Ianadmin

Siemens to deliver state-of-the-art power plant technology to South Korea

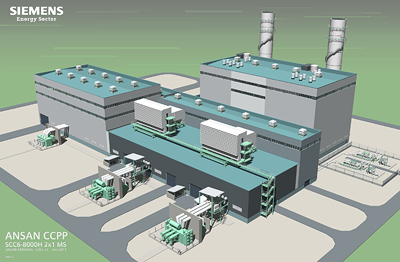

Siemens is again to deliver state-of-the-art power plant technology to South Korea. For the Ansan combined cycle power plant (CCPP), the company is supplying the Power Island consisting of two innovative SGT6-8000H gas turbines, one steam turbine, three generators, and two heat recovery steam generators as well as the entire instrumentation and control technology. Ansan is now the second power plant in South Korea to be equipped with the new gas turbines – SGT6-8000H – from Siemens. The customer is the South Korean Posco Engineering & Construction Co. Ltd., headquartered in Incheon, which is responsible for construction of the entire plant. The CCPP Ansan will be fueled with liquefied natural gas (LNG) and will have a gross installed electrical capacity of 834 megawatts (MW) at a gross efficiency of 61 percent. In addition to generating electricity, the plant will also provide district heating for the inhabitants of the city of Ansan, which raises the overall fuel utilization factor to over 75 percent. Commissioning is planned for the end of 2014.

The Ansan CCPP is being built in the city of the same name in Gyeonggi-Do province southwest of the capital Seoul. Siemens is constructing the core element of the plant, the so-called power block, as a turnkey project and will supply the main components – two gas turbines of type SGT6-8000H, an SST6-5000 steam turbine, and three hydrogen-cooled generators of type SGen6-2000H. Siemens is also supplying two Benson heat recovery steam generators, and the SPPA-T3000 instrumentation and control system. A long-term service agreement has also been signed for the main components.

South Korea enjoys a burgeoning economy, with demand for electricity annually growing at the rapid rate of 3.6 percent. In the last ten years the installed power plant capacity rose from 60 gigawatts (GW) to more than 80 GW. However, the country has few energy resources of its own and is the second largest importer of LNG in the world. Because of high gas prices, high-efficiency CCPP play a particularly important role. "Ansan is now the second power plant in South Korea that we are equipping with our ground-breaking new gas turbine technology," said Roland Fischer, CEO of the Fossil Power Generation division at Siemens Energy. "We are pleased that we are making an important contribution towards a cost-efficient and environmentally friendly power supply."

"Because of our high gas prices, the efficiency of energy conversion is very important to us. Siemens offers the to date most efficient power plant technology and is an experienced and reliable partner in the handling of projects. We are pleased to be implementing this world-class project together with Siemens," said Kwang-Jae Yoo, CEO at Posco Engineering & Construction Division.

High-efficiency combined cycle power plants are part of the Siemens environmental portfolio, with which the company earned revenues of about €30 billion in fiscal 2011. This makes Siemens one of the largest global suppliers of environmentally friendly technology. Using Siemens products and solutions, customers saved nearly 320 million metric tons of carbon dioxide (CO2) during the same time period; this figure is equivalent to the total annual CO2 emissions of Berlin, Delhi, Hong Kong, Istanbul, London, New York, Singapore and Tokyo combined.

Ahlstrom to complete the transfer of Brazilian wipes business in the second quarter 2012

Ahlstrom Corporation, a global high performance materials company, estimates that the transfer of the Brazilian operation of its former wipes fabrics business, Home and Personal, to Suominen Corporation will take place in the second quarter of 2012.

Ahlstrom had previously anticipated that the transfer would have taken place in the first quarter of 2012. The transfer is subject to the acquiror receiving all necessary Brazilian regulatory permits for its operations.

The Home and Personal business area excluding the Brazilian part of the operation was transferred on October 31, 2011 to Suominen Corporation. Receiving an approval from the competition authorities in Brazil is not a prerequisite for completing the transaction.

