The decision of the United Kingdom to leave the European Union at some point in the next two years (seemingly sooner, rather than later) sent shock waves around the global economy on Friday and across the weekend.

Given the shock and panic it engendered, it seems the exit of Britain from the European Union was unexpected, or at least considered unlikely. In a two horse race, its peculiar this result was so unexpected, but there’s nothing like financial markets for behaving like high-strung thoroughbreds startled by the merest bite from a horse-fly.

As global business comes to terms with the implications of Britain’s impending exit from the European Union, it is important to keep the situation in perspective. The world keeps on turning.

For businesses in the paper and wood products industry, IndustryEdge considers the following to be the key issues:

Currency crunch has just begun

The currency and exchange rate implications of the British referendum outcome were immediate and severe.

For the immediate future the focus will be on market stability. Almost all major capital markets lost value when the results of the vote were announced. Some of this was realignment after markets were primed the wrong way in the lead up to the vote.

The upside of the falling value of the British Pound (GBP), particularly against the US Dollar (USD), is that it also dragged down the Australian Dollar (AUD) and the New Zealand Dollar (NZD), as well as the Euro. All of these currencies declined to a far lesser extent than the GBP. To what extent this may assist or hinder Australasian exporters and importers is unclear. The length of time the local currencies are suppressed will be the critical factor. If a stronger USD is a component in the medium term, further turmoil can be expected as the US elections draw near, especially given the disparity between Trump and Clinton.

We offer the cautionary note that the fracturing of global financial markets on the back of the seemingly unimaginable Brexit may merely be a precursor to the dysfunction that will arise in November should the USA’s most unimaginable election result transpire.

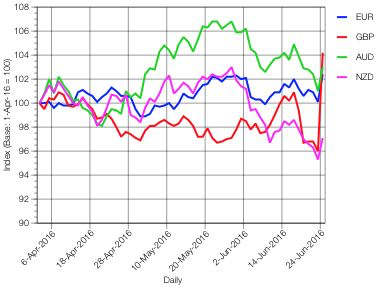

As the chart below shows, the last month has seen turbulence for relevant currencies, with speculation about the outcome of the British referendum providing some of the uncertainty over that period.

USD v Selected Currencies: 1 Apr '16 - 24 Jun '16

The USD had, until Friday, tracked pretty much sideways for the AUD and the Euro, despite the turbulence, since the beginning of April. It was a different story for the NZD and the GBP, which had appreciated strongly against the US Dollar.

All of that changed on 24th June, with the AUD, the Euro and NZD losing approximately 2% of their value as a result of the Brexit decision. For the GBP, the result was a single day 8.5% loss of value against the USD, as the chart's red line shows.

In Australia, as a result, an interest rate cut became more likely, according to surveyed economists. The RBA meets on 5th July and our view, if anyone is interested, is they are unlikely to see events unfold sufficiently to warrant an urgent rate cut.

Balance of trade creates concern only at specific product level

The UK, and also to a large extent Europe, are not significant destinations for wood products or pulp and paper products from Australia and New Zealand. The balance of trade between the two regions show there is a greater propensity for Australia and New Zealand to import from the UK and Europe. However, compared with the volume and values being traded between Australasia and Asia, any changes in the European trade are not going to be significant in the overall balance of trade.

At a product-by-product level, this is less the case, with some key grades, especially of printing and communication papers, being extensively imported from Europe. Some of these are hotly contested, where the market operates on wafer thin margins and in a context of global over-supply. For some, there is a component of domestic manufacturing, for other products, it is an entirely import trade.

It is notable that wood processing and pulp and paper manufacturing equipment continues to be imported from Europe. Brexit is unlikely to impact that element of the trade.

The balance of trade with Europe in total, including the UK, for both Australia and New Zealand, will be the subject of detailed features in the July editions of Pulp & Paper Edge (Edition 132) and Wood Market Edge (Edition 35).

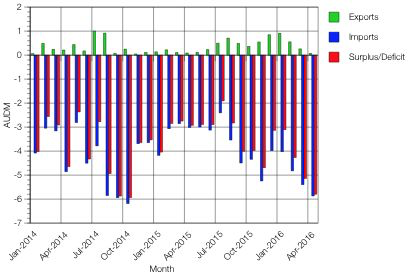

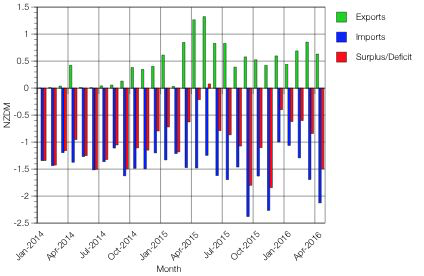

To provide a snapshot of trade with Britain, the charts below provide the balance of trade in paper and paper products between first, Australia and the United Kingdom, and the second, between New Zealand and the United Kingdom.

Australia's Balance of Trade in Paper & Paper Products with UK: Jan '14 - Apr '16 (AUDM)

Source: ABS

NZ's Balance of Trade in Paper & Paper Products with UK: Jan '14 - Apr '16 (AUDM)

Source: Statistics NZ

What the charts convey is that both Australia and New Zealand have a small trade interface with the United Kingdom. In both cases, the red bars show that by value, Australasia imports more than it exports to Britain.

However, there isn't much in it. For instance, in April 2016, Australia's trade deficit with the UK for paper and paperboard was AUD5.8M, with imports accounting for just 2.8% of the total value of paper and paperboard imports for the month. In New Zealand, the deficit was NZD1.5M, in what is an observably far less stable two-way trade with the UK.

At least when it comes to trade with the UK, there is little about which to be immediately concerned.

In closing, we can do no better than paraphrase Rudyard Kipling’s ‘If’:

“If you can keep your head when all about you are losing theirs… Yours is the Earth and everything that's in it…”

Demand and consumption fundamentals did not change last week. Supply patterns, on the other hand, may change and could do so dramatically in Europe. It is less likely there will be significant trade impacts in Australia and New Zealand, but there will, as outlined above, be some distractions, if not disruptions.

For detailed product level analysis, further information or discussion about the support IndustryEdge can provide your business, contact us at This email address is being protected from spambots. You need JavaScript enabled to view it., call us on +61 3 5229 2470, or go to www.industryedge.com.au.