Ianadmin

Mondi Syktyvkar €30 million pulp dryer project nears completion

The €30 million large-scale pulp dryer project for the production of softwood market pulp at Mondi Group’s Syktyvkar mill is nearing completion. Mondi Syktyvkar celebrated its 45th anniversary this year and the investment demonstrates Mondi’s continued commitment to the operation. “We are proud of our mill’s heritage, community relations and continued achievements”, explains Peter Orisich, CEO of Mondi Uncoated Fine Paper.

The €30 million large-scale pulp dryer project for the production of softwood market pulp at Mondi Group’s Syktyvkar mill is nearing completion. Mondi Syktyvkar celebrated its 45th anniversary this year and the investment demonstrates Mondi’s continued commitment to the operation. “We are proud of our mill’s heritage, community relations and continued achievements”, explains Peter Orisich, CEO of Mondi Uncoated Fine Paper.

“The new pulp dryer will allow us to produce more than 100,000 tonnes of FSC® certified softwood market pulp per year”, says Klaus Peller, Mondi Syktyvkar Managing Director. “The project has been successfully managed by a professional team and we’re set to officially mark the opening of the pulp dryer on 19 November 2014 as planned”, explains Klaus Peller, Managing Director, Mondi Syktyvkar.

The foundation works for the pulp dryer and auxiliary equipment were finished late May 2014, while the roof and ventilation were completed this summer. In the final phase, the drying section, tanks, pipelines, electrical and automation equipment were installed during September.

The pulp dryer allows Mondi Syktyvkar to produce a new bleached softwood market pulp called KOMICELL, which is FSC® certified and produced without elemental chlorine (ECF). “This FSC® chain of custody certified product is ideally suited to meet the needs of our national and international packaging, tissue, and newsprint industry customers. Together with our proven supply chain capabilities, we are looking forward to fulfilling our customer requests – on time and in full”, said Igor Naumov, Mondi Syktyvkar Market Pulp Sales Manager.

Softwood pulp is the most valuable fiber material in paper production. It mainly consists of long fibers that can be used with short-fibered materials (mechanical, hardwood, straw and cane pulp) in paper production and can also be used on its own. First deliveries of KOMICELL are planned for this year.

About Mondi Syktyvkar

Mondi Syktyvkar is a part of Mondi Uncoated Fine Paper. The mill is one of the leaders in pulp and paper industry and the biggest paper producer in Russia. The company’s core business is the production of office and offset paper. It also produces newsprint and White Top Kraftliner. The most important brand of the company is the office paper “Snegurochka”.

About Mondi Group

Mondi is an international packaging and paper Group, employing around 26,000 people in production facilities across 31 countries. In 2013, Mondi had revenues of €6.5 billion and a ROCE of 15.3%. The Group's key operations are located in central Europe, Russia, the Americas and South Africa.

The Mondi Group is fully integrated across the packaging and paper value chain - from the management of its own forests and the production of pulp and paper (packaging paper and uncoated fine paper), to the conversion of packaging paper into corrugated packaging, industrial bags, extrusion coatings and release liner. Mondi is also a supplier of innovative consumer packaging solutions, advanced films and hygiene products components.

Mondi has a dual listed company structure, with a primary listing on the JSE Limited for Mondi Limited under the ticker code MND and a premium listing on the London Stock Exchange for Mondi plc, under the ticker code MNDI. The Group’s performance, and the responsible approach it takes to good business practice, has been recognised by its inclusion in the FTSE4Good Global, European and UK Index Series (since 2008) and the JSE's Socially Responsible Investment (SRI) Index since 2007.

Contacts:

Ekaterina Edapina, Mill Communications Manager, Mondi Syktyvkar

+7(8212) 69-95-33 or This email address is being protected from spambots. You need JavaScript enabled to view it.

Mondi Syktyvkar OAO, 2, Bumazhnikov pr., RU - 167026, Syktyvkar

Susan Brunner, Sustainability & Marketing Communications Manager, Uncoated Fine Paper

Tel: +43 1 79013 – 5654, e-Mail: This email address is being protected from spambots. You need JavaScript enabled to view it.