Verso Paper Corp. Announces Exchange Offer for Outstanding Debt and Related Consent Solicitation

Verso Paper Corp. have announced that two of its wholly owned subsidiaries, Verso Paper Holdings LLC and Verso Paper Inc. (collectively, the "Issuers"), have launched an offer to issue up to $180.2 million aggregate principal amount of a new series of 9.75% secured notes due 2019 (the "New Notes") in exchange for any and all of the Issuers' outstanding $180.2 million aggregate principal amount of senior secured floating-rate notes due 2014 (the "Old Notes").

Simultaneously, the Issuers commenced a solicitation of consents from the holders of the Old Notes to waivers of, and proposed amendments to, certain covenants in the indenture pursuant to which the Old Notes were issued (the "Proposed Amendments"), and, separately, to authorize release from the liens and security interests in the collateral securing the Old Notes (the "Collateral Release"). Holders who tender their Old Notes into the exchange offer will be deemed to have given their consents to both the Proposed Amendments and the Collateral Release with respect to those tendered Old Notes.

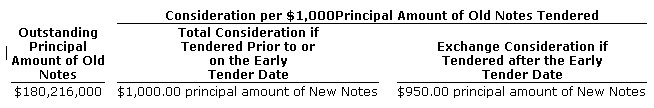

The Old Notes and other information relating to the exchange offer and consent solicitation are set forth in the table below.

The exchange offer and consent solicitation and the effectiveness of any supplemental indenture entered into pursuant to the exchange offer and consent solicitation are conditioned on the tenders and associated consents by holders of more than 50% of the Old Notes.Each holder who validly tenders its Old Notes prior to 5:00 p.m., New York City time, on April 10, 2012 (as may be extended, the "Early Tender Date") will receive, if such Old Notes are accepted for purchase pursuant to the exchange offer, the total consideration of $1,000.00 principal amount of New Notes per $1,000.00 principal amount of Old Notes tendered, which includes an early tender payment of $50.00 per $1,000.00 principal amount of Old Notes tendered. Each Holder who does not validly tender its Old Notes prior to the Early Tender Date will only receive $950.00 principal amount of New Notes for each $1,000.00 of Old Notes tendered and accepted and will not be entitled to receive the $50.00 early tender payment.

The Issuers intend to enter into a supplemental indenture to effectuate the Proposed Amendments promptly after the receipt of the requisite consents for the Proposed Amendments. To the extent requisite consents for the Collateral Release have also been received, such supplemental indenture will also include the Collateral Release. To the extent that the requisite consents for the Collateral Release have not been obtained at the time such supplemental indenture is executed, such supplemental indenture will not include provisions effecting the Collateral Release, but if such requisite consents for the Collateral Release are later obtained, the Issuers will execute another supplemental indenture providing for the Collateral Release promptly after receipt of the requisite consents for the Collateral Release. Each of the foregoing supplemental indentures will be effective immediately upon execution thereof, but the provisions thereof will not be operative until all of the Old Notes that have been tendered prior to the date of such supplemental indenture have been accepted for payment and paid for in accordance with the terms of the exchange offer and consent solicitation.

The exchange offer and consent solicitation will expire at 11:59 p.m., New York City time, on April 24, 2012, unless extended or earlier terminated (the "Expiration Date"). Tendered Old Notes may be validly withdrawn prior to the earlier of (a) the date the Issuers receive the requisite consents and execute the supplemental indenture providing for the Proposed Amendments and (b) 5:00 p.m., New York City time, on April 10, 2012, unless extended (such time and date described in (a) or (b), as the same may be extended, the "Withdrawal Deadline"). Tendered Old Notes may not be validly withdrawn subsequent to the Withdrawal Deadline. Prior to the Withdrawal Deadline, if a holder withdraws its tendered Old Notes, such holder will be deemed to have revoked its consents to both the Proposed Amendments and the Collateral Release and may not deliver consents without re-tendering its Old Notes. After the Withdrawal Deadline, consents to the Proposed Amendments may be validly revoked prior to the execution of the supplemental indenture giving effect to the Proposed Amendments. While tendered Old Notes may not be withdrawn subsequent to the Withdrawal Deadline, if the supplemental indenture giving effect to the Proposed Amendments (but not the Collateral Release) has been executed, consents to the Collateral Release may be validly revoked (but neither the relevant Old Notes may be withdrawn nor the consents to the Proposed Amendments may be revoked) until the execution of the supplemental indenture giving effect to the Collateral Release.

