling and logistic services in Europe to improve customer service. These processes currently handled at seven customer service centres, mills and logistic service centres will be centralised into five customer service centres located in Finland, Sweden, Germany, Belgium and the UK. It is planned to establish a separate Logistics Service Centre for overseas business in Gothenburg, Sweden to serve all Stora Enso’s Business Areas.

Building and Living to streamline operations throughout the whole Business Area

Building and Living plans to reduce costs, increase productivity and find sustainable improvement in all operations to overcome continued poor profitability. The plans announced include downsizing of Sollenau Sawmill in Austria, transfer of some production from the high-cost Pfarrkirchen Mill in Germany to the low-cost Zdírec Mill in the Czech Republic and efficiency improvement actions at Kitee and Honkalahti sawmills in Finland. In addition, Building and Living is planning cost reduction measures in all other units and in sales and general administration, as well as in support functions throughout the whole business area.

Financial impacts

Stora Enso will record a restructuring provision and a fixed asset and working capital write-down as non-recurring items related to the restructuring plans described above with a negative impact of approximately EUR 88 million on the operating profit in its first quarter 2013 results.

No decisions regarding closures and employee reductions will be taken until the local co-determination negotiations have concluded. Stora Enso would make every effort in co-operation with local communities to help the affected personnel find new employment opportunities, and all job openings in other Stora Enso units would be available to those affected.

STORA ENSO OYJ

Stora Enso and Chalmers enter collaboration in intelligent pharmaceutical packaging

Stora Enso and Chalmers’ Encubator have reached a co-operation agreement under which Stora Enso will act as a partner to Encubator. The focus of the collaboration is an innovation project developing intelligent pharmaceutical packaging. The idea comes from Stora Enso, and Encubator will run the business development together with Chalmers School of Entrepreneurship.

Stora Enso and Chalmers’ Encubator have reached a co-operation agreement under which Stora Enso will act as a partner to Encubator. The focus of the collaboration is an innovation project developing intelligent pharmaceutical packaging. The idea comes from Stora Enso, and Encubator will run the business development together with Chalmers School of Entrepreneurship.

“This gives us a new approach to innovations supporting our packaging business. Forming a dedicated team will create an environment that can enable successful market entry and create a growth company,” says Mats Nordlander, Executive Vice President, Stora Enso Renewable Packaging.

The innovation project will develop intelligent pharmaceutical packaging to address the problem of poor adherence to prescription instructions by patients, a problem which in Sweden alone causes costs of over SEK 20 billion annually. The package simplifies communication between patient and doctor by registering when pills are removed from the package. If the medication is missed, a reminder is sent wirelessly to, for example, a mobile phone. Information may also be shared with family members to increase support.

Encubator is a Chalmers incubator that exploits ideas by combining advanced entrepreneurship education with real business incubation. The ideas mainly come from national and international industry and academia. Over the past 15 years, Encubator and Chalmers School of Entrepreneurship have created more than 50 new companies.

“To be able to exploit innovations, it is important to take advantage of combined strengths. The collaboration with Stora Enso is an example of how innovations can develop through partnership between young entrepreneurs and established companies,” says Linnea Olsson, Business Developer at Encubator.

Stora Enso plans profitability improvement actions across all Business Areas

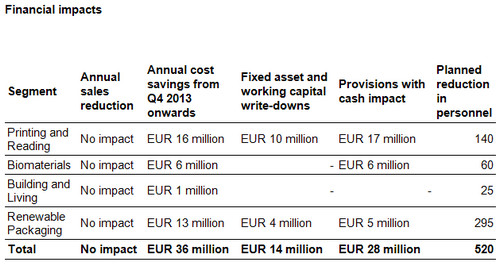

Stora Enso plans restructuring of its operations through the permanent shutdown of paper machine 1 at Hylte Mill in Sweden and the permanent closure of the corrugated packaging plant at Ruovesi in Finland. In addition, Stora Enso plans efficiency improvements at several other mills. The profitability improvement actions are planned to reduce annual costs by EUR 36 million and reduce the number of employees by approximately 520 altogether. Stora Enso will record a restructuring provision and a fixed asset and working capital write-down as non-recurring items totalling approximately EUR 42 million related to the restructuring plans in the fourth quarter 2012 operating profit.

