Displaying items by tag: Wood Resources International LLC

WRI Market Insights, Feb 2022: Russia’s invasion of Ukraine will likely halt planned investments in the Russian forest industry

Russia’s invasion of Ukraine is likely to impact global trade in the coming months. Increased sanctions against trading with Russia and difficulty with financial transactions will probably interrupt and re-direct shipments of forest products throughout the world. As a result, trade with Russia will likely decline, impacting long-established international trade flows of forest products.

Countries like China and India, who have reluctantly supported Russia in the conflict, may also be affected by limited trade sanctions. This development would mainly affect China, which relies on the importation of forest products, including logs, wood chips, lumber, pulp, and paper from North America, Europe, Oceania, and Latin America for domestic use. These world regions are considering expanded sanctions for Russia and countries that directly or indirectly support Russia’s attack on Ukraine.

Governments in North America and Europe are also seriously considering locking Russia out of the international SWIFT money transaction system. If this occurs, Russian companies will find it challenging to trade with the world.

Governments in North America and Europe are also seriously considering locking Russia out of the international SWIFT money transaction system. If this occurs, Russian companies will find it challenging to trade with the world.

Russia exported forest products were valued at over 12 billion dollars in 2021, and imports of paper products (mainly) are valued at about 2 billion dollars, according to Wood Resource Quarterly. Much of this trade is in jeopardy.

Russia is the largest lumber exporter globally and ranks as the seventh biggest exporter of forest products worldwide. Forest products exports from Russia have increased rapidly in the past five years, led by softwood lumber and paper products (see table).

Export value in 2021 Change 2017-2021

(Billion US $) (%)

Softwood lumber 5.8 24

Paper products 2.0 11

Wood panels 1.9 15

Wood pulp 1.3 19

Hardwood logs 0.5 15

Softwood logs 0.5 -52

Wood pellets 0.3 102

Total 12.2 24

Note. An estimated 40% of exports were destined for China, while the remainder was predominantly shipped to European markets.

Russia has vastly under-utilized forest resources and has the potential to increase timber harvests to supply its domestic industry. To meet increased global demand for forest products, the Russian government recently initiated programs to encourage investments in the sector to both expand/modernize existing manufacturing plants and build greenfield facilities.

However, it is likely that many investments projects in the forest products manufacturing sector in Russia will grind to a halt as the growing list of sanctions and financial transaction restrictions take effect.

Are you interested in the worldwide wood products market information? The Wood Resource Quarterly is a 75-page quarterly report established in 1988 and has subscribers in over 30 countries. The publication tracks prices for sawlog, pulpwood, lumber, and pellets and reports on trade and wood market developments in key regions worldwide. For more insights on the latest international forest product market trends, please visit www.WoodPrices.com

Track global sawlog, pulpwood and lumber prices and trade - subscribe to the 75-page market report Wood Resource Quarterly - read by forest industry analysts and company executives in over 30 countries since 1988

New Focus Reports for 2021 (click for info):

Russian Log Export Ban in 2022 - Implications to the Global Forest Industry

European Pellet Outlook: Where will the raw material come from?

Sawlog supply in US South is tightening, opportunities for pulp and wood pellet expansion

The US South’s softwood industry has enormous potential for a variety of reasons. The region has a significant forest resource with room for expansion, low and stable wood costs, and a thriving lumber and pellet manufacturing sector. The local forest industry is set to grow in the coming years and play a more prominent role in regional and global forest product markets. This expansion will lead to a tighter log market, but growth will still exceed harvests (drain) in most states. Longer-term, the drain could overtake growth in some states unless the productive forest area expands, harvest yields improve, or access to small woodlots and underutilized forest increases. It should be noted that wood markets are often very local, and the demand-supply balance can vary significantly in micro-markets within individual states.

The sawmilling industry is the largest end-user of softwood logs in the US South and is also the sector that has increased capacity the most over the past decade. Lumber output has grown from 26% of North American production in 2011 to 33% in 2021. Lumber producers in the region are still not likely to be significant players in international markets due to expected strong domestic demand and declining imports from Canada. However, the continued expansion in capacity will help reduce the US lumber import demand in the coming years.

Pulp mills receive about one-third of harvested softwood roundwood in the US South. With the pulp sector not expected to expand in the short-term, wood fiber demand will not change much. With increases in residue supply from the expanding lumber sector, there will be less demand for softwood pulplogs, a trend that will probably intensify in the coming years.