Subject to the terms and conditions described below, payment of the exchange offer consideration will occur promptly after the Expiration Date. Such payment is currently expected to occur on or about April 25, 2012, unless the Expiration Date is extended or the exchange offer is earlier terminated. In addition, at any time after the Early Tender Date but prior to the Expiration Date, and subject to the terms and conditions described below, the Issuers may accept for exchange Old Notes validly tendered on or prior to such time and exchange such notes for the exchange consideration promptly thereafter.

The Issuers may terminate or withdraw the exchange offer and consent solicitation at any time and for any reason, including if certain conditions described in the Exchange Offer Documents (defined below) are not satisfied, subject to applicable law.

This announcement shall not constitute an offer to purchase or a solicitation of an offer to sell any securities. The complete terms and conditions of the exchange offer are set forth in a confidential offering memorandum and consent solicitation statement, dated March 28, 2012 and the related consent and letter of transmittal (the "Exchange Offer Documents") that are being sent to eligible holders of the Old Notes. The exchange offer and consent solicitation are being made only through, and subject to the terms and conditions set forth in, the Exchange Offer Documents and related materials.

The New Notes are being offered in the U.S. only to (1) qualified institutional buyers in reliance on Rule 144A under the Securities Act and (2) "accredited investors" as defined in Rule 501(a)(1), (2), (3) or (7) of Regulation D under the Securities Act, and outside the United States only to non-U.S. investors pursuant to Regulation S. The New Notes will not initially be registered under the Securities Act or any state securities laws and may not be offered or sold in the United States absent an effective registration statement or an applicable exemption from registration requirements or in a transaction that is not subject to the registration requirements of the Securities Act or any state securities laws.

Global Bondholder Services Corporation will act as the Information Agent for the exchange offer. Requests for the Exchange Offer Documents from eligible holders may be directed to Global Bondholder Services Corporation at (212) 430-3774 (for brokers and banks) or (866) 470-3700 (for all others).

Neither the Issuers' boards of directors nor any other person makes any recommendation as to whether holders of Old Notes should exchange their Old Notes, and no one has been authorized to make such a recommendation. Eligible holders of Old Notes must make their own decisions as to whether to exchange their Old Notes, and if they decide to do so, the principal amount of the Old Notes to exchange. Eligible holders of Old Notes should read carefully the Exchange Offer Documents and related materials before any decision is made with respect to the exchange offer and consent solicitation.

Source: Verso Paper Corp.

Jet fuel based on forest biomass passes the test

Virent and Virdia have announced the successful conversion of cellulosic pine tree sugars to drop-in hydrocarbon fuels within the BIRD Energy project, a joint program funded by the U.S. Department of Energy, the Israeli Ministry of National Infrastructure and the BIRD Foundation. The project, started in January of last year, has successfully demonstrated that Virdia’s deconstruction process generated high-quality sugars from cellulosic biomass, which were converted to fuel via Virent’s BioForming® process.

Virent used Virdia’s biomass-derived sugars to produce gasoline and jet fuel, the latter being sent to the U.S. Air Force Research Laboratory (AFRL) for analysis where it passed rigorous testing. Tim Edwards of the Fuels Branch of the AFRL said, “This fuel passed the most stringent specification tests we could throw at it (such as thermal stability) under some conditions where conventional jet fuels would fail. This fuel is definitely worth further evaluation.”

“The high-quality sugars generated from pine trees using Virdia’s process leveraged Virent’s conversion process, establishing a viable route to drop-in hydrocarbons from biomass,” said Virent co-founder and chief technology officer Dr. Randy Cortright.

“As demonstrated by the BIRD Energy project results, Virdia’s CASE™ (Cold Acid Solvent Extraction) process can deliver the high-purity, cost-effective cellulosic sugars needed as the primary raw material for jet fuels and other applications,” said Philippe Lavielle, Virdia CEO.

