Displaying items by tag: Wood Resource Quarterly

The family of global wood chip carriers is becoming smaller and younger, reports the Wood Resource Quarterly

Overseas shipments account for about 70% of global wood chip trade, with pulp mills in Japan and China being the major destinations, reports the Wood Resource Quarterly. This trade is handled by specialty made wood chip carriers predominantly built in Japan and China. Many of the older and smaller vessels are likely to be scrapped in the next few years, and with new and larger ships being ordered, the average chip vessel is becoming larger.

International trade of wood chips has steadily increased over the past decade and will likely reach a record high of approximately 36 million tons in 2014, according to the Wood Resource Quarterly (WRQ). This has occurred because pulp and wood panel production capacity has increased in regions with a lack of sufficient supply of domestic wood fiber at competitive costs, and between neighboring countries when opportunities exist for pulp mills to cross country borders in search of marginal wood fiber volumes. This type of inter-continental trade flow can be seen between the US and Canada, Russia and Finland, and the Baltic States with the Nordic countries.

International trade of wood chips has steadily increased over the past decade and will likely reach a record high of approximately 36 million tons in 2014, according to the Wood Resource Quarterly (WRQ). This has occurred because pulp and wood panel production capacity has increased in regions with a lack of sufficient supply of domestic wood fiber at competitive costs, and between neighboring countries when opportunities exist for pulp mills to cross country borders in search of marginal wood fiber volumes. This type of inter-continental trade flow can be seen between the US and Canada, Russia and Finland, and the Baltic States with the Nordic countries.

However, as much as 70% of the global chip trade is overseas with the major consuming countries being in Asia. This trade, valued at over 4.5 billion dollars, is handled by vessels that are specially built for carrying wood chips. There are currently 145 of these specialty ships circling the globe with a majority of them either sailing towards or en route from ports in Japan or China.

The oldest chip vessels are from the 1980’s, but it is expected that within a few years the world’s entire woodchip fleet will be less than 20 years old, according to the wood chip ship-brokering firm Arc Chartering. Looking ahead towards 2017, the chip vessel fleet will not only be younger, but will also contain fewer ships, and the average ship will be bigger than in 2014.

Between 10-15 smaller older ships are likely to be scrapped in the next few years, while roughly 5-10 new larger vessels may be built during 2015-17. With a declining number of chip vessels traveling the seas, there are currently fewer spot shipments and a high utilization of the existing fleet.

Historically, wood chip carriers have been built in Japan for Japanese trading houses and forest companies. However, in recent years Chinese shipyards have also built large vessels for Chinese customers. Japanese companies currently own approximately 75% of the world’s chip vessels, while Chinese companies own about 14% of the fleet, while other countries such as South Korea, Turkey, Thailand and Indonesia account for the remaining 11%. The share of non-Japanese owned chip carriers is likely to increase in the coming years.

The Global Timber and Forest Industry This Quarter - Wood Resource Quarterly

Global Timber Markets

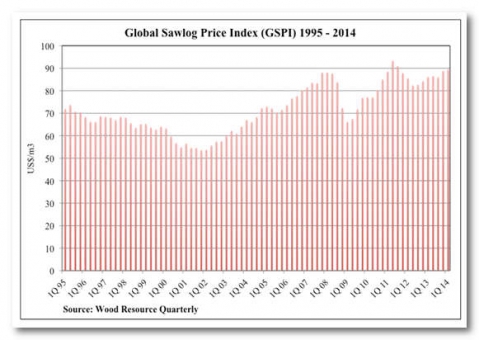

- With improved lumber markets in many regions around the world in early 2014, sawlog consumption was higher and sawlog prices were moving upward in a majority of the 20 regions covered by WRQ. The Global Sawlog Price Index (GSPI) rose by 0.8% from the 4Q/13 to US$89.45/m3 in the 1Q/14.

- During the 1Q/14, trade of logs was up in all major markets of the world as compared to the 1Q/13. For the four largest exporting countries, the increase was 17%, with the biggest rise in shipments coming out of Russia.