Mondi Uncoated Fine Paper Sales GmbH, Marxergasse 4a, A-1030 Wien

Domtar wins two Pulp and Paper International Awards

Domtar Corporation (NYSE: UFS) (TSX: UFS) accepted the Environmental Strategy of the Year Award and the Innovative Printing and Writing Campaign of the Year Award at the Pulp and Paper International (PPI) Awards 2014 held on October 8 in Boston, Massachusetts. The PPI Awards are held each year to recognize the achievements of companies, mills and individuals in the pulp and paper sector.

Domtar Corporation (NYSE: UFS) (TSX: UFS) accepted the Environmental Strategy of the Year Award and the Innovative Printing and Writing Campaign of the Year Award at the Pulp and Paper International (PPI) Awards 2014 held on October 8 in Boston, Massachusetts. The PPI Awards are held each year to recognize the achievements of companies, mills and individuals in the pulp and paper sector.

For the Environmental Strategy of the Year, Domtar's Windsor Mill was chosen for its steadfast dedication to reduction in greenhouse gas emissions, water consumption, energy use and waste, as well as championing the use of raw materials sourced from Forest Stewardship Council® (FSC®) certified sources.

"This award recognizes that we are leaving a legacy of sustainable development and caring in our community. Caring is one of Domtar's core values, and that means being a responsible corporate citizen," said Eric Ashby, Domtar's Windsor General Manager.

The Innovative Printing & Writing Campaign of the Year recognized Domtar's Paper Fun Truck initiative. This whimsically decorated truck visited schools, businesses, retirement communities and even a Los Angeles area beach to show how paper remains fun and valuable. The Paper Fun Truck is part of Domtar's PAPERbecause campaign, which uses humor and facts to debunk myths about the paperless society.

"Paper is an important part of our daily lives, both professionally and personally. We are pleased that Domtar has had success in telling compelling stories about the products we make, which has impacted our entire industry," said Paige Goff, Domtar's Vice-President of sustainability and business communications.

About Domtar

Domtar Corporation (NYSE: UFS) (TSX: UFS) designs, manufactures, markets and distributes a wide variety of fiber-based products including communication papers, specialty and packaging papers and absorbent hygiene products. The foundation of its business is a network of world class wood fiber converting assets that produce papergrade, fluff and specialty pulps. The majority of its pulp production is consumed internally to manufacture paper and consumer products. Domtar is the largest integrated marketer of uncoated freesheet paper in North America with recognized brands such as Cougar®, Lynx® Opaque Ultra, Husky® Opaque Offset, First Choice® and Domtar EarthChoice®. Domtar is also a leading marketer and producer of a broad line of incontinence care products marketed primarily under the Attends®, IncoPack and Indasec® brand names as well as baby diapers. In 2013, Domtar had sales of US$5.4 billion from some 50 countries. The Company employs approximately 10,000 people. To learn more, visit www.domtar.com.

SOURCE Domtar Corporation

Iggesund’s investments led to sought-after industry award

Over the past four years Iggesund Paperboard has invested more than 370 million euro to improve the energy solutions at its paperboard mills in Iggesund, Sweden and Workington, England. Compared with the situation a decade ago, the company has succeeded in reducing its fossil carbon emissions by more than 260,000 tonnes of carbon dioxide from fossil sources. The reduction is the equivalent of taking 85,000 cars, each driven 10,000 kilometres a year, off the road. It is against the background of these investments that the industry organisation PPI awarded its Bio Strategy of the Year prize to Iggesund Paperboard at the beginning of October.

Over the past four years Iggesund Paperboard has invested more than 370 million euro to improve the energy solutions at its paperboard mills in Iggesund, Sweden and Workington, England. Compared with the situation a decade ago, the company has succeeded in reducing its fossil carbon emissions by more than 260,000 tonnes of carbon dioxide from fossil sources. The reduction is the equivalent of taking 85,000 cars, each driven 10,000 kilometres a year, off the road. It is against the background of these investments that the industry organisation PPI awarded its Bio Strategy of the Year prize to Iggesund Paperboard at the beginning of October.

