Ianadmin

ANDRITZ successfully starts up the longest Steel Yankee of the world at Indonesian paper mill

International technology Group ANDRITZ has successfully started up a Steel Yankee cylinder and headbox supplied to a customer in Indonesia for a new MG paper machine. With a shell length of 7.4 m, this Steel Yankee is the longest of the world.

In addition to the PrimeDry Steel Yankee and the headbox, ANDRITZ also delivered the core components for the approach system and the dilution water control equipment.

The headbox (PrimeFlow SW) has been newly developed for the use with fourdrinier wires and hybrid formers. With this innovative ANDRITZ technology for paper and board machines, the step diffuser and the lamella nozzle generate micro-turbulence in order to produce optimum formation and evenness of the paper. The mechanical design, manufacturing precision, and the dilution water system (PrimeProFiler F) ensure excellent cross-direction profiles.

Another major project for BUTTING Anlagenbau: chemical pulp factory in Punta Pereira

In Punta Pereira, Colonia department, a new chemical pulp factory is being constructed based on a joint venture of Stora Enso and Arauco.

A good performance and high flexibility during a comparable project in the years from 2006 until 2008 have for sure been important reasons for order placement of this

actual Uruguayan large scale project. Even at that time BUTTING was involved in the construction of the chemical pulp factory in Fray Bentos with more than 3,500 tons of

fabricated and delivered material.

For BUTTING the total order volume amounts to 50 km of pipes and 60 internal vessels. BUTTING Anlagenbau fabricates, delivers and assembles vessels and pipelines coming up to approx. 80 per cent of the overall required raw material.

BUTTING delivers the material (pipes and fittings) for the pipeline bridges and equips the pulp pipeline and the drying line with vessels and pipes. In this area also prefabrication of the pipelines and the subsequent assembly on site will be assumed. The appropriate pipes have been produced in Knesebeck production, prefabricated in

Schwedt works since December 2011 and will be assembled at Uruguay location starting the second quarter 2012.

For installation of the delivered parts, we actually calculate with 210 fitters in Punta Pereira – an internationally mixed team led by an experienced BUTTING management team. This order is highly sophisticated not only for the reason of a high capacity. “An on-schedule supply and a smooth organization at site – at a distance of

more than 11,000 kms – require a logistical master accomplishment” Debora Stimpel says. She works in a leading position on this project. “Another problem that cannot be

influenced can be founded in the highly unsteady weather conditions at the location – semi-tropical rainstorms are no curiosity”, she supplements.

We at BUTTING are sure to successfully perform this large-scale project as well.

BUTTING – Progress by Tradition

China log and lumber imports down in 1Q/12

China log and lumber imports down in 1Q/12, with Russia and New Zealand suppliers hit the hardest, while North America gained market share, reports the Wood Resource Quarterly

China’s demand for logs and lumber fell in late 2011 and early 2012 because of their slowing housing market. However, over the past ten years, importation of wood products has increased dramatically, as reported in the Wood Resource Quarterly (www.woodprices.com). Lately, North American log and lumber exporters have increased their market share in China at the expense of exporters in Russia and New Zealand.

The full article can be found in the attached PDF file delow for download....

BASF Business Water Solutions Invites Customers to Engage in Dialog at the World’s Leading Trade Fair IFAT ENTSORGA

Around 2.730 exhibitors will be showing their latest portfolios at IFAT ENTSORGA, the world’s trade fair for water, sewage, waste and raw material management, at Munich, Germany, from 7 to 11 May 2012. As a strong partner of the water treatment industry BASF will be presenting its innovative and sustainable water treatment solutions on their booth under the theme “water loves solutions” (Booth No. 223/332 in Hall A3).

