Ianadmin

UPM Raflatac opens new labelstock slitting and distribution terminal in Vietnam

UPM's Label business UPM Raflatac has opened a new labelstock slitting and distribution terminal in Ho Chi Minh City, Vietnam. The terminal began operations in November and will supply both film and paper label materials to customers in Vietnam.

UPM's Label business UPM Raflatac has opened a new labelstock slitting and distribution terminal in Ho Chi Minh City, Vietnam. The terminal began operations in November and will supply both film and paper label materials to customers in Vietnam.

The new terminal demonstrates UPM Raflatac’s commitment to the Southeast Asian markets. “Our presence in Vietnam will allow us to further expand and strengthen our customer network, by providing fast delivery, high quality products and technical support in this dynamic market,” says Nasuf Culha, General Manager, Southeast Asia.

“Customers in Vietnam have welcomed UPM Raflatac’s investment as a high quality global labelstock provider. We have recognised our customer’s needs, and we are very excited to be able to provide our localised product and service offer, catering to both the local and global customers and brand owners based in Vietnam,” says Poh-Keong Lee, Country Manager, Vietnam

The Board of Directors of Minerals Technologies Approves a Two-for-One Stock Split and Doubles Cash Dividend

The Board of Directors of Minerals Technologies Inc. (NYSE: MTX) has approved a two-for-one stock split in the form of a 100-percent stock distribution payable on December 11, 2012 to shareholders of record of the company's common stock on November 27, 2012. Trading in the common stock on a post-split adjusted basis will begin December 12, 2012.

The Board of Directors also declared a fourth quarter dividend of $0.05 per share payable on December 31, 2012 to shareholders of record December 21, 2012. This dividend will be paid on all shares post-split, effectively doubling dividend payments to shareholders of the company's common stock as of the record date.

"This two-for-one stock split and dividend increase is a result of the Board of Directors' continued confidence in the long-term growth and financial performance of Minerals Technologies," said Joseph C. Muscari, chairman and chief executive officer. "This action reflects our balanced approach of returning cash to shareholders while maintaining our ability to fund our growth strategies of geographic expansion and technological innovation, as well as continue our pursuit of mergers and acquisitions."

The stock split will result in an increase from approximately 17.7 million to 35.4 million in the number of outstanding shares of the company's common stock. Each shareowner of record on the close of business on the record date will receive one additional share of common stock for each share held.

Minerals Technologies' common stock began trading at $16 per share in 1992, when it became a publicly owned company. Since that time, the company's market capitalization has increased from $400 million to $1.24 billion.

Almere City scores with Satino Black

Almere City FC has a burning ambition. This professional football club from Almere wants to win a place in the Dutch Premier league, the highest level attainable in the Netherlands, during the next 5 to 6 years. In anticipation, renovation work has been carried out at the stadium during the past few months. “That work also includes the washroom and sanitation equipment”, says Managing Director Raymond Groenteman. “We recently chose in favour of the very stylish range of Satino Black products, which are a perfect match for our lofty ambitions.”

Almere City FC is currently being subjected to a facelift. The club collaborates closely with Ajax in terms of sporting development. Ajax sends young, promising players to Almere City where they can mature while playing in the Jupiler League. Trainer Fred Grim, who is also from Ajax, wants to use these players to help the club rise through the Leagues. Managing Director Raymond Groenteman: “When you acquire players like these, you need to ensure that they feel at home at a well equipped and friendly club. All your facilities have to be in perfect order and that includes the toilet areas.”

All the toilet areas in the main building were recently equipped with the complete range of Satino Black products; i.e. hygienic paper, hand soap, foam soap, toilet seat cleaner and dispensers. Raymond Groenteman: “It was the attractive design of the dispensers which swayed our decision in favour of Satino Black. Obviously, we also value the fact that Satino Black products are produced in a CO2-neutral process and don't leave harmful products behind in the environment.”

Manus Vos, the Managing Director of Total Cleaning Products, is the club's supplier. “Almere City FC is the first professional football club in the Netherlands to choose in favour of Satino Black and we are particularly proud of this achievement. In an organisation where you would expect all eyes to be focused on football, the club's directors are also concerned about style and appearances and that's not something you see every day. Professional football attracts a great deal of public interest and Satino Black is bound to benefit from that exposure. Almere City FC is working hard to achieve its ambitions; when the club scores, that's a goal for Satino Black as well. ”

Almere City not only applies the principles of Corporate Social Responsibility in its sustainability policy, but also in its charitable activities. The club is an ambassador for Stichting DON, a foundation that funds research into diabetes in the Netherlands, and the players all proudly wear DON's logo on their sleeve. Groenteman: “This was another project that we carefully selected. Diabetes is a silent killer. Hardly anybody is aware that the disease can kill you almost without warning. We wholeheartedly support this valuable project. We can safely say that Almere City FC is about much more than just football alone.”

