Ianadmin

Hunkeler Innovationdays Review: Mondi demonstrates growth in printing possibilities

At this year’s Hunkeler Innovationdays trade fair in Lucerne Switzerland, Mondi presented its high-speed inkjet portfolio after a year of fast-moving developments that resulted in the launch of several new papers. The international paper and packing manufacturer has focused on creating a wide-ranging high-speed inkjet portfolio, which offers a variety of grammages, haptics, and whiteness levels to accommodate the expanse of applications possible with high-speed inkjet machines.

At this year’s Hunkeler Innovationdays trade fair in Lucerne Switzerland, Mondi presented its high-speed inkjet portfolio after a year of fast-moving developments that resulted in the launch of several new papers. The international paper and packing manufacturer has focused on creating a wide-ranging high-speed inkjet portfolio, which offers a variety of grammages, haptics, and whiteness levels to accommodate the expanse of applications possible with high-speed inkjet machines.

A main feature at Hunkeler Innovationdays was printing and converting machines for book printing applications. In addition to sponsoring the Digital Book Printing Forum on February 13 with the off-white paper BIO TOP 3® high-speed inkjet, Mondi papers were also in use by various OEMS and printers at the fair. The Swiss, climate neutral printing house Edubook used Mondi’s DNS® high-speed inkjet CF (coated feel) for a book-on-demand application they displayed at Hunkeler Innovationdays. Edubook specialises in digital printing technologies for book-on-demand and content-on-demand applications for educational or training purposes.

Edubook Director Nicolas von Muehlenen commented: “We used DNS® high-speed inkjet CF in-house on an Océ ColorStream 3700 to print a medical text book with high image content. For this type of an application, we felt the paper was a good fit. It has a smooth even surface that resembles a satin finish and the colour reproduction is excellent. The ink doesn’t absorb too deeply into the paper, which results in richer colours. We were also impressed with the red shades achieved. Overall, the image quality was sharp and the contrasts were clean, which is why we showcased this book at the Hunkeler Innovationdays.”

Mondi also highlighted DNS® enhanced color inkjet, which delivers a higher colour density due to its pigment coated surface. With DNS® enhanced color inkjet, dye inks reach density levels comparable to pigment inks. To illustrate this point, Mondi printed several full colour applications on DNS® enhanced colour inkjet, where more critical colours, such as red, were reproduced evenly and accurately in terms of shade.

Mondi also highlighted DNS® enhanced color inkjet, which delivers a higher colour density due to its pigment coated surface. With DNS® enhanced color inkjet, dye inks reach density levels comparable to pigment inks. To illustrate this point, Mondi printed several full colour applications on DNS® enhanced colour inkjet, where more critical colours, such as red, were reproduced evenly and accurately in terms of shade.

“The use of colour applications for high-speed inkjet printing is increasing and Mondi has developed a full high-speed inkjet portfolio to stay ahead of this trend. Our high-speed inkjet papers are optimised for both dye and pigment ink so the ink fixes to the surface of the paper while the water absorbs into the paper and dries in the machine. The optimisation process also helps printers reduce ink consumption, because the ink doesn’t penetrate so deeply into the paper,” said Johannes Klumpp Marketing and Sales Director for Mondi Uncoated Fine Paper.

Mondi’s high-speed inkjet portfolio includes smooth, high-white, recycled, off-white and coated high-speed inkjet papers. These include DNS® high-speed inkjet CF (coated feel), DNS® high-speed inkjet NF (natural feel), 100% recycled NAUTILUS® high-speed inkjet, BIO TOP 3® high-speed inkjet and DNS® enhanced color inkjet.

With the growing demand for CO2 offsetting within the printing industry, Mondi also offers a CO2 neutral option for all high-speed inkjet papers as well as 100% recycled NAUTILUS® SuperWhite. Mondi’s colour laser paper Color Copy is fully CO2 neutral.

All Mondi-branded papers are part of the Green Range of eco-conscious papers that are FSC® or PEFC™ certified, 100% recycled or TCF (totally chlorine free). More information about Mondi’s complete digital printing portfolio is available at www.mondigroup.com/printing.

Ahlstrom's Annual Report 2012 published

Ahlstrom's Annual Report 2012, including the financial statements, the report of operations and Corporate Governance Statement, has been published today on the company's website in English and Finnish. The publications can be viewed as PDF files at www.ahlstrom.com > Investors.

In addition, Ahlstrom will publish next week its Sustainability Report 2012. The publication will available in English on the company's website.

