Ian Melin-Jones

Sonoco Named One of the 25 Top Companies by Aon Hewitt

Sonoco, one of the largest diversified global packaging companies, has been named to the 2011 list of North American Top Companies for Leaders, announced Allan McLeland, vice president, Human Resources. Sonoco was ranked number 16 on this year's list of North American Top Companies for Leaders.

Conducted by Aon Hewitt, the global human resource consulting and outsourcing business of Aon Corporation (NYSE: AON), in partnership with The RBL Group, a strategic HR and leadership systems advisory firm, and Fortune magazine, the Top Companies for Leaders list is the most comprehensive study of organizational leadership in the world. An expert panel of independent judges selected and ranked winners based on criteria including strength of leadership practices and culture, examples of leader development on a global scale, impact of leadership in communities in which they operate, business performance and company reputation.

"Sonoco is very proud to be recognized as a Top Company for Leaders for a fourth consecutive time and to be the only packaging company on this year's list," said McLeland. "The belief that 'People Build Businesses' has always been an integral part of our culture, which is why our managers, not HR, take the lead in selecting, developing and retaining Sonoco's leaders. Managers give their people ongoing coaching, focused training and exposure to new areas through special projects. They also make sure their people know they're valued, regularly communicate where they stand in terms of career growth and reward them based on performance."

When comparing its Top Companies with more than 470 other companies worldwide, Aon Hewitt identified a common characteristic that sets them apart from their peers--Top Companies are committed to building leadership capability within their organizations.

"Aon Hewitt would like to congratulate Sonoco on being named one of the North American Top Companies," said Pete Sanborn, global leader of the Talent and Organization Practice with Aon Hewitt. "Through our research, it's clear that Top Companies such as Sonoco understand the connection between investing in leaders and financial success. Leaders at these organizations are passionate and committed. They have a focus on talent and developing leaders in a manner that is aligned with business goals."

Other companies making the 2011 list are IBM; General Mills; Procter & Gamble, Colgate-Palmolive; McDonald's; Whirlpool; PepsiCo; General Electric; Deere & Company; Target; 3M; Eli Lilly; McKinsey & Company; Intel; Capital One; V.F. Corporation; Raytheon; Fluor; United Health Group; Honeywell; AT&T, Accenture; American Express Bank; and Kiewit Corporation.

About the Top Companies for Leaders Study

With more than 1,200 data points and 900 executive interviews, the Aon Hewitt 2011 Top Companies for Leaders Study is the most comprehensive global research on leadership in the market, examining the link between leadership practices and financial results. This study explores how organizations assess, select, develop and reward leaders, and examines the execution of leadership practices, as well as the strategy that guides it. To learn more or to download a copy of this study, please visit http://www.aon.com/topcompanies.

Aon Hewitt, The RBL Group and Fortune utilized a three-step screening process to identify the finalist companies. This included assessing survey responses, conducting in-depth interviews and analyzing financial performance in relation to industry. Aon Hewitt provided this information to a panel of independent judges in each region to select and rank a 2011 Top Companies for Leaders list in Asia-Pacific, Europe, Latin America and North America.

SOURCE: Sonoco

Sappi orders Press and Dryer section modification from EV Group

Sappi Nijmegen, PM 7 in Netherlands has ordered press and dryer section modification by EV Group

The project includes stabilizing technology, tail threading equipment and machine geometry updates for the press section.

In the single felted section, the 1st and the 2nd dryer will be optimized with EV EasyOne high release web stabilizers and with new air systems, felt rolls and stretchers. In EV EasyOne concept, three high release web stabilizers will be installed above the existing dryers, which will be drilled for vacuum rolls on site.

The drying section optimization also includes EVdf Web Stabilizers and air equipment for the 3rd dryer group.

Taan Forest Achieves FSC Certification on Haida Gwaii

The Rainforest Alliance today announced that Taan Forest, owned by the Haida Enterprise Corporation (HaiCo) of Haida Gwaii, in British Columbia, has successfully achieved Forest Stewardship Council (FSC) certification, becoming the first forest in British Columbia to meet FSC standards since 2009. Haida Gwaii is an archipelago of 200 islands off the northwest coast of British Columbia renowned for both its cultural importance and unique biodiversity.