Global Pulpwood Prices

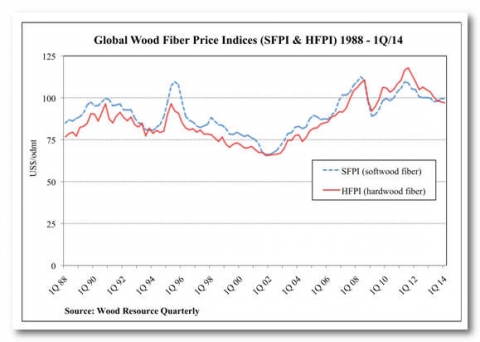

- Lower wood fiber prices in local currencies and a strengthening US dollar resulted in declines in both the Softwood and Hardwood Fiber Price Indices (SFPI and HFPI), which are the price indices that track wood costs for the global pulp industry.

- The SFPI fell from $99.51/odmt in the 4Q/13 to $99.43/odmt in the 1Q/14, with the biggest price reductions occurring in Canada, Russia, Australia and Brazil.

- The prices for hardwood pulplogs have trended downward in many markets for more than two years, which is reflected in an HFPI Index that has constantly fallen each quarter since its peak in the 3Q/11. In the 1Q/14, the HFPI was $97.01/odmt, down from $97.59/odmt in the previous quarter. Prices fell the most in Russia, Eastern Canada, Western US and Brazil.

Global Pulp Markets

- Production of market pulp fell in two of the three major pulp-producing regions in the world in early 2014. Production was down 5.2% in N. America and 4.2% in Europe. In Latin America, production was up 2.6% mainly because of higher exports to China and Europe.

- Prices for NBSK pulp have been holding up better than those for HBKP this year. With the recent opposing price trends for softwood and hardwood pulp, the price discrepancy between the two major pulp grades has widened to a two-year record.

Global Lumber Markets

- Lumber imports to Japan slowed down in the 1Q/14, with volumes being four percent lower than the first quarter of 2013 and, in fact, representing the lowest 1Q import levels since 2010.

- A slowdown in the Chinese economy has impacted the construction sector, resulting in a decline in lumber imports during the first four months of 2014. The biggest drop has been in lumber shipments from Canada, while Russian sawmills have kept up deliveries fairly well.

- The sawmilling sector in the US has been in a steady comeback mode ever since the global financial crisis struck in 2008. From 2009 to 2013, production has gone up every year, and the total production increased 28 % over this four-year period. In early 2014, production fell slightly.

- Lumber exports from Canada in the 1Q/14 fell to all markets except the US. The biggest decline from the previous quarter was in lumber headed to China (-22%) and to Japan (-32%).

- The Finnish sawmilling industry had a good year last year with total production reaching over ten million m3, the highest level in five years. This positive trend continued in 2014, with production in the 1Q being up 5% thanks to higher shipments to France, Germany and Algeria.

Global Biomass Markets

- With no slowdown in sight, North American wood pellet exporting companies keep building new facilities to manufacture pellets for the European market. Export volumes hit a new record high in the 4Q/13 and the total shipments for 2013 were up almost 50% from the previous year.

- South Korea has increased importation of pellets dramatically the past two years with Vietnam and Canada being the major suppliers

Sawlog prices in North and Central Europe have trended downward the past two years

Sawlog prices in North and Central Europe have trended downward the past two years, while prices in Eastern Europe have increased slightly, reports the Wood Resource Quarterly

Sawlog prices in Europe were generally lower in 2012 than in 2011 because of lower log demand from the sawmilling sector, reports the Wood Resource Quarterly. Many sawmills on the continent have been forced to reduce production as a result of the weak lumber market. Log prices fell the most in the Nordic countries, while prices in Eastern Europe were steady or even slightly higher toward the end of 2012.

Sawlog prices have trended downward in most major markets in Western Europe the past two years in US dollar terms, but this trend was broken in the 4Q/12 when prices increased slightly mainly as a result of a weakening US dollar. In the local currencies, log prices were practically unchanged in the 4Q/12.

The biggest price declines have been seen in Sweden where pine sawlog prices fell over 15 percent from the 4Q/10 to the 4Q/12 in both the local currency and in US dollar terms.

Spruce log prices have declined over 25 percent during the same time period. In Finland, Germany and Norway, prices have dropped a more modest 5-10 percent over the past two years, as reported by the Wood Resource Quarterly. Sawlog prices fell during 2012 because sawmills were cutting back production in response to the weaker demand for lumber throughout Europe.