Virdia’s CASE process encompasses a sequence of proprietary extraction and separation operations. Originally developed around the Bergius process (concentrated hydrochloric acid hydrolysis of biomass), the CASE process achieves the highest yields in the industry, and produces high purity fractions of sugars and lignin. Its low temperature, low pressure hydrolysis coupled with its closed loops of acid recovery and solvent extraction establish it as one of the most economical and environmentally sustainable processes.

Virent’s BioForming platform utilizes a novel combination of catalytic processes to convert water-soluble oxygenated hydrocarbons derived from biomass to non-oxygenated hydrocarbons that can be used as drop-in compounds in gasoline, jet fuel and diesel fuel. Virent’s BioForming platform catalysts and reactor systems are similar to those found in today’s petroleum oil refineries and petrochemical complexes.

Buyer of St. Marys Paper would fire workers, not restart paper machine

The receiver for the shuttered St. Marys Paper mill in Sault Ste. Marie, Ont. has been granted court approval to proceed with a sale of assets to 2319839 Ontario Inc. The purchaser is described by the receiver as a consortium of companies, including an auctioneer, a real estate developer, a forest products company and a metals recycler.

All employees of St. Marys Paper are to be terminated prior to the sale. The purchaser has stated it may try to operate a biomass and co-gen facility, but does not expect to manufacture paper. Any unused assets of the mill are expected to be liquidated.

St. Marys Paper consists of a groundwood pulp mill and three supercalendered paper machines. The mill has operated sporadically since 2009. It shut down in March 2011, due to mechanical problem on a paper machine, was not restarted due to market weakness. The receiver, Ernst & Young, noted that it had received feedback from several parties during the sales process that it would be not economical to restart the mill given current market conditions for supercalendered paper.

The mill has remained in a cold idle state, and was put into receivership on Dec. 30, 2011. When fully operational, it employed about 300 people.

The mill wood yard is subject to lien in favor of Ministry of Natural Resources, and is excluded from the purchase agreement.

Ernst & Young, in its latest report to the court, explained that nine parties submitted bids. Three were from demolition firms, three from auctioneers, and three from parties interested in operating certain aspects of the mill or redeveloping it into a biomass operation. The winning bid was none of the above.

Ernst & Young also noted that none of the bids would provide sufficient proceeds to cover the debt of the mill’s primary secured creditor, International Forest Products. That debt is estimated in the media to be about $7 million.

UPM Tervasaari mill’s rebuilt paper machine 8 starts after renewal

UPM Tervasaari mill’s paper machine 8, producing label release base papers, has been started-up after major renovation. Modifications have been made throughout the paper machine line in order to increase speed and further improve paper quality.

The renewal will increase the capacity of the paper machine by 30,000 tonnes.

"The investment is UPM's way of meeting the increasing demand for label papers. The company wants to secure its market leader position in label papers and support customer growth," says Pentti Putkinen, General Manager of the Tervasaari Mill.

“The new technology enables us to produce even thinner high quality papers. The better efficiency of the paper production and material usage also improves the competitiveness of label papers. This strengthens the position of paper based labelstock in competition with other materials and alternative product decoration techniques in the market”, Antti Heimola, Product Manager of UPM Label Paper explains.

PM 8 was built in 1996. It underwent major renovations in 2006.

The UPM Tervasaari Mill produces approximately 385,000 tonnes of speciality papers annually using three paper machines. UPM signed a preliminary contract in February 2012 and will sell its packaging paper production to the Swedish company Billerud. The transaction includes two packaging paper machines: PM 7 in Tervasaari that produces kraft papers, i.e. envelope, bag and technical papers, and PM 1 in Pietarsaari that produces kraft paper and sack kraft paper. The aim is to finalise the transaction during the second quarter of 2012.

MM Packaging announces closure of Liverpool plant

Mayr-Melnhof Packaging today announced that it is to close its packaging plant in Liverpool.

In recent years, the team in Liverpool has worked hard to improve the plant’s competitiveness, in order to keep production at the site. However, the economic situation, latest market developments and the demands of MM-Packaging’s customers have finally led to this difficult decision.

The factory in Liverpool has most recently employed a total of 109 employees.

Customers are not affected by this measure as they are now being supplied by other parts of the European MMP production network.

Mayr-Melnhof Packaging, the packaging division of MM Group, is the European market leader in folding cartons. As of December 31st, 2011 the Mayr-Melnhof Group employed about 8,900 people.

