Kemira's President and CEO Harri Kerminen:

"The fourth quarter marks the end of the fourth year implementing the water chemistry strategy for Kemira. Kemira's growth in water business continued throughout the year, especially in the Oil & Mining segment. The water business share of the total revenue has increased to 78% and water related revenues grew 6% in 2011. At the same time, Kemira earnings per share from continuing operations increased to a record high level. Most importantly, 2011 was the third consecutive year of strong positive cash flow generation. Therefore, Kemira has been able to continuously invest in future growth projects.

Raw material prices increased rapidly in the beginning of the year. The prices for some of our key raw materials have continued to increase during the second half of the year and are still at a very high level. This, together with slower demand in the Paper segment and Municipal as well as inconsequential de-icing business in the fourth quarter, impacted Kemira's profitability in 2011.

Kemira's first priority is to improve the profitability by being cost efficient and by growing the topline especially through localized presence in the emerging markets. The profitability will improve by implementing various productivity and efficiency measures and developing more stringent sales pricing management. In 2011, more than EUR 40 million in revenue was generated through new products and applications. One example are new water chemistry applications for the fast growing unconventional oil and gas business.

It has been evident that the importance of water, energy and raw material efficiency in our customer industries has increased. This trend is an opportunity for Kemira to further develop our offering and work closely with our customers to improve their process efficiency and productivity. Kemira's strategic priorities and business targets will remain intact.

In the near term, uncertainty in Europe and a slowdown in global economic growth may affect the demand for our products in the customer industries. In 2012, Kemira expects the revenue and operative EBIT to be slightly higher than in 2011."

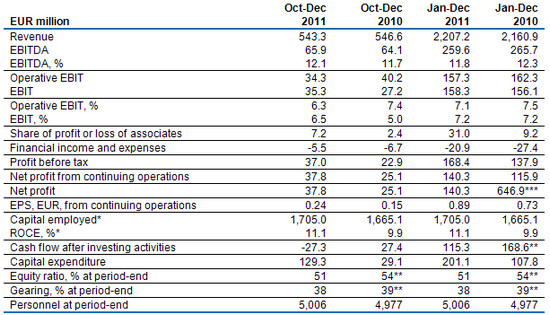

Key figures and ratios

The figures for 2010 are for continuing operations, excluding Tikkurila, unless otherwise stated. Tikkurila Oyj was separated from Kemira on March 26, 2010.

* 12-month rolling average

**Includes Tikkurila until March 25, 2010

***Net profit January-December 2010 includes a non-recurring income of EUR 529.2 million from the separation of Tikkurila consisting of the difference between the market price of Tikkurila on March 26, 2010 and the shareholder's equity of Tikkurila on March 25, 2010 less the transfer tax related to Tikkurila's listing as well as the listing costs.

Definitions of key figures are available at www.kemira.com > Investors > Financial information. Comparative 2010 figures are provided in parentheses for some financial results, where appropriate. Operating profit, excluding non-recurring items, is referred to as Operative EBIT. Operating profit is referred to as EBIT.

Dividend

On December 31, 2011, Kemira Oyj's distributable funds totaled EUR 633,128,300 net profit of which accounted for EUR 245,598,837 for the period. No material changes have taken place in the company's financial position after the balance sheet date.

Kemira Oyj's Board of Directors proposes to the Annual General Meeting to be held on March 21, 2012 that a dividend of EUR 0.53 totaling EUR 81 million shall be paid on the basis of the adopted balance sheet for the financial year ended December 31, 2011.

Outlook

Kemira's vision is to be a leading water chemistry company. Kemira will continue to focus on improving profitability and reinforcing positive cash flow. The company will also do investments to secure the future growth in the water business.

Kemira's financial targets remain as communicated in connection with the Capital Markets Day in September 2010. The company's medium term financial targets are:

- revenue growth in mature markets > 3% per year, and in emerging markets > 7% per year

- EBIT, % of revenue > 10%

- positive cash flow after investments and dividends

- gearing level < 60%.

The basis for growth is the growing water chemicals markets and Kemira's strong know-how in water quality and quantity management. Increasing water shortage, tightening legislation and customers' needs to increase operational efficiency create opportunities for Kemira to develop new water applications for both new and current customers. Investment in research and development is a central part of Kemira's strategy. The focus of Kemira's research and development activities is on the development and commercialization of new innovative technologies for Kemira's customers globally and locally.

In the near term, uncertainty in Europe and a slowdown in global economic growth may affect the demand for our products in the customer industries. In 2012, Kemira expects the revenue and operative EBIT to be slightly higher than in 2011.