- Innovative system solutions for drinking water, waste water and process water treatment

- Focus on ultrafiltration solutions from inge GmbH

- Forum for intensive customer dialog

“Thanks to our global expertise in the field of water treatment, we offer customers local presence and a comprehensive product portfolio. We innovate to make our customers more successful – and we can demonstrate that well at the IFAT.” said Dr. Matthias Halusa, Head of BASF’s Global Business Management Water Solutions. “Europe is a very important market for us. We will use the trade fair extensively as a forum for dialog and like to invite all customers to use IFAT as an opportunity to engage in intensive discussion with our international team of experts.”

Tailored system solutions for our customers

At the BASF booth a large selection of innovative and sustainable system solutions for the wide range of uses awaits the trade visitor. BASF’s extensive range of established products, such as flocculants, coagulants, corrosion inhibitors, antiscalants, biocides, chelating agents and defoamers, provides tailor-made solutions for the treatment of waste water, drinking water and industrial water. This year’s main focus at IFAT will be ultrafiltration technology, a field of activity that BASF is strengthening since the acquisition of inge GmbH in 2011.

Focus on ultrafiltration solutions from inge GmbH

The German company inge GmbH – widely regarded as the global leader in the field of ultrafiltration technology – hundred percent owned by BASF and part of its Water Solutions business – features the highly-efficient and robust ultrafiltration membranes as well as the space-saving rack designs used to treat drinking water, process water, waste water and sea water. The extremely small-pore filters of the Multibore® membrane reliably intercept not only particles, but also microorganisms such as bacteria and viruses, thereby providing a dependable source of clean water.

Cepi reports that Paper-based packaging recycling at 78%

Paper is the most recycled packaging material in the EU with a recycling rate of 78% based on 2010 figures. The rate was announced today by the Confederation of European Paper Industries (CEPI), who used Eurostat data for their calculations.

This result exceeds the 60% target set in the Packaging and Packaging Waste Directive, which had been reached in 1997 (European Commission data). In fact, the paper-based packaging recycling rate was already at 73.3% in 2005 up from 63.8% in 2000 (Eurostat).

These outcomes give an additional indication that renewable and recyclable paper packaging contributes positively to the European objective of resource efficiency.

“Through high recycling rates, the European paper industry is a leading example on how sustainability and competitiveness can go hand in hand”, said Teresa Presas, CEPI Director General. “But in the forthcoming revision of the European packaging directive, it will be important to consider the level playing field between different packaging materials. Currently, each material has a different recycling target rate ranging from 15% to 60%”, she reminded. “In addition, it is time to consider the essential role smart packaging plays in a resource efficient Europe. Packaging can prevent waste of goods and spillage of food in particular”, she added.

The flagship ‘Resource Efficient Europe’, promoting a responsible use of resources as part of the EU 2020 Strategy for growth and jobs, is particularly important in the current difficult economic climate, which requires all possible efficiency gains. The European paper industry utilises resources that are constantly renewed and recycled and expects that policies supporting resource efficiency are actually enforced in a harmonised way across Europe.

The calculation method and comparison to other materials:

CEPI calculations take into account the share of paper packaging that arrives in Europe with imported goods. This consumption of packaging is not always included in the calculations of other recycling statistics and can result in recycling rates beyond 100%. CEPI believes its calculation is realistic, conservative and gives a reliable indicator of paper-based packaging performance in this aspect. The figures collected by the European Commission and published by Eurostat are available with a delay of several years. The latest Eurostat figures available are from 2007.

According to the respective European trade associations, paper-based packaging had the best recycling performance of all materials in 2010: aluminium was recycled at the rate of 64%, glass at 68% and steel packaging 71%. Paper had reached such levels more than five years ago and is currently recycled at the rate of 78%.

Packaging can have several functions:

• to protect the product, especially during transit;

• to preserve the product and avoid in particular food waste;

• to contain the product, e.g. in the case of liquids;

• to provide information to the consumer regarding the product and its safety; and

• to market the product.

