Ianadmin

Metso's new Quality Control System for BM8 at Stora Enso's board mills in Skoghall

Metso has received an order for a new Metso IQ quality control system from Stora Enso Skoghall. The system will be installed on BM8, one of the largest board machines in the world with an annual production amount of over 400,000 tons. The order was placed after careful evaluation, since Stora Enso places high demands on availability. One of the main criteria for the choice of supplier was to minimize the risk of production losses, both during the project phase and during normal operation of the board machine.

The delivery includes four scanners with the latest sensor versions, Metso Moisturizer IQ for the drying section, a reconstruction of the coating stations for automatic profiling with the new actuators, Metso IQ Dilution Profilers, plus MD and CD controls.

Metso is responsible for delivery, installation and performance. Installation and commissioning will take place in three phases starting in October 2012. The last stage will be carried out during the autumn shutdown in 2014.

"We are pleased and proud of this extensive order and consider it a privilege to work with Stora Enso Skoghall," Says Maria Dotzsky, Regional Director at Metso Automation.

Metso IQ quality control system, including high-level intelligent control applications, optimizes the cross-machine performance of papermaking processes. It integrates process quality management, measurements and profile controls, resulting in faster startups and grade changes, reduced dryer breaks and better runnability with stable short circulation to improves the uniformity of the wet sheet. (www.metso.com/metsoiq)

Metso IQ profilers provide effective profile management, improve production and runnability, and ensure better paper quality and printing properties. Metso's profilers feature advanced self-diagnostics and compact designs for easy maintenance and installation. (www.metso.com/automation/pp_prod.nsf/WebWID/WTB-041026-2256F-5F91A)

Resolute Owns 63.3% of Fibrek; Extends Offer to May 17

AbitibiBowater Inc., doing business as Resolute Forest Products, has announced that it has taken up and accepted for payment 12,305,679 additional shares of Fibrek Inc. (TSX: FBK) deposited to its offer as of the close of business today. Together with the shares the Company acquired up to and including May 3, Resolute holds approximately 63.3% of the currently outstanding shares. As aggregate consideration for the shares taken up today, Resolute will distribute approximately 350,000 newly-issued shares of its common stock and CAD$6.8 million in cash through RFP Acquisition Inc., a wholly-owned subsidiary.

The Company also announced that it has extended to 5:00 p.m. on May 17 the expiry time for its offer. As further described in the offer circular and other ancillary documentation related to the offer (as amended), Resolute intends to carry out a second step transaction to acquire the Fibrek shares not deposited in the offer.

The offer to acquire all of the issued and outstanding shares of Fibrek made by Resolute, together with RFP Acquisition Inc., a wholly-owned subsidiary, is more fully described in the offer circular and other ancillary documentation that Resolute filed on December 15, 2011, on the "SEDAR" website maintained by the Canadian Securities Administrators, as varied and extended. The offer expires at 5:00 p.m. (Eastern time) on May 17, 2012.

Questions and requests for assistance or further information on how to tender Fibrek common shares to the offer should be directed to, and copies of the above referenced documents may be obtained by contacting, Georgeson at 1-866-598-0048 or by email at This email address is being protected from spambots. You need JavaScript enabled to view it.

OMNOVA Solutions' Fitchburg Receives Environmental Merit Award from the EPA

OMNOVA Solutions Fitchburg, Massachusetts specialty chemicals facility recently received an Environmental Merit Award from the New England Region One Office of the U.S. Environmental Protection Agency (EPA). Ongoing since 1970, the EPA merit awards honor individuals and groups who have shown particular ingenuity and commitment in their efforts to preserve the region's environment.

OMNOVA's Fitchburg plant received the award for improvement in all major company sustainability categories, including reducing its consumption of natural gas, electricity and water, as well as decreasing its emissions. Since the establishment of baseline metrics in 2007 through the Company's Vision 2014 sustainability commitment, the plant achieved improvements of 33% or more in each of these categories. Employees at the Fitchburg facility utilized LEAN SixSigma methodologies, to focus on eliminating waste and achieving continuous improvement in all facets of manufacturing to drive these changes.

In addition, the Fitchburg plant has provided over $27,000 annually to local educational, health and wellness, and civic organizations through the OMNOVA Solutions Foundation as part of its commitment to building strong communities.

