Ianadmin

SCA reports conversion of shares

According to SCA's articles of association, owners of Class A shares have the right to have such shares converted to Class B shares. Conversion reduces the total number of votes in the company. When such a conversion has occurred, the company is obligated by law to disclose any such changes in this manner.

According to SCA's articles of association, owners of Class A shares have the right to have such shares converted to Class B shares. Conversion reduces the total number of votes in the company. When such a conversion has occurred, the company is obligated by law to disclose any such changes in this manner.

In December, at the request of shareholders 653,435 Class A shares were converted to Class B shares. The total number of votes in the company thereafter amounts to 1,544,613,327.

The total number of registered shares in the company amounts to 705,110,094 of which 93,278,137 are Class A shares and 611,831,957 are Class B shares.

Baikal pulpmill set on bankruptcy administration and received €11.4 million VEB’s credit

Arbitration court set bankruptcy administration at Baikal pulpmill until June 05, 2013 following the request of the external administrator. The mill is bankrupted, and Aleksandr Ivanov is appointed its insolvency administrator.

Arbitration court set bankruptcy administration at Baikal pulpmill until June 05, 2013 following the request of the external administrator. The mill is bankrupted, and Aleksandr Ivanov is appointed its insolvency administrator.

At the court session, Ivanov said that during the external control period the mill did not manage to set all its debts.

Aleksandr Ivanov also reported that VEB bank opened a credit line for the mill with €11.4 million limit for two years with 15% annual interest rate. The mill will use these funds to pay for resources, chemicals and fuel. It is also planned to use the credit to upgrade the mill in order to reduce breakdowns rate.

Head of Arkhangelsk pulpmill board: next year will bring growth for pulp & paper industry

Head of Arkhangelsk pulpmill’s board of directors Heinz Zinner gave his forecast on the industry in 2013.

Head of Arkhangelsk pulpmill’s board of directors Heinz Zinner gave his forecast on the industry in 2013.

Until recently, there was no possibility to evaluate clearly state of the pulp and paper industry, Dr. Zinner said. Europe and North America produce more than they can consume, and production of pulp, paper and board is decreasing there. The same applies to Japan. In other regions, there is fast growth of home consumption like China and South-East Asia. Some have competitive advantages like South America.

Evaluating key trends in the industry, Heinz Zinner noted that the recent crisis was a consumption indicator for some market sectors and hurt such product niches as newsprint, LWC and wood-free paper.

Talking on Russia’s accession to WTO and its influence on pulp & paper in Russia, Arkhangelsk pulpmill board director noticed that 85% of Russian pulp, board and paper are made by large companies that make competitive products in terms of both quality and costs.

‘’For sure, there will be some rules of the game, but this will be a controlled process’’, Zinner noted, ‘’Under these circumstances small and obsolete market players will suffer difficulties’’.

One should hope that Russia with its reach forest and energy reserves will invest into new capacities like China, Indonesia or Chile, Zinner said, however, there is much talking about it, but not much have changed.

Talking on perspectives of the industry in 2013, Arkhangelsk board director predicted growth of pulp and paper production on the global scale. In some regions growth will be minimal, but Central & Eastern Europe, China, South America, and South-East Asia will show good demand and constant growth. This will offset poor consumption in Western Europe and North America.

‘’Corrugated and tissue markets that are basic for enterprises of Pulp Mill Holding GmbH, Arkhangelsk pulpmill and Kiev pulpmill, have the brightest perspective in 2013’’, Zinner concluded.

Clariant divests Textile Chemicals, Paper Specialties and Emulsions businesses to SK Capital

Clariant, a world leader in specialty chemicals, has signed an agreement to divest its Textile Chemicals, Paper Specialties and Emulsions businesses to SK Capital. The total consideration of the sale amounts to approximately CHF 502 million, out of which approximately 460 million in cash, equivalent to 6.3 times the estimated full year 2012 recurring EBITDA of those businesses. The divestment has been approved by the Boards of both companies. Subject to regulatory approvals, the transaction is expected to close by the end of the second quarter of 2013.

Clariant, a world leader in specialty chemicals, has signed an agreement to divest its Textile Chemicals, Paper Specialties and Emulsions businesses to SK Capital. The total consideration of the sale amounts to approximately CHF 502 million, out of which approximately 460 million in cash, equivalent to 6.3 times the estimated full year 2012 recurring EBITDA of those businesses. The divestment has been approved by the Boards of both companies. Subject to regulatory approvals, the transaction is expected to close by the end of the second quarter of 2013.