The Rainforest Alliance today announced that Taan Forest, owned by the Haida Enterprise Corporation (HaiCo) of Haida Gwaii, in British Columbia, has successfully achieved Forest Stewardship Council (FSC) certification, becoming the first forest in British Columbia to meet FSC standards since 2009. Haida Gwaii is an archipelago of 200 islands off the northwest coast of British Columbia renowned for both its cultural importance and unique biodiversity.

“This investment by the Haida people in achieving FSC Certification is a big step forward for Taan Forest,” said Bob Brash, president of Taan Forest. “The Haida Nation’s special relationship with their forests and environment is well known. We are extremely pleased that stringent independent audits under the world’s preeminent FSC standards confirmed as such.”

Taan Forest completed a series of assessments and reports over the last year led by the Rainforest Alliance. Taan is the group manager of the FSC certificate that includes Tree Farm Licence 60 and the Haida and British Columbia Timber Sales Forest Licenses within Timber Supply Area 25 on Moresby and Graham Islands, representing 884,884 acres (358,100 hectares).

“Taan Forest was able to achieve FSC certification in just 11 months, illustrating its strong commitment to adopting the highest social and environmental standards,” said Krista West, forest management coordinator at the Rainforest Alliance. “This achievement sets a shining example to the forestry community in BC and Canada, demonstrating that FSC certification is within practical reach.”

“Change starts with us and the way we approach forestry,” said Guujaaw, president of the Haida Nation. “We know that we can maintain our culture, respect nature, and still derive a livelihood from the forests.”

FSC certification requirements are widely considered the “gold standard” for sustainable forest management, and the Rainforest Alliance is the leading FSC certifier worldwide. Over 167,413,895 acres (67,750,000 hectares) of forestlands worldwide have been certified to FSC standards by the Rainforest Alliance. The FSC standards cover environmental protection, wildlife protection, worker rights and safety, just wages, good living conditions and healthcare.

Loss of two Tembec employees in a crash

Two Tembec employees from Kapuskasing operations, Chad McQuade, area forestry technician and Daniel Simis, area forester died in a helicopter crash last Thursday 3rd Nov, in Northern Ontario, during a forest survey. The pilot of the contracted helicopter also died.

“It is a very sad time for all of us at Tembec. We wish to express our sincere condolences to the families, friends and co-workers. Our thoughts and prayers go to every member of these families who have lost their loved ones,” said President and Chief Executive Officer James Lopez.

Tembec is a large, diversified and integrated forest products company which stands as the global leader in sustainable forest management practices. The Company’s principal operations are located in Canada and France. Tembec’s common shares are listed on the Toronto Stock Exchange under the symbol TMB and warrants under TMB.WT. Additional information on Tembec is available on its website at www.tembec.com.

Sonoco Completes Acquisition of Tegrant Corporation

Sonoco one of the largest diversified global packaging companies, today announced that it has completed the acquisition of Tegrant Corporation, a leading provider of highly engineered protective, temperature-assured and retail security packaging solutions, from Metalmark Capital for $550 million.

According to Harris E. DeLoach, Jr., Sonoco chairman and chief executive officer, the acquisition of Tegrant has created a North American leader in multi-material protective packaging with more than 40 years of industry experience. Sonoco's Protective Packaging businesses operate nearly 40 manufacturing, design and testing facilities in the United States, Mexico, Puerto Rico and Ireland, with estimated annualized net sales of $540 million.

"We are pleased to welcome Tegrant's businesses and its more than 2,000 employees to the Sonoco family," said DeLoach. "Sonoco's new Protective Packaging segment combines our strong application engineering capabilities and problem-solving expertise to help deliver custom-engineered protective packaging solutions to a variety of growing consumer and industrial markets. Sonoco Protective Packaging now has leading positions in fast growing markets, including medical devices, pharmaceuticals, automotive components and health and beauty products, along with expanded access to a variety of industrial markets."

