Ian Melin-Jones

International Paper Declares Dividend

International Paper (NYSE: IP) today declared a quarterly dividend of $0.2625 per share for the period from July 1, 2011, to September 30, 2011, inclusive, on its common stock, par value $1. This dividend is payable on September 15, 2011, to holders of record at the close of business on August 15, 2011.

Today the company also declared a regular quarterly dividend of $1 per share for the period from July 1, 2011, to September 30, 2011, inclusive, on the cumulative $4 preferred stock of the company. This dividend is also payable on September 15, 2011, to holders of record at the close of business on August 15, 2011.

Nalco Announces Dates for Second-Quarter Financial Results and Conference Call/Webcast

Nalco (NYSE: NLC), providing essential expertise for water, energy and air, announced today it will release its second-quarter 2011 financial results after market close on August 2.

At 10 a.m. ET on August 3, the Company will hold a conference call and live audio webcast led by Nalco Chairman and Chief Executive Officer J. Erik Fyrwald and Executive Vice President and Chief Financial Officer Kathryn Mikells to discuss these results.

Date:8/3/2011

Start Time:10 a.m. ET / 9 a.m. CT / 8 a.m. MT / 7 a.m. PT

Length: 60 minutes

Dial-in Telephone Number: 1-913-312-1480

Confirmation Code: 1549570

To help ensure the conference call begins in a timely manner, please dial in five to 10 minutes prior to the scheduled start time on August 3.

The audio webcast will be available through the Investor Relations section of Nalco's Web site, www.nalco.com/investors. Following the live event, an archived version of the Webcast will also be available on the Nalco Web site under Investor Relations, Events/Presentations.

Ashland Inc. Q3 Earnings Webcast Set for 9 a.m. EDT, July 28

Ashland Inc. has announced that on Thursday, July 28, at 9 a.m. EDT, it will conduct a live webcast of its third-quarter earnings presentation to the investment community. The presentation will cover results for the quarter ended June 30, 2011, the third quarter of Ashland's 2011 fiscal year. The company's results will be issued earlier in the day.

In attendance at the presentation will be: James J. O'Brien, chairman and chief executive officer; Lamar M. Chambers, senior vice president and chief financial officer; John E. Panichella, president, Ashland Aqualon Functional Ingredients; and David A. Neuberger, director, investor relations.

The webcast, which will last approximately 60 minutes, will be accessible through Ashland's Investor Relations website, http://investor.ashland.com, along with supporting materials. Following the live event, an archived version of the webcast and supporting materials will be available on the Ashland website for 12 months. Minimum requirements to listen to the webcast include the free Windows MediaPlayer software and a 28.8 Kbps connection to the Internet.

In more than 100 countries, the people of Ashland Inc. (NYSE: ASH) provide the specialty chemicals, technologies and insights to help customers create new and improved products for today and sustainable solutions for tomorrow. Our chemistry is at work every day in a wide variety of markets and applications, including architectural coatings, automotive, construction, energy, personal care, pharmaceutical, tissue and towel, and water treatment. Visit www.ashland.com to see the innovations we offer through our four commercial units - Ashland Aqualon Functional Ingredients, Ashland Hercules Water Technologies, Ashland Performance Materials and Ashland Consumer Markets (Valvoline).

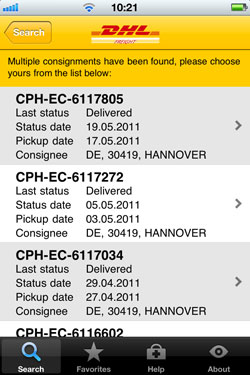

DHL to increase visibility for freight shipment processes

DHL Freight now offers its customers an upgraded and uniform way to track shipments across Europe. The increased flexibility of the new Active Tracing system makes it easier for them to check the whereabouts of their road freight transports. Customers can now receive up to 30 status information events from across the entire transportation chain, from pick-up to delivery. And with the additional Active Tracing apps for iPhones and Android smartphones designed especially for small and medium-sized businesses, customers will be able to access this information anywhere and anytime.

