Ianadmin

Resolute Announces Indefinite Idling of Paper Machine at its Calhoun Mill

Resolute Forest Products Inc. has announced the indefinite idling of a newsprint machine at its Calhoun mill in Tennessee. The idling comes as a result of a decrease in demand for newsprint, coupled with high operating costs for the machine, which produced 215,000 metric tons per year. The decision follows Resolute's March 11 acquisition of the 49% interest in Calhoun Newsprint Company ("CNC") owned by The Herald Publishing Company, LLC, its joint-venture partner.

Resolute Forest Products Inc. has announced the indefinite idling of a newsprint machine at its Calhoun mill in Tennessee. The idling comes as a result of a decrease in demand for newsprint, coupled with high operating costs for the machine, which produced 215,000 metric tons per year. The decision follows Resolute's March 11 acquisition of the 49% interest in Calhoun Newsprint Company ("CNC") owned by The Herald Publishing Company, LLC, its joint-venture partner.

The Calhoun mill, which presently employs 610 workers, will continue to operate the two specialty paper machines and the pulp dryer. The announcement will affect approximately 150 positions at the mill.

The Company recognizes the impacts this decision will have on the employees concerned and their families. Severance will be provided to affected employees according to the local labor agreement or the corporate policy for salaried employees. Outplacement assistance will be made available through government agencies.

SOURCE: Resolute Forest Products Inc.

BTG at PaperCon 2013, Atlanta, Booth 138

BTG would like to invite attendees of the upcoming PaperCon Conference in Atlanta to come and meet our global team of specialists at booth 138.

BTG is committed to helping clients achieve significant, sustainable gains in business performance. We accomplish this through our world-class people, market-leading technologies, industry expertise and a passion for results.

Recent innovations include the new TCT-2531, an open flow sensor for low fiber consistency applications such as measuring fiber losses; the Optical Bleach PlantT for enhanced productivity and chemical savings in the fiber line; and the completely new Mütek PCD-05, the industry standard for charge measurement.

Recent innovations include the new TCT-2531, an open flow sensor for low fiber consistency applications such as measuring fiber losses; the Optical Bleach PlantT for enhanced productivity and chemical savings in the fiber line; and the completely new Mütek PCD-05, the industry standard for charge measurement.

BTG continues to deliver unique solutions in the coated paper segment. ICC - Integrated Coating Capabilities; combines our world-class products from Duroblade®, IPI and the Instruments groups with unmatched application expertise and excellent Customer Service.

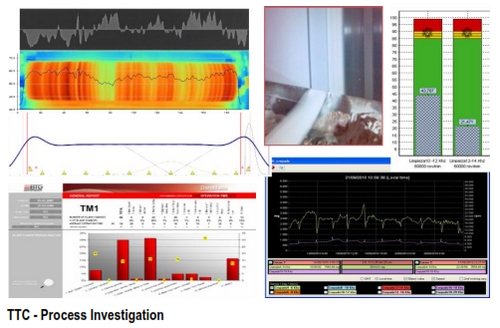

TTC - Total Tissue Capability has taken the Industry by storm! BTG introduces insightful concepts after a detailed assessment of the critical success factors with our customers is complete. These opportunities are managed by closing gaps in the process with an onsite team that delivers and sustains results from the wet end to converting.

Come and discuss your solutions with our team of experts at PaperCon 2013!

BTG - raising your productivity

MIAC 2013 : The Show

MIAC - International Exhibition of Paper Industry takes place in Italy every year. It has received a great deal of attention since its first edition (1994) and now it has reached its 20thedition.

The Exhibition has developed through time thanks to its excellent location and constant participation of the leading companies in the sector of the paper industry. Moreover, every year these highly skilled and innovative companies, through MIAC, present the latest developments in machines, systems and avant-garde solutions to improve the management of the various stages in the paper production cycle.

Visiting MIAC is a unique opportunity for paper and converting technicians to find out the latest news in this profession as it provides paper producers with a forum where they can directly address the different demands and problems in the sector. These characteristics make MIAC a very important date in the paper industry’s calendar!

