Ianadmin

Lorentzen & Wettre introduce L&W FSD Sensor for Paper and Board machines

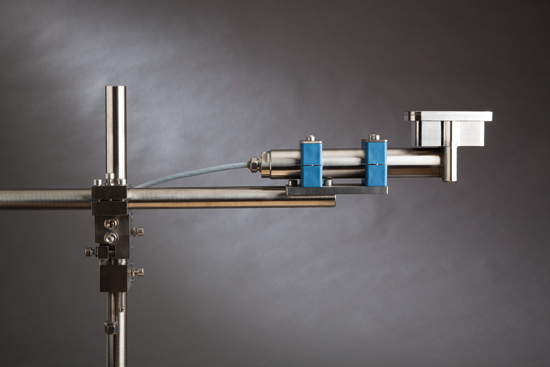

Lorentzen & Wettre, and ABB Company, have announced a new FSD (Forming Section Drainage) Sensor for paper and board machines. This new sensor measures the amount of water at any desired position in the forming section. The measurement results make it possible to gain control of drainage and ply bonding.

With L&W FSD Sensor it is possible to optimize the wet end chemistry of the stock, which will enable better runnability and increase paper quality.

Normal use is in single point measurements between step foils or vacuum boxes. It is common to measure before or after the couch roll, to be able to estimate moisture content in the paper, before it leaves the wire. In multi-layer Fourdrinier machines all layers are easily monitored, providing a better overall picture to improve multiple ply bonding. The instrument provides for control of foils adjustments, vacuum, refining and the use of retention chemicals.

The main advantages of controlling drainage is reduced energy consumption, reduced number of web breaks, reduced emissions, reduced usage of chemicals and reduced wear and maintenance. These are benefits that lead to lower costs, better runnability and increased paper quality. Further L&W FSD Sensor uses high frequency technology instead of radioactivity and therefore requires no special permit to be used.

“With this new sensor in combination with our other portable instruments, it is possible to monitor the drainage profile all the way from headbox to couch”, says Mr Lars Kånge, Product Manager, Lorentzen & Wettre.

Paptech Finland 2012 - End of Show Report

Paptech Finland, held in Helsinki on March 21-22, gathered 35 exhibitors and a total of 457 visitors over the two day event period. The new event concept was well received by exhibitors and visitors.

Paptech Finland, held in Helsinki on March 21-22, gathered 35 exhibitors and a total of 457 visitors over the two day event period. The new event concept was well received by exhibitors and visitors.

- We are pleased about the organisation of the event and about the way it looked, says Marcus Bergström, CEO of Adforum, organisers of the event. - The concept was also well received by our exhibitors who appreciated the simplicity of participating. By offering complete stand packages at a reasonable price, exhibitors were just able to show up with their marketing materials and start networking.

- Of course we had hoped for some more visitors, Bergström continues, but we think that most exhibitors had a decent amount of qualitative meetings with existing and new potential clients.

- The idea behind the event was in my opinion brilliant, as the thought was to make for example the opening of conversations easier, says Heikki Mustalahti, Managing Director of ACA Systems Oy, who exhibited at Paptech Finland 2012. - I hope that more paper makers would attend the next Paptech, Mustalahti continues.

Paptech Finland was developed as a new meeting concept for the pulp and paper industry, enabling easy and cost effective meetings between suppliers and buyers. This two-day forum included informative seminars, an exclusive Gala Dinner, match-making areas and opportunities to catch up with colleagues over a cup of coffee. Paptech was developed as regional meeting place for the Finnish market in order to fill the gap between the two large PulPaper exhibitions, held in 2010 and 2014.

Paptech Finland was organised by Adforum with official support from PI, the Paper Engineers’ Association.

Nalco Programs Save NV Energy 281 Million Gallons of Water Annually and Reduce Fuel Consumption

Nalco, an Ecolab company, has helped NV Energy dramatically reduce its water use and fuel consumption while supplying reliable power to its more than two million customers in Nevada.

NV Energy's coal-fired Reid Gardner Station north of Las Vegas, Nev., uses both river and well water in its cooling system, but the source water contains high concentrations of silica, which can cause harmful buildup in the cooling system. Nalco's 3D TRASAR® Technology for Cooling Water employs fluorescence-based monitoring to prevent silica buildup through a combination of innovative chemistry and sophisticated system control.

The optimized cooling system requires less fresh water to operate, allowing NV Energy to reduce its water withdrawals, saving more than 281 million gallons of water annually. Based on water-use information from the Southern Nevada Water Authority, that's enough water to meet the annual daily use needs of more than 3,400 people1. The reduction in freshwater use also reduces the facility's wastewater by the same amount, helping it meet its ZLD (zero liquid discharge) requirements.