DHL Freight now offers its customers an upgraded and uniform way to track shipments across Europe. The increased flexibility of the new Active Tracing system makes it easier for them to check the whereabouts of their road freight transports. Customers can now receive up to 30 status information events from across the entire transportation chain, from pick-up to delivery. And with the additional Active Tracing apps for iPhones and Android smartphones designed especially for small and medium-sized businesses, customers will be able to access this information anywhere and anytime.

"The new application offers our customers enhanced transparency and control over their shipments. This represents a significant benefit mainly for companies who transport time-sensitive, temperature-controlled or premium goods such as in the technology and pharmaceutical sectors. With the Active Tracing apps we also respond to an ever increasing need for mobile and flexible services - taking the customer experience with our track and trace service to the next level of convenience and thereby simplifying their lives," says Henning Goldmann, Chief Information Officer at DHL Freight.

DHL's new online Active Tracing site, which combines all existing European tracing systems into one, is particularly useful for multinational companies that do business in various European countries. Customers can log on to http://activetracing.dhl.com and receive constant updates about the departures, current locations, destinations and arrival dates of their shipments. They can look up shipping histories for the last six months and can even create their own personalized reports.

Divestment process of M-real' s Premium Papers business postponed

M-real Corporation’s negotiations to divest M-real’s Premium Papers business to a sister company of German Papierwerke Lenk AG have been suspended. M-real, part of Metsäliitto Group, announced in April 2011 the Memorandum of Understanding (MoU) regarding the divestment of the Germany based Reflex mill’s Premium Papers business to a sister company of Papierwerke Lenk AG. Consequently M-real expected to book a negative EUR 12 million non-recurring item in Speciality Papers business area. Transaction was expected to be closed during 2Q 2011.

Parties will evaluate possibilities to continue negotiations later and M-real will also consider other options to divest Premium Papers business. The EUR 12 million negative non-recurring item will not be booked in M-real’s in 2Q 2011 result.

Temple-Inland Board of Directors to Review Announced Tender Offer from International Paper

Temple-Inland Inc. has acknowledged that International Paper Company (NYSE: IP) announced that it will be commencing an unsolicited offer to acquire all of the outstanding shares of common stock of Temple-Inland for a price of $30.60 per Temple-Inland share in cash.

Consistent with its fiduciary duties and as required by applicable law, Temple-Inland's Board of Directors will review the offer to determine the course of action that it believes is in the best interests of the Company and its stockholders. Temple-Inland's stockholders are advised to take no action at this time pending conclusion of the review of the tender offer by Temple-Inland's Board of Directors.

Temple-Inland's Board of Directors, in consultation with its independent financial and legal advisors, intends to advise stockholders of its formal position regarding the announced offer within ten business days from the date of commencement of the unsolicited tender offer by making available to stockholders and filing with the U.S. Securities and Exchange Commission (the "SEC") a Solicitation/Recommendation Statement on Schedule 14D-9.

Goldman, Sachs & Co. is acting as financial advisor to Temple-Inland, and Wachtell, Lipton, Rosen & Katz is acting as Temple-Inland's legal counsel.

International Paper Commencing Tender Offer to Acquire All Outstanding Shares of Temple-Inland

International Paper Company announced yesturday that it is commencing a fully financed tender offer for all outstanding common shares of Temple-Inland Inc. (NYSE: TIN) for $30.60 per share in cash. The all-cash offer represents a 46% premium to Temple-Inland's closing price on June 6, 2011, the last trading day prior to public disclosure of International Paper's proposal to acquire Temple-Inland. The offer will commence tomorrow and will expire at 5:00 p.m.New York City time on August 9, 2011, unless extended.

International Paper chairman and CEO John Faraci said, "We believe Temple-Inland's price expectations are unrealistic and their unwillingness to engage in any meaningful discussions with respect to value has left us with no alternative but to make our offer directly to Temple-Inland shareholders. While we prefer to reach a negotiated, friendly deal, we are committed to remaining disciplined and completing this transaction at a fair price for both companies' shareholders. We are confident in our ability to secure the necessary regulatory approvals to complete this transaction in a timely manner."

