Displaying items by tag: Metsä Group

Tomi Seppä appointed manager of Metsä Group’s mills in Kemi and Ari-Pekka Vanamo manager of Metsä Group’s pulp mill in Rauma

Tomi Seppä, Mill Availability Manager at Metsä Fibre's Kemi pulp mill, has been appointed manager of the Kemi mills as of 1 January 2018. Seppä will be responsible for managing Metsä Fibre’s pulp mill and Metsä Board’s board mill in Kemi. In his new position, Tomi Seppä will report to Harri Pihlajaniemi, SVP, Production at Metsä Board, with regard to the board mill, and to Camilla Wikström, SVP, Production of Metsä Fibre’s pulp business, with regard to the pulp mill.

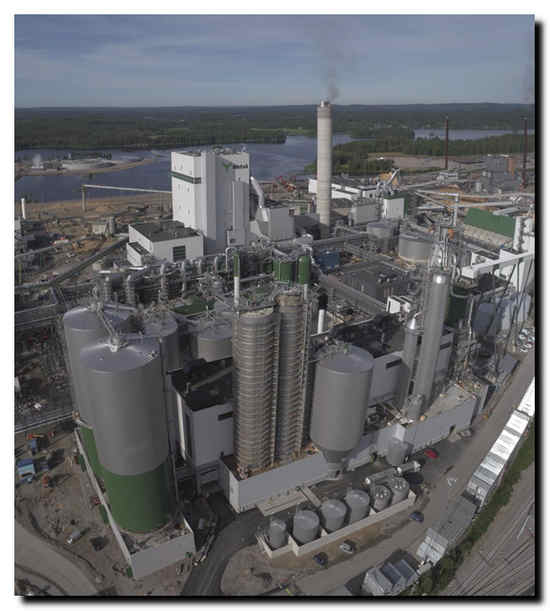

Metsä Board Kemi Mill

Metsä Board Kemi Mill

Ari-Pekka Vanamo, Manager of Metsä Group’s mills in Kemi, will start as the manager of Metsä Group’s pulp mill in Rauma as of 1 January 2018. In his new position, Vanamo will report to Camilla Wikström, SVP, Production of Metsä Fibre’s pulp business.

Metsä Board

www.metsaboard.com

Metsä Board is a leading European producer of premium fresh fibre paperboards including folding boxboards, food service boards and white kraftliners. Our lightweight paperboards are developed to provide better, safer and more sustainable solutions for consumer goods as well as retail-ready and food service applications. We work together with our customers on a global scale to innovate solutions for better consumer experiences with less environmental impact. The pure fresh fibres Metsä Board uses are a renewable resource, traceable to origin in sustainably managed northern forests.

The global sales network of Metsä Board supports customers worldwide, including brand owners, retailers, converters and merchants. In 2016, the company’s sales totalled EUR 1.7 billion, and it has approximately 2,500 employees. Metsä Board, part of Metsä Group, is listed on the Nasdaq Helsinki.

Metsä Group

www.metsagroup.com

Metsä Group is a forerunner in bioeconomy utilising renewable wood from sustainably managed northern forests. Metsä Group focuses on wood supply and forest services, wood products, pulp, fresh fibre paperboards and tissue and cooking papers.

Metsä Group’s sales totalled EUR 4.7 billion in 2016, and it employs approximately 9,300 people. The Group operates in some 30 countries. Metsäliitto Cooperative is the parent company of Metsä Group and owned by approximately 104,000 Finnish forest owners.

Metsä Group’s bioproduct mill chooses ABB Ability[TM] Collaborative Operations Center

Leading producer of bioproducts and bioenergy Metsä Fibre, part of Metsä Group, and ABB have signed an agreement to connect ABB electrical systems installed at the Äänekoski bioproduct mill to the ABB Ability Collaborative Operations solution portfolio. The solutions include the remote monitoring of electrical systems using cloud services, and remote access to ABB experts 24/7 aimed at raising the performance and reliability of electrical systems to a new level.