Printing and Reading plans to close capacity in Sweden

Stora Enso plans the permanent shutdown of paper machine (PM) 1 at Hylte Mill in Sweden with annual capacity 180 000 tonnes of newsprint by the end of the fourth quarter of 2012 due to structural weakening of newsprint demand in Europe. The planned closure and other efficiency improvements would affect approximately 140 employees at Hylte Mill.

Renewable Packaging streamlines operations in Finland, Sweden and Poland

Stora Enso plans permanent closure of the corrugated packaging plant at Ruovesi in Finland in the second quarter of 2013 due to decreased demand for offset-printed corrugated packaging in Finland and poor financial performance of the plant. Stora Enso plans to serve Finnish offset customers through its other offset plants in Europe. The planned closure would affect approximately 60 employees at Ruovesi.

It is also planned to streamline operations at the Heinola, Ingerois and Pori board plants in Finland and corrugated packaging operations at all the Swedish units to ensure long-term competitiveness. The plans would reduce the number of employees in Sweden and Finland by up to 100 altogether mostly by the end of the third quarter of 2013.

In addition, Stora Enso plans the permanent shutdown of board machine (BM) 2 at Ostrołęka Mill in Poland as announced earlier. BM 2 is reaching the end of its technical lifetime. The shutdown of BM 2 and related technical functions is planned by the end of 2012. Including the effects of an overall review of Polish board and converting operations, the number of employees in Poland would decrease by up to 135 altogether.

Biomaterials efficiency improvement plans

Stora Enso plans to improve efficiency at Skutskär Pulp Mill in Sweden to reduce costs and improve the mill’s competitiveness in response to the challenging market environment. The plans would reduce the number of employees at Skutskär Mill by approximately 60 mostly by the end of Q3 quarter of 2013.

Building and Living plans to improve flexibility

Building and Living plans to improve flexibility and reduce costs at the Ala and Gruvön sawmills in Sweden and Varkaus Sawmill in Finland from the first quarter of 2013. The restructuring plans would affect approximately 25 employees at the Ala, Gruvön and Varkaus sawmills.

No decisions regarding closures and employee reductions will be taken until the local co-determination negotiations have concluded. Stora Enso would make every effort in co-operation with local communities to help the affected personnel find new employment opportunities, and all job openings in other Stora Enso units would be available to those affected.

Stora Enso CEO Jouko Karvinen and CFO Karl-Henrik Sundström comment on third quarter 2012 results

CEO Jouko Karvinen comments on the third quarter and company transformation:

“We finished the third quarter as we promised, and a little more. Markets overall varied from weak in Europe in printing and reading and wood products, to a mixed picture in renewable packaging. We finished the quarter at the upper end of our earnings expectations, and most important kept the cash generation rock solid as demonstrated by the improved quarter-end liquidity of EUR 1.7 billion,” says CEO Jouko Karvinen.

“This is a path we must continue to move on with accelerating speed. Today’s announcements of new profitability action plans across all businesses will be difficult for our people, but also a prerequisite for implementing our transformation in a responsible way. The weak performance of Building and Living is clear evidence that we have much more to do.

“The growth investments at Skoghall, Ostrołęka and Montes del Plata are reaching their final months and quarters of completion – living proof points of the transformation of Stora Enso into a value-creating renewable materials growth company. In parallel, we continue the planning for our China investment, as we do planning integration of our new joint venture in Pakistan.”

