Ianadmin

EU approves SCA's disposal of its packaging operations to DS Smith

The European Commission has on the, 25 May 2012, approved DS Smith’s acquisition of SCA's packaging operations, excluding the two kraftliner mills in Sweden. The purchase price amounts to EUR 1.7bn on a debt free basis. The operations have approximately 12,000 employees.

Jan Johansson, President and CEO of SCA, comments: "The most important condition for finalizing the deal has now been fulfilled. Today's decision by the EU will enable SCA to continue to strengthen and consolidate its positions in the hygiene and forest products areas."

The Commission has conditioned the decision to DS Smith making some divestments after the acquisition. SCA's packaging operations will be transferred to DS Smith's ownership in connection with the closing of the deal which is expected to take place according to schedule.

See also previous press releases dated 17 January and 25 April 2012.

UPM sells closed Albbruck paper mill to Karl Unternehmensgruppe, Germany

UPM and Karl Unternehmensgruppe, Innernzell, Germany have reached an agreement on the sale of the Papierfabrik Albbruck GmbH. The closing of the deal is planned to be effective by the beginning of August 2012. The contract parties have agreed not to disclose the value of the transaction.

UPM closed the unprofitable Albbruck paper mill in Baden-Württemberg, Germany in January 2012 and permanently ceased graphic paper production at the site. Since then UPM has actively participated in round table discussions about the possible future use of the mill premises.

“The aim of the forum was to find development ideas and business opportunities for the site. This is now possible by selling the mill to the Karl Unternehmensgruppe“, explains Hartmut Wurster, Executive Vice President, UPM. “We are glad to have found a solid partner in Karl Unternehmensgruppe, which already has experience in the field of re-allocation of industrial companies. This provides new opportunities to the economy of the whole region,” says Wurster.

Kruger ponders fate of Newfoundland mill

Kruger says it will “reassess the viability” of its Corner Brook newsprint mill in Newfoundland, after its proposed relief measures for pension plan funding were rejected by unionized employees.

Only one of four groups of pension plan members rejected the proposal to apply funding relief measures to its pension plan deficits.

There were very few objections to the proposal from active and retired members of the pension plan for non-unionized employees, and few objections from retired members of the pension plan for unionized employees. But, among active members of the pension plan for unionized employees, 54% objected to the proposal.

Under Newfoundland legislation, in order for the relief measures to be applied, they cannot be opposed by more than one-third of members in each group (active and retirees). Consequently, explains Kruger, the relief measures cannot be applied to the unionized employees' pension plan.

The company states that the relief measures were “absolutely necessary” to improve the mill’s competitiveness and secure its future. “In recent years, the Kruger Company has gone to extraordinary lengths to support its Corner Brook operation in a very challenging market afflicted by declining demand for newsprint, increasing energy costs and the negative effects of a strong Canadian currency on exports,” the press release states.

In addition, “the Corner Brook Mill has to contend with other Canadian paper mills that have competitive operating costs and benefit from the additional advantage of funding relief measures for their own pension plan deficits,” the press release continues.

In the days leading up to the vote on pension funding relief measures, a vocal battle took place in the local media, with the CEP union accusing Kruger holding back information regarding the pension funding formula. Kruger defended its actions a direct letter from executive vice-president and chief operating officer Daniel Archambault to union members, saying, “…creating controversy by falsely accusing the company of such maneuvers is extremely irresponsible and may jeopardize our chances to obtain the funding relief measures.

“The company never had any intention to renege on its 2005 commitment and it is appalling to hear such declarations after we have helped the Mill survive the recent recession and worked relentlessly with the unions to find solutions to secure the Corner Brook operation for the long term.”