ABB supplied the Metsä Group’s bioproduct mill in Äänekoski in Central Finland in 2016 with a comprehensive electrification solution including the mill’s entire electrical power distribution system and process electrification. Metsä Fibre and ABB have now signed an agreement to connect a considerable number of the supplied devices to ABB Ability Collaborative Operations. This will enable remote monitoring of functionality and availability of the electrical devices and electrical systems through Metsä Fibre as well as ABB experts and allow real-time collaborating to achieve the highest possible availability and performance.

“This gives us an at-a-glance overview of the status of all of ABB electrical devices connected to the system. We can see what level of stress the frequency converters are under, and can monitor their condition and react to deviations proactively,” says Botnia Mill Service’s Ossi Puromäki, who is in charge of the bioproduct mill’s lifecycle contracts.

Photo: Metsä Group

Photo: Metsä Group

ABB Collaborative Operations is a true Internet-of-Things application and is part of the company's portfolio of ABB Ability with industry-leading digital solutions. Collaborative Operations provides performance management, remote monitoring and preventive analysis technologies to ensure security, and improve efficiency and productivity in various industries. ABB Collaborative Operations Centers connects people in enterprise-wide production facilities and headquarters to ABB’s technology and expertise.

The electrical power distribution system at the mill includes 650 frequency converters alone. Condition monitoring is also facilitated by extensive device-specific alarms and, as ABB Ability presents its data in the cloud, ABB experts can provide instant support in tackling problems. Furthermore, analyzing the data collected from electrical systems and devices for its predictive value also enhances reliability over the long-term.

“Monitoring helps us to do maintenance on the right device at the right time, instead of simply servicing all devices at predefined intervals. This will optimize both costs and quality of upkeep,” says Puromäki.

“Our mill’s most important performance indicator is its availability rate, which we target to maintain at 98 percent and above on an annual rate. Maintenance plays a critical role in ensuring this high level of performance,” said Timo Merikallio, Project Director of bioproduct mill project. ”At the same time, we simply don’t have all expertise at the mill. Therefore, maintenance based on cooperation with trusted partners is key for us.” Merikallio continued.

“ABB has been remotely monitoring paper mill drives and electrical distribution systems for many years. Applying this knowledge in the context of ABB Ability Collaborative Operations takes it to a whole new level and demonstrates our leadership in delivering real benefits to our customers through big data. It allows us to turn data into insights and immediate actions that significantly improve our customers’ operations in terms of availability, performance and quality,” says Jim Fisher, Global Product Group Manager for Pulp and Paper.

The Metsä Fibre site will primarily be monitored from the Helsinki ABB Ability Collaborative Operations Center, which ABB has opened in October this year. Along with the existing centers in Westerville, Ohio, USA and a planned center in Singapore, scheduled to be opened beginning of next year, this center will focus on the pulp and paper industry, giving access to ABB industry experts on the “follow the sun” principle and supporting customers anywhere in the world.

ABB (ABBN: SIX Swiss Ex) is a pioneering technology leader in electrification products, robotics and motion, industrial automation and power grids, serving customers in utilities, industry, and transport and infrastructure globally. Continuing history of innovation more than 125 years long, ABB today is writing the future of industrial digitalization and driving the Energy and Fourth Industrial Revolutions. ABB operates in more than 100 countries and has about 136,000 employees. www.abb.com

Metsä Group’s tissue and cooking paper business invests in bioenergy in Sweden

Katrinefors Kraftvärme AB (KKAB), a 50/50 joint venture owned by Metsä Tissue, part of Metsä Group, and the local municipal energy company VänerEnergi AB, will build a new biomass combined heat and power (CHP) plant in Mariestad, Sweden, in conjunction with the Metsä Tissue mill. This will be the second bioenergy plant operated by KKAB.

The construction of the new plant will start in April 2013. The plant is expected to be operating by the end of 2014. The total investment will amount to approximately 30 million euros of which Metsä Tissue’s share will be 50 per cent.

According to Mark Watkins, SVP Tissue Scandinavia, KKAB’s new bioenergy plant is an important step in increasing the share of bioenergy. In Metsä Group, the share of wood-based bioenergy is high, as over 80 per cent of all the used fuel is biomass.