Furthermore, the Exhibition Centre of Lucca is located in a strategic position in the North-Centre of Italy. Pisa Airport is only 20 minutes car distant from Lucca and Florence Airport is 45 minutes car distant from the Exhibition Centre of Lucca.

Also for the 2013 edition, MIAC Exhibition planned several “technical meetings” in order to take stock of the situation regarding trend, future perspectives and new available technologies in the paper sector.

MIAC is “more international” at every new edition. As a matter of the fact, about 35% of Visitors of MIAC 2012 came from foreign Countries.

The Conferences

Also for the 2013 edition, after the success reached in the past editions, MIAC Exhibition planned several “technical meetings” in order to take stock of the situation regarding trend, future perspectives and new available technologies in the paper sector. As every year, participation in MIAC Technology Conference and MIAC Tissue Conference is completely free of charge for all the Paper Mills and Converters technicians.

Simultaneous translation from Italian to English and vice versa is available during the Conferences.

ANDRITZ to support Mondi’s program for energy optimization and environmental protection

International technology Group ANDRITZ has received orders to supply a High Energy Recovery Boiler (HERB) and further environmental technologies for Mondi mills in Slovakia, Sweden, and the Czech Republic. The orders are part of Mondi’s program to increase energy efficiency and environmental protection.

For Mondi SCP, Ružomberok, Slovakia, ANDRITZ PULP & PAPER will deliver a High Energy Recovery Boiler. In terms of its power-to-heat ratio, the new boiler will be one of the most efficient recovery boilers in the world. The new boiler will replace an existing boiler, increase the mill’s electricity production significantly, provide conditions for operation with a minimized amount of fossil fuels and will also enable an increase of pulp production. The delivery also includes an evaporation plant retrofit. The evaporator will represent the latest technology including 7-effect heat economy, enhanced internal condensate purification, and 85% black liquor concentration. Start-up of the boiler and the rebuilt evaporation plant is scheduled for the end of 2014.

Two existing lime kilns at Mondi’s Dynäs mill in Väja, Sweden, will be replaced by a new ANDRITZ lime kiln. Based on its LimeFlash technology, operating costs will be reduced due to lower fuel consumption. Start-up is planned for the fourth quarter of 2013.

For Mondi Štětí, Czech Republic, ANDRITZ will build a packaging paper machine (PM7) to produce a various amount of bleached kraft grades. PM7 will start up in the latter part of 2014. In addition, the mill’s PM5 will receive an upgrade of the dryer section until October 2013.

Catalyst Paper Q4 results impacted by lower sales volumes, higher maintenance and stronger Canadian dollar

Catalyst Paper (TSX:CYT) results in the fourth quarter were negatively impacted by lower sales volumes, higher maintenance spending and a stronger Canadian dollar.

Catalyst Paper (TSX:CYT) results in the fourth quarter were negatively impacted by lower sales volumes, higher maintenance spending and a stronger Canadian dollar.

Catalyst posted a net loss of $35.2 million for the quarter, in contrast to net earnings of $655.7 million in the third quarter, when the one-time gains realized on emergence from creditor protection were booked. Before specific items, net losses were $15.7 million and $7.5 million in Q4 and Q3 respectively. Adjusted EBITDA was $7.2 million in Q4, with no impact from restructuring costs, and $13.8 million in Q3 ($14.0 million before restructuring costs).

Market conditions were mixed during the fourth quarter, with North American paper demand down from the third quarter for directory and newsprint, and up for coated and uncoated grades. Benchmark prices were up for newsprint and coated and otherwise stable for paper, while there was moderate benchmark price recovery for pulp. A market curtailment at Powell River was necessary over the holidays to balance production with orders, and Catalyst incurred a loss from discontinued operations largely due to an increased estimated pension withdrawal liability associated with the Snowflake closure.