“We’re very pleased with the award but even more with the major move we’ve made from fossil fuel to bioenergy,” comments Arvid Sundblad, Vice President Sales and Marketing for Iggesund. “Of course that’s because we’re assuming our own responsibility for the climate issue but also because it will give us more stable energy costs over time.”

At the mill in Workington, where Incada is made, Iggesund has implemented a dramatic shift from fossil natural gas to biomass. A new biomass boiler was completed in the spring of 2013 and has contributed to a big reduction of Incada’s carbon footprint. Today Incada is among the folding box boards with the lowest values in this respect. At Iggesund, where the company produces Invercote, a new recovery boiler has helped to minimise the mill’s fossil carbon dioxide emissions and has also enabled the mill to often operate without using any fossil fuel at all. The goal is for the mill to be powered only by biomass and also to be self-sufficient in both electricity and heat.

“This is very gratifying,” Sundblad says. “The world is pressuring us to reduce our fossil carbon emissions and we’re living up to that. We’re thereby helping to support public policy goals and at the same time we also expect to stabilise our energy costs.”

As well as switching its energy source from fossil to renewable fuel, Iggesund has also worked to improve its energy efficiency. Producing one tonne of Invercote now requires just over ten per cent less energy than was needed five years ago. The mill in Workington has achieved a similar result. The new incineration plants are part of the explanation but so are patient efforts to continually improve the mills’ internal processes and make them more efficient. At Iggesund this process has also led to tangible improvements to the local environment.

“We’ve succeeded in reducing our sulphur emissions to air, and our particulate emissions to air by 50 per cent,” Sundblad emphasises. “This has been done from what were already low levels but it is still gratifying. For example, our mill, which dominates the municipality of Iggesund, is now only responsible for 1 per cent of the municipality’s particulate emissions.”

Iggesund Paperboard’s practice for many years has been to include sustainability issues as part of every investment decision.

“We don’t just take big steps – above all, we take many small steps because sustainability must be taken into account in every individual investment. We’re a capital-intensive industry but once the ball has been set in motion then it’s done with vigour,” Sundblad concludes.

UK Packaging (Paper & Board) Market Report 2014

Research and Markets (http://www.researchandmarkets.com/research/tq6qjq/packaging_paper) has announced the addition of the "Packaging (Paper & Board) Market Report 2014" report to their offering.

“Packaging (Paper & Board) Market Report 2014”

![]() This market report examines the market for paper and board packaging in the UK. In 2013, the apparent total value of manufacturers' sales increased by 1.8%, representing the fourth consecutive year of market growth over the 5-year review period from 2009 to 2013.

This market report examines the market for paper and board packaging in the UK. In 2013, the apparent total value of manufacturers' sales increased by 1.8%, representing the fourth consecutive year of market growth over the 5-year review period from 2009 to 2013.

Paper and board packaging is the most widely used form of packaging in the UK, representing over a third of the total domestic packaging industry. This is unsurprising given the variety of paper and board packaging formats and the range of end-use sectors within which such packaging can be applied. In this report, analysis of seven market subsectors is provided, the largest of which is corrugated and non-corrugated paper and board cartons, boxes and cases. This approach to market categorisation includes primary, secondary and tertiary packaging formats, which are the three general uses for this form of packaging.

Primary and secondary packaging solutions are the most heavily used with regard to end-use sectors in the UK marketplace. Applications within the latter are widespread and include the industries for food and beverages, tobacco, pharmaceuticals, personal care and household care. As such, consumer demands and perceptions are an important influence in this market. For instance, the growing demand for convenient foodstuffs is fuelling the use of paper and board packaging in products such as ready meals. Yet despite this, consumer perceptions continue to be predominantly negative when considering packaging, being based primarily on the penetrative opinion that packaging of all varieties is harmful to the environment. This is, in fact, a misconception, but until UK consumers are convinced of this, potential avenues for further growth will continue to be restricted.