Ahlstrom's Corporate Governance Statement 2012 and Remuneration Statement 2012 have also been published today as separate documents. The statements are available as PDF files in English and Finnish on the company's website at www.ahlstrom.com > Investors > Corporate governance.

Printed reports will be available next week and can be ordered via the company's website or email: This email address is being protected from spambots. You need JavaScript enabled to view it..

The English version of the Annual Report 2012 is attached to this document as a PDF file.

Södra raises softwood and hardwood pulp price in Europe

Seasonal improvement together with maintenance shutdowns will improve the market balance further in spring 2013.

International Paper Ranks No. 1 in Forest and Paper Products Sector

International Paper has announced that it has once again been named by FORTUNE magazine as the No. 1 company in the Forest and Paper Products sector according to FORTUNE's annual report of "America's Most Admired Companies." This is International Paper's tenth time in the last eleven years to top the Fortune list within this category. Out of the nine key attributes on which companies are judgedInternational Paper took the top spot in seven of those categories within its industry. Those categories included, people management, quality of management, financial soundness, quality of products and services, global competitiveness, use of corporate assets and innovation.

International Paper has announced that it has once again been named by FORTUNE magazine as the No. 1 company in the Forest and Paper Products sector according to FORTUNE's annual report of "America's Most Admired Companies." This is International Paper's tenth time in the last eleven years to top the Fortune list within this category. Out of the nine key attributes on which companies are judgedInternational Paper took the top spot in seven of those categories within its industry. Those categories included, people management, quality of management, financial soundness, quality of products and services, global competitiveness, use of corporate assets and innovation.

"This is well-deserved recognition and a reflection of International Paper's 68,000 talented employees around the globe," said John Faraci, chairman and chief executive officer. "Managing through an uneven global economy while continuing to generate solid results is what good execution is all about. Congratulations to all of our employees."

Survey Methodology

The FORTUNE/Hay Group study compiles its data from approximately 1,400 companies: the Fortune 1,000 (the 1,000 largest U.S. companies ranked by revenue) and non-U.S. companies in Fortune's Global 500 database with revenue of$10 billion or more. Hay then selected the 15 largest for each international industry and the 10 largest for each U.S. industry, surveying a total of 687 companies from 30 countries. To create the 57 industry lists, Hay asked executives, directors, and analysts to rate companies in their industry on nine criteria, from investment value to social responsibility. A company's score must rank in the top half of its industry survey to be listed.

To arrive at the top 50 Most Admired Companies overall, the Hay Group asked 3,800 respondents to select the 10 companies they admired most. They chose from a list made up of the companies that ranked in the top 25% in last year's survey, plus those that finished in the top 20% of their industry. Anyone could vote for any company in any industry.

Hay Group, which has conducted the research for the World's Most Admired Companies list since 1997 and for America's Most Admired Companies since 2001, is a global management consulting firm. For information about Hay Group's services, go to www.haygroup.com

SOURCE International Paper

Innventia researcher is awarded SEK 500,000 for carbon fibre research

Innventia’s Hannah Schweinebarth has been awarded this year’s Skills Prize by the Gunnar Sundblad Research Foundation. The prize of SEK 500,000 will be used to develop new knowledge on the production of carbon fibre from the wood raw material lignin.

Hannah is a young employee at Innventia’s Biorefinery Processes and Products group. There, she carries out research within the focus area Lignin & Carbon, which covers the entire lignin production chain from black liquor to end products, such as lightweight carbon fibre materials.

Hannah is a young employee at Innventia’s Biorefinery Processes and Products group. There, she carries out research within the focus area Lignin & Carbon, which covers the entire lignin production chain from black liquor to end products, such as lightweight carbon fibre materials.

Carbon fibre is strong and light, with many applications, especially in the automotive industry. Today, demand is mainly limited by the high cost, with the petroleum-based raw materials and fibre spinning accounting for around 50 percent of the cost. Lignin, a substance that is found in wood but removed during kraft pulp production, has great potential for use as a raw material for manufacturing carbon fibre. Innventia has extensive experience in the production and characterisation of lignin from black liquor. Innventia worked with Chalmers University of Technology to develop the LignoBoost process (now owned by Metso), making it possible to extract a very pure lignin that could be used as a raw material for carbon fibre. The first industrial LignoBoost plant is now starting up at Domtar’s pulp mill in Plymouth, USA.

Thanks to the Skills Prize, Hannah will be spending six months at the Oak Ridge National Laboratory (ORNL) in Tennessee, USA. ORNL is one of the world’s leading “green energy” research centres, and is currently building a pilot plant which will produce about 25 tonnes of carbon fibre from lignin each year. This will enable Hannah to learn more about the properties of lignin and how they affect the properties of carbon fibre. The University of Tennessee will also be involved.