Pulp mills receive about one-third of harvested softwood roundwood in the US South. With the pulp sector not expected to expand in the short-term, wood fiber demand will not change much. With increases in residue supply from the expanding lumber sector, there will be less demand for softwood pulplogs, a trend that will probably intensify in the coming years.

In the new Focus Report: US South Softwood Industry - Outlook for the world's most important softwood fiber basket, Wood Resources International (WRI) and O'Kelly Acumen establish a fact base around the forest resources and industry in the Southern US. The report also highlights plans for increased manufacturing capacity, reduced US lumber import needs, and opportunities for forest products exports from the world's largest softwood forest product-producing region.

One of the conclusions from the study is that the expansion of the lumber industry in the South looks set to outpace wood fiber-based industries (pellets, panels, and pulp), potentially creating a deficit in demand for small-diameter logs and sawmill residues. Finding end-uses for smaller logs could be the most significant predicament for timberland owners in the US South in the coming decade. However, the surplus of small-diameter logs will create long-term opportunities to expand pulp and wood pellet sectors.

The excerpt above is from the just-released Focus Report "US South Softwood Industry - Outlook for the world's most important softwood fiber basket" published by Wood Resources International LLC and O'Kelly Acumen. For more information about the study or to inquire about purchasing the 85-page report, please contact either Hakan Ekstrom (//This email address is being protected from spambots. You need JavaScript enabled to view it.">This email address is being protected from spambots. You need JavaScript enabled to view it.) or Glen O'Kelly (This email address is being protected from spambots. You need JavaScript enabled to view it.).

Wood fiber costs increased for softwood pulp producers worldwide in 2021 but decreased for manufacturers of hardwood pulp

Wood fiber costs for pulp manufacturers have gone up in practically all countries covered by the WRQ over the past year. In the 3Q/21, the Softwood Fiber Price Index (SFPI) was at its highest level since 2014, 8.1% higher than the 3Q/20. The most significant price increases have occurred in Western Canada, US South, Latin America, and Oceania. Softwood pulplog prices in the US South were up 9% y-o-y, an unusual jump in a region with relatively small price adjustments historically. Other noteworthy price increases were for softwood chips in Western Canada (+11% y-o-y) and softwood pulplogs in France (+9%), Brazil (+20%), and Chile (+15%).

The Hardwood Fiber Price Index (HFPI) has moved up the past year, following a downward trend of almost ten years since its record high in 2011. Despite the recent increases, the HFPI is currently about 4% below its 30-year average. In the past year, hardwood pulplog prices have gone up in practically all the primary hardwood pulp-producing regions of the world.

Wood raw-material costs for Brazilian pulp manufacturers increased almost 10% q-o-q in the 3Q/21. Log demand has been high in the solid wood sector, with sawmills and veneer plants increasingly competing for small-diameter logs that typically would be used by pulpmills, composite board manufacturers, and the pig iron industry. The pig iron sector is a significant consumer of eucalyptus logs for charcoal and its production grew by 18% y-o-y in the 3Q/21.

The high log demand and tight supply pushed prices for sawlogs and pulplogs to all-time highs in Brazilian Real terms. In US dollar terms, Eucalyptus pulplog prices have increased by over 20% from their 15-year low levels in early 2021. Despite the substantial jump in wood fiber costs over the past year, Brazil's pulpmills continue to have some of the lowest wood fiber costs of all regions tracked by the WRQ.

Wood fiber costs for Chilean pulpmills have also been on an upward trajectory the past year in the local currency, reaching a record high in the 3Q/21. As a result, eucalyptus pulplog prices have almost doubled in ten years in Pesos terms. However, due to a weakening Chilean currency, the price movements in the US dollar have been more modest, with current levels being closer to their ten-year average. The country's pulp industry is very competitive in the global market due to its hardwood pulpwood costs being substantially lower than in North America and Europe.