"As a Responsible Care company, it is our responsibility to enhance the sustainability of our processes, products and communities," said Dan Flint, Director of Operations for OMNOVA's Performance Chemicals Division. "By reducing its environmental footprint and embracing its role as good corporate citizen, the Fitchburg plant has exemplified the values of our Company and is one of the leaders in delivering on our Vision 2014 sustainability commitment. This award signifies the willingness of our employees to take an active role in driving continuous improvement to secure a better future for OMNOVA, our customers and our neighbors."

SOURCE OMNOVA Solutions

IP Announces 100% Recycled Paper for North American Customers

International Paper is pleased to announce the launch of a 100% recycled paper offering, Hammermill Great White 100 to North American customers. The paper is the newest product to join the Hammermill Great White line of recycled products.

"Consumers are interested in recycled paper products, but they also want confidence in the quality and how the product performs. Hammermill Great White 100 is the best of both worlds and offers a dependable 99.99% Jam-Free Guarantee paper that has a 92 brightness. It's a great paper that runs smoothly, looks sharp, and contains 100% post consumer fiber," said Jon Ernst, International Paper vice president for Imaging Papers.

This product is produced at IP's world-class Riverdale, Ala. Mill and comes after a multi-million dollar investment into their recycled product capabilities. The Hammermill Great White 100 joins IP's 30% and 50% recycled paper offerings already available and carries the Forest Stewardship Council® certification.

The product launch coincides with the celebration of the Hammermill brand's 100th anniversary. "Hammermill is one of oldest brands in the industry because of its ability to continually evolve to meet customer needs and this product is our latest example of meeting consumers where they are in the marketplace," added Ernst.

SOURCE International Paper

UPM showcases a new service for comprehensive workflow, colour and print quality management

UPM brings in display a new service UPM ColorCTRL at drupa. The new pdf workflow, colour management and print optimisation service is developed to support users in reaching the best possible print result on UPM Papers – each time. It is created in co-operation with market leading supply chain partners including the expertise of UPM’s technical field team, the best-in-class workflow system by Dalim Software and award-winning ColorServer technology by GMG in one application. UPM is piloting the new service with selected customers.

UPM brings in display a new service UPM ColorCTRL at drupa. The new pdf workflow, colour management and print optimisation service is developed to support users in reaching the best possible print result on UPM Papers – each time. It is created in co-operation with market leading supply chain partners including the expertise of UPM’s technical field team, the best-in-class workflow system by Dalim Software and award-winning ColorServer technology by GMG in one application. UPM is piloting the new service with selected customers.

UPM ColorCTRL is the first full turnkey solution in the market which covers the whole process from the creation of the print ready pdf page to the final colour accurate print product. Service includes a quick and effortless mobile publishing feature. UPM ColorCTRL is enabled through the use of optimised paper profiles by GMG.

UPM ColorCTRL is a cost effective and easy to use cloud based solution. With a service based fee the user will get an access to an online tool, which enables them to control workflows between different collaborators.

The service comes with consultancy and has everything in one package including pdf approval collaboration, version control, pre-flight checking, collaborative softproofing and colour optimisation. No investment or maintenance cost in local servers, hardware or software is needed.

“UPM ColorCTRL is an online service which allows easy collaboration with all partners in the value chain - from brand owner to advertising agency, publisher and printing house,” explains Gerd Carl, Project Manager for UPM ColorCTRL, and continues: “UPM ColorCTRL cuts down the time to market for quality print products and gives users savings in time, materials and investment costs.”

As a Biofore Company UPM strives for continues development and innovative solutions with added value. “UPM’s services are tailored to improve our customers’ business processes and to help them to reach their business targets – from efficiency and also environmental point of view. UPM ColorCTRL is an excellent example of this,” says Thomas Ehrnrooth, Vice President of Marketing and Communications, UPM.

DALIM SOFTWARE provides its ES workflow technology for the UPM ColorCTRL workflow online platform and the GMG ColorServer engine secures the optimal print ready pdf quality. Proof to print match is obtained using the optimized GMG ColorProof software within the package. Colour accuracy of the final print product will be achieved by always up-to-date UPM paper profiles, service setup and consultancy.