Increasing the share of bioenergy is one of the key activities in Metsä Group’s efforts to mitigate climate change and reduce fossil CO2 emissions. Metsä Group’s target is to reduce fossil-based CO2 emissions by 30 per cent per product tonne by 2020 from the 2009 level.

The new bioenergy production reduces significantly, even as much as 90 per cent, Metsä Tissue Mariestad mill’s oil usage. The new power plant will decrease Mariestad mill’s CO2 emissions by approximately 6,000 tonnes, i.e. by 30 per cent from the present. Currently oil is used to cover wintertime peak in heat demand and as reserve fuel.

The new biomass CHP plant will be composed of an approximately 28 MW biomass boiler to produce heat and approximately 7 MW turbine to produce electricity. The biomass fuels consist of energy wood and the mill’s recycled fibre residues.

In addition to producing electricity and heat to Mariestad mill, the plant will provide renewable energy for the surrounding community in the form of district heating and bio-based grid electricity.

METSÄ GROUP

Group Communications

Fire at Metsä Board’s Gohrsmühle mill in Germany

A fire broke at the reel warehouse of Metsä Board Corporation’s Gohrsmühle mill in Germany early in the morning of 15 February 2013. Several fire rescue departments’ units from the neighboring areas arrived on the mill site and the work to put out the fire continues. According to current information there is no danger of the fire spreading to a wider area. No personal injuries have occurred.

A fire broke at the reel warehouse of Metsä Board Corporation’s Gohrsmühle mill in Germany early in the morning of 15 February 2013. Several fire rescue departments’ units from the neighboring areas arrived on the mill site and the work to put out the fire continues. According to current information there is no danger of the fire spreading to a wider area. No personal injuries have occurred.

Metsä Board produces cast coated Chromolux papers and has folding boxboard sheeting operations, launched in autumn 2012, at the Gohrsmühle mill.

The sheeting operations at the site will be stopped for some time due to the fire and customers will be informed about the possible impacts on the deliveries in due course. According to current understanding, the fire is not expected to have any material impact on Metsä Board’s total folding boxboard deliveries nor any material result impact for Metsä Board.

Metsä Board Corporation’s operating result excluding non-recurring items was EUR 74 million in 2012

Metsä Board Corporation Financial Statements 1 January–31 December 2012, 7 February 2013 at 12:00 noon

Full year result for 2012

-Sales were EUR 2,108 million (Q1–Q4/2011: 2,485).

-The operating result excluding non-recurring items was EUR 74 million (59). The operating result including non-recurring items was EUR 220 million (-214).

-The result before taxes excluding non-recurring items was EUR 30 million (0). The result before taxes including non-recurring items was EUR 176 million (-281).

-Earnings per share excluding non-recurring items were EUR 0.13 (0.02) and including non-recurring items EUR 0.53 (-0.83).

-The Board of Directors proposes that a dividend of 0.06 euros per share be distributed for the financial year 2012.

Result for the fourth quarter of 2012

-Sales were EUR 509 million (Q3/2012: 532).

-The operating result excluding non-recurring items was EUR 25 million (25). The operating result including non-recurring items was EUR 41 million (22).

-The result before taxes excluding non-recurring items was EUR 12 million (10). The result before taxes including non-recurring items was EUR 27 million (8).

-Earnings per share excluding non-recurring items were EUR 0.08 (0.02) and including non-recurring items EUR 0.13 (0.02).

Events in the fourth quarter of 2012

-Delivery volumes decreased from the previous quarter mainly due to seasonal reasons.

-Average price of linerboard increased. Pulp price took an upward turn. The average prices of folding boxboard and papers declined slightly.

-The new biopower plant owned by Pohjolan Voima and Leppäkosken Sähkö was commissioned at Metsä Board Kyro mill.

Events after the period

The Alizay mill site in France, including machines, equipment and buildings, was sold to Conseil General de l’Eure for EUR 22 million.