“We saw lower prices for coated and newsprint and weaker demand across our paper product lines in 2012. However, capacity reductions helped mitigate the demand impacts,” said Catalyst President and CEO Kevin J. Clarke. “Pulp prices took a hit as markets weakened in China due to overstocked inventories. These sorts of challenges aren’t going away, but with a better cost structure across all product segments, and continued market share momentum, we’re better positioned to take them on.”

Results for the Year

Net earnings of $583.2 million for 2012 were heavily impacted by one-time non-cash restructuring credits and fair value accounting adjustments. This compared with a $974.0 million net loss in 2011 which was driven largely by asset impairment charges.

Catalyst entered creditor protection on January 31, 2012, and exited on September 13, having achieved a US$390.4 million or 60 per cent reduction in its debt, savings in annual interest expense of US$33.9 million, and a range of other cost reductions. The restructuring included the permanent closure of its Snowflake mill at the end of the third quarter. Results from this discontinued operation are excluded from those being reported, with comparative periods having been restated accordingly.

Before specific items – which also included restructuring-related fees, closure costs at Snowflake, and a foreign exchange gain on translation of US dollar-denominated debt – Catalyst posted a net loss of $37.8 million ($2.62 per common share), in contrast to a net loss of $126.3 million in 2011 ($0.33 per common share). Total sales were $1,058.2 million, slightly below $1,079.7 million in 2011.

Adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) were $55.4 million for 2012 ($60.7 million before specific items), down from $62.8 million for 2011 ($68.7 million before specific items). A significant drop in pulp transaction prices and lower average paper transaction prices were only partially offset by cost reductions, higher sales volumes and favourable currency impacts.

Liquidity

Total liquidity stood at $97.9 million at the end of 2012, compared to $96.7 million a year earlier. The borrowing base on the new Asset Backed Loan (ABL) facility put in place upon the conclusion of the restructuring was down mainly due to lower accounts receivable and inventories as a result of the Snowflake shutdown. Letters of credit, amounts drawn and cash on hand were also down. Free cash flow was negative $47.2 million largely due to reorganization costs of $37.5 million and salaried defined benefit pension solvency funding of $11.8 million, in comparison with negative $58.8 million in 2011.

Internally generated cash flows from operations, in combination with advances under the ABL facility, are expected to be sufficient to meet future operating cash requirements.

Restructuring

Catalyst issued 14,400,000 new common shares to holders of its now-cancelled 2016 Notes upon its exit from creditor protection in September. A further 127,571 common shares were issued in December to unsecured creditors who elected this option in lieu of participating in the proceeds pool from specified asset sales. On January 7, 2013, Catalyst’s new common shares were listed on the Toronto Stock Exchange under the symbol “CYT”.

In addition to savings associated with the cancellation of its previous notes, additional annual cost reductions include new competitive five-year labour agreements ($18-$20 million), lower municipal taxes ($6.1 million), and pension funding relief ($7 million). The closure of the Snowflake recycled paper mill will also eliminate financial losses due to intense input-cost and market-related pressures, and significantly reduce working capital requirements.

The US court-approved sale of the assets of the Snowflake mill and the shares of the Apache Railway closed on January 30, 2013, for US$13.5 million and other non-monetary consideration. Closure costs were $18.6 million. Agreements were also reached in 2012 to sell smaller non-core assets in both Port Alberni and Powell River, and efforts continue to market the site of the former Elk Falls operation and Catalyst’s remaining poplar plantation lands.

On February 13, 2013, Catalyst agreed to sell its interest in Powell River Energy for $33 million. Catalyst will continue to purchase electricity under the existing power purchase agreement which expires in 2016, with possible extension to 2021 in one-year terms at Catalyst’s option.

Under the terms of the Plan of Arrangement, unsecured creditors who did not elect to receive shares in settlement of their claims will receive their pro rata share of the net sale proceeds. Given that many creditors elected to receive shares, this will result in a distribution of approximately 40% of the net proceeds of the sale. Catalyst will offer to purchase a portion of the notes issued as part of its exit financing arrangements with the balance of the sale proceeds. The sale is expected to close in the first quarter of 2013.