While log prices have fallen in both US dollar terms and local currencies the past two years in Northern and Central Europe, prices for sawlogs in the 4Q/12 in Eastern European countries, including Estonia, Latvia and the Czech Republic, were generally higher than in 2011. This development has mainly come as a result of the relatively strong lumber export market which kept the log markets healthy.

The only major market in Eastern Europe where log prices have fallen has been Poland. From the 2Q/11 to 4Q/12, average prices have fallen over 20 percent and the country has now some of the lowest conifer sawlog prices in Europe, according to the Wood Resource Quarterly.

As a consequence of slowing lumber production, log trade declined in Europe during 2012, which also had a dampening impact on log prices on the continent. Net log imports to Western Europe fell from over 14 million m3 in 2011 to an estimated 10.8 million m3 in 2012. Much of the decline in imports was those from Russia and the Baltic States.

Sawlog prices might be close to the bottom in the 1Q/13, and they are likely to remain at these levels as long as the European demand for lumber continues to be weak. Despite the recent price declines, current price levels are higher than the ten-year average in all major markets throughout Europe.

Wood fiber costs for pulp mills fell in both North America and Latin America

Wood fiber costs for pulp mills fell in both North America and Latin America in the 4Q/12 because of weaker pulp markets and an increased supply of sawmill chips, reports the Wood Resource Quarterly

Lower pulp prices during last summer and an increased supply of sawmill chips put downward pressure on pulpwood prices in North America and Latin America in the 4Q/12, according to the Wood Resource Quarterly. The biggest declines occurred in Western US, British Columbia and Brazil.

Seattle, USA. Wood fiber prices trended downward in the local currencies in many of the key pulp-producing countries of the world in the fourth quarter. However, as a result of the weakening US dollar, wood fiber prices actually increased in US dollar terms in a number countries and the Softwood Wood Fiber Price Index (SFPI) was up slightly (+0.1%) in the 4Q/12 to $100.13/odmt. The biggest increases from the 3Q to the 4Q occurred in Eastern Canada, Finland, France and New Zealand, according to the Wood Resource Quarterly (www.woodprices.com).

The price declines in the local currencies were mainly the result of an increased supply of softwood fiber in regions with extensive lumber production. In the US Northwest, chip prices fell as much as 27 percent during 2012 and pulp mills in the region had some of

the lowest softwood fiber costs in the world in the 4Q/12.

Additional volumes of residual chips from increased lumber production, reductions in pulp production and pulpmill outages, and large supplies of pulplogs were all factors that contributed to the dramatic turnaround in fiber costs during 2012. A similar trend was

seen in Western Canada, where prices in the 4Q/12 were down 22 percent from late 2011, reaching their lowest levels in three years.

Hardwood fiber price movements were mixed, with hardwood pulplog prices generally trending downward in many of the key hardwood pulp-producing regions in both local currencies and in US dollar terms. This resulted in a decline in the Hardwood Wood Fiber Price Index (HFPI) to US$104.80/odmt in the 4Q/12. This was down 1.5 percent from the previous quarter and 7.8 percent from the 4Q/11.

The biggest decline in hardwood fiber prices occurred in Brazil where Eucalyptus log prices have fallen continuously for over a year from early 2011, when they were at their all-time highs. In the 4Q/12, prices in US dollar terms were back down to same levels as where they were in early 2009. Few regions in the world currently have lower hardwood costs than Brazil.

Wood pellet exports from North America to Europe were up over 70% in the 3Q/12

Wood pellet exports from North America to Europe were up over 70% in the 3Q/12 year-over-year, reports the North American Wood Fiber Review

Rapid expansion of wood pellet production in both the US South and British Columbia has dramatically increased pellet exports from North America to Europe the past year, according to the North American Wood Fiber Review. In the 3Q/12, total shipments were up 70 percent year-over-year to 860,000 tons. The growth is expected to continue with numerous plans for adding capacity, particularly in the US South.