“The operating result excluding non-recurring items in the last quarter of 2012 was at the third quarter level, as expected. Folding boxboard delivery volumes were at a normal level, although slightly lower than in the previous quarter due to seasonal effects. Demand for linerboard continued to be strong, and the price increase had a positive impact on the result in the last quarter of the year. The price of pulp also increased, and demand was good in the last quarter. Instead, demand for and price level of papers decreased in Europe, which weakened the profitability of our paper production.

The year 2012 was a significant milestone for our company. We successfully completed our strategic review, launched in 2006, which has resulted in the transformation of the company from a paper producer to the leading paperboard company. The measures to eliminate the last heavy losses of our paper operations were successfully completed. In the fall of 2012, we completed our EUR 120 million investment programme, related to which we increased our annual folding boxboard capacity by approximately 150,000 tonnes, modernized the Kemi linerboard mill, and increased the use of bioenergy in our production.

Our main targets for the year 2013 are the full utilisation of our expanded folding boxboard capacity, development and expansion of our current paperboard product portfolio and improvement of the profitability and cash flow of the paper and market pulp units”.

Mikko Helander, CEO

Near-term outlook

Folding boxboard delivery volumes in the last quarter of 2012 were at a normal level, although seasonally slightly lower than in the previous quarter. Folding boxboard order volumes are expected to gradually improve at the beginning of the year and delivery volumes to increase slightly in the first quarter of 2013, compared to the previous quarter. As a result of the completed annual folding boxboard contract negotiations the volumes are increasing in 2013 compared to 2012 and no material price changes are expected.

Demand for linerboard is expected to continue to be very strong, and delivery volumes are expected to increase slightly in the first quarter of 2013, compared to the previous quarter. No significant changes are expected in the price of linerboard in the coming months.

Delivery volumes of uncoated fine paper are expected to increase slightly in the first quarter of 2013, compared to the previous quarter, and delivery volumes of pulp are expected to be at the previous quarter level. No considerable changes are on the horizon in the price of uncoated fine paper. The currency-denominated price increase of long-fibre pulp is expected to continue at the beginning of the year.

The market situation of coated paper has weakened further since the year end, and delivery volumes and prices are expected to decrease slightly in the first quarter of 2013.

Production costs are expected to increase slightly in the first quarter of 2013, compared to the previous quarter, primarily due to increased energy costs.

Metsä Board’s operating result for the first quarter of 2013, excluding non-recurring items, is expected to improve slightly from the fourth quarter of 2012.

Disclosure procedure

Metsä Board Corporation follows the disclosure procedure enabled by Standard 5.2b published by the Finnish Financial Supervision Authority and hereby publishes its Financial Statements 2012 enclosed to this stock exchange release. Metsä Board's complete Financial Statements is attached to this release in pdf-format and is also available on the company's web site at www.metsaboard.com.

Metsä Board Corporation’s operating result excluding non-recurring items

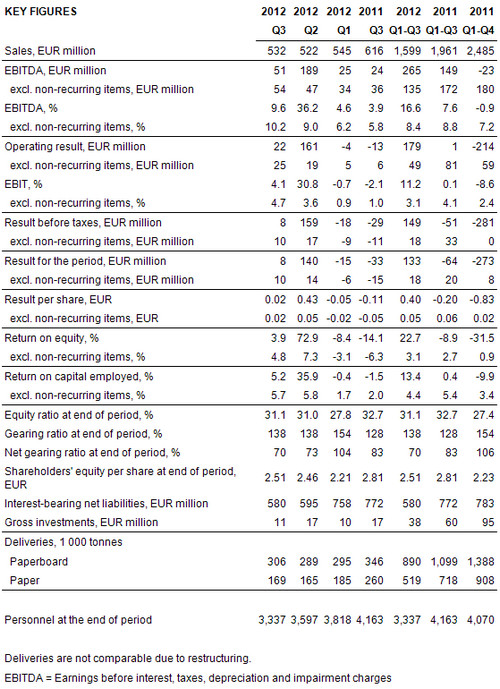

Metsä Board Corporation Interim Report 1 January–30 September 2012, 1 November 2012 at 12 noon

Result for January–September 2012

- Sales were EUR 1,599 million (Q1–Q3/2011: 1,961).

- The operating result excluding non-recurring items was EUR 49 million (81). The operating result including non-recurring items was EUR 179 million (1).