Resolute Forest Products Increases FSC® Certification from 51% to 65%

Resolute Forest Products (NYSE: RFP) (TSX: RFP) has certified an additional 3.5 million hectares (8.6 million acres) of Company-managed forestlands in Quebec to Forest Stewardship Council® (FSC) standards. These new certifications raise the total area of Resolute tenures that are FSC-certified in North America to 15.8 million hectares (39 million acres), an area larger than Greece and twice the size of Ireland.

Resolute Forest Products (NYSE: RFP) (TSX: RFP) has certified an additional 3.5 million hectares (8.6 million acres) of Company-managed forestlands in Quebec to Forest Stewardship Council® (FSC) standards. These new certifications raise the total area of Resolute tenures that are FSC-certified in North America to 15.8 million hectares (39 million acres), an area larger than Greece and twice the size of Ireland.

- Resolute already world's largest manager of FSC-certified forests

The newly-certified areas include 2.2 million hectares (5.4 million acres) in the Baie-Comeau region of Côte-Nord and 1.3 million hectares (3.2 million acres) in the Senneterre region of Abitibi, the latter representing a joint certification with Tembec. The combined area is equivalent in size to Belgium.

Resolute has committed to increasing FSC certification of its forest tenures from 18% in 2010 to 80% in 2015. As of today, the Company has certified approximately 65% of its forests to FSC standards. 100% of the forests managed by Resolute are already certified to at least one of three internationally-recognized responsible forest management standards - FSC, Canadian Standards Association (CSA Z809) and Sustainable Forestry Initiative® (SFI).

"Obtaining FSC certification for an area this size is a major milestone," said Richard Garneau, President and Chief Executive Officer. "The dedication of our forestry teams has been instrumental in Resolute becoming the largest manager of FSC-certified forests in the world. Such an achievement demonstrates our ongoing commitment to responsibly managing the natural resources in our care."

FSC is an international certification and labelling system dedicated to promoting responsible management of the world's forests. Co-founded in Canada by the World Wildlife Fund in 1993, FSC works to endorse environmentally appropriate, socially beneficial and economically viable forest management. FSC is an important example of partnership between environmental organizations and businesses.

SOURCE: RESOLUTE FOREST PRODUCTS INC.

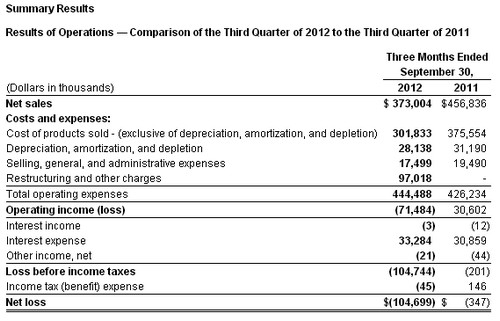

Verso Paper Corp. Reports Third Quarter 2012 Results

Verso's net sales for the third quarter of 2012 decreased $83.8 million, or 18.4%, compared to the third quarter of 2011, reflecting a 14.9% decline in total sales volume, which was driven by the closure of three paper machines late last year and the closure of the Sartell mill in the third quarter of this year, as well as a 4.0% decrease in the average sales price per ton for all of our products. Verso's gross margin was 19.1% for the third quarter of 2012 compared to 17.8% for the third quarter of 2011.

Verso reported a net loss of $104.7 million in the third quarter of 2012, or $1.98 per diluted share, which included $92.7 million of net charges from special items, or $1.75 per diluted share, primarily due to restructuring charges related to the closure of the Sartell mill in the third quarter of this year. Verso had a net loss of $0.3 million, or $0.01 per diluted share, in the third quarter of 2011, which included $1.1 million of charges from special items, or $0.02 per diluted share.

