Displaying items by tag: Mreal

M-real reduces its pulp surplus

M-real Corporation, a part of Metsä Group, has agreed to divest 7.3 percentage points of its shareholding in Metsä Fibre Oy to the Japan-based Itochu Corporation for EUR 138 million and approximately 0.5 percentage points of its holding in Pohjolan Voima Oy to Metsä Fibre for EUR 64 million.

The closing of M-real’s divestment of the 7.3 percentage point shareholding in Metsä Fibre is subject to German competition authority approval and it is expected to take effect by end 2Q 2012. Once the announced restructuring of the ownership of Metsä Fibre is completed, M-real owns 24.9 per cent, Metsäliitto Cooperative 50.2 per cent and Itochu Corporation 24.9 per cent of the company.

The divestment of the 7.3 percentage point shareholding in Metsä Fibre is done to reduce M-real’s pulp surplus and to further strengthen Metsä Fibre’s business especially in the growing Asian market. Once the transaction is completed, M-real’s pulp surplus reduces from approximately 0.5 million annual tonnes to 0.3 million annual tonnes.

After the 0.5 percentage point reduction of shareholding in Pohjolan Voima that took effect today, M-real owns approximately 2 per cent of the company.

M-real will in the 2Q 2012 Other operations’ operating result book as a non-recurring item a capital gain of approximately EUR 88 million related to the Metsä Fibre shares to be divested. The Other operations’ 2Q 2012 operating result will also include as a non-recurring item a realized fair value and gain of approximately EUR 40 million related to the divested Pohjolan Voima shares that does not have an impact on the company’s total equity. The divestments have a negative impact of approximately EUR 15 million on annual operating result compared to actual results in 2011. The divestments have an approximately 40 percentage point positive impact on M-real’s net gearing compared to end 2011.

“We are reducing our pulp surplus according to our strategy. The transaction with Itochu provides an excellent possibility to develop Metsä Fibre further and shows also the great value of our pulp assets. Also in the future we produce more pulp than we use, thus we continue to have a good platform to grow our profitable paperboard business. These divestments also strengthen the company’s liquidity without having a material impact on our operating cash flow,” comments M-real’s CEO Mikko Helander.

Itochu Corporation is one of the largest trading companies in Japan with approximately 130 bases in different industries in close to 70 countries. Itochu Corporation’s trading volume for the fiscal year ended on 31 March 2011 exceeded EUR 100 billion. Further information of the company can be found on their home page http://www.itochu.co.jp/en/.

Annual General Meeting of M-real Corporation decided on 28 March 2012 to change the company’s business name to Metsä Board Corporation. The new business name is expected to be officially registered during April 2012. Before the official registration the company’s stock exchange releases are sent under the name M-real Corporation.

M-REAL CORPORATION

Resolutions of the M-real Corporation’s Annual General Meeting

The Annual General Meeting of M-real Corporation held today 28 March 2012 decided to change the company’s business name to Metsä Board Corporation, amended the field of business of the company to more accurately correspond to the current business operations, and further adopted the following resolutions:

Annual accounts

The Annual General Meeting approved the company's financial statements for the financial year 2011 and

decided not to distribute dividend. The Annual General Meeting further discharged the members of the Board of Directors and the CEO from liability.

Remuneration of the Board of Directors

The Annual General Meeting resolved to maintain the remuneration of the members of the Board of Directors unchanged. Thus, the Chairman receives an annual remuneration of EUR 76,500, the Vice Chairman EUR 64,500 and members EUR 50,400. Approximately one half of the remuneration will be paid in cash while the other half is paid in the company’s B-series shares to be acquired from the open market during April 2012. In addition, the members are paid a fee of EUR 500 per each attended Board and committee meeting.

Composition of the Board of Directors

The Annual General Meeting fixed the number of Board members to nine (9) members and elected the following persons as members of the Board of Directors: Mikael Aminoff M.Sc. (Forestry), Martti Asunta, M.Sc. (Forestry), Kari Jordan, Honorary Counsellor, Kirsi Komi, LL.M., Kai Korhonen, M.Sc. (Technology), Liisa Leino, M.Edu., Juha Niemelä, Honorary Counsellor, Antti Tanskanen, Minister and Erkki Varis, M.Sc. (Technology). The term of office of the members of the Board of Directors expires at the end of the next Annual General Meeting.