Sonoco CorrFlex's Winston Salem Plant Named a Sonoco Sustainability Star Award Winner

The Company's Winston Salem facility achieves silver-tier award status

Sonoco Recycling, LLC, a unit of Sonoco and one of the largest packaging recyclers in North America, has announced that Sonoco CorrFlex's Winston Salem, N.C., facility has received a silver-tier Sonoco Sustainability Star Award for diverting a minimum of 95 percent of its waste to landfill.

In 2008, employees at the North Carolina facility established Team Green, aimed at cutting landfill waste in half and implementing a plant-wide recycling program. All plant waste streams were audited and evaluated for potential opportunities, using reduction, reuse and recycling to determine the best solution for landfill diversion, including changing landfill pick-up to an on-call basis. Additionally, Team Green focused on controlling utility and water usage through assessment and reduction activities, and began diverting salvageable metal to recycling outlets instead of storing or landfilling it.

Recycling containers were placed in all common areas, and employees were encouraged to bring in their recyclables from home as well. The team even set up an employee recycling fund, paid out once yearly, where all funds collected from recycling of plastic cans, aluminum bottles, office paper and plastic bags are divided evenly between all employees.

"The Winston Salem group has shown a real dedication towards reducing waste to landfill and increasing recycling," said Ray Howard, general manager, Sonoco Recycling. "Currently, they're recycling approximately 98 percent of their materials and we applaud them for their efforts."

Duncan Sullivan, Sustainability and Special Projects, said, "Our facility is the second Sonoco CorrFlex location to win a Star award. While it's been very rewarding for the team to see our facility reach silver-tier status, our York, Pa., facility went landfill-free last year, and we're working to join them by the end of 2012."

As a result of these initiatives, Team Green was invited to partner with one of the facility's largest customers, PepsiCo's Frito-Lay business, in ongoing Resource Conservation activity, and was recognized at its global sustainability summit for creating a best-in-class culture for RECON performance.

Created to recognize customer and Sonoco facilities for achieving significant milestones in landfill diversion and waste stream reduction, the program is composed of three tiers:

- Gold Star Awards, which recognize facilities that have achieved 99 percent landfill diversion;

- Silver Star Recognition, which is awarded to facilities achieving 95 percent landfill diversion; and

- Bronze Awards, which recognize facilities that have made significant waste reduction achievements.

Learn more about our Sonoco Sustainability Star Award program at http://www.sonoco.com/productsservices/sonocorecyclinginc/sustainabilitystarawards.aspx.

A recycling leader with 50 locations and expertise worldwide, Sonoco Recycling annually collects approximately 3 million tons of old corrugated containers, various grades of paper, metals and plastics. In addition, the Company has experts who provide secure, reliable and innovative recycling solutions to residential and commercial customers. Currently, Sonoco Recycling operates six material recovery facilities (MRFs) and serves nearly 150 communities in which curbside-collected residential and commercial materials are processed. The Company also provides recycling programs which identify waste reduction opportunities that reduce operating expenses for many of the largest consumer product companies in the U.S.

SOURCE Sonoco

First industrial scale foam forming research environment for forest sector

VTT invests to new sustainable and added value fibre-based products for the forest sector

Foam forming technology gives exciting opportunities to develop new recyclable and light weight wood fiber products. It also gives a possibility to decrease raw material and production costs remarkably compared to recent technology. VTT Technical Research Centre of Finland, together with industry has started setting up a new pilot scale technology platform for foam forming applications.

With foam forming technology it is possible to improve paper properties and enable to manufacture high porosity, smooth and light weight products (e.g. hygiene products, insulation materials and filters). It may be solution for various printed intelligence, nano- or microcellulose applications.

"The foam forming technology requires significantly less water than conventional paper and board manufacturing. In foam forming large amounts of air is mixed to fiber furnish which makes possible to achieve unique product properties. Technology reduces water and energy consumption while saving raw material. Laboratory results from the Forestcluster programmes have shown potential for remarkable fiber savings states Technology Manager Janne Poranen from VTT.