Seattle, USA. Pellet exports from the two primary pellet-producing regions on the North American continent, the US South and British Columbia, continued to increase in the 3Q/12 and reached a new record of 860,000 tons. Shipments in the 3Q/12 were over 70 percent higher than the same quarter in 2011, according to the North American Wood Fiber Review (www.woodprices.com), which compiles and publishes pellet trade based on customs data and surveys of pellet exporters each quarter. Pellet exports from the US South have skyrocketed the past two years with a quadrupling to 485,000 tons from the 3Q/10 to 3Q/12 to the 485,000 tons. Canadian exports have also gone up the past few years, but at a slower pace.

Beyond the trade statistics tracking the rise of pellet export volumes, another spate of export pellet plant announcements – detailed in the NAWFR – emphasized the quickly growing trade relations that are being established between European power utilities and US pellet producers. The most striking announcement came in mid-December when Drax, a United Kingdom power company, stated its intention to build two 450,000 tons pellet plants, one in the state of Louisiana and one in Mississippi. Most other export- oriented pellet plants, while invested in by European utilities, are separate US-based entities, with supply agreements and MOU’s defining the business relationship.

The three major European pellet import countries remain the UK, the Netherlands, and Belgium, while Italy, Denmark and Sweden are notably involved in pellet imports from North America, but on a much smaller scale. Denmark’s Dong Energy utility, however, announced its intentions to switch to woody biomass at three of its coal plants, an action likely to add demand from the US Southeast.

Announced US South pellet export plants increased sharply in the 2nd half of 2012. Export pellet facilities, which are under construction, conversion or redesigned will add an additional 1.7 million tons of capacity during 2013, as reported in the NAWFR. In addition to these plants that are already under construction, five additional plants have been announced, and if they are actually built on the disclosed sites, they would bring another 2.3 million tons of capacity into play by the end of 2014.

Increased reliance on domestic Eucalyptus fiber by Spanish pulp mills

Increased reliance on domestic Eucalyptus fiber by Spanish pulp mills has resulted in a dramatic reduction in wood chip shipments from Uruguay, reports the Wood Resource Quarterly

European pulpmills imported much less Eucalyptus chips from Latin America during

2012, mainly because Spanish pulp mills reduced their reliance on relatively costly wood

fiber from Uruguay dramatically, reports the Wood Resource Quarterly. Pulp mills in Spain have also paid less for domestic pulplogs the past year, resulting in substantially lower wood fiber costs in 2012 than the previous year.

Seattle, USA. The pulp industry in Spain has turned its focus to increasingly rely on domestic wood fiber sources rather than imported wood fiber the past year. Importation of wood chips importation was down as much as 58 percent the first ten months of 2012 as compared to the same period in 2011, and there has not been a single chip vessel that has entered a Spanish port since May of 2012, as reported in the Wood Resource Quarterly (www.woodprices.com). This is a remarkable turn-around in wood fiber sourcing. As late as 2011, Spain imported 675,000 tons of Eucalyptus chips, 87 percent from Uruguay and the rest from Congo and Chile.

Seattle, USA. The pulp industry in Spain has turned its focus to increasingly rely on domestic wood fiber sources rather than imported wood fiber the past year. Importation of wood chips importation was down as much as 58 percent the first ten months of 2012 as compared to the same period in 2011, and there has not been a single chip vessel that has entered a Spanish port since May of 2012, as reported in the Wood Resource Quarterly (www.woodprices.com). This is a remarkable turn-around in wood fiber sourcing. As late as 2011, Spain imported 675,000 tons of Eucalyptus chips, 87 percent from Uruguay and the rest from Congo and Chile.

Over the past eight years, Uruguay has exported between 300,000 oven-dry metric tons (odmt) and 600,000 odmt annually to Spain, so losing all that volume is a major setback for landowners and chip exporters in the country. Total chips exports to Spain for 2012 will be an estimated 200,000 odmt, which represents less than half of the shipments in

2011, and is the lowest levels seen since 2004. Even the other two major buyers of Eucalyptus chips, Portugal and Norway, have cut back purchases substantially the past 12 months with the result that total volumes of chips exported from Uruguay in 2012 may reach a total of only 700,000 odmt, down from almost 1.6 million odmt in 2011.

Eucalyptus log prices in Spain have been declining steadily for more than a year, and the major fiber consumers have lowered the price they pay to land owners practically every quarter since early 2011. The average Eucalyptus log price in the 3Q/12 was 11 percent below the price in 3Q/11, according to the WRQ. In US dollar terms, the average cost for Eucalyptus has declined by 26 percent since its all-time-high in the 2Q/11. Spanish pulp mills currently have some of the lowest hardwood fiber costs in Europe, but are still paying more for hardwood fiber than competitors in Latin America and North America.