NanoPro – new roll cover for calenders

At the beginning of 2013, Voith launched the NanoPro roll cover for calenders onto the market, which offers a very noticeable reduction of vibrations. This new cover is available for supercalenders, soft calenders and multi-nip calenders.

At the beginning of 2013, Voith launched the NanoPro roll cover for calenders onto the market, which offers a very noticeable reduction of vibrations. This new cover is available for supercalenders, soft calenders and multi-nip calenders.

NanoPro provides a reliable and consistent performance as it has unique attributes in areas where vibrations would normally restrict the performance of roll covers. In comparison with other conventional roll covers, it manages to further reduce vibrations, even under difficult conditions. The annual operating and maintenance costs are thus lowered. Moreover, the profile of NanoPro remains uniform due to its high level of wear and abrasion resistance.

NanoPro provides a reliable and consistent performance as it has unique attributes in areas where vibrations would normally restrict the performance of roll covers. In comparison with other conventional roll covers, it manages to further reduce vibrations, even under difficult conditions. The annual operating and maintenance costs are thus lowered. Moreover, the profile of NanoPro remains uniform due to its high level of wear and abrasion resistance.

The multi-layer fiber-reinforced roll cover guarantees a uniform distribution of nanoparticles. Customized components and the manufacturing process ensure that the NanoPro layers can withstand severe impact damages. NanoPro also distributes a high compressive stresses evenly over the entire nip. Thus the customer can count on the best possible sheet characteristics for gloss and smoothness and ultimate running behavior.

Stora Enso in Ethisphere Institute’s list of the World’s Most Ethical Companies

Stora Enso has been included in Ethisphere Institute’s 2013 list of the World’s Most Ethical Companies. The Ethisphere list recognises companies’ ethical leadership, compliance practices and corporate social responsibility. This is now the sixth time running that Stora Enso has been selected for the list, and it is the only Finnish company and one of only five Nordic companies in the 2013 list.

“Not only did more companies apply for the World’s Most Ethical Companies recognition this year than any year in the past, which demonstrates that ethical activity is an important part of many of these companies’ business models, but we are also seeing more companies be proactive and create new initiatives that expand ethics programmes and cultures across entire industries, such as industry-based ethics associations and other activities,” says Alex Brigham, Executive Director of Ethisphere. “We are excited to see the 2013 World’s Most Ethical Companies take these leadership positions, and embrace the correlation between ethical behaviour and improved financial performance.”

The record number of nominations and applications this year is evidence of increasing regard for the list of the World’s Most Ethical Companies among various stakeholder groups and the desire of companies to be recognised for their integrity and ethical culture. The 2013 list is the largest since the award’s inception in 2007.

“We are happy to receive this recognition again this year. Our commitment to global responsibility and ethical business practices will be further strengthened with the establishment of a Global Responsibility and Ethics Committee of the Board of Directors following our Annual General Meeting in April this year,” says Stora Enso’s Head of Global Responsibility Terhi Koipijärvi.

Through in-depth research and a multi-step analysis, Ethisphere reviewed nominations from companies in more than a hundred countries and 36 industries. The methodology for the World’s Most Ethical Companies list includes reviewing codes of ethics, litigation and regulatory infraction histories; evaluating the investment in innovation and sustainable business practices; looking at activities designed to improve corporate citizenship; and studying nominations from senior executives, industry peers, suppliers and customers.

Read about the methodology and view the complete 2013 list of the World’s Most Ethical Companies at http://ethisphere.com/wme.

Xerium Technologies Reports Steady Sales and Orders and Implementation of Cost Reduction and Sales Growth Actions

Xerium Technologies, Inc. (NYSE:XRM), a leading global manufacturer of specially engineered textiles and roll covers used in the production of paper, paperboard, building products, non-wovens and specific industrial processes, announced that the results of its operations for the quarter and year ended December 31, 2012.