UPM is piloting the new service with selected customers and introduces UPM ColorCTRL at drupa.

Rottneros appeals against Finansinspektionen’s decision

Finansinspektionen (the Swedish Financial Supervisory Authority) made an order on 12 April 2012 requiring Rottneros to pay a charge of SEK 200,000 for violating the provisions on publication of changes to share capital. Rottneros has appealed against this decision to the Stockholm Administrative Court.

The provisions concerned aim to ensure that no shareholder might be put at risk of breaching the flagging obligation, which can arise in the event of changes to a company’s share structure without the owner themself having taken any action by a purchase or sell. This may for instance occur as a result of a share issue.

Rottneros claims that the formal error that was committed by the company, that it had not published the number of outstanding shares on the last date of trading in the month, could not have entailed any problems for the company’s shareholders, as those who could have been affected by the flagging obligation were not only very well informed about the changes that were made but they were in fact also participative in the negotiations that led to the changes to the share structure. Rottneros has also on a number of occasions and in various ways informed the market of the changes when they were planned and subsequently when implemented.

Rottneros is consequently of the opinion that full leniency should be granted for the special charge for the violation or that it should be reduced to a minimum.

Mondi Paper to be used by Landa S7 Nanographic Printing Press at drupa 2012

Landa S7 Nanographic Printing™ Press will demonstrate use of Landa NanoInkTM on Mondi’s 100% recycled NAUTILUS® SuperWhite paper

When Landa Corporation unveils its new line up of Nanographic PrintingTM presses at drupa 2012, the B2 sheetfed Landa S7 Nanographic Printing Press will be performing live demonstrations using the 90 g/m² NAUTILUS® SuperWhite paper. This will mark the first public use of Landa digital technology with off-the-shelf paper.

“We are very pleased to be cooperating with Landa Corporation with the launch of the Nanographic Printing presses,” said Johannes Klumpp, marketing and sales director for Mondi Uncoated Fine Paper. “Benny Landa, the Founder, Chairman and CEO of Landa, is recognised for developing revolutionary printing technologies that shape the industry. At drupa, Mondi and Landa are demonstrating the ability of our off-the-shelf paper to be successfully used by professional printers and converters who will use Landa NanoInkTM as part of the Nanographic Printing process.”

A high-white 100% recycled paper that shows excellent contrast for text and graphic printouts, NAUTILUS® SuperWhite has long since been a part of Mondi’s Green Range of sustainably produced papers. As of 2012, all Mondi branded papers meet Green Range criteria and are FSC® (Forest Stewardship Council®) or PEFC™ certified, 100% recycled or bleached Totally Chlorine Free (TCF).

“We are happy that Mondi has agreed to take part in our launch of the Landa Nanographic Printing Presses. This is a ground-breaking development for both commercial printing and paper technology,” said Benny Landa.

In addition to NAUTILUS® SuperWhite, Mondi’s professional portfolio carries a number of brands suitable for Landa’s Nanographic Printing Presses. DNS® premium, MAESTRO® PRINT, BIO TOP 3® next and NAUTILUS® are available in all formats for Landa Nanography™ and are offered in grammages from 60 to 400g/m².

Visitors to drupa can see the print results of NAUTILUS® SuperWhite 90 g/m2 on Landa’s S7 B2 sheet-fed machine at the Landa stand in Hall 9, Booth A73-3, May 3-16.

Clariant delivers resilient performance

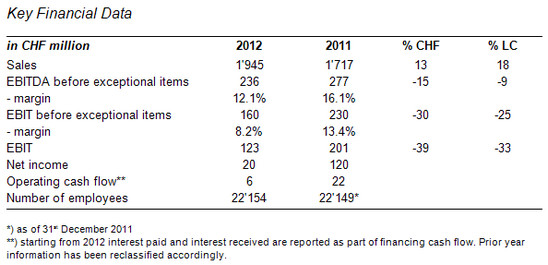

Clariant, a world leader in specialty chemicals, today announced first quarter sales of CHF 1.945 billion, compared to CHF 1.717 billion in the previous-year period. Sales grew 18% in local currencies and 13% in Swiss francs, mainly driven by the acquisition of Süd-Chemie. On a like-for-like basis, sales declined 2% in local currencies year-on-year.