Sonoco's new Protective Packaging segment includes four businesses. Protexic(TM) Brands, the largest business, is North America's premier manufacturer of molded expanded foam. It serves a number of industries, including high technology, consumer electronics, automotive, appliances and medical devices. ThermoSafe(R) Brands is the world's leading provider of temperature-assured solutions, primarily used in packaging temperature-sensitive pharmaceuticals and food. Alloyd Brands(R) is a leading manufacturer and designer of high-visibility packaging, printed products and blister packaging machines for retail and medical markets. Sonoco's existing protective packaging business is a leading provider of custom-designed paper-based packaging solutions for household appliances, heating and air conditioning units, home and office furniture, lawn and garden equipment, and a variety of other consumer products.

Financings Update

In preparation for completing the Tegrant acquisition, Sonoco previously issued $500 million of new senior unsecured notes consisting of $250 million of 4.375% Notes due 2021 and a reopening of its 5.75% Notes due 2040 for $250 million.

Additionally, the Company recently entered into a $150 million three-year Term Loan Agreement, using a substantial portion of the proceeds to reduce outstanding commercial paper.

Merrill Lynch, Pierce, Fenner & Smith Incorporated; J.P. Morgan Securities, LLC; and Wells Fargo Securities, LLC acted as joint book-running managers for the Notes offering.

The lenders under the Term Loan include Bank of America, N.A.; J.P. Morgan Chase Bank, N.A.; and Wells Fargo Bank, N.A. Bank of America is also the administrative agent and Merrill Lynch, Pierce, Fenner & Smith Incorporated; J.P. Morgan Securities LLC; and Wells Fargo Securities LLC are joint lead arrangers.

Resolute Forest Products Launches New Identity

Resolute Forest Products, formerly doing business as AbitibiBowater, today began the rollout of its new Company name and identity. When communicating in French, the Company is using the name Produits forestiers Résolu.

"The launch of our new identity, Resolute Forest Products, underscores our forward momentum," stated Richard Garneau, President and Chief Executive Officer. "Our 10,000 employees are united and ready to deliver on Resolute's vision of continued sustainability and profitability."

The Company's new name and associated visual identity now appears on all marketing materials and communications. AbitibiBowater Inc. and its subsidiaries will not change their legal entity names until the Company obtains shareholder approval, as required by law, at its 2012 annual general meeting.

For Resolute's customers, suppliers and other stakeholders little will change beyond how the Company refers to itself. Until the Company obtains shareholder approval to change its legal entity names, the new Company name will not be used on invoices, checks, contracts, product names, Company stocks and stock market listings.

"Resolute is well-positioned for the long term," continued Garneau. "To remain competitive, we must anticipate and respond swiftly to market developments by continuously leveraging operating efficiencies and being opportunistic about investments and realistic when faced with difficult choices."

The Resolute Forest Products logo calls to mind the forest in which the Company works, the paper and lumber products it manufactures, and the modern and dynamic nature of the organization. Paper products are reflected in the half-circle of the "R", symbolizing a paper roll, as well as in the folds within the logo. The rectangular and triangular shapes, in the legs of the "R", represent pulp bales, wood products and forestry. Through the use of green as a primary color, the design also depicts the Company's determination to be a profitable business, committed to sustainability.

Verso Paper Corp. Reports Third Quarter 2011 Results

Verso Paper Corp. (NYSE: VRS) has reported financial results for the third quarter and nine months ended September 30, 2011. Results for the periods ended September 30, 2011 and 2010 include:

- Operating income increased 136% to $30.6 million in the third quarter of 2011 from $12.9 million in the third quarter of 2010.

- Net sales were $456.8 million in the third quarter of 2011 compared to $432.9 million in the third quarter of 2010.

- Adjusted EBITDA before pro forma effects of profitability program was $64.2 million in the third quarter of 2011, compared to $46.0 million in the third quarter of 2010. (Note: EBITDA and Adjusted EBITDA are non-GAAP financial measures and are defined and reconciled to net income later in this release).