Weaker pulp markets are forcing pulp manufacturers worldwide to reduce costs

Weaker pulp markets are forcing pulp manufacturers worldwide to reduce costs, resulting in the lowest softwood wood fiber prices seen since 2010, reports the Wood Resource Quarterly.

The declining prices for softwood pulp during much of 2012 have forced many pulp mills to try to cut wood fiber costs to remain profitable. As a consequence, the wood fiber price index (SFPI) has continuously declined the past year and, during the 3Q/12 was at its lowest level since 2010, according to the Wood Resource Quarterly.

The declining prices for softwood pulp during much of 2012 have forced many pulp mills to try to cut wood fiber costs to remain profitable. As a consequence, the wood fiber price index (SFPI) has continuously declined the past year and, during the 3Q/12 was at its lowest level since 2010, according to the Wood Resource Quarterly.

Prices for softwood market pulp (NBSK) prices have trended downward for more than a year from their record highs of over $1000 per ton in the summer of 2011. In the 3Q/12, prices had fallen to between $750-800/ton in Europe and were about 50 dollars higher in the US. This relatively long-lasting price decline seems to have come to an end this fall, as there are now pulp producers negotiating higher prices again. List prices for December are in the range of $820-870/ton depending on if the deliveries are to Europe or North America.

The lower pulp prices have resulted in downward price pressure on wood fiber prices in many high wood cost regions around the world as pulp companies have seen product prices approach production costs. When profit margins for pulp mills are being squeezed, one of the first step taken to improve profitability is often to try to reduce the wood costs, since those costs typically account for 60-70 percent of the production costs when manufacturing pulp.

Prices for pulplogs and wood chips fell in the local currencies in most of the key regions worldwide in the 3Q/12, according to the Wood Resource Quarterly www.woodprices.com. However, because the US dollar weakened against most currencies, wood prices in US dollar terms did not decline as much in the third quarter.

The Softwood Wood Fiber Price Index (SFPI), which is based on US dollars, was down another 0.5 percent from the 2Q/12 to US$100.05 per oven-dry metric ton (odmt). This was the fifth consecutive quarterly decline, and the index has now fallen 8.7 percent since early 2010. The biggest price declines were seen in the Northwestern US, Germany, Spain and Russia.

Hardwood fiber prices started to increase in some regions around the world in the 3Q/12, which resulted in the first increase of the Hardwood Wood Fiber Price Index (HFPI) in over a year, as reported in the WRQ. The Index increased by $1.56/odmt from the 2Q/12 to $106.44/odmt in the 3Q/12. Hardwood fiber prices increased the most in Russia, Eastern Canada and Brazil.

The price outlook for wood prices in the fourth quarter is mixed, with a stabilizing of prices in most softwood pulp-producing countries but also continued price declines in a few regions.

The Global Forest Industry Q3 review

The Global Sawlog Price Index (GSPI) fell for the fifth consecutive quarter to $81.94/m3.

The Softwood Wood Fiber Price Index (SFPI), which is based in US dollars, was down another 0.5 percent from the 2Q/12 to US$100.05/odmt. Hardwood Wood Fiber Price Index (HFPI) increased by $1.56/odmt from the 2Q/12 price to $106.44/odmt in the 3Q/12.

Softwood pulp (NBSK) prices have trended downward for more than a year from their record highs in the summer of 2011. Hardwood pulp (BHKP) prices have not experienced the same price fall as NBSK prices.

Despite the weakening markets for lumber, six of the ten largest lumber-exporting countries in the world have shipped more lumber this year than last year.

North American lumber production rose for the third straight quarter in the 3Q/12.

The importation of softwood lumber to China in September was down for the fourth consecutive month to 1.14 million m3, a decline of 14 % from September 2011.

Pellet exports from the US South to Europe rose 13 % in the 2Q/12 from the previous quarter; almost a doubling in one year.

Wood costs for pulp mills and sawmills in Brazil have fallen

Pulp mills and sawmills in Brazil became more competitive in 2012, because the costs for the wood raw-material, which accounts for about 70 percent of the production costs,have declined by over 20 percent since 2011, according to the Wood Resource Quarterly.