“It’s great fun!” says Hannah. “The prize represents an excellent opportunity for development, both professionally and personally. I get to come to a new country and an environment that provides completely new aspects for what I’m doing. I think that lignin offers tremendous potential, and it’s fun to be involved.”

“Carbon fibre from lignin is a new and expanding area for us, and one where we are now investing in more advanced equipment for further development,” says Peter Axegård, Director of Innventia’s Biorefining business area. “Knowledge building is also very important in terms of acquiring the necessary skills. We are therefore looking forward to this collaboration with ORNL, which will benefit Sweden and Innventia in many ways.”

About the prize

The Gunnar Sundblad Research Foundation’s Skills Prize has been awarded annually since 2007. The prize aims to promote the development of the Swedish pulp and paper industry towards new and improved products and services that can meet today’s increasingly tough competition. The prize enables a researcher from the Swedish research and innovation system to work at a foreign research environment in order to develop, make contacts and bring home new knowledge. The Gunnar Sundblad Research Foundation Board is appointed by the Swedish Forest Industries Federation Board. Find out more at www.skogsindustrierna.org.

SCA announces Conversion of shares

According to SCA’s articles of association, owners of Class A shares have the right to have such shares converted to Class B shares. Conversion reduces the total number of votes in the company. When such a conversion has occurred, the company is obligated by law to disclose any such changes in this manner.

According to SCA’s articles of association, owners of Class A shares have the right to have such shares converted to Class B shares. Conversion reduces the total number of votes in the company. When such a conversion has occurred, the company is obligated by law to disclose any such changes in this manner.

In February, at the request of shareholders 1,100,009 Class A shares were converted to Class B shares. The total number of votes in the company thereafter amounts to 1,528,406,964.

The total number of registered shares in the company amounts to 705,110,094 of which 91,477,430 are Class A shares and 613,632,664 are Class B shares.

Stockholm, Sweden, 28 February 2013

Kemira's Annual and Sustainability Report 2012 published

Kemira Oyj's Annual and Sustainability Report 2012 has been published online at www.kemiraannualreport2012.com (in English) and www.kemiravuosikertomus2012.fi (in Finnish) on February 28, 2013 at 12 pm (CET + 1). The Annual and Sustainability Report are available only online.

Kemira Oyj's Financial Statements 2012 has been published at www.kemiraannualreport2012.com > Financials. In addition, Kemira has published today the Corporate Governance Statement which is available online at www.kemira.com under Investors > Corporate Governance.

Kemira has also published its sustainability targets for the years 2013-2015. The sustainability targets address several operations within Kemira: responsible business conduct, supplier performance management, efficient use of water and energy in manufacturing, employee health & safety, performance management and leadership development, community involvement, and development of sustainable customer solutions. The targets enable Kemira to lead its sustainability actions in a goal-oriented way, and create value for both business and stakeholders.

Attachments:

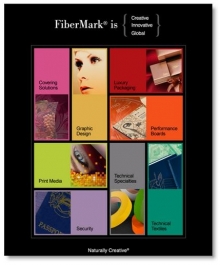

New FiberMark Website Mirrors Company’s Strategic Direction

FiberMark, a global leader in manufacturing innovative, fiber-based specialty covering materials for world-leading brands, recently unveiled a strikingly improved and visually stunning new company website (www.fibermark.com), The new website represents a marked departure from the former site, inaugurating some sweeping innovations and enhancements.

The project to revamp the FiberMark website was several months in development. A project team composed of internal FiberMark marketing professionals and external contractors who specialize in Web design, programming and content development collaborated on the new site.

The project to revamp the FiberMark website was several months in development. A project team composed of internal FiberMark marketing professionals and external contractors who specialize in Web design, programming and content development collaborated on the new site.

“From the onset, we took a very strategic approach to the site’s redesign,” explains Danielle Cutler, FiberMark Marketing Manager - Communications, who spearheaded the project. “We asked ‘How are we organized, what are our strengths, and what are our global customers looking for when they visit our website?’ It was critical to the project that we take a customer- and market-focused approach. Before we even got started, we had a series of meetings to simply define what our goals and messaging would be, and how the site would look and be structured to improve its user friendliness for our visitors and offer solutions for them when they visit the site.”