At its organising meeting the Board of Directors elected Kari Jordan as its Chairman and Martti Asunta as its Vice Chairman. The Board further resolved to organize the Board committees as follows: The members of the Audit Committee are Kirsi Komi, Kai Korhonen, Antti Tanskanen and Erkki Varis and the members of the Nomination and Compensation Committee are Mikael Aminoff, Martti Asunta, Kari Jordan, Liisa Leino and Juha Niemelä.

Auditor

The Annual General Meeting elected Authorized Public Accountants KPMG Oy Ab as the company’s auditor with Raija-Leena Hankonen, Authorized Public Accountant, acting as principal auditor. The term of office of the auditor expires at the end of the next Annual General Meeting. The Annual General Meeting resolved that the fee of the auditor is paid according to invoice as approved by the company.

Amendment of Articles of Association

In addition to changing the company’s name and field of business, the Annual General Meeting decided to make certain technical and terminology changes to the Articles of Association to accommodate to changes in legislation.

Share Issue Authorization

The Annual General Meeting authorized the Board of Directors to decide on the issuance of new shares or special rights, as specified in section 1 of Chapter 10 of the Companies Act, entitling to shares. By virtue of the authorization the Board is entitled to issue up to 70,000,000 new B-series shares or special rights entitling to such shares such that the maximum number of new shares issued does not exceed 70,000,000 B-shares. The special rights entitle their holders to receive new B-series shares against the payment of a subscription price or by setting off a receivable against the subscription price (“Convertible Bond”). New shares can be issued against payment or without payment. The authorization replaces the authorization previously in effect and is effective until March 28, 2017.

M-REAL CORPORATION

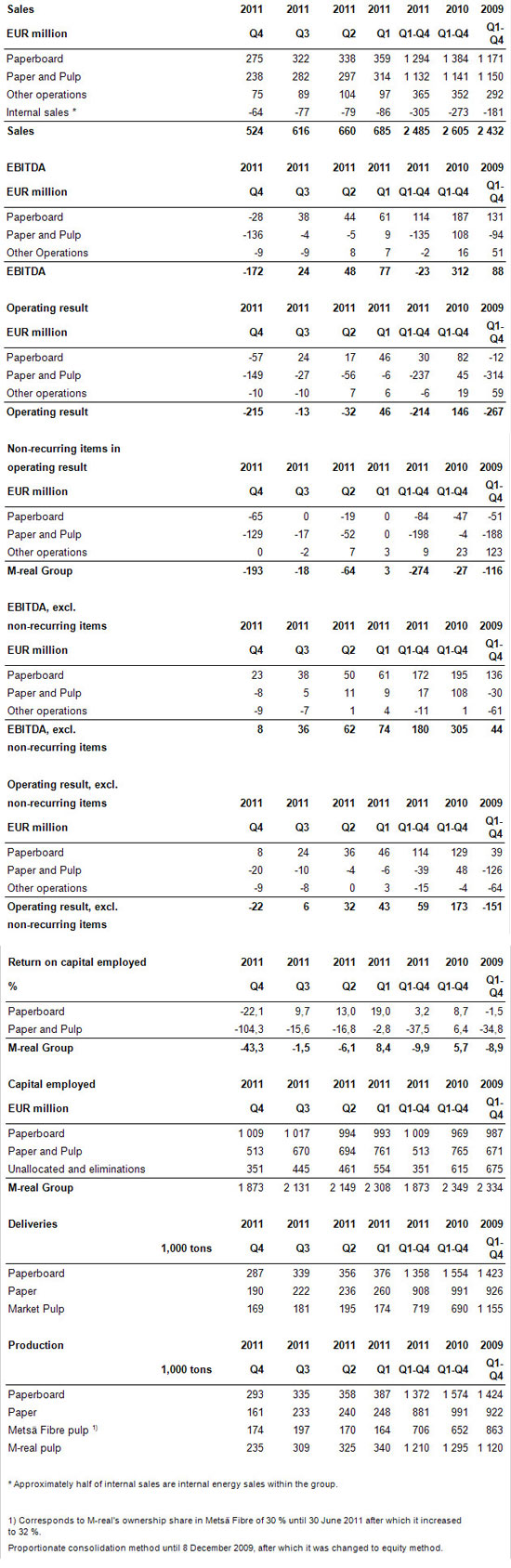

M-real Corporation Historical figures based on the new reporting structure

M-real Corporation, part of Metsä Group, announced on 19 January 2012 to renew its management and reporting structure to better reflect the company’s strategy and the focus on fresh forest fibre cartonboard. The company operates through two business areas that are also the company’s reporting segments from the first quarter of 2012 onwards:

- Paperboard

- Paper and Pulp

Paperboard business area includes the Kemi, Kyro, Simpele, Tako and Äänekoski board mills, Kyro wallpaper base machine and Joutseno BCTMP mill located in Finland as well as Gohrsmühle mill in Germany. Paper and Pulp business area includes Husum paper and pulp mill in Sweden, Alizay mill in France and Kaskinen BCTMP mill in Finland. As earlier announced M-real is planning to close the entire Alizay mill and the unprofitable operations at Gohrsmühle mill. The plans are expected to materialize in early 2012 that would improve the company’s profitability materially.