Net sales have been stable in 2012, averaging approximately $134.7 million per quarter, and within a range of +/- 2%. Our backlog, defined as orders expected to ship within one year, suggests that this trend will continue and currently stands at $174.0 million as of December 31, 2012. Compared to the third quarter of 2012, net sales were essentially the same at a 0.3% decline, or a 1.4% decline on a constant currency basis. Compared to the fourth quarter of 2011, net sales decreased 7.9%, or 6.2% on a constant currency basis, to $133.8 millionfrom $145.2 million. Year over year, net sales decreased 8.2%, or 4.8% on a constant currency basis, to $538.7 million from $587.0 million. See "Segment Information" and "Non-GAAP Financial Measures" below.

Gross profit has been fairly stable in 2012, averaging approximately $48.4 million per quarter and within a range of +/- 3%. The 4.5% decline from $49.2 million in the third quarter of 2012 to $47.0 million in the fourth quarter of 2012 was primarily as a result of special charges for asset impairments, lower constant currency sales volume and reduced production absorption.

Despite stable sales, Adjusted EBITDA declined 15.6% in the fourth quarter of 2012 to $20.6 million from $24.4 million in the third quarter of 2012. This decline was primarily a result of special charges of $1.5 million for items including payroll tax exposures, accounts receivables and inventory and the third quarter reversal of $0.5 million management incentive costs that did not occur in the fourth quarter of 2012. In addition to these unusual items, Adjusted EBITDA declined $1.5 million, primarily due to reduced gross profit on lower constant currency sales and lower production absorption. See "Non-GAAP Financial Measures" below.

Total debt is trending down as a result of explicit pay down actions and stands at $445.0 million at December 31, 2012. During the fourth quarter of 2012, the Company paid down $5.1 million of debt, including the repurchase of $3.6 million of its Notes in December of 2012. On a full year basis, debt was paid down $25.7 million. Net debt, as defined as total debt less cash balances, was $410.2 million at December 31, 2012.

Commenting on the quarter, Harold Bevis, Xerium's President and Chief Executive Officer stated, "The Company is fully underway with its multi-year commitment to increasing sales and EBITDA. The Company is right-sizing its cost structure around its core business. It is also repositioning its production capacity to be lower cost and better serve its customers. The Company has taken specific cost reduction actions to increase 2013 Adjusted EBITDA including the closure of four manufacturing operations and reduction of headcount. We have targeted savings net of reinstated incentive compensation of approximately $12 million in 2013 with a progressive quarterly build up of cost out actions and a carryover into 2014. Specifically, the Company took action against approximately $1.5 million of cost, net of incentive compensation reinstatement, in the first quarter of 2013, compared to the fourth quarter of 2012. The Company is funding and gating its cost reduction activities with internal cash flow. The Company has also kicked off and/or accelerated several new sales growth and new product programs in order to re-establish top-line growth opportunities. These strategic moves will be kept private by Company management for the time being, but these actions are expected to open up another ~$200 million aperture into our served markets."

FOURTH QUARTER FINANCIAL HIGHLIGHTS

Source: Xerium Technologies, Inc.

World's largest biomass gasification plant inaugurated in Vaasa - plant supplied by Metso

Vaskiluodon Voima Oy has inaugurated the world's largest biomass gasification plant, which was supplied by Metso, in Vaasa, Finland. The plant was inaugurated by the Finnish Minister of Labour Lauri Ihalainen on March 11th.

Vaskiluodon Voima's plant is ground-breaking in many ways, as this is the first time in the world that biomass gasification is being adopted on such a large scale for replacement of fossil fuels.

Clean gas from biomass

The technology of the new plant is based on Metso's long-term development work. Metso's delivery included fuel handling, a large-scale dryer and a circulating fluidized bed gasifier, modification work on the existing coal boiler and a Metso DNA automation system. The bio-gasification plant was constructed as part of the existing coal-fired power plant, and the produced gas will be combusted along with coal in the existing coal boiler.

Metso's pioneering role is illustrated by the fact that the company delivered its first plant using gasification technology back in the 1980s. A major challenge in the Vaskiluoto project was the sheer scope - the now inaugurated plant is the world's largest biomass gasification plant.