NV Energy also wanted to reduce environmental impact and improve operations at its coal-fired North Valmy Station, near Valmy, Nev. The station's steam turbines, which drive the generators, were experiencing deposits that reduced overall efficiency.

NV Energy selected patented 3D TRASAR Boiler Technology, which combines advanced sensors, software and control capability to deliver a unique solution that allows real-time monitoring and control of the steam system under extremely high temperature and pressure conditions.

Nalco 3D TRASAR Boiler Technology provides the capability to apply proper treatments at the precise time and in the exact amount to prevent copper corrosion and deposits that can damage equipment, require expensive cleaning and reduce the efficiency of the generating process. These improvements allow the North Valmy Station to generate the same amount of electricity while reducing fuel consumption by 87,000 tons of coal annually. The fuel savings reduced costs by $3.5 million per year, helping hold down electricity rates and providing additional eROI value to NV Energy.

"NV Energy is committed to providing cost-effective electricity to our customers while meeting or exceeding environmental standards," said Kevin Geraghty, vice president of Power Generation for NV Energy. "Improving the operation of our cooling and steam systems with Nalco's help allows NV Energy to continue to preserve Nevada's precious water supply and reduce fuel use while still meeting the electricity needs of our customers."

Resolute Announces Take-Up of 46.8% of Fibrek Shares

AbitibiBowater Inc., doing business as Resolute Forest Products, has announced that all applicable conditions to its offer for Fibrek Inc. have been satisfied and that it has taken up and accepted for payment the 60,831,859 shares deposited as of 11:59 p.m. on April 11. The tendered shares represent approximately 46.8% of the currently outstanding Fibrek shares. As aggregate consideration for the shares, Resolute will distribute approximately 1.7 million newly-issued shares of its common stock and CAD$33.5 million in cash through RFP Acquisition Inc., a wholly-owned subsidiary.

The Company also announced that the Bureau de révision et décision (Québec) has issued an order to cease trade, effective immediately, Fibrek's second shareholder rights plan, which its board adopted on April 11.

In addition, in order to allow additional Fibrek shareholders to participate, the Company announced that it has extended to 5:00 p.m. on April 23 the expiry time for its offer. As further described in the offer circular and other ancillary documentation related to the offer (as amended), Resolute intends to carry out a second step transaction to acquire the Fibrek shares not deposited in the offer.

The offer to acquire all of the issued and outstanding shares of Fibrek made by Resolute, together with RFP Acquisition Inc., a wholly-owned subsidiary, is more fully described in the offer circular and other ancillary documentation that Resolute filed on December 15, 2011, on the "SEDAR" website maintained by the Canadian Securities Administrators, as varied and extended. The offer will expire at 5:00 p.m. (Eastern time) on April 23, 2012, unless it is extended by Resolute.

Verso Paper Corp. Announces Amendments to Exchange Offer

Verso Paper Corp. has announced that it has amended certain terms of its previously announced exchange offer and consent solicitation of two of its subsidiaries, Verso Paper Holdings LLC and Verso Paper Inc. (together, the "Issuers"), with respect to their second priority senior secured floating rate notes due 2014 (the "Old Notes").

Initially, only those holders that validly tendered their Old Notes prior to the previously scheduled early tender date of 5:00 p.m., New York City time, on April 10, 2012, were entitled to receive the total consideration of $1,000 in principal amount of new 9.75% Secured Notes due 2019 (the "New Notes") per$1,000 in principal amount of Old Notes tendered, which includes an early tender payment of $50 per $1,000 in principal amount of Old Notes tendered (the "Total Consideration"). The Issuers have now determined that all holders that validly tender their Old Notes prior to 11:59 p.m., New York City time, onApril 24, 2012, which is the expiration date of the exchange offer and consent solicitation, will be entitled to receive the Total Consideration. Tendered Old Notes may no longer be withdrawn, except to the extent that the Issuers are required by law to provide additional withdrawal rights.

In addition, the Issuers are amending the terms of the exchange offer and consent solicitation by waiving the condition requiring receipt of tenders (and associated consents) from holders of more than 50% of the outstanding Old Notes.

Except as set forth herein, the complete terms and conditions of the exchange offer and consent solicitation for the Old Notes remain the same as set forth and detailed in the Issuers' confidential offering memorandum and consent solicitation statement dated as of March 28, 2012, and the related consent and letter of transmittal (the "Exchange Offer Documents"), copies of which were previously distributed to eligible holders of the Old Notes.