Accounting for the 32 percent ownership in Metsä Fibre (formerly Metsä-Botnia) will remain unchanged. The associated company result of Metsä Fibre will continue to be allocated to business segments based on their respective pulp consumption and is reported in EBITDA. Roughly two thirds of the result impact of Metsä Fibre ownership is expected to be included in the Paperboard business area and the rest in Paper and Pulp business area.

The historical figures based on the new business area structure are presented in the tables below. In addition to the above listed mills, the historical business area figures include also discontinued and divested operations.

M-REAL CORPORATION

Information and consultation process to discontinue Gohrsmühle mill’s unprofitable operations finalised

M-real Corporation, part of Metsä Group, has concluded the information and consultation process at the Gohrsmühle mill in Germany. In order to eliminate the severe losses of the mill, M-real started the negotiations with the workers’ representatives concerning the planned discontinuation of the mill’s uncoated fine paper and unprofitable speciality paper production. M-real released a stock exchange bulletin on 18 October 2011 concerning these plans.

Following the conclusion of the negotiations, M-real is able to make the final decisions to discontinue Gohrsmühle mill’s uncoated fine paper production and the production of the unprofitable speciality papers. As a result, M-real’s annual uncoated fine paper capacity reduces by approximately 120,000 tonnes and speciality paper capacity by 70,000 tonnes. The related personnel reduction of maximum 260 people will be implemented by the end of the second quarter of 2012. The level of redundancy costs is in line with the cost provisions made in the last quarter of 2011.

M-real continues the Chromolux business and is currently investigating possibilities to start up folding boxboard sheeting operations at the Gohrsmühle site.

Actions to establish a business park in Gohrsmühle continue together with the workers’ representatives and the local authorities with the target to create new jobs at the site. One of the alternatives is to find partners to the site to utilise the existing paper production and converting equipment as well as other site infrastructure. An example of the successful implementation of the business park concept is the Reflex mill, where M-real was able to divest business units to different companies saving more than 200 jobs. Divestment of M-real’s last operations at the Reflex mill, the Premium Paper business, was finalised in mid-February 2012.

“We have reached a very important step in our work to eliminate losses of our paper business. Opportunities to establish a business park in Gohrsmühle are good,” says M-real’s CEO Mikko Helander.

M-Real introduces its first Colorpro Technology Paper

Commercial printers will soon be able to give customers enhanced print results at more competitive prices with ColorPRO Technology. This new technology will enable printers to achieve brighter colours, higher contrast blacks, sharper lines and finer detail on any printers that use pigmented inks.

ColorPRO Technology is applied to the paper during the production process. Treated papers ‘hold’ the ink at the surface of the paper, producing higher quality and more striking results. The technology also eliminates the need for bonding agents.

M-real’s Modo Jet PRO is one of the first papers to be made with ColorPRO Technology and will be part of the well-established Modo Papers range. Developed in conjunction with HP and Pitney Bowes, it has undergone extensive third party testing and is guaranteed for use on all HP Inkjet Web Presses and Pitney Bowes IntelliJet printing systems series printers, as well as any technology using pigmented inks.

Modo Jet PRO is suitable for all applications on uncoated, wood-free paper, particularly variable data print applications such as invoices and statements. From January 2012, Modo Jet PRO is available in 80, 90, 100 and 115 g/m2.

M-real renews its management and reporting structure

M-real operates through two business areas that are also the company’s reporting segments from first quarter of 2012 onwards:

- Paperboard

- Paper and Pulp

Pasi Piiparinen (50) has been appointed SVP, Head of Paperboard business area and a member of M-real Corporate Management Team as of 20 March 2012. Piiparinen reports to CEO Mikko Helander. Piiparinen joins M-real from Stora Enso where his latest position was SVP, Sales and Marketing, Fine Paper Business Area. Piiparinen has an extensive background also in Stora Enso’s packaging business. His education is Master of Science, Engineering.