Chloe Jones, president of FreshJones, a Greenfield, Mass., firm retained to develop the site, explains that the new site offers visitors a much more dynamic, integrated approach to its use. “We developed it to align with FiberMark’s designated market segments, with a home page for each and every market FiberMark serves. In that way, new visitors can hone in on their particular interest immediately.” Jones adds that a primary goal was addressing content and delivering text that was outward-focused, in order to meet the needs and concerns of the FiberMark website audience. The site also offers traditional navigation and search tools, which are particularly useful for visitors already familiar with the company and website.

Jones explains that the new website’s programming structure was designed to accommodate FiberMark’s many market segments and their vast array of products. “We created dynamic pages that are database-driven, which enables the company to create relationships with the product data across different areas of the site, such as ‘News,’ ‘Environment,’ and ‘Design,’” she notes. “Whether it be the virtual design tool or the gallery of award-winning designs from customers showcasing how products can be used, the information presented and gathered through the site is much more sophisticated, dynamic and refined. It’s a really diverse tool.” She also notes that the site is designed for an optimal visual display for the current mix of communications devices, including desktop computers, laptops, tablets and smart phones.

As Cutler emphasizes, “We’ve taken an approach to build this new site from the ground up, to build in the design features and technical functionality that we know our customers want to have. Now there are many more targeted paths for users to find their way through the site, to get to the information they need easier, quicker and with better results.”

Bank of Moscow finalized sale of Kama pulpmill

The Bank of Moscow finalized sale of 100% of Kama pulpmill which was owned via Investlesprom holding, as Perm edition of Kommersant newspaper reports. Quoting kartoteka.ru website, the paper states that Kama pulpmill was sold on February 18 to Energoaktiv LLC. This company was established in 2010, 99% of shares belongs to Cyprus SEPERIAN Trading LTD offshore, 1% to its director Irina Barysheva.

Earlier Kommersant paper wrote that new owners of the mill chose not to disclose themselves. According to the data available at Kommersant, the mill was acquired by former managers of Alfa Eko consortium (now A1 holding) which controlled the mill until 2005.

Federal version of Kommersant says that Bank ofMoscow confirms the deal. The mill is now owned by "a group of investors headed by mill manager Sergei Starodubtsev", the bank reports. The value of the contract is not disclosed. Earleir analysts evaluated the enterprise at around 0.9-1.1 billion Rubles (€22.4-27.4 million). New mill owners will concentrate on reaching full capacity and further development of the mill.

Sergei Starodubtsev was Kama mill manager in 2004-2008 and was reappointed in this position in early 2013. Kommersant sources said then this appointment may be linked with the mill sale. Investlesprom will use the proceedings from the sale to settle its debts to the Bank of Moscow.

In December 2012, Krasnokamsk mayor Yuri Chechetkin announced that the mill sale is almost closed, while equipment is being prepared to resume production. The launch was delayed several times. On February 7, production finally resumed, as the mill made first 130 tons of paper at PM1.

BASF increases sales and income from operations in 2012

BASF maintained its good performance in 2012. The company exceeded the 2011 record levels in sales and income from operations (EBIT) and once again earned a substantial premium on the cost of capital. Dr. Kurt Bock, Chairman of the Board of Executive Directors of BASF SE, said at the Annual Press Conference: “The Oil & Gas and Agricultural Solutions segments achieved new records, while development in our chemicals business was weaker than in 2011.”

BASF maintained its good performance in 2012. The company exceeded the 2011 record levels in sales and income from operations (EBIT) and once again earned a substantial premium on the cost of capital. Dr. Kurt Bock, Chairman of the Board of Executive Directors of BASF SE, said at the Annual Press Conference: “The Oil & Gas and Agricultural Solutions segments achieved new records, while development in our chemicals business was weaker than in 2011.”

Sales in the fourth quarter of 2012 were €19.6 billion, 9% higher than in the same quarter of the previous year. This increase was mainly due to higher volumes in almost all segments as well as price and currency effects. At €1.8 billion, EBIT before special items was 18% above the level of the previous fourth quarter, mainly due to significantly higher volumes in Oil & Gas as well as improved earnings in Polyurethanes and Construction Chemicals.

For the full year, BASF increased sales to €78.7 billion, up 7% compared with 2011. EBIT before special items improved by 5% to €8.9 billion and EBIT by almost 5% to around €9 billion. Net income fell by €1.3 billion to €4.9 billion, due in part to the higher earnings contribution from Oil & Gas and thus the significantly higher taxes. Furthermore, gains from the sale of BASF’s shares in K+S Aktiengesellschaft in 2011 were predominantly tax-free.