- Net income before items was $0.8 million in the third quarter of 2011, or $0.01 per diluted share, compared to a net loss before items of $18.6 million, or $0.35 per diluted share in the third quarter of 2010.

Overview

Verso's net sales for the third quarter of 2011 increased $23.9 million, or 5.5%, compared to the third quarter of 2010, reflecting an 8.0% increase in the average sales price for all of our products while sales volume decreased 2.3% compared to last year's third quarter. Verso's gross margin was 17.8% for the third quarter of 2011 compared to 14.1% for the same period in 2010.

"Our third quarter results improved significantly from the third quarter of 2010. In spite of some demand challenges with specific product categories and the cost pressures of raw materials, Verso recognized a solid quarter. Pricing improved significantly as compared to the prior-year period and slightly on a sequential quarter basis. Our operations, as we projected in our second quarter earnings call, continued to improve in the area of material usage," said Mike Jackson, President and Chief Executive Officer of Verso.

"Our major energy projects continue to advance on our projected timeline, and we expect to start up our energy project at our Quinnesec mill in late November, which will continue to improve our cost position at our largest freesheet facility.

"As many of you know, on October 11, 2011, we announced some capacity closures that are in the best interest of our long-term performance and support our strategy of both lowering our costs and balancing supply with demand.

"Finally, we continue to recognize a correlation between operational performance and safety results. During the quarter, our total incident rate was 0.8, which is a world-class performance. I wish to recognize all of our employees who continue to contribute to this outstanding achievement."

Verso reported a net loss of $0.3 million in the third quarter of 2011, or $0.01 per diluted share, which included $1.1 million of charges from special items, or $0.02 per diluted share. Verso had a net loss of $19.2 million, or $0.36 per diluted share, in the third quarter of 2010, which included $0.6 million of charges from special items, or $0.01 per diluted share.

Verso reported a net loss of $69.2 million, or $1.32 per share, for the first nine months of 2011, which included $31.3 million of charges from special items, or $0.60 per diluted share, primarily due to $26.1 million in pre-tax net losses related to our debt refinancing in the first quarter of 2011. Verso reported a net loss of $117.1 million, or $2.23 per share, for the first nine months of 2010, which included $3.7 million of charges from special items, or $0.07 per diluted share, primarily due to costs associated with new product development.

Xerium Technologies Unveils Advanced Tissue Felt Technology

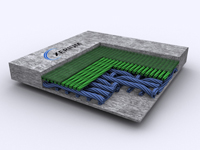

Xerium Technologies, Inc., a leading global manufacturer of industrial textiles and rolls used primarily in the paper production process, today announced full global availability of Impact TS, advanced tissue felt technology, as part of its clothing (PMC) technology designed to help customers improve operational performance and reduce energy consumption, which are vital to the manufacturing of tissue grades.

With Impact TS, Xerium continues to take the lead in advancing the technology of PMC, which is critical to tissue machines' overall energy efficiency and product quality as it is produced. PMC products are highly engineered synthetic textile belts that are used to transport raw paper along the length of the paper-making process, as it is formed, pressed, and dried, keeping in constant contact with the paper as it is formed.

With Impact TS, Xerium continues to take the lead in advancing the technology of PMC, which is critical to tissue machines' overall energy efficiency and product quality as it is produced. PMC products are highly engineered synthetic textile belts that are used to transport raw paper along the length of the paper-making process, as it is formed, pressed, and dried, keeping in constant contact with the paper as it is formed.

"Through innovations such as Impact TS, we continue to lead the market with technological solutions that boost efficiency and lower the cost of manufacturing paper," said Stephen R. Light, President, Chief Executive Officer and Chairman. "Time and again we earn our customers' loyalty by developing products with measurable return on investment."

Impact TS incorporates a unique combination of innovative raw materials, highly compressible base structure elements, topped with our premium needling technology delivering outstanding press performance. Impact TS technology utilizes hydrophilic base yarns aligned perfectly parallel in order to provide an ideal combination of pressure uniformity, exceptional dimensional stability and immediate nip saturation. These unique features provide immediate startup, lower energy consumption and optimum steady-state performance.