New business opportunities for forest sector

At the beginning of this year VTT launched a KOTVA project targeting to scaleup foam forming technology to SUORA. SUORA is a pilot-scale research environment for fibre processes, developed in close collaboration with the members of Forestcluster Ltd. SUORA offers cost efficient prototyping of ideas, fast experimenting, and development of new process solutions. The two-year KOTVA project has a budget of EUR 2 million and it supports the national research strategy of the Finnish forest cluster. The forest cluster has a target to double its turnover before year 2030. Half of the turnover is expected to come from entirely new products.

In the KOTVA, VTT and the University of Jyväskylä combine their knowledge in developing new production and measurement technologies for foam forming. Other partners of the project are UPM, Stora-Enso, M-real, Metso, Kemira, Omya, Wetend Technologies and Vision Systems, and the cities of Jyväskylä, Äänekoski and Jämsä. The project is funded (EUR 917,778) by the European Regional Development Fund (ERDF) via the Regional Council of Central Finland.

VTT’s research environment for fibre processes - SUORA

Foam forming research environment

Comunicado de Imprensa: VTT terá o primeiro ambiente global de pesquisa de tecnologia de espuma em escala industrial

Transparent plastic-like packing material from birch fibril pulp

VTT Technical Research Centre and Aalto University have developed a method which for the first time enables manufacturing of a wood-based and plastic-like material in large scale. The method enables industrial scale roll-to-roll production of nanofibrillated cellulose film, which is suitable for e.g. food packaging to protect products from spoilage.

Nanofibrillated cellulose typically binds high amounts of water and forms gels with only a few per cent dry matter content. This characteristic has been a bottleneck for industrial-scale manufacture. In most cases, fibril cellulose films are manufactured through pressurised filtering but the gel-like nature of the material makes this route difficult. In addition, the wires and membranes used for filtering may leave a so-called “mark” on the film which has a negative impact on the evenness of the surface.

According to the method developed by VTT and Aalto University nanofibrillated cellulose films are manufactured by evenly coating fibril cellulose on plastic films so that the spreading and adhesion on the surface of the plastic can be controlled. The films are dried in a controlled manner by using a range of existing techniques. Thanks to the management of spreading, adhesion and drying, the films do not shrink and are completely even. The more fibrillated cellulose material is used, the more transparent films can be manufactured.

Several metres of fibril cellulose film have been manufactured with VTT’s pilot-scale device in Espoo. All the phases in the method can be transferred to industrial production processes. The films can be manufactured using devices that already exist in the industry, without the need for any major additional investment.

VTT and Aalto University are applying for a patent for the production technology of NFC film. Trial runs and the related development work are performed at VTT.

The invention was implemented in the Naseva – Tailoring of Nanocellulose Structures for Industrial Applications project by the Finnish Funding Agency for Technology and Innovation (Tekes) that is included in the Finnish Centre for Nanocellulosic Technologies project entity formed by UPM, VTT and Aalto University.

Nanofibrillated cellulose grade used was UPM Fibrilcellulose supplied by UPM.

International Paper To Host Investor Day Conference on May 24

International Paper will host an Investor Day conference on May 24 in New York City, with a live webcast beginning at 11:45 a.m. Reflecting the meeting theme of "Reaching Our Potential," the company will outline its global business strategy as well as the earnings and cash flow capability of its current portfolio. The event will be hosted by Chairman and CEO John Faraci and will include presentations by Chief Financial Officer Carol Roberts, along with Senior Vice Presidents of the business segments.

Interested parties may listen to the webcast via International Paper's Internet site at http://www.internationalpaper.com by clicking on the Investors tab and then clicking on the Webcasts and Presentations link. The webcast is expected to end by 5 p.m. A replay of the webcast will be available on the web site the following day.