- The result before taxes excluding non-recurring items was EUR 18 million (33). The result before taxes including non-recurring items was EUR 149 million (-51).

- Earnings per share excluding non-recurring items were EUR 0.05 (0.06) and including non-recurring items EUR 0.40 (-0.20).

Result for the third quarter of 2012

- Sales were EUR 532 million (Q2/2012: 522).

- The operating result excluding non-recurring items was EUR 25 million (19). The operating result including non-recurring items was EUR 22 million (161).

- The result before taxes excluding non-recurring items was EUR 10 million (17). The result before taxes including non-recurring items was EUR 8 million (159).

- Earnings per share excluding non-recurring items were EUR 0.02 (0.05) and including non-recurring items EUR 0.02 (0.43).

Events in the third quarter of 2012

- Delivery volumes of paperboard and coated paper increased.

- Delivery volumes of uncoated paper and pulp decreased.

- There were no material changes in paper and paperboard prices. The market price of pulp decreased.

Events after the period

- The biopower plant owned by Pohjolan Voima and Leppäkosken Sähkö was inaugurated at the Kyro mill.

“Our profitability improved further in the third quarter. Favourable development in the paperboard business continued, and delivery volumes increased as expected. Despite the extensive maintenance shutdown at the Husum mill, the operating result of the paper and pulp business remained at the second quarter level.

The paper and paperboard order books and operating rates are currently at a normal level. Folding boxboard order inflows have in recent weeks slowed down somewhat, but the price situation is stable. Paperboard delivery volumes are estimated to be slightly lower in the fourth quarter than in the third quarter, due to seasonal factors. Market prices of pulp are expected to increase in the fourth quarter, but it is estimated that the average price of deliveries will be slightly lower than in the third quarter. The overall situation in the global economy is currently uncertain, which makes business forecasting more difficult than in normal conditions.

We completed the Paperboard business area’s investment programme as planned with the inauguration of the biopower plant at the Kyro mill. Our production machinery is now top class in the world, and our folding boxboard capacity, which was expanded by 150,000 annual tonnes, will be fully available from the beginning of 2013. New capacity is necessary in order for us to ensure the availability of board for our customers in all situations.”

Mikko Helander, CEO

Near-term outlook

The situation in the global economy is currently uncertain, which makes business forecasting more difficult than in normal conditions.

Folding boxboard order books and operating rates are currently at a normal level, but the order inflows have recently slowed down somewhat. The average prices of folding boxboard are not expected to change materially in the coming months.

Linerboard order books and operating rates are at a strong level. Prices of linerboard will be slightly higher in the fourth quarter than in the third quarter, as a result of the price increase implemented in September.

It is estimated that in the fourth quarter the delivery volume of folding boxboard and linerboard will be slightly lower than in the third quarter, due to the seasonally weaker December. The slight increase in the price of linerboard is, however, not estimated to be sufficient to completely cover the negative result impact of the seasonally lower delivery volumes in the fourth quarter in the Paperboard business area.

The delivery volumes of paper and pulp are in the fourth quarter expected to be at least at the third quarter level. No material changes are on the horizon in paper prices. The USD denominated market price of long fibre pulp is estimated to increase somewhat during the fourth quarter. All in all, the average price of Metsä Board’s pulp deliveries in the fourth quarter is however estimated to be slightly lower than in the third quarter.

Production costs are not estimated to change materially in the coming months.

Metsä Board’s operating result in the fourth quarter of 2012, excluding non-recurring items, is expected to be roughly at the third quarter of 2012 level.

Disclosure procedure

Metsä Board Corporation follows the disclosure procedure enabled by Standard 5.2b published by the Finnish Financial Supervision Authority and hereby publishes its Interim Report for January-September 2012 enclosed to this stock exchange release. Metsä Board's complete Interim Report is attached to this release in pdf-format and is also available on the company's web site at www.metsaboard.com.

Metsä Fibre Price announcement

Metsä Fibre will announce a new price of Botnia Nordic Pine (Northern Bleached Softwood Kraft) in Europe, effective November 1, 2012 until further notice.