Faraci continued, "We respect Temple-Inland, but we disagree on the realistic standalone value of the company, which we believe is currently $21 to $24 per share. The premium we are offering is substantial, the multiple is well above recent directly comparable transactions, and we are providing Temple-Inland shareholders the certainty of cash in the midst of a very uncertain economic environment. At $30.60, we believe our offer fully reflects the future business plans and economic outlook for Temple-Inland and for the sector, including the current environment and outlook for containerboard, the potential cyclical improvement in Temple-Inland's building products segment and near-term expected increases in Temple-Inland's earnings. We are confident that Temple-Inland shareholders support a transaction, and it is now incumbent upon the Temple-Inland Board to take the next step."

International Paper noted that its fully financed, all-cash offer represents compelling value when compared against all reasonable metrics and precedents, including:

- -A 46% premium to Temple-Inland's closing price of $21.01 on June 6, 2011, the last trading day prior to public disclosure of the offer

- -A 30% premium over the present value of average analyst price targets for a standalone Temple-Inland of $23.57

- -A highly attractive multiple of 9.8x Temple-Inland's 2011 estimated EBITDA (9.0x excluding timber tax liability) versus forward EBITDA multiples of recent precedent transactions of -6.1x for Smurfit-Stone and 6.3x for Weyerhaeuser's corrugated packaging business, and well above Temple-Inland's average forward EBITDA multiple of 6.1x since 2008

- -The fact that IBES research estimates for Temple-Inland's EBITDA have come down since International Paper's proposal was made public, given market expectations

- -A significant premium to Temple-Inland's standalone value which, based on pre-offer trading and independent analyst estimates of Temple-Inland's earnings potential, International -Paper and third parties credibly estimate at $21 to $24 per share. This compares to Temple-Inland's contention that standalone value should reflect multiple expansion to near 7x applied to an above-average estimated EBITDA for 2012 - a view we believe neither investors nor third parties share

- -Realization of the benefits from a potential cyclical improvement in Temple-Inland's building products segment, even with a recovery uncertain and likely years away

- -The benefits of more than half of the synergies that are expected to result from the combination

- -The certainty of cash, versus the uncertainty of any potential future benefits to shareholders that Temple-Inland's current business plan may, or may not, deliver through cyclical and operational improvement

International Paper has secured committed financing from UBS Investment Bank, and the offer will not be conditioned on financing. The offer will be conditioned on there being validly tendered and not withdrawn at least a majority of the total number of Temple-Inland shares outstanding on a fully diluted basis, Temple-Inland's Board of Directors redeeming or invalidating its "poison pill" shareholder rights plan, the receipt of regulatory approvals and other customary closing conditions as described in the Offer to Purchase.

International Paper also is filing notification tomorrow with the Federal Trade Commission ("FTC") and Department of Justice ("DOJ") as required under the Hart-Scott-Rodino Antitrust Improvements Act of 1976 (HSR). The HSR waiting period will expire on July 27, 2011 unless extended by the FTC or DOJ, which would not be unusual in these circumstances.

The Offer to Purchase, Letter of Transmittal and related documents will be filed tomorrow with the U.S. Securities and Exchange Commission (SEC). Temple-Inland's stockholders may obtain copies of all of the offering documents free of charge at the SEC's website (www.sec.gov) or by directly requesting copies of all of the offering documents free of charge at Innisfree M&A Incorporated, the Information Agent for the offer, at (877) 456-3488 (toll-free). Banks and brokers may call collect at (212) 750-5833. The tender offer will expire at 5:00 p.m.New York City time on August 9, 2011, unless extended in the manner set forth in the Offer to Purchase.

International Paper's dealer managers for the tender offer are UBS Investment Bank and Evercore Partners. Its legal advisor is Debevoise & Plimpton LLP.

Continued expansion for Endress+Hauser Conducta

Endress+Hauser inaugurates new premises at the liquid analysis competence center in Gerlingen

Endress+Hauser celebrates the expansion of its competence center for liquid analysis. Floor space at the headquarters of Endress+Hauser Conducta has been trebled the last years – evidence of the company’s commitment to its location in Gerlingen, Germany, which can look back on decades of successful business. “Our objective is to continue to grow and to create new jobs,” declared Managing Director Dr Manfred Jagiella at the inauguration.