As earlier announced, Mika Joukio, current SVP, Head of Paperboard business area has been appointed CEO of Metsä Tissue Corporation as of 1 February 2012. After Mika Joukio leaves and before Pasi Piiparinen starts in his new position, CEO Mikko Helander will be the acting Head of Paperboard business area.

M-real's Corporate Management Team consists of the following persons:

- Mikko Helander, CEO, also acting Head of Paperboard business area starting from 1 February 2012 until 19 March 2012

- Matti Mörsky, CFO

- Pasi Piiparinen, SVP, Head of Paperboard business area as of 20 March 2012

- Seppo Puotinen, SVP, Head of Paper and Pulp business area

- Sari Pajari, SVP, Supply Chain and Business Development

- Mika Paljakka, SVP, HR

- Jani Suomalainen, SVP, Procurement

The changes in management structure take effect immediately.

Soili Hietanen and Heikki Husso will step out of M-real’s Corporate Management Team. Husso continues as the Managing Director of M-real Zanders GmbH while Hietanen will work in different development projects in the M-real head office.

Paperboard business area includes the Kemi, Kyro, Simpele, Tako and Äänekoski board mills, Kyro wallpaper base machine and Joutseno BCTMP mill located in Finland as well as Gohrsmühle mill in Germany. Paper and Pulp business area includes Husum paper and pulp mill in Sweden, Alizay mill in France and Kaskinen BCTMP mill in Finland.

As earlier announced, M-real is planning to close the entire Alizay mill and the unprofitable operations at Gohrsmühle mill. The plans are expected to materialize in early 2012 that would improve the company’s profitability materially.

The accounting treatment of the M-real’s 32 percent ownership in Metsä-Botnia will remain unchanged. The associated company result of Metsä-Botnia will be allocated to business segments based on their respective pulp consumption. Roughly two thirds of the result impact of Metsä-Botnia ownership is expected to be included in the Paperboard business area and the rest in Paper and Pulp business area.

M-real will announce its financial statements 2011 on 9 February 2012 based on the old business area and reporting structure. The restated historical figures based on the new business structure will be released during the second half of February 2012.

M-real divests the Reflex mill’s Premium Paper business to Hahnemühle FineArt GmbH

M-real Corporation, part of Metsäliitto Group, has agreed to divest the Reflex mill’s Premium Paper business to Walzmühle AG that is owned by Hahnemühle FineArt GmbH, the Hahnemühle management and private shareholders of Hahnemühle. The divestment includes the complete Premium Paper business and related assets as well as approximately 100 of M-real’s employees.

Premium Paper products are used in high-quality graphical end-uses, such as letterhead, brochures, books, calendars and envelopes.

The divestment is expected to be closed during 1Q 2012. The divestment would decrease M-real’s annual sales by approximately EUR 20 million and it would not have a material impact on M-real’s operative result. The divestment is not expected to have a material non-recurring result or cash flow impact taking into account the bookings made in 4Q 2011.

“We are very satisfied that the well-recognised speciality paper producer Hahnemühle takes over the Reflex Premium Paper business. Our actions to build a Business Park at Reflex by finding other producers to the site have been very successful. Thanks to our Business Park concept, more than half of the originally over 400 jobs can be saved at the mill. Key issues in the success have been excellent cooperation with the union, works council, local authorities and Metsä Tissue Corporation who is already our partner at the site. Based on this experience we have a good opportunity to implement the Business Park concept successfully also at Gohrsmühle mill,” says M-real’s CEO Mikko Helander.

After the divestment of the Premium Paper business, M-real has no operations left at the Reflex mill. The discontinuation of the carbonless paper converting was agreed in late 2011. In October 2010, M-real sold the paper machine 5 and some related assets at the Reflex site to Metsä Tissue.

Hahnemühle FineArt GmbH is a German based speciality paper producer and one of the market leaders in its field in Germany (www.hahnemuehle.com).

M-real has concluded the statutory negotiations at the Äänekoski mill

M-real Corporation, part of Metsäliitto Group, has concluded the statutory negotiations at the Äänekoski mill. In order to improve the profitability of its coated paper business M-real started on 9 November 2011 statutory negotiations concerning the potential closure of the Äänekoski paper machine and conversion of the mill’s sheeting capacity entirely to folding boxboard sheeting. M-real released a stock exchange bulletin on 2 November 2011 concerning these plans.