Except as set forth herein, all of the other conditions set forth in the Exchange Offer Documents remain unchanged. If any of the conditions is not satisfied, the Issuers may terminate the exchange offer and consent solicitation and return tendered Old Notes not previously accepted. The Issuers have the right to waive any of the foregoing conditions with respect to the Old Notes. In addition, the Issuers have the right, in their sole discretion, to terminate the exchange offer and consent solicitation at any time, subject to applicable law.

This announcement shall not constitute an offer to purchase or a solicitation of an offer to sell any securities. The complete terms and conditions of the exchange offer and consent solicitation are set forth in the Exchange Offer Documents that were sent to eligible holders of the Old Notes, as amended to the extent described in this news release. The exchange offer and consent solicitation is being made only through, and subject to the terms and conditions set forth in, the Exchange Offer Documents (as amended to the extent described in this news release) and related materials.

The New Notes are being offered in the U.S. only to (1) qualified institutional buyers in reliance on Rule 144A under the Securities Act of 1933 (the "Securities Act") and (2) "accredited investors" as defined in Rule 501(a)(1), (2), (3) or (7) of Regulation D under the Securities Act, and outside the United Statesonly to non-U.S. investors pursuant to Regulation S. The New Notes will not initially be registered under the Securities Act or any state securities laws and may not be offered or sold in the United States absent an effective registration statement or an applicable exemption from registration requirements or in a transaction that is not subject to the registration requirements of the Securities Act or any state securities laws.

Global Bondholder Services Corporation is acting as the Information Agent for the exchange offer and consent solicitation. Requests for the Exchange Offer Documents may be directed to Global Bondholder Services Corporation at (212) 430-3774 (for brokers and banks) or (866) 470-3700 (for all others).

Neither the Issuers' boards of directors nor any other person makes any recommendation as to whether holders of Old Notes should tender their Old Notes, and no one has been authorized to make such a recommendation. Holders of Old Notes must make their own decisions as to whether to tender their Old Notes, and if they decide to do so, the principal amount of the Old Notes to tender. Holders of the Old Notes should read carefully the Exchange Offer Documents and related materials before any decision is made with respect to the exchange offer and consent solicitation.

Source: Verso Paper Corp.

Metso strengthens its valve supply and service capabilities in India

Metso opens a new valve supply and service center in Vadodara, India. The new supply center supports company's strategy to grow valve business globally and strengthens Metso's service capabilities in India for major petrochemical, energy, and oil and gas companies such as Reliance Industries Ltd, Indian Oil Corporation, Technip, Praxair India Pvt Ltd and PRAJ Industries Ltd.

"The market in India is growing. Last year we doubled our order intake for valves and related services, and expect the good development to continue. Establishing a new supply center to India is a step going forward in widening manufacturing and service capabilities in India'', says Alok Kishore, Country Manager India, Metso Automation.

This investment is in line with Metso's long-term strategy to develop and expand its valve offering, delivery and service capabilities for customers in oil and gas, power, pulp and paper industries. It was preceded by a series of investments in Metso's global offering and presence. Last month Metso announced acquiring a valve technology and service company, Valstone Control Inc. in South Korea. Currently Metso is expanding its valve production premises in the US. Last year, Metso opened a new valve technology center in Finland. In 2010 Metso opened a new valve facility in Shanghai, China. Metso also has high-class industrial valve facilities in Brazil and Germany.

The new valve supply center is located in Vadodara city, 400 km north of Mumbai in the state of Gujarat, where Metso's service center has been in operation for more than two years. The state of Gujarat has the fastest growing economy in India, and it is also one of the most industrialized states, having per capita GDP almost the double of the national average. The industrial city of Vadodara houses major customers and engineering, procurement and construction companies such as Reliance Industries Ltd., Indian Oil Corporation, L&T and Linde.

Experienced in valves

Metso is the leading valve solutions and services provider. Metso's Flow Control solutions include control valves, automated on/off and emergency shut-down valves, as well as smart positioners and condition monitoring. Metso's world-leading brands include Neles, Jamesbury and Mapag.

Due to Metso's strong position in advanced valves technology, services are a major part of the offering. For example, customers like Petrobras and Arcelor Mittal have awarded Metso with large service contracts. For valve customers alone, Metso already has 31 service centers around the globe on top of this new one now being opened in India.

The Automation segment's process automation and flow control solutions meet the growing needs of Metso's customer industries to improve production process efficiency as raw materials and energy sources become scarcer and their costs increase. Our global network of service experts delivers business solutions to our customers that improve their productivity, lower risks and optimize costs.

Changes in SCA's reporting structure

As a result of the ongoing divestment of the packaging operations, excluding the kraftliner operations in Sweden, certain changes will be made in reporting starting with the first quarter of 2012, with retroactive adjustment of comparative periods in 2011 and 2010.