There are also a variety of current issues threatening potential sales in the UK market for paper and board packaging. The ongoing development of innovative, plastic packaging solutions is perhaps the most sizeable, although calls to legislate against branded cigarette packaging, and high overheads for manufacturers, are also significant concerns. In terms of the latter, both global woodpulp prices and domestic energy prices are extremely high, threatening the survival of smaller firms operating in this energy-intensive industry (EII). As such, market consolidation has been common; this has been exacerbated by industrial globalisation, which has benefited huge corporations capable of creating a global supply network.

Despite these threats, the market for paper and board packaging remains robust in the UK simply because of the variety of packaging formats and the number of applications in end-use sectors. This report therefore forecasts modest growth of 6.3% between 2014 and 2018.

Companies Mentioned

- Amcor Packaging UK Ltd

- Chesapeake Ltd

- DS Smith PLC

- Iggesund Paperboard (Workington) Ltd

- Macfarlane Group UK Ltd

- Saica Pack UK Ltd

- Smurfit Kappa UK Ltd

For more information visit http://www.researchandmarkets.com/research/tq6qjq/packaging_paper

Contacts

Research and Markets

Laura Wood, Senior Manager

This email address is being protected from spambots. You need JavaScript enabled to view it.

For E.S.T Office Hours Call 1-917-300-0470

For U.S./CAN Toll Free Call 1-800-526-8630

For GMT Office Hours Call +353-1-416-8900

U.S. Fax: 646-607-1907

Fax (outside U.S.): +353-1-481-1716

Sector: Pulp and Paper

The 10th edition of the Paper Recycling Conference Europe brings key industry experts to Milan

Taking place for the first time in Milan, Italy from 29-30 October, 2014, the 10th edition of the Paper Recycling Conference Europe, organised by Recycling Today Media Group and Smithers Pira, announces its fully confirmed programme.

Organisers of the Paper Recycling Conference Europe, Recycling Today Media Group and Smithers Pira, are delighted to announce the European recovered paper conference agenda for 2014. It is once again positioned to provide an ideal forum for the entire paper recycling industry to network and share ideas, while also gaining insight into key industry drivers from the perspectives of both the consuming and supply side of the recycling market.

The conference will kick off with an executive session featuring leaders in the paper recycling industry, including Marc-Antoine Belthe, the Head of Recycling for Veoila Proprete France Recycling and Jim Malone, European Sales and Purchasing Director, DS Smith Recycling Division. The session also will include a global forecast from Per-Ove Nordstrom, McKinsey & Company’s expert in Global Basic Materials Practise. The opening session will provide key insights on the current and projected state of the recovered paper industry and will feature perspectives from across the value chain.

The conference’s two-day agenda includes the popular mill buyers’ session, which will be chaired by paper recycling industry consultant Bill Moore. The panel will feature panellists from across Europe including Smurfit Kappa, Europac, Metsa Tissue, and Aylesford Newsprint Ltd. The session will tackle quality requirements, shifts in paper grades, procurement trends and other factors that are forcing paper mills throughout Europe to revisit their approach to business.

The 2014 conference will have a session focussing on the transportation of recovered paper. The panel will include key executives with major container shipping lines.

View full list of confirmed speakers here

The Italian recovered fibre market is the fourth largest in Europe. Despite this success, Italy only has a recycling rate of 63.3%, lower than the European recycling average of 71.7%. To examine the opportunities, as well as challenges, in the Italian paper recycling industry the Paper Recycling Conference Europe will finish with a roundtable discussion that brings together several of the largest and most influential paper and paper recycling firms in Italy. Panelists from BSB Recycling, Lucart, Reno De Medici S.p.A. and R.P. Trading Srl will take part in this session.

Once again the conference programme will be complemented by a table-top exhibition area, the main destination for the extended networking breaks, ensuring attendees make the most of their time in Milan and exchange ideas and contacts with the rest of the recycling supply chain throughout the two days.

BASF reorganizes its paper chemicals business

BASF is changing the organizational set-up of its paper chemicals business to strengthen its competitiveness and better meet the needs of the paper industry. BASF is a leading global supplier to the paper industry and offers a comprehensive range of chemical products for paper manufacturing and coating.