Resolute Forest Products Shareholders Approve Company Name Change

AbitibiBowater Inc., doing business as Resolute Forest Products, has held its annual general meeting of stockholders in Charlotte, North Carolina. At the meeting, shareholders approved a resolution to amend the Company's certificate of incorporation to change its legal corporate name to "Resolute Forest Products Inc.", effective May 24, 2012. As part of this change, stockholders also agreed to change the Company's common stock ticker symbol from ABH to RFP on both the New York Stock Exchange (NYSE) and the Toronto Stock Exchange (TSX), also effective May 24, 2012. Any impact this legal entity name transition may have for Resolute's customers and business partners will be communicated directly to these parties over the coming days.

Other resolutions approved at the annual stockholder meeting, included:

- The election of eight directors for 2012: Richard B. Evans, Richard D. Falconer, Richard Garneau, Jeffrey A. Hearn, Bradley P. Martin, Alain Rhéaume, Michael S. Rousseau and David H. Wilkins.

The ratification of the appointment of PricewaterhouseCoopers LLP as the Company's independent registered public accounting firm for the 2012 fiscal year.

International Paper Hosts Investor Day Conference

International Paper hosted its Investor Day conference in New York City on Thursday 24th May 2012 as Chairman and CEO John Faraci outlined the company's global business strategy and cash flow potential for the coming years.

As the leading global provider of paper and packaging, the company detailed plans for growing its free cash flow. "The way we measure the success of our transformation is our profitability," said Faraci. "The transformation that we have made as a company over the last eight years has allowed us higher, more sustainable and less cyclical margins. The company is well-positioned in attractive markets with low-cost assets that can generate strong free cash flow and returns that exceed our cost-of-capital. Most importantly, we have the leadership and global talent to execute and drive results."

The company says it has significant earnings runway with the current portfolio and will continue to build leading positions in fiber-based paper & packaging segments in high-growth markets, as increasing cash generation enables both reinvestment and return of capital to shareholders.

SOURCE International Paper

Ahlstrom extends innovative Acti-V(TM) technology to its entire supercalendered release papers range

Ahlstrom, a global high performance materials company, will extend the application of its recently launched Ahlstrom Acti-V(TM) technology to all supercalendered release papers manufactured at its La Gère plant in France. The products are used for Pressure Sensitive Adhesive (PSA) labeling, as well as for specialty tape and industrial applications.

Ahlstrom started to market Ahlstrom Acti-V(TM) release papers for PSA labeling applications, manufactured at its Turin plant in Italy. In order to meet the growing customer demand worldwide, the company is planning equipment modifications at its La Gère facility in France in August 2012. Consequently, Ahlstrom will be able to increase its Ahlstrom Acti-V(TM) production volume and potentially reach up to one hundred percent of the plant's output. This will also enable applying Ahlstrom Acti-V(TM) technology to the two-side silicone coating papers range for tape and industrial applications, which represent a major focus of the French site.

Ahlstrom Acti-V(TM) is a new generation of release papers for silicone coating. The Ahlstrom patented technology was first introduced to the market at Labelexpo Europe 2011 in the end of last year. Thanks to the new technology, Ahlstrom Acti-V(TM) plays an active role in the silicone curing and anchorage process. Silicone curing requires less catalyst (platinum) and energy. At the same time, it improves silicone coverage while the anchorage is stronger and more durable, even in challenging environmental conditions.

"Ahlstrom Acti-V(TM) has received an extremely warm acceptance from the market, since it responds to some of the key operational challenges of our customers. A few months after introduction, the product proves its benefits running on industrial coaters in Europe, Asia and the Americas. By expanding manufacturing to our La Gère plant, we will be in the position to offer Ahlstrom Acti-V(TM) benefits for an even wider number of applications" says Daniele Borlatto, Executive Vice President, Label and Processing.

Ahlstrom is a global leading producer of release papers for the PSA industry. It operates five release liners production sites located in Europe (4) and South America (1). Those plants belong to the Ahlstrom's Label and Processing business area.