"We experienced our typical seasonal pick-up in demand during the third quarter in both coated freesheet and coated groundwood shipments. Industry operating rates were strong even though we continue to see a year over year drop-off in advertising spending which is impacted by the sluggish GDP growth. As we anticipated, coated groundwood pricing moved higher during the quarter and coated freesheet pricing was stable. Adjusted EBITDA of $50.2 million was about double what we recorded in the second quarter of this year driven by the stronger volumes, higher prices and improvements in our manufacturing costs resulting from our cost improvement programs and having the second quarter scheduled maintenance outages behind us," said David Paterson, President and Chief Executive Officer of Verso.

"During the quarter, we made the difficult decision not to restart the Sartell Mill and are well into evaluating the options relative to the decommissioning of the site and marketing the properties and assets for eventual sale.

"Looking ahead, we anticipate that coated groundwood prices will continue to move up during the fourth quarter and coated freesheet pricing to remain relatively stable. Coated volumes will move slightly lower than the seasonally stronger third quarter, but we do not anticipate a significant drop-off. We'll finish the year at very good inventory levels with coated groundwood inventory fairly tight. Operating costs and input prices should remain flat to down slightly, although we do have a scheduled maintenance outage at our Quinnesec Mill during the quarter. Finally, we are excited about the start-up of ourBucksport Renewable Energy Project during the quarter which will complete the last of the initiatives included in the first phase of our energy strategy that you've heard us talk a lot about."

Net Sales. Net sales for the third quarter of 2012 decreased 18.4%, to $373.0 million from $456.8 million in the third quarter of 2011, led by a quarter-over-quarter decline in the price of pulp. Additionally, total sales volume was down 14.9% compared to the third quarter of 2011, which was driven by the shutdown of three paper machines late last year and the closure of the Sartell mill in the third quarter of this year, as well as a 4.0% decrease in the average sales price per ton for all of our products.

Net sales for our coated papers segment decreased 19.7% in the third quarter of 2012 to $300.9 million from $374.5 million for the same period in 2011, due to a 17.4% decrease in paper sales volume, which was driven by the shutdown of three paper machines late last year and the closure of the Sartell mill in the third quarter of this year. The average sales price per ton of coated paper decreased 2.8% compared to the same period last year.

Net sales for our market pulp segment decreased 13.1% in the third quarter of 2012 to $35.1 million from $40.4 million for the same period in 2011. The average sales price per ton decreased 11.0% while sales volume decreased 2.3% compared to the third quarter of 2011.

Net sales for our other segment decreased 11.7% to $37.0 million in the third quarter of 2012 from $41.9 million in the third quarter of 2011. This decrease was due to an 11.5% decrease in sales volume, while the sales price per ton remained flat.

Cost of sales. Cost of sales, including depreciation, amortization, and depletion, was $329.9 million in the third quarter of 2012 compared to $406.7 million in 2011, reflecting realized cost reduction from the shutdown of three paper machines late last year and the closure of the Sartell mill in the third quarter of this year. Our gross margin, excluding depreciation, amortization, and depletion, was 19.1% for the third quarter of 2012 compared to 17.8% for the third quarter of 2011. Depreciation, amortization, and depletion expenses were $28.1 million for the third quarter of 2012 compared to $31.2 million for the third quarter of 2011.

Selling, general, and administrative. Selling, general, and administrative expenses were $17.6 million in the third quarter of 2012 compared to $19.5 million for the same period in 2011, primarily driven by a decrease in personnel costs.

Restructuring and other charges. Restructuring and other charges for the third quarter of 2012 was $97.0 million, and consisted primarily of fixed asset and other impairment charges of $75.8 million and severance and benefit costs of $16.3 million related to the closure of the Sartell mill.

Interest expense. Interest expense for the third quarter of 2012 was $33.2 million compared to $30.8 million for the same period in 2011.

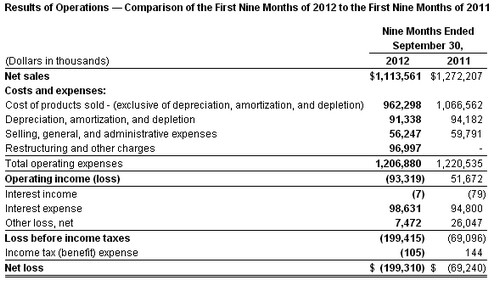

Net Sales. Net sales for the nine months ended September 30, 2012, decreased 12.5% to $1,113.6 million from $1,272.2 million for the nine months ended September 30, 2011, reflecting an 8.9% decrease in total sales volume, which was driven by the shutdown of three paper machines late last year and the closure of the Sartell mill in the third quarter of this year. Additionally, the average sales price for all of our products decreased 3.8%, led by a decline in the price of pulp.