BASF is changing the organizational set-up of its paper chemicals business to strengthen its competitiveness and better meet the needs of the paper industry. BASF is a leading global supplier to the paper industry and offers a comprehensive range of chemical products for paper manufacturing and coating.

- BASF to remain a leading global supplier to the paper industry

- New set-up follows structure of BASF value chains

- Strategic options for paper hydrous kaolin business being evaluated

As of January 1, 2015, the Paper Chemicals division will be dissolved. The current headquarters of the Paper Chemicals division in Basel, Switzerland will be closed by the end of 2014. Overall, there will be a reduction of about 50 positions globally as a result of the implementation of the new set-up. The business will be continued in other divisions of the Performance Products segment as follows:

- The wet-end chemicals and kaolin businesses will be integrated into the Performance Chemicals division, supplementing the polyacrylamide value chain. A new global business unit “Paper Chemicals” will be established within the Performance Chemicals division. BASF is evaluating strategic options for its paper hydrous kaolin business.

- The paper dispersions business and the Center for Sustainable Paper Packaging (CSPP) will be integrated into the division Dispersions & Pigments, supplementing the latex dispersions value chain.

“Integrating the paper chemicals business along existing value chains will allow BASF to optimally steer plant capacity and leverage the advantages of the BASF Verbund. This will strengthen our businesses and further increase the competitiveness of our Performance Products segment,” said Michael Heinz, member of the Board of Executive Directors of BASF SE and responsible for the Performance Products segment.

BASF remains committed to the paper chemicals industry by providing sustainable solutions and technical expertise. There will be no impact on supply security and service for the customers. Sales with paper chemicals were €1.44 billion in 2013.

BASF continues to analyze further measures to improve the competitiveness of the Performance Products segment.

About BASF

At BASF, we create chemistry – and have been doing so for 150 years. Our portfolio ranges from chemicals, plastics, performance products and crop protection products to oil and gas. As the world’s leading chemical company, we combine economic success with environmental protection and social responsibility. Through science and innovation, we enable our customers in nearly every industry to meet the current and future needs of society. Our products and solutions contribute to conserving resources, ensuring nutrition and improving quality of life. We have summed up this contribution in our corporate purpose: We create chemistry for a sustainable future. BASF had sales of about €74 billion in 2013 and over 112,000 employees as of the end of the year. BASF shares are traded on the stock exchanges in Frankfurt (BAS), London (BFA) and Zurich (AN). Further information on BASF is available on the Internet at www.basf.com.

Competition authority prevents acquisition of Uetersen paper mill

On 9 October, Brigl & Bergmeister withdrew its application to the German Federal Cartel Office for approval of the merger with the Uetersen paper mill.

In May 2014, Brigl & Bergmeister GmbH signed an agreement for acquisition of the Uetersen speciality paper mill from the Stora Enso Group, subject to merger control approval.

In May 2014, Brigl & Bergmeister GmbH signed an agreement for acquisition of the Uetersen speciality paper mill from the Stora Enso Group, subject to merger control approval.

Already in September, the German Federal Cartel Office (FCO) expressed reservations against the merger. Both parties subsequently submitted further conclusive market information and expert reports, none of which, however, managed to persuade the FCO to change its stance. Consequently, Brigl & Bergmeister withdrew the merger application on 9 October 2014.

The contracting parties have mutually agreed to cancel the share purchase agreement.

Brigl & Bergmeister regret the decision made by the FCO. The label market would have benefited substantially from the acquisition of the Uetersen paper mill. The merger would have created a strong group of speciality paper mills and provided positive impulses throughout the entire value chain.

At the two locations in Austria and Slovenia, Brigl & Bergmeister manufacture wet-strength and non-wet strength label papers as well as flexible packaging papers.

related article : Stora Enso’s Uetersen Mill buyer withdraws application for merger

BRIGL & BERGMEISTER

B&B is the leading manufacturer of label papers and flexible packaging papers. Annually, some 100 billion labels are printed on B&B papers, and our papers bear the face of innumerable famous brands.