Metsä Fibre will announce a new price of Botnia Nordic Pine (Northern Bleached Softwood Kraft) in Europe, effective November 1, 2012 until further notice.

The new price is 820 USD, CIF Metsä Fibre’s usual European ports.

The other terms remain as agreed.

Metsä Board organizes a Capital Market's Day on 19 September 2012 in London

Metsä Board Corporation, part of Metsä Group, organizes a Capital Market’s Day on September 19, 2012 in London, UK. The event is organized on invitational basis for analysts. The focus of the day will be on Metsä Board’s growth potential in the traditional European and North American markets as well as in the fast growing Asian markets.

analysts. The focus of the day will be on Metsä Board’s growth potential in the traditional European and North American markets as well as in the fast growing Asian markets.

The event will be organized in the premises of Metsä Board’s highly valued cartonboard customer Unilever, a leading global consumer goods company. As part of the Capital Market’s Day, participants will get an insight on the role of sustainable and high quality packaging as well as the importance of a close partnership with a paperboard supplier and a customer in the global consumer goods business.

Presentation materials will be available on Metsä Board's website www.metsaboard.com on 19 September 2012 by 13 p.m. EET.

METSÄ BOARD CORPORATION

Change in Metsä Board’s Corporate Management Team

Mika Paljakka (43), who has held the Corporate Management Team position of SVP, Human Resources of Metsä Board Corporation, part of Metsä Group, has been appointed Sales Director, Cartonboards, USA. Paljakka will be located in the Metsä Board’s US sales office and he will report to Jorma Sahlstedt, SVP, Paperboard sales, USA.

Mika Paljakka (43), who has held the Corporate Management Team position of SVP, Human Resources of Metsä Board Corporation, part of Metsä Group, has been appointed Sales Director, Cartonboards, USA. Paljakka will be located in the Metsä Board’s US sales office and he will report to Jorma Sahlstedt, SVP, Paperboard sales, USA.

Susanna Tainio, VP, Human Resources, (37) is responsible for Metsä Board’s human resources related matters as of today.

From now on Metsä Board’s Corporate Management Team is the following:

- Mikko Helander, CEO

- Matti Mörsky, CFO

- Pasi Piiparinen, SVP, Head of Paperboard business area

- Seppo Puotinen, SVP, Head of Paper and Pulp business area

- Sari Pajari, SVP, Supply Chain and Business Development

- Jani Suomalainen, SVP, Purchasing

METSÄ BOARD CORPORATION

New frame agreement between Pöyry and Metsä Group

Pöyry and Metsä Group have signed a frame agreement for technical consulting and engineering services. The frame agreement will enable easy cooperation in small and medium sized operations improvement and engineering assignments and provide Metsä Group access to Pöyry's global service network.

According to the agreement, Pöyry will provide Metsä Group with mill lifecycle services ranging from project development services to daily operational engineering work and document management services.

The new agreement is a further step in the long history of cooperation between Metsä Group and Pöyry, which started already in 1958 with Pöyry's first assignment for the engineering of the Äänekoski pulp mill.

"This agreement further strengthens our co-operation with Metsä Group by bringing value added services for the whole life cycle of a mill", comments Nicholas Oksanen, President, Pulp & Paper.

"From now on Pöyry's project management, technology know-how and engineering services are easily available for the client through our broad international office network", says Stefan Nyström, President, Local Service Network.

"We have a long history with Pöyry, who has provided us wide range of engineering services. As we want to focus on the continuous and efficient development of our mills, we needed a partner who knows our operations and is capable of providing state-of-the-art know-how and services. I look forward to our extended co-operation", says Arto Kankaanpää, Head of Main Category, Mill related Support Services from Metsä Group.

Metsä Group is an international forest industry group present in some 30 countries. Metsä Group combines responsible forest economy and innovative technology to produce high-quality products and solutions from renewable Nordic wood in a sustainable way. The Group's five business areas are Wood Supply, Wood Products, Pulp, Board and Paper, and Tissue and Cooking Papers. Metsä Group's sales total EUR 5.3 billion and it employs 12,500 persons.

PÖYRY PLC