Endress+Hauser Conducta has invested more than 15 million euros in the two building projects over the past three years. The company now has in excess of 20,000 square meters floor space at its Gerlingen site. In addition to further production and office space, a new laboratory and a seminar center have been added. Modern training and seminar rooms and the company restaurant ‘SkyRest’ are located on the upper floor.

The clean design of the glass facade and supporting framework links the new buildings with the old sections. A striking canopy construction marks the new main entrance. Visitors enter the premises via a transparent, generously proportioned reception area. The heart of this communicative architecture is an atrium with glass roof. “As the central element, the atrium reflects a windmill, linking all sections of the building,” Manfred Jagiella explained the concept. The galleries opening upwards convey a sense of openness and transparency to visitors and employees alike.

Room for further innovation

“Work has to be fun – but it also has to be successful,” emphasized Manfred Jagiella. “The new building will support us in achieving these objectives.” Klaus Endress, CEO of the Endress+

Hauser Group, stressed the significance of liquid analysis devices in the future product portfolio. Reflecting these ideas, Professor Hans-Jörg Bullinger, president of the German research organization Fraunhofer Society, spoke about ‘The outlook for future markets – Germany as a location with innovation potential’. During a guided tour the guests – including Georg Brenner, the Mayor of Gerlingen – were able to see the company’s performance for themselves.

Endress+Hauser Conducta is a leading international supplier in the field of liquid analysis measurement including pH, conductivity, oxygen, chlorine, turbidity, ammonium, nitrate and phosphate concentration as well as other chemical substances that can be identified in liquids. The devices are deployed in all process industries, such as the chemical, life sciences, food & beverages, water & wastewater, pulp & paper and power & energy industries. The comprehensive product portfolio ranges from sensors, armatures and transmitters right through to complete sampling systems and the seamless integration of measuring points in modern process control systems.

Endress+Hauser Conducta continually invests in the expansion of its capacity and resources. Managing Director Manfred Jagiella places special emphasis on the human factor: highly motivated and committed employees form the basis of the successful development of the company. The company therefore values close cooperation with universities and research establishments, well-grounded in-house training and continual further development.

Metso to supply off-machine coater main parts for Ilim Group’s Koryazhma Branch mill in Russia

Metso will supply the main components for the coated woodfree paper line’s off-machine coater at the Koryazhma Branch mill of Ilim Group in Koryazhma, Russia. The start-up of the PM 7 off-machine coater is scheduled for the fourth quarter of 2013. The value of the order is approximately EUR 20 million.

Metso’s off-machine coater will be 4-stage, 2-sides, and the delivery will include a ValSizer coating station, an OptiSoft Gloss calender, two energy efficient high-drying-capacity PowerDry Plus gas dryers and a WinDrum winder. The Metso DNA automation system will comprise quality controls, process controls and machine condition monitoring, as well as electric drive and machine controls for the coater and the winder. Metso’s supply will also include a coating color kitchen with ultrafiltration and a StreamLine C roll handling and wrapping machine, serving both the PM 7 paper machine and the coater. The PM 7 will produce uncoated and coated woodfree paper in the basis weight range of 60 to 170 g/m2.

Ilim Group is a leading Russian pulp and paper producer, headquartered in St. Petersburg. The strategic partner of Ilim Group is International Paper, a global leader in the paper and packaging industry. The total annual pulp and paper production volume of Ilim Group is more than 2.3 million tonnes. Ilim Group employs over 20,000 people.

Viscose Fibers Business turned profitable in May

Neo Industrial's Viscose Fibers business, namely Avilon Ltd, has turned profitable in May. In its interim report for the first quarter of 2011 on 5 May, 2011, Neo Industrial said it expected the Viscose Fibers business' operating profit to be positive on the second half of the year.

Avilon's operations, started in January 2011, turned profitable as the company introduced its in-house developed technology for converting paper grade pulp into a suitable material for viscose production. Having previously suffered from availability problems and high price of dissolving pulp, Avilon has in this way significantly lowered its production costs.

- I am sure that the business continues challenging due to the turbulent textile market and the slow fire retardant fiber market in the United States. However, Avilon's raw material management and delivery accuracy are now in place, and the business has all the prerequisites for profitability, comments Neo Industrial's Managing Director Markku E. Rentto.

Neo Industrial announces its second quarter earnings on 4 August, 2011.