The Brigl & Bergmeister plant is located at the heart of Europe, in Niklasdorf in Styria | Austria.

ENAGES, the thermal recycling plant of Brigl & Bergmeister, supplies the factory with 100% CO2-neutral energy in the form of steam and electricity.

The Papirnica Vevče factory is situated in Slovenia, in the greater area of Ljubljana. A cooperation that had originally started as a joint venture has developed into a fully-fledged partnership. Since 2004, Papirnica Vevče has been a 100% subsidiary of Brigl & Bergmeister.

Brigl & Bergmeister, ENAGES as well as Papirnica Vevče are part of the Vienna-based Roxcel group of companies.

Stora Enso’s Uetersen Mill buyer withdraws application for merger

As earlier communicated, Stora Enso signed an agreement in May 2014 to divest its Uetersen specialty and coated fine paper mill in Germany to Brigl & Bergmeister, an Austrian specialty paper producer. Stora Enso recorded a negative non-recurring item of approximately EUR 34 million related to the planned disposal in the second quarter 2014 operating profit.

As earlier communicated, Stora Enso signed an agreement in May 2014 to divest its Uetersen specialty and coated fine paper mill in Germany to Brigl & Bergmeister, an Austrian specialty paper producer. Stora Enso recorded a negative non-recurring item of approximately EUR 34 million related to the planned disposal in the second quarter 2014 operating profit.

In September, the German Federal Cartel Office (FCO) indicated intentions to prohibit the proposed merger. Despite further evidence provided by the parties to clear the concerns of the FCO, the authorities’ assessment remained. Consequently, Brigl & Bergmeister withdrew the application for the merger on 9 October. The parties have agreed to terminate the share purchase agreement.

As a consequence, Stora Enso will reverse the loss on disposal of approximately EUR 28 million as a positive non-recurring item in its third quarter 2014 operating profit.

Stora Enso will now evaluate its options, which may include divestment or restructuring of the loss-making Uetersen Mill. This process does not affect the speciality paper production at Imatra Mill or the coated fine paper production at Oulu Mill in Finland.

Realated article : Competition authority prevents acquisition of Uetersen paper mill

For further information, please contact:

Ulrika Lilja, Executive Vice President Communications, tel. +46 72 221 9228

Ulla Paajanen-Sainio, Head of Investor Relations, tel. +358 40 763 8767

www.storaenso.com

www.storaenso.com/investors

Stora Enso is the global rethinker of the paper, biomaterials, wood products and packaging industry. We always rethink the old and expand to the new to offer our customers innovative solutions based on renewable materials. Stora Enso employs some 29 000 people worldwide, and our sales in 2013 amounted to EUR 10.6 billion. Stora Enso shares are listed on NASDAQ OMX Helsinki (STEAV, STERV) and Stockholm (STE A, STE R). In addition, the shares are traded in the USA as ADRs (SEOAY) in the International OTCQX over-the-counter market.

Ahlstrom to start co-operation negotiations at its Kauttua production line

![]() Ahlstrom, a high performance fiber-based materials company, today announced that it will start on October 16, 2014, co-operation negotiations with employee representatives at its Kauttua production line in Finland as part of its earlier announced rightsizing program. The negotiations will affect the whole personnel at the site and may lead to personnel reductions or temporary lay-offs. The aim of the negotiations is to evaluate ways to adjust Ahlstrom's production capacity and costs to the prevailing overcapacity on the global masking tape markets.

Ahlstrom, a high performance fiber-based materials company, today announced that it will start on October 16, 2014, co-operation negotiations with employee representatives at its Kauttua production line in Finland as part of its earlier announced rightsizing program. The negotiations will affect the whole personnel at the site and may lead to personnel reductions or temporary lay-offs. The aim of the negotiations is to evaluate ways to adjust Ahlstrom's production capacity and costs to the prevailing overcapacity on the global masking tape markets.