SOURCE International Paper

Ashland Inc. reports preliminary financial results for second quarter of fiscal 2012

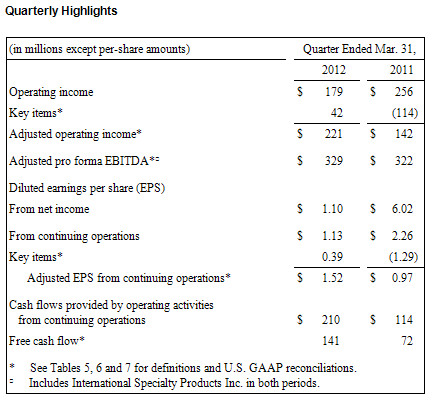

Ashland Inc., a global leader in specialty chemical solutions for consumer and industrial markets, today announced preliminary(1) financial results for the quarter ended Mar. 31, 2012, the second quarter of its 2012 fiscal year.

Earnings from continuing operations equal $1.13 per diluted share; adjusted earnings, excluding key items, increased 57 percent to $1.52 per diluted share

For the second quarter of fiscal 2012, Ashland reported income from continuing operations of $90 million, or $1.13 per diluted share, on sales of $2.1 billion. These results included three key items that together reduced income from continuing operations by approximately $31 million, net of tax, or 39 cents per diluted share. The after-tax charges related to adjustments to stepped-up inventory values from the acquisition of International Specialty Products Inc. (ISP) last August; expenses related to Ashland's integration and cost-reduction program; and a write-off related to pre-construction costs for a previously planned greenfield manufacturing facility in northern China. Excluding these three key items, Ashland's adjusted income from continuing operations was $121 million, or $1.52 per diluted share, an increase of 57 percent versus the year-ago quarter.

For the year-ago quarter, income from continuing operations was $182 million, or $2.26 per diluted share, on sales of $1.6 billion. The year-ago results included four key items that had a combined positive impact of $103 million, net of tax, or $1.29 per diluted share. Excluding these items, adjusted income from continuing operations was 97 cents per diluted share. The March 2011 results do not include ISP or related financing costs associated with that acquisition. (Please refer to Table 5 of the accompanying financial statements for details of key items in both periods.)

Adjusting for the impact of key items in both the current and prior-year quarters and for the acquisition of ISP on a pro forma basis, Ashland's results for the March 2012 quarter as compared with the March 2011 quarter were as follows:

- Sales grew 2 percent to $2.1 billion;

- Operating income rose 4 percent to $221 million;

- Earnings before interest, taxes, depreciation and amortization (EBITDA) increased 2 percent to $329 million; and

- EBITDA as a percent of sales held steady at 15.8 percent.

"I am pleased with Ashland's solid financial performance in the second quarter. Our overall business continues to perform well, with increased sales, stable margins and improved cash flow during the quarter despite some market weakness in certain commercial units," said James J. O'Brien, Ashland chairman and chief executive officer. "Ashland Specialty Ingredients achieved another strong quarter with double-digit sales and earnings increases, and good sales growth in all regions of the world. With last year's acquisition of International Specialty Products, we have strengthened our position in higher-margin growth markets and we are seeing the benefit to our bottom-line results. Also during the quarter, Ashland Performance Materials had improved pricing and stronger demand in the North American market. Although Ashland Consumer Markets was down versus the prior year due to softness in the domestic market, its performance improved when compared to the first quarter. Ashland Water Technologies continues to face a challenging demand environment, with lower volumes more than offsetting the benefit from improved pricing in the quarter."

Business Segment Performance

In order to aid understanding of Ashland's ongoing business performance, the results of Ashland's business segments are presented on an adjusted or pro forma adjusted basis, and EBITDA is reconciled to operating income in Tables 7 and 8 of this news release.

Ashland Specialty Ingredients reported sales of $723 million for the March 2012 quarter, an increase of 11 percent when compared to a year ago on a pro forma basis. EBITDA rose 12 percent, to $186 million, while EBITDA as a percent of sales was 25.7 percent, an increase of 10 basis points versus the year-ago quarter. Each of Specialty Ingredients' businesses performed well during the quarter, with particularly impressive performance from the Energy, Construction and Specialty Performance businesses. Specialty Ingredients represents the largest commercial unit within Ashland, comprising 56 percent of the company's consolidated EBITDA on a trailing 12-month basis.