ABB helps China’s papermaking machines to achieve fully integrated automation

Offering customized fully integrated automation systems for China’s papermaking machines, narrowing the gap between China’s papermaking machines and internationally advanced machines, and helping to achieve efficient and high quality production

ABB, a Fortune 500 company, signed a contract with China’s leading pulp and paper maker Minfeng Special Paper Co., Ltd. (Minfeng) to supply a fully integrated automation system for its domestically-made papermaking machine that produces Glassine paper . The system shall help the production line achieve full process control, from making paper pulp to producing finished rolls of paper, along with quality control.

With the System 800xA, ABB seamlessly integrates the Distributed Control System(DCS), Quality Control System(QCS), Web Imaging Systems (WIS) into this domestically-made papermaking machine to achieve equipment sharing between sub-systems and centralized intelligent control of the sub-systems as well as reduced investment in equipment, improved product quality and decreased manpower and material resource usage.

“Compared to systems that are not integrated, fully integrated automation systems have simplified design, an excellent degree of visualization and outstanding level of intelligence, and provide engineers with added convenience during operation while helping enterprises to significantly cut manpower and equipment maintenance costs,” said Lin ShuMing, head of ABB Pulp & Paper in North Asia, “Like Minfeng, more and more paper makers are starting to use ABB’s fully integrated automation systems in their domestically-made papermaking machines for the production of plasterboard surface paper, special paper, wrapping paper and other types of paper.”

ABB once successfully cooperated with Shanxi Qiangwei Paper Co., Ltd. (Qiangwei) for a 300,000 ton / yr plasterboard surface paper project. ABB has customized its fully integrated automation systems for Minfeng and Qiangwei to meet the needs of domestically-made papermaking machines in terms of operational characteristics and individualized production lines. With extensive experience and advanced technology, ABB’s systems can improve product quality, increase output of finished products and ensure production line operations remain stable, have low levels of resource consumption and maintain high levels of efficiency.

ABB has maintained a strong business in providing fully integrated automation systems for many years due to its customized services for paper makers. Through its cooperation with domestic and international paper makers such as UPM-Kymmene and Hengan for large papermaking projects using advanced international papermaking equipment produced by Voith, Metso, etc., ABB has accumulated a great deal of successful experience in this business area. Minfeng equipped its two Voith machines that produce high grade cigarette paper and writing paper with ABB’s fully integrated automation systems in 1999 and 2002 respectively.

Nowadays, more and more paper makers have realized that unpredictable machine breakdowns can lead to huge losses and many including Hua Run Paper Co., Ltd. and Nine Dragons Paper (Holdings) Limited’s Leshan subsidiary have already begun using ABB’s fully integrated automation systems in their domestically-made papermaking machines. In 2011, Changtai Paper ordered two fully integrated automation systems from ABB for use in two domestically-made papermaking machines at its new plant that produce plasterboard surface paper and linerboard.

ABB also provides annual support services to paper makers. Under such services, ABB’s professional engineers can analyze production lines while the machines are shut down for only a very short period of time, and provide paper makers with comprehensive and preventive suggestions on maintenance, thereby helping to ensure production lines are stably and efficiently operated, and the service life of equipment is extended.

China’s papermaking industry has grown continuously over the past 10 years. ABB established its pulp and paper team in China as early as 1994 and went on to successively establish business branches in Beijing, Shanghai and Guangzhou with its industry-leading workforce and services. In November 2010, ABB established its QCS and WIS factory in Shanghai – the global manufacturing base for its pulp and paper business. By the end of 2011, ABB had successfully completed up to 300 large-scale projects within China’s papermaking industry and had maintained long term partnerships with many leading domestic and international paper makers such as Hengan, Nine Dragons Paper, Lee & Man Paper and Huatai Group.

Assignment of Vacon's own shares - share bonus scheme 2011-2013

Vacon's Board of Directors has confirmed that the bonus in the share bonus scheme for 2011 is 19.8% of the maximum amount. The Board decided to assign 11,781 of the company shares held by the company without consideration to the recipients of the bonus as the share portion of the total bonus. In accordance with the terms of the share bonus scheme, 50% of the total bonus is paid in cash and 50% as shares. For the 2011 earnings period, the recipients of the bonus are 57 persons in corporate management and other positions. The handover date for the shares is 24 April 2012. After handing over these shares, the company holds 23,277 of its own shares.