The Kauttua plant manufactures base paper for masking tape. The markets for masking tape have significant overcapacity globally, especially in Europe. Ahlstrom manufactures base paper for masking tape also in Pont Audemer, France and Longkou, China.

The Kauttua production line is part of Ahlstrom's Food Business Area and it employs approximately 20 employees. The negotiations are expected to be completed by early December 2014.

For more information, please contact:

Liisa Nyyssönen

VP, Communications

Tel. +358 10 888 4757

Ahlstrom in brief

Ahlstrom is a high performance fiber-based materials company, partnering with leading businesses around the world to help them stay ahead. We aim to grow with a product offering for clean and healthy environment. Our materials are used in everyday applications such as filters, medical fabrics, life science and diagnostics, wallcoverings and food packaging. In 2013, Ahlstrom's net sales from the continuing operations amounted to EUR 1 billion. Our 3,500 employees serve customers in 24 countries. Ahlstrom's share is quoted on the NASDAQ OMX Helsinki. More information available at www.ahlstrom.com.

ANDRITZ successfully starts up tenth tissue machine for Hengan Group, China

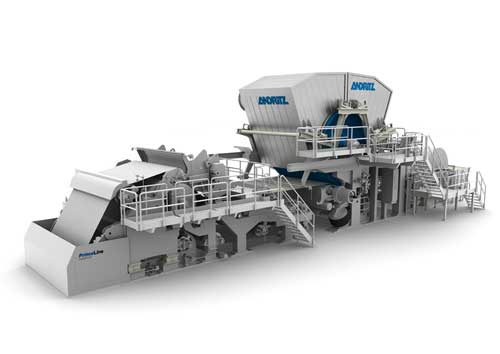

International technology Group ANDRITZ has successfully started up Hengan Group’s PM17 tissue machine at the Changde mill. Hengan Group is one of the leading producers of hygiene and sanitary products in China.

ANDRITZ has started up its tenth tissue machine for the Hengan Group, China | Photo Andrtitz

The PrimeLineTM W8 tissue machine– already the tenth tissue machine supplied by ANDRITZ to Hengan Group – has a design speed of 2,000 m/min and a width of 5.6 m. The scope of supply also included a steel Yankee with a diameter of 18 ft., the complete stock preparation plant, and the automation system.

ANDRITZ is presenting its latest technologies for tissue production at the MIAC trade fair (October 15-17, 2014, in Lucca, Italy) and at Tissue World Asia (November 11-13, 2014, in Shanghai, China).

The ANDRITZ GROUP

The ANDRITZ GROUP is a globally leading supplier of plants, equipment, and services for hydropower stations, the pulp and paper industry, the metalworking and steel industries, and solid/liquid separation in the municipal and industrial sectors. The publicly listed, international technology Group is headquartered in Graz, Austria, and has a staff of around 24,100 employees. ANDRITZ operates over 250 production sites as well as service and sales companies all around the world. The ANDRITZ GROUP ranks among the global market leaders in all four of its business areas. One of the Group’s overall strategic goals is to strengthen and extend this position. At the same time, the company aims to secure the continuation of profitable growth in the long term.

ANDRITZ PULP & PAPER

The business area is a leading global supplier of equipment, systems, and services for the production and processing of all types of pulps, paper, tissue, and cardboard. The technologies cover the processing of logs, annual fibers, and waste paper; the production of chemical pulp, mechanical pulp, and recycled fibers; the recovery and reuse of chemicals; the preparation of paper machine furnish; the production of paper, tissue, and board; the calendering and coating of paper; as well as treatment of reject materials and sludge. The service range includes modernization, rebuilds, spare and wear parts, service and maintenance, as well as machine transfer and second-hand equipment. Biomass, steam, and recovery boilers, gasification plants for energy production, flue gas cleaning plants, production equipment for biofuel (second generation) and biomass pelleting, biomass torrefaction, plants for the production of nonwovens, dissolving pulp, plastic films, and panelboards (MDF), and recycling plants are also allocated to the business area.

For further information please contact:

Oliver Pokorny

Head of Corporate Communications

This email address is being protected from spambots. You need JavaScript enabled to view it.