Following the conclusion of the statutory negotiations, M-real has decided that the Äänekoski paper machine, with an annual capacity of approximately 200 000 tonnes of coated fine paper, will be closed by the end of 2011. The mill’s sheeting capacity will be converted fully to folding boxboard. Planning work related to the sheeting capacity conversion is on-going.

The related personnel reduction at the Äänekoski mill is a maximum of 169 people. In close cooperation with local authorities, M-real will assist redundant employees to find new employment. In addition, M-real will also facilitate redeployment, if possible, by offering employment opportunities internally within the company or other Metsäliitto Group's business areas.

M-real continues to produce coated papers at the Husum mill in Sweden. Äänekoski paper machine’s reel production will be transferred to Husum. The annual coated paper capacity at Husum will be increased from 285 000 tonnes to 340 000 tonnes during 2012.

Also in the future M-real’s coated papers will be sold by Sappi Fine Paper Europe. Based on the above measures, M-real’s annual coated paper capacity is reduced by approximately 145 000 tonnes. M-real’s annual sales will reduce by approximately EUR 60 million and operating result will increase by approximately EUR 20 million based on the results of the coated paper production in 1–3Q 2011. The full annual financial impact of the measures is expected to materialise from 2012 onwards.

Consumer Packaging’s 4Q 2011 operating result includes approximately EUR 25 million non-recurring impairments and cost provisions related to the measures in Äänekoski. Total net cash impact of the measures is expected to be slightly positive when taken into account the reduction of working capital.

M-real plans to restructure its coated paper business

M-real Corporation, part of Metsäliitto Group, plans to restructure its coated paper business to achieve an approximately EUR 20 million improvement in annual operating result.

Paper production at the Husum mill in Sweden is planned to be reorganized. The annual coated paper capacity on the mill will be increased from 285,000 tonnes to approximately 340,000 tonnes without material investments. The reel production of Äänekoski paper machine is planned to be transferred to Husum.

Äänekoski mill’s coated fine paper machine is planned to be closed and the sheeting capacity converted fully to folding boxboard sheeting. Statutory negotiations related to the possible closure of the paper production and the development of sheeting capacity covering the whole of Äänekoski paper and board mills’ personnel of approximately 370 people will be commenced on 9 November 2011. Amount of personnel at the Äänekoski mills is expected to reduce by 180 at the maximum.

Currently there is one machine at Äänekoski paper mill with an annual capacity of approximately 200,000 tonnes of coated fine paper. After the planned closure of paper production the paper and board sheeting operations at the site are planned to be combined. This would increase the folding boxboard sheeting capacity and improve M-real’s profitability.

M-real’s coated papers will also in the future be sold by Sappi Fine Paper Europe. Based on the planned measures M-real’s annual coated paper capacity would reduce by approximately 145,000 tonnes. M-real’s annual sales would reduce by approximately EUR 60 million and operating result would increase by approximately EUR 20 million based on the actual performance of the coated paper production in the first half of 2011. The full annual financial impact of the planned measures is expected to be seen from 2012 onwards.

“Profitability of coated paper production is very weak due to the worsened market situation and the structural overcapacity in Europe. The situation is not expected to materially improve in the future either, due to which we are planning to reduce our coated paper production and to focus it to our most efficient unit in Husum where M-real has one of the most modern and efficient coated paper production lines in Europe. Husum is one of Europe’s largest paper and pulp integrated sites which productivity has been increased to a very good level thanks to successful improvement measures.” says M-real’s CEO Mikko Helander.

Consumer Packaging’s 4Q/2011 operating result is expected to include approximately EUR 25 million non-recurring impairments and cost provisions related to the planned measures in Äänekoski. Total net cash impact of the planned measures is expected to slightly positive taken into consideration also the reduction of working capital.

M-REAL CORPORATION

M-real starts measures to eliminate losses of its paper business

M-real Corporation, part of Metsäliitto Group, announced on 4 May 2011 in a stock exchange release its plans to divest the Alizay mill in France and the entire Gohrsmühle mill in Germany or, alternatively parts of the Gohrsmühle separately based on a Paper Park concept. It was then announced also that if the divestments do not materialize, M-real plans to start consultation processes proposing to close the operations. M-real also announced plans to discontinue its remaining carbonless paper converting operations at the Reflex mill in Germany.

Consultation process to close the Alizay mill will be commenced

M-real received several offers for the Alizay mill, based on which the negotiations have been carried out to divest the mill. None of the buyer candidates however fulfilled M-real’s conditions for entering into transaction. The main conditions for divestment set by M-real relate to the financial status of the buyer, credibility and capability to implement the presented business plan, ability to take responsibility for the employees and the business risks as well as the financial consequences to M-real of the divestment.