“For Clariant the transaction marks a significant milestone in the execution of its profitable growth strategy, after the acquisition of Süd-Chemie in 2011”, CEO Hariolf Kottmann said. “I am pleased that we are able to execute this divestment faster than originally expected. By the end of 2013, Clariant will be an even more profitable company than today, generating a majority of sales in non-cyclical growth businesses.”

Barry Siadat, a Managing Director of SK Capital, noted, “We are delighted to partner with the management and employees of these businesses to build upon their strong technology, brand, and leading market positions to more efficiently serve their large and growing global markets and customers. We believe these businesses provide an attractive platform to capitalize on their overlaps in technology, manufacturing, supply chain and logistics.”

Repositioning the company’s portfolio is an essential part of Clariant’s profitable growth strategy. To achieve the targets set for 2015, Clariant will focus on markets with future perspectives and strong growth rates and on businesses that have a competitive position, resulting in strong pricing power. In this context, the company has announced in early 2012 to look for strategic options for the Business Units Textile Chemicals, Paper Specialties and the Business Line Emulsions until year-end 2013. Also subject to this process but in a second phase are the Business Unit Leather Services and the Business Line Detergents & Intermediates.

In 2012, the divested businesses will generate an estimated CHF 1.2 billion in sales, equaling approximately 15 % of total Group sales, and an estimated EBITDA of CHF 80 million. The three businesses employ around 3,000 employees (14% of total workforce) in 35 countries around the globe.

SK Capital is a private investment firm with a disciplined focus on the specialty materials, chemicals and healthcare sectors, located in New York, NY (USA) and Boca Raton, FL (USA). The company has a strong track record in chemicals investing, in transitioning non-core divisions of larger corporations to standalone entities and in acquiring global businesses.

UPM sells 6000 hectares of forest land to Taaleritrdas

UPM and Taaleritehdas have agreed today on the sale of 6,000 hectares of forest land. The estates are located in Central and Eastern Finland in Pyhäntä, Utajärvi, Kiuruvesi and Ilomantsi. At the same time the parties have signed an agreement on wood trade and forest services. It has been agreed by the parties not to disclose the purchase price.

UPM and Taaleritehdas have agreed today on the sale of 6,000 hectares of forest land. The estates are located in Central and Eastern Finland in Pyhäntä, Utajärvi, Kiuruvesi and Ilomantsi. At the same time the parties have signed an agreement on wood trade and forest services. It has been agreed by the parties not to disclose the purchase price.

Wealth Management Company Taaleritehdas’ new fund “Taaleritehtaan Metsä” is a totally new way to own forest. It offers the investors an easy and effortless way to buy a piece of forest land and enjoy regular income from forest ownership. Professional forestry as well as sales and purchase improve return. The forest specialist with the fund together with the UPM forest professionals are responsible for the timely forest management on the estates now purchased by Taaleritehdas.

The estates acquired today from UPM are the first forest properties within the fund. It will acquire more forest land during the next two years when suitable estates are available. Investors in the fund are private Finnish investors as well as institutional investors and organisations.

“As an investment, forest is suitable for Finnish investors. It is a concrete ownership which spreads the risk in the portfolio as well. The earnings from forest ownership have not correlated with the other investments like shares and interest rates. Additionally forest ownership offers an inflation hedge as the wood price has traditionally followed the inflation rate,” says Juhani Elomaa, Managing Director of Taaleritehdas.

“Taaleritehtaan Metsä is a new and interesting way to increase the interest in the forests, forest ownership and sustainable use of the forests. UPM shares this aim and therefore we are pleased to act as an enabler in this process,” says Sauli Brander, Vice President, Forestry Business, UPM.

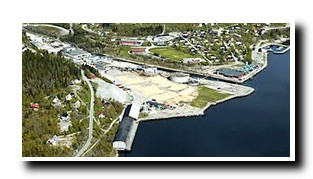

Mayr Melnhof Karton to acquire Södra's Follafoss mill

Södra and Mayr Melnhof Karton have signed a Letter of Intent where Mayr Melnhof Karton intends to purchase 100% of the shares in Södra Cell Folla AS and thereby take over Södra's pulp mill in Follafoss.

Södra and Mayr Melnhof Karton have signed a Letter of Intent where Mayr Melnhof Karton intends to purchase 100% of the shares in Södra Cell Folla AS and thereby take over Södra's pulp mill in Follafoss.Mayr Melnhof Karton intends to resume operations at Folla as soon as possible, hopefully early in 2013. The parties' intention is to close the deal during the first quarter of next year.