§ First quarter sales up 18% in local currencies and 13% in CHF, driven by acquisitions

§ EBITDA margin before exceptional items at 12.1%, compared to 16.1% in the previous-year period, reflecting the expected soft start to 2012, with lower demand compared to the high basis of the previous year

§ Continuing growth in non-cyclical businesses while cyclical and structurally challenged businesses faced similar trading conditions to Q4 2011, improving towards the end of the quarter

§ Outlook for 2012 confirmed: Clariant expects further sales growth in local currencies and sustained profitability in 2012 as the global economy is expected to strengthen progressively in the course of the year.

CEO Hariolf Kottmann commented: "As expected, Clariant had a soft start into the year as the global economy stabilized. While the non-cyclical parts of the portfolio continued to perform well, the more cyclical businesses faced ongoing challenges in the current uncertain environment, especially in Europe. This is reflected in lower margins for the Group compared to an extraordinarily strong quarter one year ago. Going forward, we anticipate a gradual improvement in business conditions throughout the remainder of the year, which combined with further efficiency gains, will lead to an improved performance in the second half-year."

The first quarter was a continuation of the trend seen in the fourth quarter of 2011. Sequentially, Catalysis & Energy weakened as it entered its low season while the seasonally strong businesses like de-icing and refinery had a weak performance due to unfavorable weather conditions. This was compensated by a solid growth in the non-cyclical Business Units and a pick-up in demand, particularly in Masterbatches, towards the end of the quarter.

In a year-on-year comparison, however, the quarter was weaker due to economic headwinds, an unfavorable currency development and the absence of restocking activities. In this environment, ongoing robust demand was observed in the non-cyclical Additives, Catalysis & Energy, Functional Materials, Industrial & Consumer Specialties, and Oil & Mining Services Business Units, contributing around 50% to total sales and 60% to EBITDA.

Oil & Mining Services achieved the highest growth with local currency sales up in the 20 percent range. Sales in the other non-cyclical BUs grew more moderately. Due to a mild winter in North America and a cold but dry winter in Europe, the seasonal de-icing and refinery businesses recorded low demand. Although seasonally weaker compared to the third and fourth quarter, Catalysis & Energy achieved a very strong order intake above previous years in the first three months, confirming ongoing strength in this business. Business activity in the mature BUs Textile Chemicals, Paper Specialties, Leather Services, and Emulsions Detergents & Intermediates remained subdued. All regions showed double-digit growth in local currencies with the exception of Europe which was heavily impacted by the euro crisis, mainly in Southern areas.

The double-digit increase in sales was the result of a 14% volume increase and 4% higher sales prices year-on-year. On a comparable basis, i.e. excluding acquisitions, volumes were 6% lower, reflecting both weaker demand in some Business Units and a deliberate loss of less profitable businesses. Compared to the first quarter 2011, the negative effect from currency movements softened somewhat but still impacted the top-line by 5%.

The gross margin decreased to 28.2% from 29.8% in the previous-year period but significantly increased from the comparable underlying 26.0% recorded in the fourth quarter of 2011. This development reflects the declining demand year-on-year, resulting in lower capacity utilization mainly in Masterbatches and Pigments. The recovery from Q4 2011 underlines the slightly improving business conditions compared to the final quarter of last year. Compared to the previous-year quarter, sales prices increased 4% and raw material costs 2%, therefore positively contributing to the gross margin of the Group. Sequentially, raw material costs were marginally lower while prices remained flat.

EBITDA before exceptional items decreased to CHF 236 million (margin 12.1%) from CHF 277 million (margin 16.1%) a year ago. The decline in profitability is explained by a lower gross margin, higher SG&A costs, the usual seasonal weakness of the catalysts business, and a high comparable base one year-ago. The operating profit (EBIT) before exceptional items fell to CHF 160 million (margin 8.2%) from CHF 230 million (margin 13.4%), again reflecting the aforementioned factors and the higher depreciation and amortization for the former Süd-Chemie businesses. Restructuring and impairment costs of CHF 41 million versus CHF 29 million were mainly related to the integration of Süd-Chemie and additional projects related with sustainable cost reductions. Net income was CHF 20 million compared to CHF 120 million one year ago.