Rottneros disposes of Rockhammars Bruk AB

Rottneros has sold Rockhammars Bruk AB, which owns the property where sawmill operations were previously conducted. The purchaser is NA Sverige AB, which intends to run a recycling operation at the site. The book value has been zero since the pulp mill at Rockhammar was disposed of in 2009, and the sale has resulted in a small positive effect on the result and cash flow.

Rottneros AB sold the pulp mill at Rockhammar to Korsnäs in 2009 through an asset sale. No operation has been run at Rockhammars Bruk AB since then besides the leasing of timber storage areas and also the management of land and buildings within the area of the sawmill, which was shut down in 2005. The new owner intends to run an industrial operation within the recycling sector at the saw mill property.

An adjacent forestry property, which does not form part of the transfer, also comprises areas that are ideal for the storage of timber and the like. The intention is to dispose of this property as well.

Rottneros discloses the information provided herein pursuant to the Securities Markets Act and/or the Financial Instruments Trading Act. The Information was submitted for publication on Wednesday, 23 May 2012 at 10.30 CET.

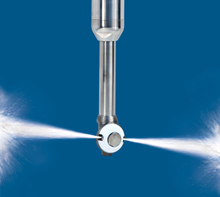

New TankJet® 55 Fluid Driven Tank Cleaner for Tanks/Barrels/Drums up to 5’ (1.5 m) in dia.

TankJet 55 tank cleaner is now available from Spraying Systems Co. The powerful TankJet 55 operates at low flows and fast cycle times enable cleaning of multiple tanks, barrels and drums in minutes. It is easy to use and can be repaired in the field.

TankJet 55 tank cleaner is now available from Spraying Systems Co. The powerful TankJet 55 operates at low flows and fast cycle times enable cleaning of multiple tanks, barrels and drums in minutes. It is easy to use and can be repaired in the field.

TankJet 55 is compact and fits in openings as small as 1-3/4" (44.5 mm). The durable tank cleaner is constructed of 316L stainless steel with carbon-filled PTFE seals. Two models are available: standard models for faster rotation and shorter cycle times and slow, rotational models which allow excellent dwell time for cleaning tougher residues.

The fluid-driven, turbine-driven TankJet 55 cleans using narrow angle full cone sprays rotating in multiple axes for 360° coverage.

TankJet 55 is suitable for many applications including cleaning 59 gallon (223 l) barrels, 55 gallon (208 l) drums and small tanks, containers and totes.

Endress+Hauser exceeds expectations in 2011

Endress+Hauser has ended the year 2011 with figures far exceeding expectations. Surprisingly powerful business developments made for new records in sales, headcount and profit. For the current year, the global measurement engineering group, headquartered in Reinach, Switzerland, expects solid growth.

Presenting the financial results in Basel, CEO Klaus Endress made no secret of his surprise regarding these positive developments. The sovereign debt crisis and resulting currency upheavals, as well as the natural disasters in Asia that led to bottlenecks in the supply of electronic components had, he said, stretched the company’s employees to their limit. “But we nonetheless grew across most regions and industrial sectors.”

Endress+Hauser increased net sales by 16 percent to 1.5 billion euros. The Americas showed even stronger dynamic growth than Asia, but sales in Europe also grew with double-digit figures. Only Africa and the Middle East fell behind expectations, a consequence of the political unrest in the Arab region and Northern Africa.

Strong drivers boost development

As COO and the CEO’s deputy in charge of sales, Michael Ziesemer sees “strong driving forces” behind these successful business figures – global megatrends such as the growing demand for energy and resources, or the necessity of energy efficiency and environmental protection. Important issues with substantial future impact, he said, could only be solved with the help of measurement engineering.

The Group achieved the biggest growth in the oil & gas industry. The Enterprise Framework Agreement with the energy group Shell shows that Endress+Hauser has established itself as a serious supplier in this industry. Sales in the chemical industry developed strongly, followed by power & energy, food & beverage, primaries, life sciences and water & wastewater industries.