M-real has decided to commence an information and consultation process to close the Alizay paper mill. There are currently approximately 330 employees at Alizay mill.

Despite extensive restructuring measures and also investments implemented at Alizay mill, it loses currently approximately EUR 3 million per month. In this very challenging operating environment that European paper industry faces, it is not possible to turn the heavily loss-making mill profitable. Nor are there any signs of such a turning point in the paper market that would change the situation.

In the past years, M-real has tried to divest the Alizay mill and discussed and negotiated with a number of companies, including key industry players with no success. M-real appointed leading industry experts who approached in excess of 80 companies in the most recent process to divest the mill started in May 2011. Out of these 65 declined and 18 showed preliminary interest, received the information memorandum and visited the site. In the last few weeks, there were serious negotiations with two remaining candidates. Also the French State’s Invest in France Agency (AFII) has supported M-real in the sales process. One key point in the negotiations has been the fact that M-real will not sell Alizay mill to a buyer who would fail to turn the mill profitable. Consequently, if the mill would be shut down it could cause an unjustified position for the employees.

Statutory negotiations will be commenced in Speciality Papers to discontinue unprofitable businesses, Chromolux business will be continued

M-real has not been able to find a buyer for its Gohrsmühle mill, whether in parts or as a whole. M-real is planning to discontinue the unprofitable speciality paper businesses as well as the production of uncoated fine paper in Gohrsmühle. M-real will continue the profitable Chromolux business and investigate possibilities to start up a new customer service and logistics center for folding boxboard in Gohrsmühle, including a sheeting facility.

M-real is currently negotiating to divest its Premium Papers business of the Reflex mill. The carbonless paper converting operations of the Reflex are under negotiations to be discontinued.

There are currently approximately 940 employees at Gohrsmühle and Reflex mills in total. The Chromolux business and the planned cartonboard customer service center would employ approximately 400 persons. There are approximately 100 employees working for the Reflex Premium Papers business, to be potentially divested.

M-real has in recent years implemented plenty of major profit improvement measures at Gohrsmühle and Reflex mills including headcount reductions, closure of the loss-making coated fine paper production in Gohrsmühle and transfer of the Simpele mill’s speciality paper volumes to Gohrsmühle. Despite heavy improvement measures the Gohrsmühle and Reflex operations have, due to the challenging operating environment of the European paper industry, remained severely unprofitable. Currently the monthly operating loss is approximately EUR 5 million per month. There are no signs that the profitability would materially improve in the future.

M-real has attempted to divest the Gohrsmühle and Reflex operations to many different buyer candidates during the last 5 years. In 2010 M-real successfully divested a part of the Reflex mill to Metsä Tissue. The other attempts to divest the operations have failed due to the major losses of the operations, the European overcapacity in fine and speciality papers and the severe cost inflation.

“We have done lot of work to find buyers for both Alizay and Gohrsmühle mills. We have been ready to accept a heavily negative sales price. Regardless, demands of buyer candidates have on the one hand been unacceptable from the company’s’ perspective, while on the other hand they have not been able to demonstrate capability to turn the unprofitable operations profitable, thereby guaranteeing the continuation of operations as a responsible owner and employer”, says M-real’s CEO Mikko Helander.

Financial impacts of the planned measures

If the production closure measures are implemented as planned M-real’s annual sales is expected to reduce by approximately EUR 400 million, while the operating result is expected to increase by approximately EUR 70 million based on 2011 first half’s actual performance. Most of the annual financial impact is expected to materialize in 2012 with full impact from 2013 onwards. None of the planned measures will be implemented without consulting the employee representatives in line with applicable legal requirements.

If the measures materialize fully as planned, they are preliminarily expected to result in approximately EUR 180 million negative non-recurring items in total. In 3Q 2011 Office Papers operating result is expected to include approximately EUR 8 million non-recurring asset impairment and Speciality Papers business area EUR 9 million cost provisions. The 2Q 2011 Speciality Papers operating result included non-recurring impairment and cost provisions in total of EUR -22 million. . Rest of the non-recurring items will be booked in 4Q 2011 and in 1Q 2012. The estimated net cash costs of all planned measures, taking into consideration change in net working capital from the beginning of May 2011, are approximately EUR 50 million in total. “If implemented, the planned measures will lead to an even stronger transformation of M-real to become a cartonboard company as stated in our strategy. At the same time the profitability of the company will raise to a new improved level,” says Helander.