After the extreme volatility in 2011, foreign exchange markets are starting to level out; however, there was still a slightly negative impact of currency movements on EBITDA and EBIT, which were therefore lower at CHF -5 million and CHF -2 million respectively.

Cash flow from operating activities of CHF 6 million was below to last year's CHF 22 million as inventories have been increased in some Business Units in anticipation of progressively higher demand going into the second quarter. As a percentage of sales, net working capital reached 20.6%.

Net debt remained basically constant at CHF 1.754 billion compared to CHF 1.740 billion at year-end 2011. This resulted in a gearing (net debt divided by equity) of 59% at quarter-end.

Outlook 2012

Clariant confirms its outlook for 2012 with the publication of its full-year figures. Raw material costs are expected to rise in the mid-single-digit range while exchange rates should remain stable compared to the beginning of the year. In its base case scenario, Clariant expects that after a weak start to 2012, the global economy will strengthen progressively in the course of the year. Therefore, results for the first half-year are expected to be lower compared to the high base of the first half of 2011, with an improvement in the second half-year 2012. For full-year 2012, Clariant expects further sales growth in local currencies and sustained profitability.

Resolute Now Owns 50.1% of Fibrek

AbitibiBowater Inc., doing business as Resolute Forest Products, has announced that it has taken up and accepted for payment 1,633,800 additional shares of Fibrek Inc. deposited to its offer as of the close of business today. Together with the shares the Company acquired up to and including April 23, Resolute now has majority control of Fibrek, with approximately 50.1% of the currently outstanding shares. As aggregate consideration for the shares taken up today, Resolute will distribute approximately 46,000 newly-issued shares of its common stock and CAD$900,000 in cash through RFP Acquisition Inc., a wholly-owned subsidiary.

AbitibiBowater Inc., doing business as Resolute Forest Products, has announced that it has taken up and accepted for payment 1,633,800 additional shares of Fibrek Inc. deposited to its offer as of the close of business today. Together with the shares the Company acquired up to and including April 23, Resolute now has majority control of Fibrek, with approximately 50.1% of the currently outstanding shares. As aggregate consideration for the shares taken up today, Resolute will distribute approximately 46,000 newly-issued shares of its common stock and CAD$900,000 in cash through RFP Acquisition Inc., a wholly-owned subsidiary.

Resolute's offer remains open and expires at 5:00 p.m. (Eastern time) on May 4, 2012.

The offer to acquire all of the issued and outstanding shares of Fibrek made by Resolute, together with RFP Acquisition Inc., a wholly-owned subsidiary, is more fully described in the offer circular and other ancillary documentation that Resolute filed on December 15, 2011, on the "SEDAR" website maintained by the Canadian Securities Administrators, as varied and extended. As further described in the offer circular and other ancillary documentation related to the offer (as amended), Resolute intends to carry out a second step transaction to acquire the Fibrek shares not deposited in the offer.

Questions and requests for assistance or further information on how to tender Fibrek common shares to the offer should be directed to, and copies of the above referenced documents may be obtained by contacting, Georgeson at 1-866-598-0048 or by email at This email address is being protected from spambots. You need JavaScript enabled to view it.

Kemira establishes local R&D in Alberta, Canada

Kemira has opened a Research & Development projects laboratory in Alberta, Canada on May 1, 2012. The laboratory, located on the campus of the University of Alberta, will be an extension of Kemira's North American R&D, headquartered in Atlanta.

"This facility demonstrates Kemira's commitment to Alberta and to the research work in the area of water quality and quantity management addressing water consumption, reuse and recycling by the in situ oil sands extraction industry. In addition, this facility establishes a local Kemira presence within the academic and technical center of oil sands related research and innovation", says Mohan Nair, Senior Manager Oil & Gas R&D.

The new laboratory also provides a technology stage to showcase and demonstrate Kemira's novel solutions to targeted audiences such as the various oil sands producers. In addition, the new site supports Kemira's regional growth in the conventional oil and gas marketplace, e.g. stimulation, drilling and cementing.

Kemira Oil & Mining offers a large selection of innovative chemical extraction and process solutions for the oil and mining industries, where water plays a central role. Utilizing our expertise, we enable our customers to improve efficiency and productivity.