Ashland Performance Materials reported sales of $408 million, a 4-percent decrease from the March 2011 quarter on the same pro forma basis, which includes the results of ISP's elastomers business. Excluding effects associated with our Casting Solutions joint venture and the recently divested PVAc business, year-over-year sales for Performance Materials rose 4 percent. EBITDA increased 9 percent, to $35 million, while EBITDA as a percent of sales grew 110 basis points to 8.6 percent.

Sales at Ashland Consumer Markets rose 6 percent, to $520 million, when compared to a year ago. EBITDA totaled $66 million, a decline of 10 percent versus a year ago, while EBITDA as a percent of sales was 12.7 percent, a decline of 220 basis points from March 2011. However, EBITDA was higher on a sequential basis when compared to the December 2011 quarter due to seasonal volume increases, increased pricing and lower raw material costs.

Ashland Water Technologies' sales totaled $428 million in the March 2012 quarter, a decline of 9 percent from the year-ago quarter. EBITDA was $39 million, a 24-percent decline from March 2011. EBITDA as a percent of sales was 9.1 percent, down 170 basis points. Lower volumes remain the primary challenge within Water Technologies' business. Water Technologies has taken a number of steps over the past year to refocus its business on higher-margin, higher-growth opportunities, and these actions should lead to improved results over time.This includes the divestiture of our synlubes business and the repositioning of our middle-market commercial business through a well-established distributor. The latter decision, announced last week, will eliminate the high costs associated with servicing approximately 5,000 customer locations that together generated only $15 million in annualized sales.

After excluding the effects from key items, Ashland's effective tax rate for the March 2012 quarter was 27 percent. Given our ongoing work in this area and a refinement of some of our initial assumptions, we now expect Ashland's tax rate for the full year to be in the range of 28-30 percent.

Outlook

Looking ahead, O'Brien said he is confident about Ashland's growth opportunities and business performance.

"Our year-to-date financial performance provides clear evidence of the strategic benefits provided by the addition of ISP's higher-margin business portfolio. Specialty chemicals are now the core of our business, and we are beginning to see the improved earnings power that comes with this focus on higher-growth, less cyclical markets. At the same time, we have made great progress on our cost reduction program, which is targeting $90 million in annualized savings. Through the end of March, we had already achieved more than two-thirds of that goal and the integration with ISP is progressing largely as expected. While rising raw material costs are always a concern in our business, we have demonstrated a strong ability to effectively manage these challenges through pricing and efficiency improvements," he explained.

"We have good momentum going into the second half of fiscal 2012, with the June quarter typically being our seasonally strongest. We will continue to focus on driving earnings through organic volume growth, margin improvement, cost efficiencies and strategic capital investment. We are well on track for the year and remain confident in our ability to deliver our fiscal 2014 financial targets for sales and earnings growth," O'Brien said.

Conference Call Webcast

Ashland will host a live webcast of its second-quarter conference call with securities analysts at 9 a.m. EDT Tuesday, April 24, 2012. The webcast and supporting materials will be accessible through Ashland's website at http://investor.ashland.com. Following the live event, an archived version of the webcast and supporting materials will be available for 12 months.

Use of Non-GAAP Measures

This news release includes certain non-GAAP (Generally Accepted Accounting Principles) measures. Such measurements are not prepared in accordance with GAAP and should not be construed as an alternative to reported results determined in accordance with GAAP. Management believes the use of such non-GAAP measures assists investors in understanding the ongoing operating performance of the company and its segments. The non-GAAP information provided may not be consistent with the methodologies used by other companies. All non-GAAP amounts have been reconciled with reported GAAP results in Tables 5, 6 and 7 of the financial statements provided with this news release.

Q2 2012 Earnings Press Release Tables Final

Source: Ashland Inc.