Net sales for our coated papers segment decreased 15.1% to $889.1 million for the nine months ended September 30, 2012, from $1,046.9 million for the nine months ended September 30, 2011. This change reflects a 13.2% decrease in paper sales volume, which was driven by the shutdown of three paper machines late last year and the closure of the Sartell mill in the third quarter of this year. The average sales price per ton of coated paper decreased 2.1% compared to the same period last year.

Net sales for our market pulp segment decreased 7.2% to $104.2 million for the nine months ended September 30, 2012, from $112.3 million for the same period in 2011. This decrease was due to a 12.5% decline in the average sales price per ton while sales volume increased 6.0% compared to the nine months ended September 30, 2011.

Net sales for our other segment increased 6.4% to $120.3 million for the nine months ended September 30, 2012, from $113.0 million for the nine months ended September 30, 2011. The improvement in 2012 is due to a 9.2% increase in sales volume, reflecting the continued development of new paper product offerings for our customers. The average sales price per ton decreased 2.5% compared to the nine months ended September 30, 2011.

Cost of sales. Cost of sales, including depreciation, amortization, and depletion, were $1,053.6 million for the nine months ended September 30, 2012, compared to $1,160.7 million for the same period last year, reflecting realized cost reduction from the shutdown of three paper machines late last year and the closure of the Sartell mill in the third quarter of this year. Our gross margin, excluding depreciation, amortization, and depletion, was 13.6% for the nine months ended September 30, 2012, compared to 16.2% for the nine months ended September 30, 2011, reflecting higher average sales prices during 2011. Depreciation, amortization, and depletion expenses were $91.3 million for the nine months ended September 30, 2012, compared to $94.2 million for the nine months ended September 30, 2011.

Selling, general, and administrative. Selling, general, and administrative expenses were $56.3 million for the nine months ended September 30, 2012, compared to $59.8 million for the same period in 2011, primarily driven by a decrease in personnel costs and other fees.

Restructuring and other charges. Restructuring and other charges for the nine months ended September 30, 2012 was $97.0 million, and consisted primarily of fixed asset and other impairment charges of $75.8 million and severance and benefit costs of $16.3 million related to the closure of the Sartell mill.

Interest expense. Interest expense for the nine months ended September 30, 2012, was $98.6 million compared to $94.8 million for the same period in 2011.

Other loss, net. Other loss, net for the nine months ended September 30, 2012, was a net loss of $7.5 million compared to a net loss of $26.1 million for the nine months ended September 30, 2011. Included in the results for 2012 and 2011 were losses of $8.2 million and $26.1 million, respectively, related to the early retirement of debt in connection with debt refinancing.

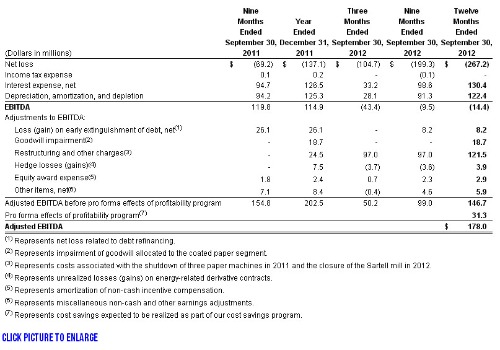

Reconciliation of Net Income to Adjusted EBITDA

The agreements governing our debt contain financial and other restrictive covenants that limit our ability to take certain actions, such as incurring additional debt or making acquisitions. Although we do not expect to violate any of the provisions in the agreements governing our outstanding indebtedness, these covenants can result in limiting our long-term growth prospects by hindering our ability to incur future indebtedness or grow through acquisitions.