Stora Enso’s new CFO Karl-Henrik Sundström comments on continuous improvement, speed of execution and risk mitigation:

“We want to be masters of our own destiny and therefore plan to take capacity action in media-driven European paper markets with overcapacity and a structural and cyclical decline of around 6% annually right now, and 4–6% in the coming years. We cannot afford to wait for a transformation in our markets, we need to act as we have done previously.

“We have maintained strong cash generation and secured all of our short-term maturities through a number of bond transactions. We have today a robust liquidity position and have covered all of our maturities until the end of 2014. In addition, we have today announced plans to further reduce costs and improve productivity, partly in response to the weak and uncertain economic growth in Europe. This is prudent as well as responsible.

“The profitability improvement action plans will not be easy since they will affect a number of businesses that have been impacted before, and will intensify some of the issues in this very hard hit European industry. To transform our company, we must redirect the deep knowledge we have in production and development to products and markets that will offer value-creating growth. This will not be an overnight process but the essence of our ongoing journey.

“As a company we are fortunate to have created a stable cash generating business in Europe, which we will use to finance the transformation our business. The most important task for us is to ensure that for years to come we continue to have the best cash engines in Europe, which means de-risking our transformation by a cost-efficient and profitable Printing and Reading business in Europe, a very efficient balance sheet and ample liquidity.”

Stora Enso to examine the possibility of selling Corbehem Mill in France

Stora Enso will examine the possibility of selling Corbehem Paper Mill in France. The annual capacity of the mill is 330 000 tonnes of light-weight coated magazine paper. Employee organisations and other stakeholders will be fully involved in any process in compliance with the French regulations.

Stora Enso expands renewable packaging business to Pakistan

Stora Enso has signed an agreement to establish a joint venture called Bulleh Shah Packaging (Private) Limited with Packages Ltd. of Pakistan. Stora Enso’s initial shareholding will be 35% with a commitment to increase the shareholding at the agreed value to 50% at a later stage subject to certain conditions being met. The joint venture will include the operations of the Kasur mill and Karachi plant currently owned by Packages Ltd.

Stora Enso has signed an agreement to establish a joint venture called Bulleh Shah Packaging (Private) Limited with Packages Ltd. of Pakistan. Stora Enso’s initial shareholding will be 35% with a commitment to increase the shareholding at the agreed value to 50% at a later stage subject to certain conditions being met. The joint venture will include the operations of the Kasur mill and Karachi plant currently owned by Packages Ltd.

The joint venture will to a large extent provide packaging products to key local and international customers in the fast-growing Pakistani market. The joint venture will employ about 950 people and its sales are forecast to be USD 130 million (EUR 99 million) in 2012.

The agreed value for 100% of the joint-venture company is approximately USD 108 million (EUR 83 million) on a cash and debt free basis. The total consideration can be up to USD 125 million (EUR 96 million), including an additional maximum performance compensation based on the financial results of the second half of 2012 and the first half of 2013. As part of the agreement, both parties are committed to a substantial USD 135 million (EUR 103 million) investment programme during 2013 and 2014 to develop the business further. The joint venture is EPS accretive and will over time after the new investments exceed Stora Enso’s ROCE target of 13%.

“This is an example of Stora Enso’s investments in value-creating growth markets. The Pakistani market, with growing demand for packaging products and paperboard, offers an attractive growth opportunity for us and the joint venture will enable us to increase our capability to serve our key customers,” says Mats Nordlander, Executive Vice President, Renewable Packaging Business Area.

The joint-venture transaction is expected to be completed during the first quarter of 2013, subject to competition and regulatory approval and other customary transaction conditions.

Stora Enso successfully issues a 5.5-year EUR 500 million Eurobond

The bond will be listed on the Luxembourg Stock Exchange. The proceeds of the offering will be used for general corporate purposes.

Barclays, Citigroup, J.P. Morgan and Nordea acted as joint bookrunners for the transaction.

“We decided to take advantage of the strong credit market conditions and issued a bond to strengthen our liquidity further. We continue to manage our maturity profile proactively,” says Jyrki Tammivuori, SVP, Group Treasurer.