Growth creates new jobs

The powerful growth in sales went hand in hand with a boost in employment. The Group counted 9,414 employees at the end of 2011, 820 more than the year before (plus 10 percent). 474 of these jobs were created in Europe, 297 of these in the Swiss-German-French region around Basel where the two biggest production centers, several Group companies and the holding company are located.

High productivity raises profit levels

Effective capacity utilization in the plants was reflected in higher productivity. Operating profit rose by 32 percent to 247 million euros, with earnings before tax rising by 46 percent to 243 million euros. The financial year was marked by strong currency exchange fluctuations. Although the euro fell by an average of 10 percent against the Swiss franc, the exchange rate at the year-end closing date was only 2.5 percent lower than the year before – unlike in 2010, the impact on the financial result was therefore moderate.

Net income exceeded 177 million euros (plus 40 percent), another record-high figure, and the equity ratio reached almost 70 percent. The Group has over 443 million euros in liquid assets, with just 40 million euros in bank liabilities. Endress+Hauser, said CFO Dr Luc Schultheiss, stands on financially firm ground. At the end of 2011, the 50-year-old took over from Fernando Fuenzalida (69). The former CFO will join the Group’s Supervisory Board.

Endress+Hauser Group invests and acquires

After two years of reticence, the Group increased investments by 49 percent to 85 million euros. Expansion focused mainly on production capacity, for example in Maulburg, Gerlingen and Waldheim in Germany, Greenwood, Indiana in the USA, and Cernay in France. The Dutch sales center moved into a new building in Naarden. Endress+Hauser set up a sales subsidiary in Saudi Arabia and opened a representative office in Vietnam.

The capital resources allowed the Group two strategic acquisitions. Endress+Hauser bought a minority share in Finesse Solutions, a US company specializing in single-use solutions for biotechnological processes. Klaus Endress sees this as a ‘key technology’ for many spin-offs in process engineering. Another promising acquisition, the CEO says, is Systemplan headquartered in Durmersheim, Germany. The engineering bureau offers businesses its consulting services in energy efficiency, supplementing Endress+Hauser’s respecting offerings in measurement engineering, software and engineering services.

Confidence in spite of uncertainties

Endress+Hauser has set a growth target of 11 percent for the current year. Figures are moderately below budget at present, said Klaus Endress, with China in particular not living up to expectations. “But our figures are robust. There is neither recession nor crisis right now.” Nevertheless the CEO mentioned severe uncertainties owing to the continuing sovereign debt crisis and tensions in the euro zone.

Endress+Hauser aims to invest 140 million euros this year, mainly in production facilities in Germany, France and Switzerland, but also in the United States, China and Brazil where a new production facility is under construction for flow, level and pressure measurement engineering. Around 700 new jobs are expected to be created worldwide. By the end of the year, Endress+Hauser will most likely top the 10,000 mark in terms of headcount.

The Endress+Hauser Group

Acquisition of UPM's packaging paper operations approved by the requisite regulatory authorities

The requisite regulatory authorities have approved Billerud Finland Oy's acquisition of UPM's packaging paper operations at Pietarsaari and Tervasaari. Billerud Finland Oy is a wholly owned subsidiary of Billerud AB. The purchase price is around EUR 130 million.

“The acquisition strengthens our offering in packaging paper and provides us with a strong platform for the further development of smarter packaging solutions. Also, the acquisition sharply reduces our pulp exposure as we will purchase an annual pulp volume corresponding to around 85% of Billerud's present pulp sales volume. We also reduce our currency exposure,” says Per Lindberg, President and CEO of Billerud.

The transaction involves Billerud taking over one paper machine at Pietarsaari and one at Tervasaari, both in Finland. In 2011, sales amounted to around EUR 220 million (SEK 2 billion). Manufactured products are various packaging papers (sack/kraft paper) with extensive areas of use in the food, retail, construction and other industries.

Completion of the acquisition is expected to take place during the second quarter of 2012.