EBITDA consists of earnings before interest, taxes, depreciation, and amortization. EBITDA is a measure commonly used in our industry, and we present EBITDA to enhance your understanding of our operating performance. We use EBITDA as a way of evaluating our performance relative to that of our peers. We believe that EBITDA is an operating performance measure, and not a liquidity measure, that provides investors and analysts with a measure of operating results unaffected by differences in capital structures, capital investment cycles, and ages of related assets among otherwise comparable companies. Adjusted EBITDA is EBITDA further adjusted to eliminate the impact of certain items that we do not consider to be indicative of the performance of our ongoing operations and other pro forma adjustments permitted in calculating covenant compliance in the indentures governing our debt securities to test the permissibility of certain types of transactions. Adjusted EBITDA is modified to align the mark-to-market impact of derivative contracts used to economically hedge a portion of future natural gas purchases with the period in which the contracts settle and is modified to reflect the amount of net cost savings projected to be realized as a result of specified activities taken during the preceding 12-month period. You are encouraged to evaluate each adjustment and to consider whether the adjustment is appropriate. In addition, in evaluating adjusted EBITDA, you should be aware that in the future, we may incur expenses similar to the adjustments included in the presentation of adjusted EBITDA. We believe that the supplemental adjustments applied in calculating Adjusted EBITDA are reasonable and appropriate to provide additional information to investors. We also believe that Adjusted EBITDA is a useful liquidity measurement tool for assessing our ability to meet our future debt service, capital expenditures, and working capital requirements.

However, EBITDA and Adjusted EBITDA are not measurements of financial performance under U.S. GAAP, and our EBITDA and Adjusted EBITDA may not be comparable to similarly titled measures of other companies. You should not consider our EBITDA or Adjusted EBITDA as an alternative to operating or net income, determined in accordance with U.S. GAAP, as an indicator of our operating performance, or as an alternative to cash flows from operating activities, determined in accordance with U.S. GAAP, as an indicator of our cash flows or as a measure of liquidity. The following table reconciles net loss to EBITDA and Adjusted EBITDA for the periods presented.

Forward-Looking Statements

In this press release, all statements that are not purely historical facts are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements may be identified by the words "believe," "expect," "anticipate," "project," "plan," "estimate," "intend," and similar expressions. Forward-looking statements are based on currently available business, economic, financial, and other information and reflect management's current beliefs, expectations, and views with respect to future developments and their potential effects on Verso. Actual results could vary materially depending on risks and uncertainties that may affect Verso and its business. For a discussion of such risks and uncertainties, please refer to Verso's filings with the Securities and Exchange Commission. Verso assumes no obligation to update any forward-looking statement made in this press release to reflect subsequent events or circumstances or actual outcomes.

Source: Verso Paper Corp.

UNFCCC registered project of Russian Lesozavod-25 converting wood waste into heat & power

The project of Lesozavod-25 CJSC (Russia, belongs to Titan Group) which entails converting bark waste for heat and power generation under Article 6 of Kyoto protocol is registered with No. RU1000409 by the Secretariat of UN Framework Convention on Climate Change (UNFCCC).

The project included consutrction of a bark boiler at Tsiglomen department and heat and power plant at Maymaksanskiy department of the mill. The plants were launched in April 2006 and May 2008 respectively.

The company estimates that boost in waste use efficiency generated by this project enabled to cut greenhouse gas emissions by 60% down to 72,500 tons in 2008-2012. Average environmental load of the mill due to this project curtailed by 25%.

According to UNFCCC document, curtailment of emissions is 215,300 tons in CO2 equivalent.

Framework Convention on Climate Change was signed on May 09, 1992, and one of its first goals was to establish national-scale cadastres on greenhouse gases. The convention is ratified by 195 countries.

ANDRITZ to supply four additional machines with Steel Yankees

International technology Group ANDRITZ received an order from the Hengan Group, China, to supply four tissue machines with Steel Yankees to mills in Changde and Chongqing. After the start-up of these machines, which is scheduled for 2014, the Hengan Group will be producing tissue on 13 ANDRITZ tissue machines.

This year, ANDRITZ has successfully started up four high-speed tissue machines for the Hengan Group, two of which are fitted with the largest steel Yankees for tissue applications.

The four new tissue machines, PrimeLineTM W8 designs, will have a design speed of 2,000 m/min and a width of 5.6 m. Each will be equipped with a Steel Yankee (diameter 18 ft.). ANDRITZ’s scope of supply also includes the complete stock preparation plant and the automation equipment.

The ANDRITZ PULP & PAPER business area, which manufactures its tissue machine components in Europe and China, is confirming its position as one of the leading suppliers of tissue machines and local services in China. ANDRITZ will be presenting its latest tissue technology at Tissue World Asia in Shanghai (November 14-16, 2012) and at Tissue World Barcelona (March 19-21, 2013).

Metso’s OptiFiner Pro refiner wins innovation award

Metso is the winner of this year’s prestigious ‘Palme d’Or’ Innovation Award, given by ATIP, the French Paper Industry Technical Association, for its OptiFiner Pro refiner. ATIP awarded the ‘Palme d’Or’ Award to Metso in its innovation contest arranged in connection with the ATIP congress in October. Highly regarded in the European pulp and paper industry, the ATIP Innovation Award is selected by a committee consisting of Paper Mill Managers, R&D Directors, Technology Directors and Production Managers from the French paper industry.