Seattle, USA. Pulp mills and sawmills in Brazil became more competitive in 2012 mostly thanks to a weakening Brazilian Real. Pine sawlog prices in Brazil, in US dollar terms, fell 22 percent in just one year, and prices in the 2Q/12 have been at a level below where they were just before the financial crisis that hit in 2008, according to the WoodResource Quarterly (www.woodprices.com).

In the local currency on the other hand, prices have actually increased steadily and in the 2Q/12 were at their highest levels in over four years. Domestic demand for wood products has been a key driver for the higher log costs. In 2010 and 2011, the local lumber market was strong because of major investments in the housing construction sector in Brazil. This market slowed in 2012, and instead, lumber and plywood exports have slowly picked up steam as those sectors have benefited from the weakening Brazilian Real and the Brazilian forest industry became more competitive in the international market.

With the Real expected to continue to stay weak against the US dollar, market participants are hoping for increased exports of lumber, plywood and value-added products in the coming months. If this scenario actually comes to fruition, demand for sawlogs may go up and log prices will likely move up in both Real and dollar terms.

Although Brazilian pulplog prices have not changed much in the local currency, they have fallen dramatically in US dollar terms as the Real weakened this past year. Eucalyptus pulplog prices in the 2Q/12 were down 28 percent from the same quarter in 2011, while pine pulplog prices declined 26 percent from a year ago, according to the Wood Resource Quarterly (WRQ).

The recent dramatic price reductions of pulpwood have had the result that the wood costs for Brazilian pulpmill now are among the lowest of all regions tracked by the WRQ, as compared to a year ago when wood fiber costs in Brazil were above the Global Wood Fiber Price Indices (SFPI and HFPI). Since wood fiber costs accounted for about 70 percent of the production costs for pulp mills in Brazil in the 2Q/12, the substantial reduction in pulpwood prices has made the country’s pulp mills more competitive in 2012 relative to other pulp producers around the world.

Log and lumber imports to China were down 19%

Log and lumber imports to China were down 19% during first eight months of 2012, y-o-y, with the biggest declines seen of logs imported from Russia and the US, reports the Wood Resource Quarterly

Importation of both logs and lumber to China fell substantially in 2012, reports the Wood Resource Quarterly. Total imports, by value, during the first eight months was 4.3 billion dollars, or 19% less than in 2011, with the biggest declines in logs imported from Russia and the US, and in lumber from North America.

The reduction in construction activities in China during 2012 has resulted in reduced demand for lumber, and as a consequence, a sharp decline in the importation of softwood logs and lumber to the country. During the first eight months this year, China imported logs and lumber worth 4.3 billion dollars, or 19 percent less than the same period last year, as reported in the Wood Resource Quarterly (www.woodprices.com). By volume, log imports were down 17 percent and lumber imports down five percent.

The importation of softwood lumber in August was down for the third consecutive quarter to 1.1 million m3, which was a decline of 21 percent from May and 23 percent lower than in August 2011. Canada and Russia are the two dominant suppliers of softwood lumber to China, together accounting for 84 percent of the total imports, with the US, Chile and New Zealand making up most of the remaining import volume.

During the first eight months of this year, Russia, Chile and New Zealand have increased their shipments to China, while volumes from North America have declined. Exports from the US are down as much as 41 percent as compared to the same period in 2011.

In August, the average import value for all softwood lumber imported to China was down nine dollars to $203/m3 from a year ago, according to Customs data. The cost for Russian lumber fell as much as $19/m3, while Canadian average costs were down only five dollars to $200/m3 over the past year. Costs for Canadian lumber have steadily increased from earlier this year and here at a 12 month-high in August.

Chinese softwood log imports have fallen dramatically this year. From January through August, imports from Russia were down 21 percent, and from the US, 31 percent as compared to the same period in 2011. The two other major log-supplying countries, New Zealand and Canada, have shipped practically the same volume this year as last year.

With the reduced demand for logs by the lumber industry in China, log prices have fallen through most of 2012. According to the latest issue of the WRQ, average import softwood log values in the 3Q/12 were down 13 percent from a year ago, and domestic Chinese-fir log prices have fallen about six percent in 12 months.