Södra's pulp mill in Follafoss, Norway, has a capacity of 105,000 tpy of CTMP pulp. Södra announced its intention to divest the mill earlier this year.

Mayr Melnhof, based in Vienna, is a world leader in the field of coated, recycled cartonboard and Europe's leading manufacturer of folding cartons. The group's business is focused on MM-Karton and MM-Packaging.

Cascades Inc. Announces Extension of Its Small Shareholder Selling Program

Cascades Inc. (TSX: CAS), has announced the extension of its Small Shareholder Program ("the Program") to February 15, 2013 at 4:00 p.m. Toronto time (EST).

Cascades Inc. (TSX: CAS), has announced the extension of its Small Shareholder Program ("the Program") to February 15, 2013 at 4:00 p.m. Toronto time (EST).

The voluntary Program, originally scheduled to expire on December 17, 2012, enables eligible registered and beneficial shareholders who owned 99 or fewer Common Shares ("Shares") of Cascades Inc. as of September 17, 2012, to sell their Shares without incurring any brokerage commission.

Orders received and cleared for execution shall be placed with the participating organization no later than 12:00 p.m. on the next business day for execution on TSX.

Cascades Inc. makes no recommendation as to whether or not an eligible shareholder should participate in the Program. The decision to participate should be based upon a shareholder's particular financial circumstances. Eligible shareholders may wish to obtain advice from their broker or financial advisor as to the advisability of participating.

Cascades Inc. has retained Georgeson Shareholder Communications Canada Inc. to manage the Program. Shareholders should direct any questions regarding the Program to Georgeson's toll-free number at 1 (866) 962-0494.

Catalyst Paper and Pacifica Deep Sea Terminals Inc. unable to close agreement on sale of Elk Falls site

Catalyst Paper has announced that the sale of its Elk Falls site in Campbell River to Pacifica Deep Sea Terminals Incorporated did not close and the sale agreement has been terminated. The sale of the 400-acre industrial site and adjacent properties was initially expected to close on September 5, 2012. A non-refundable prepayment of a portion of the purchase price was received and the transaction timeline was extended multiple times up to the ultimate deadline of December 18, 2012.

Catalyst Paper has announced that the sale of its Elk Falls site in Campbell River to Pacifica Deep Sea Terminals Incorporated did not close and the sale agreement has been terminated. The sale of the 400-acre industrial site and adjacent properties was initially expected to close on September 5, 2012. A non-refundable prepayment of a portion of the purchase price was received and the transaction timeline was extended multiple times up to the ultimate deadline of December 18, 2012.

“It’s disappointing that this transaction with Pacifica could not be completed even with the extended timeline. This is a fully serviced property in an excellent location and we remain confident that the right fit between site and buyer will be found that will bring new jobs and opportunities to Campbell River,” said Kevin J. Clarke, Catalyst President and Chief Executive Officer. “In the meantime, site personnel are maintaining safety, security and environmental requirements and complying with all applicable legislation.”

The former pulp and paper site was indefinitely curtailed in 2009 and closed permanently in 2010. It has since been decommissioned with removal of chemicals, process wastes, and key papermaking equipment. The landfills remain intact as does the wastewater system which continues to operate in preparation for the site’s redevelopment to other industrial uses. The Elk Falls mill began operation in 1952, and at its peak, produced 784,000 tonnes of pulp, paper and kraft paper annually.

Catalyst Paper manufactures diverse specialty mechanical printing papers, newsprint and pulp. Its customers include retailers, publishers and commercial printers in North America, Latin America, the Pacific Rim and Europe. With three mills, located in British Columbia, Catalyst has a combined annual production capacity of 1.5 million tonnes. The company is headquartered in Richmond, British Columbia, Canada and is ranked by Corporate Knights magazine as one of the 50 Best Corporate Citizens in Canada.

Clearwater Paper Announces Divisional Executive Appointments

Clearwater Paper Corporation (NYSE:CLW) has announced two key divisional executive appointments, effective January 1, 2013. Thomas A. Colgrove, president of the pulp and paperboard division, has been named president of the consumer products division, succeeding Robert P. DeVleming, who will retire after a transitional period during the first half of 2013. Danny G. Johansen, vice president of sales and marketing for the pulp and paperboard division, has been named president of the pulp and paperboard division.