The changes are as follows:

Profit for the period with respect to the packaging operations that are currently being divested will be reported up until the completion of the sale only on one line in SCA's earnings report – Profit from disposal group held for sale. This profit item is not included in operating profit and thereby only affects net profit for the period.

Cash flow attributable to the packaging operations that are currently being divested is indicated separately. These assets were indicated separately on the balance sheet already at the end of 2011.

Starting with the first quarter of 2012, the kraftliner operations, i.e., the two kraftliner mills in Munksund and Obbola that SCA is keeping, have been transferred to the Forest Products business area.

All product groups in the Forest Products business area, including kraftliner, will be reported together as a total for the business area.

With these changes, starting with the first quarter of 2012 SCA will have three business areas: Personal Care, Tissue and Forest Products.

Brødrene Hartmann A/S Course of Annual General Meeting

The annual general meeting adopted the report on the company's activities in the past financial year. The report contained the information already communicated to NASDAQ OMX Copenhagen A/S in the company's electronic Annual Report 2011 on 8 March 2012.

The Annual Report 2011 was approved, and the members of the Executive Board and the Board of Directors were discharged from liability.

The annual general meeting adopted the proposal from the Board of Directors for the declaration of DKK 9.25 per share in dividend for FY 2011, representing 85% per cent of the profit for the year.

Agnete Raaschou-Nielsen, Walther Vishof Paulsen, Niels Hermansen, Jørn Mørkeberg Nielsen and Peter-Ulrik Plesner were re-elected to the Board.

The annual general meeting adopted the proposal from the Board of Directors for a revised compensation policy for the members of the Board of Directors and the Executive Board of Brødrene Hartmann A/S, which means a separate amount in compensation for the board members participating in the Audit Committee.

The amount in emolument to the Board of Directors for 2012 was approved and remains unchanged from the 2011 level, cf. however the changes resulting from the Board of Directors' proposal regarding a separate amount in compensation for participating in the Audit Committee.

Deloitte Statsautoriseret Revisionspartnerselskab was re-elected auditor of the company.

The annual general meeting adopted the proposal from the Board of Directors for amendments to the Articles of Association item 8.1, 8.2 and 8.3 as a result of the name change of the Danish Commerce and Companies Agency to Danish Business Authority.

The annual general meeting authorised the Chairman of the meeting to arrange for, and to make such alterations and additions as may be required for, the notification of resolutions made at the annual general meeting to the Danish Business Authority.

The Board of Directors was granted authority to let the company acquire treasury shares for a maximum nominal value of DKK 14,030,180 in the period until 11 October 2013 at the price listed at the stock exchange at the time of acquisition, plus/minus maximum 10%.

At a subsequent initial meeting of the Board of Directors, Agnete Raaschou-Nielsen was appointed Chairman and Walther V. Paulsen was appointed Deputy Chairman.

Brødrene Hartmann A/S

Wood pellet exports from the US and Canada to Europe reached a record high in the 4Q/11

Wood pellet exports from the US and Canada to Europe reached a record high in the 4Q/11 thanks to increased demand in the United Kingdom, reports the North American Wood Fiber Review

Exports of wood pellets from North America to Europe reached a record of over two million tons in 2011, according to analysis reported in the North American Wood Fiber Review (www.woodprices.com). Canada has long been the main exporter of pellets but in the second half of 2011, the US caught up and exported an equal volume to Canada.

The full article can be found in the attached PDF file.....

NewPage Awarded Patent for PointTrac™ TT RFID Product

NewPage Corporation announced today that it has been awarded U.S. (8,096,479) and Canadian (CA 2678556) patents for PointTrac™ TT, a new paper-based substrate for printed Radio Frequency Identification (RFID) labels. PointTrac TT offers RFID label manufacturers the ability to combine thermal transfer printed variable analog information with advanced RFID chip technology. This technology facilitates low-cost production of printed paper RFID labels when compared with traditional multi-layer plastic film substrates.

RFID uses a wireless non-contact radio system for the transfer of data for automatic identification and tracking. PointTrac TT has special dual functionality built in so that printed barcodes on the label face can be read with a line of sight optical device or by using an out of sight electronic device.

"The NewPage PointTrac TT technology will allow RFID chips to become more widely used in shipping, tracking and transactions by making conversion to this technology more affordable," said Jim Sheibley, director of Specialty Business and Product Development.

PointTrac TT is available with third-party chain-of-custody certifications, providing customers with high performance RFID products, while maintaining a level of both sustainable and renewable attributes.

PointTrac TT joins the broader range of NewPage specialty label papers used in supply chain and variable data end uses. In addition, NewPage manufactures specialty papers used in flexible packaging, technical and pressure-sensitive labeling applications.

SOURCE NewPage Corporation