At the Annual Shareholders’ Meeting, the Board of Executive Directors and the Supervisory Board will propose a higher dividend of €2.60 per share. This is an increase of €0.10 compared with the previous year. Based on the 2012 year-end share price of €71.15, the dividend yield would be 3.65%.

“ At €6.7 billion, cash flow from operating activities once again reached a high level,” said Dr. Hans-Ulrich Engel, Chief Financial Officer of BASF. The equity ratio of 40.1% remained at a high level.

Outlook for 2013

BASF’s outlook for 2013 is based on the following economic conditions (previous year figures in parentheses):

---World economic growth: +2.4% (+2.2%)

---Growth in global chemical production: +3.6% (+2.6%)

---An average euro/dollar exchange rate of $1.30 per euro ($1.28 per euro)

---An average oil price of $110/barrel ($112/barrel)

“We aim to grow again in 2013 and exceed the 2012 levels in sales and EBIT before special items,” said Bock. The company strives to increase sales and earnings in all operating segments. The expected increase in demand, together with measures to improve operational excellence and raise efficiency, will contribute to this. BASF aims to earn a high premium on its cost of capital once again in 2013.

Bock said: “ Innovations are the basis for future profitable growth and thus lie at the core of our competitiveness.” Therefore, BASF will once again increase its research and development spending in 2013, after expenditures of €1.7 billion in the past year – around 9% more than in 2011.

Sales increase in almost all segments in the fourth quarter

In Chemicals, sales in the fourth quarter 2012 increased, equally driven by price and portfolio effects. Volume growth and currency tailwinds also contributed to topline growth. EBIT before special items declined mainly due to lower margins and plant shutdowns. For the full year 2012, sales increased by 7% to €13.8 billion. EBIT before special items decreased by 30% to €1.7 billion.

Sales in Plastics increased due to higher volumes and prices as well as positive currency effects. There was continuing strong demand from the automotive industry, particularly in North America and Asia. EBIT before special items rose substantially due to a significant improvement in earnings in Polyurethanes. In 2012, sales in the Plastics segment increased 4% to €11.4 billion. EBIT before special items declined by 27% to €873 million.

Sales in Performance Products came in above the previous fourth quarter, mainly driven by higher volumes. Price declines were offset by positive currency effects. EBIT before special items in the segment decreased due to lower margins. Sales for the full year 2012 of €15.9 billion were around 1% higher than in the previous year. EBIT before special items fell 17% to €1.4 billion.

Sales in Functional Solutions decreased slightly compared with the fourth quarter of 2011. Volumes were down, particularly due to a lower contribution from precious metals trading. A small decrease in sales prices was compensated for by currency tailwinds. Healthy demand in Catalysts and Coatings came from the automotive industry. Strict fixed cost management led to a substantial increase in EBIT before special items. Sales in 2012 were €11.5 billion, 1% higher than in 2011. At €561 million, EBIT before special items was slightly above the previous year.

Sales in Agricultural Solutions were up in the fourth quarter of 2012. Growth was driven by higher volumes, the Becker Underwood acquisition, and favorable currency effects. Sales in South America increased significantly despite dry weather conditions in Brazil. Prices were just below the high level of the prior-year quarter. EBIT before special items was lower than in the fourth quarter of 2011 due to higher R&D expenditures and investments in growth markets. In addition, royalty income in North America reported in the fourth quarter in 2011 was already reported in the third quarter in 2012. Agricultural Solutions had another record year in 2012. Sales rose by 12% to €4.7 billion. EBIT before special items grew by 28% to more than €1 billion. The EBITDA margin target of 25% was achieved.

Sales in Oil & Gas in the fourth quarter grew strongly mainly due to significantly increased oil production in Libya and higher volumes from Natural Gas Trading. The start-up of additional wells in the Achimgaz joint venture also contributed to sales. EBIT before special items grew substantially. Special items of €120 million were related to impairment charges on the Yme development project in Norway. Non-compensable taxes on oil production amounted to €492 million. Net income decreased by 9% and was €250 million. For the full year, sales rose by 39% to €16.7 billion and EBIT before special items almost doubled to €4.1 billion. Net income also grew to €1.2 billion.

In the fourth quarter, sales in Other were around €1.2 billion. These activities include the sale of raw materials, engineering and other services, rental income and leases. EBIT before special items declined by €91 million mainly due to lower earnings of other businesses. In 2012, sales were €4.8 billion, a decline of 24% and EBIT before special items decreased to minus €839 million. This was primarily due to the divestiture of the styrenic plastics activities and the fertilizer business.