The Share Ownership Plan includes three earning periods, calendar years 2011, 2012 and 2013. The Board of Directors of the Company will decide on the target group, the Plan's earnings criteria and on targets to be established for them at the beginning of each earning period. The shares paid on the basis of earning periods 2011, 2012 and 2013 may not be transferred during the restriction period, which will end two years from the end of the earning period. Should a target group person's employment or service end during the restriction period, he or she must gratuitously return the shares given as reward to the Company. The members of the Management Team must hold a half of the shares received on the basis of the incentive plan as long as the value of his or her shareholding in total corresponds to the value of his or her gross annual salary. Such number of shares must be held as long as his or her employment or service in a Group company continues.

Resolutions of the M-real Corporation’s Annual General Meeting

The Annual General Meeting of M-real Corporation held today 28 March 2012 decided to change the company’s business name to Metsä Board Corporation, amended the field of business of the company to more accurately correspond to the current business operations, and further adopted the following resolutions:

Annual accounts

The Annual General Meeting approved the company's financial statements for the financial year 2011 and

decided not to distribute dividend. The Annual General Meeting further discharged the members of the Board of Directors and the CEO from liability.

Remuneration of the Board of Directors

The Annual General Meeting resolved to maintain the remuneration of the members of the Board of Directors unchanged. Thus, the Chairman receives an annual remuneration of EUR 76,500, the Vice Chairman EUR 64,500 and members EUR 50,400. Approximately one half of the remuneration will be paid in cash while the other half is paid in the company’s B-series shares to be acquired from the open market during April 2012. In addition, the members are paid a fee of EUR 500 per each attended Board and committee meeting.

Composition of the Board of Directors

The Annual General Meeting fixed the number of Board members to nine (9) members and elected the following persons as members of the Board of Directors: Mikael Aminoff M.Sc. (Forestry), Martti Asunta, M.Sc. (Forestry), Kari Jordan, Honorary Counsellor, Kirsi Komi, LL.M., Kai Korhonen, M.Sc. (Technology), Liisa Leino, M.Edu., Juha Niemelä, Honorary Counsellor, Antti Tanskanen, Minister and Erkki Varis, M.Sc. (Technology). The term of office of the members of the Board of Directors expires at the end of the next Annual General Meeting.

At its organising meeting the Board of Directors elected Kari Jordan as its Chairman and Martti Asunta as its Vice Chairman. The Board further resolved to organize the Board committees as follows: The members of the Audit Committee are Kirsi Komi, Kai Korhonen, Antti Tanskanen and Erkki Varis and the members of the Nomination and Compensation Committee are Mikael Aminoff, Martti Asunta, Kari Jordan, Liisa Leino and Juha Niemelä.

Auditor

The Annual General Meeting elected Authorized Public Accountants KPMG Oy Ab as the company’s auditor with Raija-Leena Hankonen, Authorized Public Accountant, acting as principal auditor. The term of office of the auditor expires at the end of the next Annual General Meeting. The Annual General Meeting resolved that the fee of the auditor is paid according to invoice as approved by the company.

Amendment of Articles of Association

In addition to changing the company’s name and field of business, the Annual General Meeting decided to make certain technical and terminology changes to the Articles of Association to accommodate to changes in legislation.

Share Issue Authorization

The Annual General Meeting authorized the Board of Directors to decide on the issuance of new shares or special rights, as specified in section 1 of Chapter 10 of the Companies Act, entitling to shares. By virtue of the authorization the Board is entitled to issue up to 70,000,000 new B-series shares or special rights entitling to such shares such that the maximum number of new shares issued does not exceed 70,000,000 B-shares. The special rights entitle their holders to receive new B-series shares against the payment of a subscription price or by setting off a receivable against the subscription price (“Convertible Bond”). New shares can be issued against payment or without payment. The authorization replaces the authorization previously in effect and is effective until March 28, 2017.

M-REAL CORPORATION