Metso is the winner of this year’s prestigious ‘Palme d’Or’ Innovation Award, given by ATIP, the French Paper Industry Technical Association, for its OptiFiner Pro refiner. ATIP awarded the ‘Palme d’Or’ Award to Metso in its innovation contest arranged in connection with the ATIP congress in October. Highly regarded in the European pulp and paper industry, the ATIP Innovation Award is selected by a committee consisting of Paper Mill Managers, R&D Directors, Technology Directors and Production Managers from the French paper industry.

Since its introduction in 2010, Metso’s revolutionary low consistency refining concept with the OptiFiner Pro refiner has established a totally new level of performance for low consistency refining. In conventional refining, fibers have to travel the full length of the refining zone and some fibers suffer excessive impacts leading to increased fines, weakening of the refined fibers and inefficient delivery of energy to the fiber. OptiFiner Pro feeds the pulp through the segments, evenly distributed across the bars directly in the refining zone where fiber treatment occurs. All the stock is treated evenly, providing a  higher refiner loadability and better energy efficiency. Documented results have shown that one OptiFiner Pro can replace two traditional refiners and deliver electrical energy savings of over 20 % with an improved or the same refining result as before.

higher refiner loadability and better energy efficiency. Documented results have shown that one OptiFiner Pro can replace two traditional refiners and deliver electrical energy savings of over 20 % with an improved or the same refining result as before.

OptiFiner Pro is suitable for all kinds of LC-refining applications including short hardwood fibers as well as recycled fibers requiring fibrillation at low refining intensities. Extremely compact and quiet running, three different capacity models are offered for maximum flexibility in installation and application. As well as energy and raw material savings, eliminating two refiners reduces maintenance and wear-part replacement costs, in one installation to half.

Satino Black wins WWF Paper Award

Van Houtum received the international WWF Environmental Paper Award 2012 on 13 November. We won this award because our Cradle to Cradle-certified hygienic paper, Satino Black, scores highly in the area of environmental performance.

A total of 11 companies received the award because they are transparent about their production process or achieve outstanding environmental performance with a specific product. Van Houtum is the only winner from the Netherlands.

The award is an initiative of the World Nature Fund and designed to put the spotlight on companies that have submitted their brands for inclusion in the WWF Check Your Paper database. A listing in this database demonstrates how transparent the producers are and how sustainable their production chain is. The database can be viewed via the WWF website: checkyourpaper.panda.org. Buyers can use this information when selecting specific companies or products.

The winning brands achieve a score of at least 90 percent in terms of overall environmental performance, or are assigned the maximum attainable five-star rating in the forest, water and climate performance categories. Satino Black complies with both requirements, achieving five stars in all of the categories and a score of 98 percent.

IPX India Conference - A World of Opportunities

Taking place in the Bombay Convention and Exhibition Centre on December 13-15, 2012, IPX India is an exhibition and conference for all suppliers, buyers and industry professionals of the fastest growing pulp and paper industry in the world today!

The two day long technical conference, with the main theme Paper Industry – A World of Opportunities, will focus on the possibilities and challenges facing the current and future Indian pulp and paper industry. Key note speaker of the event is Mr. Timo Suhonen, Poyry Management Consulting OY, Finland. Through lectures, panel discussions and case studies, renowned Indian and International experts and senior industry professionals will give their views on themes like

- Overview of environmental concerns in pulp & paper industry

- A proactive strategy for long term sustainability of paper industry

- Rawmaterial Bottleneck in paper industry

- Possibility of enhancing the capability of Indian Paper Industry through value added product lines

The programme is tentative and might be subject to change without prior notice

For full conference programme, please click here.

The conference will be held on a stage in the middle of the exhibition floor meaning no more conference fees and an easier way for people to meet, making the conference available to everyone visiting IPX India. Business related seminars and social activities will make sure that participants will be getting the most out of their IPX India experience.

The planning of the conference programme has been overseen by the Advisory Council in the presence of Mr Arun Maira, Member of the Planning Commission, Government of India.

The organisers are happy to announce two new supporting partners of the event, IPPTA , Indian Pulp and Paper Technical Association, and CPPRI, Central Pulp and Paper Research Institute.