Clearwater Paper Corporation (NYSE:CLW) has announced two key divisional executive appointments, effective January 1, 2013. Thomas A. Colgrove, president of the pulp and paperboard division, has been named president of the consumer products division, succeeding Robert P. DeVleming, who will retire after a transitional period during the first half of 2013. Danny G. Johansen, vice president of sales and marketing for the pulp and paperboard division, has been named president of the pulp and paperboard division.

"We look forward to the continued contributions from Tom and Dan in their new positions, and congratulate Bob on a long and successful career at Clearwater Paper," said Gordon Jones, chairman and CEO. "Tom and Dan are highly accomplished executives, each with more than 30 years of industry experience, and they have both been integral to our success. I am confident that, together with incoming CEO Linda Massman, they will successfully advance our strategic priorities and continue to deliver significant shareholder value."

Mr. Colgrove joined Clearwater Paper as vice president of the pulp and paperboard division in 2009. Before joining the company, he was North American senior director, family care products, for Kimberly-Clark Corporation, where he was responsible for seven manufacturing facilities with 4,200 employees. Mr. Colgrove's 25 years of tenure with Kimberly-Clark included management of numerous facilities and product lines. Prior to joining Kimberly-Clark, he also served as vice president of manufacturing for Central Paper Company, and held management positions with Procter & Gamble Corporation. Mr. Colgrove earned a Bachelor of Science in civil engineering from Lafayette College in Easton, Pennsylvania, and an MBA from the University of Chicago.

"Tom's extensive knowledge regarding running and managing major tissue operations will be a critical asset in helping drive stronger results for the company," said Clearwater Paper President and COO Linda Massman. "Tom has successfully led our pulp and paperboard division for more than three years, and we are fortunate to have an individual of his deep experience, which includes more than 33 years in consumer tissue products, leading our consumer tissue business."

Mr. Johansen joined the company in 1973 and during that time, has served in many leadership positions, including senior director of sales for pulp and paperboard, production and strategic planning manager for pulp and paperboard, and vice president of the western wood products division. He was named vice president of sales and marketing in 2008. Mr. Johansen received his Bachelor of Arts from California State University Humboldt.

"Dan's nearly 40 years of experience is both broad and deep at Clearwater Paper," continued Ms. Massman. "His intimate understanding of our customers and markets and his knowledge of our pulp and paperboard business make him a strong addition to our leadership team."

Added Ms. Massman, "On behalf of the entire management team and everyone at Clearwater Paper, I would like to thank Bob for his leadership and countless contributions to the company. Bob has been an integral part of our success, and we wish him the best in his retirement."

Russian pulp & paper companies prepared amendments to the draft Forest Policy

Austria’s capital hosted 17th Adam Smith Conference “Pulp & Paper in Russia and CIS”. Following the results of it, a workgroup will prepare a Resolution of the conference and send it to Russian officials. The document will contain detailed actions that should be included in the draft Forest Policy, according to the business community, as well as protective tariff measures that should foster competitiveness of Russian companies in the course of country’s accession to WTO.

Austria’s capital hosted 17th Adam Smith Conference “Pulp & Paper in Russia and CIS”. Following the results of it, a workgroup will prepare a Resolution of the conference and send it to Russian officials. The document will contain detailed actions that should be included in the draft Forest Policy, according to the business community, as well as protective tariff measures that should foster competitiveness of Russian companies in the course of country’s accession to WTO.

Forest Policy draft elaborated by Federal Forest Service hardly gives any attention to business interests, as it does not contain state measures to ameliorate business environment and establish up-to-date further processing capacities in Russia, Arkhangelsk pulpmill GR director Natalya Pinyagina said at the conference.

Pinyagina noticed that the forest industry which is a single system does not have centralized management, as it is diffused among various services. The draft policy does not set clear rules.

Natalya Pinyagina illustrated her words with the state of forest roads construction. In Russia, 1,000 ha of forest are served with 1.2 km of roads, which is 40 times less than in Europe. Despite numerous government regulations, the matter of road classification is not resolved. Pinyagina mentioned that two years ago the government allocated funds for forest roads construction for the first time in 15 years, but even this was complicated with numerous conditions, mainly co-financing from the regional budget.

Instruments of state control are needed along with state financing of forest roads and interest rate concessions for crediting upgrades and new facility projects, Pinyagina added.

Following the results of the conference, a workgroup will prepare a Resolution that will be sent to Russian officials, namely Ministry for Natural Resources, Federal Forest Service, Ministry for Industry and Trade and some others.