The plant started up at the turn of the year. The contract for the new plant was announced in June 2011, and Metso started the construction at Vaskiluoto in April of the following year, making the actual construction phase fairly short.

"The operational experiences so far indicate that the 140-MW bio-gasification plant functions as planned, and the produced gas burns cleanly in the coal boiler and reduces emissions," says Mauri Blomberg, Managing Director, Vaskiluodon Voima.

Sights set on energy turnaround

Nearly half of the coal used by the plant can be replaced with gasified biomass. This makes the solution highly environmentally friendly, enables the flexible use of different fuels and significantly extends the life of the current power plant. "The commissioning of the gasification plant is a major step in our company's target of using mainly domestic fuels for heat and electricity production. This can be considered a complete energy turnaround," says Rami Vuola, Chairman of the Board of Vaskiluodon Voima and CEO of EPV Energia Oy, joint owner of Vaskiluodon Voima.

The recent gasification technology projects are an indication of Metso's strategy of offering energy solutions in which technologies related to fuel refining have been brought forth alongside traditional combustion. In May 2012, a similar event was held in Lahti, Finland, with the inauguration of the world's first waste gasification plant.

"I'm sure that Vaskiluoto's investment in increasing the use of renewable energy will draw major international attention. Coal powered plants can be made greener, and Vaskiluoto's plant is leading the way," says Jyrki Holmala, President of Metso's Power business line. "Coal boilers still account for the majority of power production in the world. Bio-gasification technology of this scale offers a new, cost-effective option for increasing the share of biomass and, consequently, for significantly decreasing the use of and emissions from coal.

" Later on in the inauguration day, Metso organized a technology seminar in Vaasa, which was attended by some 50 customers from around Europe. A visit to the new gasification plant was also on the agenda.

Vaskiluodon Voima Oy is equally owned by the energy companies EPV Energia Oy and Pohjolan Voima Oy. The company's power plants, located in Vaasa and Seinäjoki, produce electricity and district heating. www.vv.fi

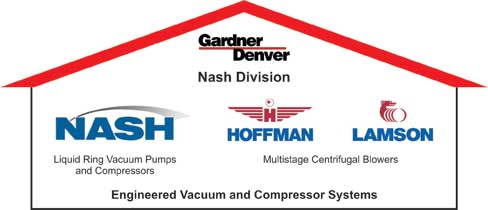

Nash Division extends its portfolio

Gardner Denver has restructured the activities within its Engineered Products Group: Effective January 01, 2013, the CF (Multistage Centrifugal Blowers) organization of Gardner Denver, encompassing the Hoffman and Lamson brands, become part of the Gardner Denver Nash division.

NASH has over 100 years of experience in manufacturing of liquid ring vacuum pumps and compressors and the CF group is a strong manufacturer of HOFFMAN & LAMSON multistage centrifugal blowers. All three brands have a strong focus on Engineered Vacuum and Compressor Systems. They have a wide product portfolio and customers all over the world.

Vacuum and compressor systems made by Nash and Hoffman & Lamson have reliably operated for decades in the chemical process industry, filter applications, pulp & paper production, electric power plants, refineries, wastewater treatment, general process industries and many more applications.

This new organization will realize significant synergies within the Nash division, especially in the engineering and supply of vacuum and compressor systems. Combined sales channels and know-how will enable us to provide better communication and further improve all processes with our partners and customers.

For business partners in EMEA, this means that the Nash sales organization will be the contact partner for all issues regarding CF Blowers. All CF inquires will continue to be handled by the experienced technical sales support team of Hoffman & Lamson.

Both Lamson (founded in 1880) and Hoffman (founded in 1905) have strong roots in the USA and a strong market position in many wastewater treatment applications. After being acquired by Gardner Denver (Lamson in 1996 and Hoffman in 2001), the two brands were merged, further improving their

market position.

Nash originated from nash_elmo which was acquired by Gardner Denver in 2004. The company is the inventor of the liquid ring pump, with patent certificates issued in Germany and the USA in 1903 and 1905 respectively.