SOURCE: Xerium Technologies, Inc.

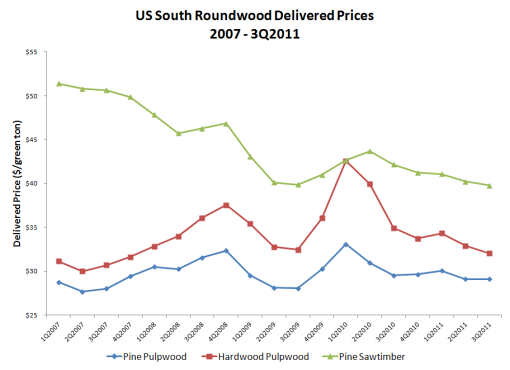

Roundwood Price Update: 3Q2011 Results

Despite increased demand and inventory building by mills, prices for roundwood in the US South continued their downward trend during the third quarter. Supply was not an issue as both delivered and stumpage prices fell despite the increased demand. Favorable weather conditions and declining diesel costs were the primary drivers; they freed up supply and caused the price reduction.

Pine Pulpwood

Delivered prices were down $0.01/ton from 2Q2011 to average $29.10/ton this quarter. Stumpage prices fell $0.18/ton to average $7.92/ton. Purchased tons were up 5 percent. Compared to the same period last year, delivered prices were down $0.42/ton, while stumpage was down $0.75/ton. Over a 5-year history (19 quarters), pine pulpwood delivered prices have increased at a compounded annual percentage rate (CAPR) of 0.2 percent while stumpage prices have decreased at a 2.9 percent CAPR.

Hardwood Pulpwood

Despite a 9 percent increase in purchased tons, delivered prices were down $0.85/ton from 2Q2011 to average $32.04/ton this quarter. Stumpage prices decreased $0.35/ton to average $6.21/ton. Compared to the same period last year, delivered prices were down $2.90/ton, while stumpage was down $1.88/ton. After peaking in 1Q2010, hardwood prices have reached their 5-year trend level. As a result delivered prices have increased at a 0.6 percent CAPR while stumpage prices have decreased at a 1.3 percent CAPR.

Pine Sawtimber

Despite a meager 1 percent increase in purchased volume, pine sawtimber reached a 5-year historic low this quarter for both delivered and stumpage prices. Delivered prices averaged $39.78/ton this quarter, down $0.45/ton compared to 2Q2011. Stumpage, prices averaged $20.05/ton, a decrease of $1.24/ton. Compared to the same period last year, delivered prices were down $2.40/ton while stumpage prices were down $3.26/ton. Five-year delivered CAPR reflects a 5.4 percent decrease. For stumpage, the CAPR reflects a 10.5 percent decrease.

Source: F2M Market Watch

Stora Enso's Nomination Board appointed

Stora Enso’s Annual General Meeting (AGM) on 20 April 2011 decided to appoint a Nomination Board to prepare proposals concerning

(a) the number of members of the Board of Directors,

(b) the members of the Board of Directors,

(c) the remuneration for the Chairman, Vice Chairman and members of the Board of Directors and

(d) the remuneration for the Chairman and members of the committees of the Board of Directors.

The Nomination Board shall consist of four members: the Chairman of the Board of Directors, the Vice Chairman of the Board of Directors and two other members appointed by the two largest shareholders (one each) as of 30 September 2011.

According to the register of shareholders, Stora Enso’s two largest shareholders on 30 September 2011 were Foundation Asset Management (FAM) and Solidium.

Stora Enso’s Nomination Board has been appointed. The composition of the Nomination Board is as follows: Gunnar Brock (Chairman of the Board of Directors of Stora Enso), Juha Rantanen (Vice Chairman of the Board of Directors of Stora Enso), Claes Dahlbäck (Senior Advisor of Foundation Asset Management) and Pekka Ala-Pietilä (Chairman of the Board of Directors of Solidium). Pekka Ala-Pietilä is the Chairman of the Nomination Board.