Wausau Paper (NYSE:WPP) has reported that:

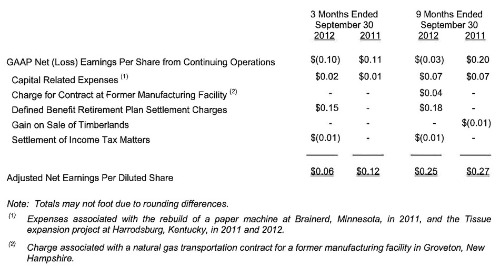

- Excluding special items, third-quarter adjusted net earnings from continuing operations were $0.06 per diluted share, compared to adjusted net earnings of $0.12 per diluted share during the same period last year.

- Net earnings from continuing operations, excluding special items, for the nine months ended September 30, 2012 and 2011, were $0.25 per diluted share and $0.27 per diluted share, respectively.

During 2012, the Company completed the sale of its premium Print & Color brands, inventory and select equipment, and the permanent closure and sale of its Brokaw, Wisconsin, manufacturing site. The Company began reporting the operations of the Brokawmanufacturing facility and related closure activities as a discontinued operation as of March 31, 2012, in the condensed consolidated balance sheet. Additionally, the discontinued operation is separately presented from continuing operations for all periods presented in the condensed consolidated statements of operations. All results discussed below exclude the discontinued operation unless otherwise indicated.

Third-quarter net loss from continuing operations was $5.2 million, or $0.10 per share compared to net earnings of $5.4 million, or $0.11 per diluted share a year ago. On a year-over-year basis, consolidated net sales decreased five percent to $202 million with shipments measured in tons decreasing three percent. Year-to-date, the Company reported a net loss from continuing operations of $1.5 million, or $0.03 per share, compared with net earnings of $10.0 million, or $0.20 per diluted share in the comparable 2011 period. For the nine months ended September 30, consolidated net sales increased two percent to $631 million as shipments increased four percent.

On an adjusted basis, third-quarter results included after-tax expenses of $7.6 million, or$0.15 per diluted share related to settlement charges on certain defined benefit pension plans and $1.2 million, or $0.02 per diluted share for capital-related expense for the Tissue expansion project. Prior-year third-quarter results included after-tax capital-related expenses of $0.4 million, or $0.01 per diluted share for the Tissue expansion project.

For the first nine months of 2012, adjusted net earnings from continuing operations were$12.3 million, or $0.25 per diluted share, compared with prior-year adjusted net earnings of$13.2 million, or $0.27 per diluted share. Although these comparisons are non-GAAP measures, the Company believes that the presentation of adjusted net earnings from continuing operations provides a useful analysis of ongoing operating trends. Adjusted earnings for the three and nine-month periods are reconciled to GAAP earnings below.

Click image to enlarge

Including discontinued operations, net of tax, third-quarter net loss was $5.3 million, or $0.11per share, compared to net earnings of $5.2 million, or $0.10 per diluted share, for the same period last year. Current-quarter and prior-year results included earnings from continuing operations before income taxes offset by income tax expense and a net loss from discontinued operations of $0.2 million, or $0.00 per share.

For the nine months ended September 30, 2012, including discontinued operations, net of tax, net earnings were $3.1 million, or $0.06 per diluted share, compared to net earnings of $7.0 million, or $0.14 per diluted share, for the same period last year. Net earnings in the current year included earnings from continuing operations before income taxes offset by income tax expense and net earnings from discontinued operations of $4.6 million, or $0.09 per diluted share. Net earnings in the prior year included earnings from continuing operations before income taxes, offset by income tax expense, and a net loss from discontinued operations of$3.0 million, or $0.06 per share.

Henry C. Newell, president and CEO, commenting on the Company’s continued progress against strategic initiatives, said, “Our Tissue expansion is on track as three to four percent case shipment growth continues to drive improving operating margins, now approaching 13 percent. The second half is proving to be a challenge for our Paper segment, as we see slowing demand in industrial and tape markets at a time when we are commercializing new technical capacity at our Brainerd, Minnesota, facility. Despite these pressures, technical volumes are up six percent this year and specifically, tape sector volume is up 14 percent, the result of new customer business and new product introductions.

“The successful exit of our Print franchise has resulted in an exceptionally well positioned balance sheet as we continue to commercialize technical capacity on our Brainerd asset and complete the installation, start-up and commercialization of the new towel and tissue machine at Harrodsburg, Kentucky. We expect to report continued progress over the coming quarters against the long-term growth targets and timelines we’ve outlined this year.”

TISSUE SEGMENT

The Tissue segment’s third-quarter operating profit of $7.5 million included pre-tax expense of $1.9 million related to the expansion activity. This result compared favorably to prior-year operating profit of $7.0 million, including $0.7 million in expansion-related pre-tax expense.

PAPER SEGMENT

During 2012, the Company completed the sale of this segment’s premium Print & Color brands, inventory and select equipment, and ceased papermaking and converting operations at its former primary Print & Color manufacturing site in Brokaw. In the third quarter, we sold the mill site to an unrelated third party. Results of operations related to the former Brokawmanufacturing facility are reported as discontinued operations and for the third quarter and the same period last year included, net-of-tax, a loss of $0.2 million from operations.

From continuing operations, the Paper segment reported a third-quarter operating loss of $7.9 million versus an operating profit of $5.9 million for the same period in 2011. The 2012 third-quarter operating loss included pre-tax expense of $7.7 million related to a settlement charge on a certain defined benefit pension plan associated with our former Jay, Maine, facility. The operating results reflect the impact of transitioning capacity to technical grades, including extensive trialing activity at our Brainerd papermaking operations and the pace of working capital liquidation as a result of the premium Print & Color sale and Brokaw closure activity.

In a release issued October 1, the Company set forth full-year guidance for adjusted net earnings from continuing operations of $0.28-$0.30 per diluted share compared to prior-year adjusted net earnings of $0.33 per diluted share.

Click here to download the full release and tables