Are you interested in the worldwide wood products market? The Wood Resource Quarterly (WRQ) is a 75-page report established in 1988 and has subscribers in over 30 countries. The publication tracks prices for sawlog, pulpwood, lumber, and pellets and reports on trade and wood market developments in most key regions worldwide. For more insights on the latest international forest product market trends, please go to www.WoodPrices.com

WRI’s Hardwood Fiber Price Index fell to a 16-year low in the 2Q/20

WRI’s Hardwood Fiber Price Index fell to a 16-year low in the 2Q/20, driven by lower pulplog prices in Brazil, Russia and Eastern Canada

Wood raw-material costs fell for most pulp manufacturers throughout the world in the 2Q/20, reducing WRI’s two fiber price indices for the fifth consecutive quarter. The q-o-q declines for the Hardwood Fiber Price Index (HFPI) and the Softwood Fiber Price Index (SFPI) were 4.8% and 1.9%, respectively. The HFPI Index reached $79.88/odmt in the 2Q/20, the lowest level since 2004, and substantially below the average rate since the Index’s inception in the 1Q/1988.

The HFPI is composed of regional prices for wood chips and pulplogs delivered to pulpmills in 14 key regions around the world, and is weighted based on the proportional amount of fiber consumption in each region. Over the past year, fiber prices (in US dollars) have fallen the most in Brazil, Russia, Eastern Canada, France, Chile, and the US South (in descending order). Brazil has a long history of having some of the lowest wood fiber costs in the world. This was cemented in the 2Q/20 when the country had both the lowest softwood and hardwood fiber costs of all 18 regions tracked by the Wood Resource Quarterly.

The HFPI is composed of regional prices for wood chips and pulplogs delivered to pulpmills in 14 key regions around the world, and is weighted based on the proportional amount of fiber consumption in each region. Over the past year, fiber prices (in US dollars) have fallen the most in Brazil, Russia, Eastern Canada, France, Chile, and the US South (in descending order). Brazil has a long history of having some of the lowest wood fiber costs in the world. This was cemented in the 2Q/20 when the country had both the lowest softwood and hardwood fiber costs of all 18 regions tracked by the Wood Resource Quarterly.

Hardwood fiber prices have dropped in US dollar terms, in part due to the strengthening of the dollar against all currencies in the WRQ countries over the past year, barring the Yen, over the past year. In local currencies, wood fiber costs from the 2Q/19 to the 2Q/20 have fallen the most in France, Eastern Canada, the US South, Russia, and the US Northwest (in descending order).

Prices for softwood fiber have also been declining the past few years, albeit in a less dramatic fashion than hardwood fiber. As a result, the SFPI was almost six dollars per odmt higher than the HFPI in the 2Q/20, the biggest discrepancy since 2Q/07.

Over the past year, softwood fiber prices (in US dollars) declined predominantly in Latin America and Europe. Prices in Brazil and Chile were down because of the weakening local WRI Market Insights 2020 - a subscription service from Wood Resources International Global Wood Fiber Markets Wood Resources International currencies, while an oversupply of residues and pulplogs in Central Europe resulted in continued downward price pressure on wood fiber in key markets.

Interested in wood products market insights from around the world? The Wood Resource Quarterly (WRQ) is a 70-page report, established in 1988 and has subscribers in over 30 countries. The report tracks prices for sawlog, pulpwood, lumber & pellets worldwide and reports on trade and wood market developments in most key regions around the world. For more insights on the latest international forest product market trends, please go to WoodPrices.com Contact Information Wood Resources International LLC Hakan Ekstrom, Seattle, USA This email address is being protected from spambots. You need JavaScript enabled to view it. www.WoodPrices.com

Hardwood Chip Trade in the Pacific Rim in the 2Q/2020

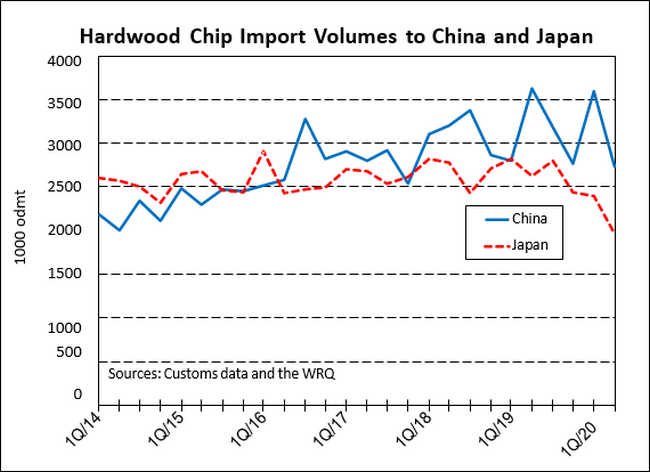

Demand for imported hardwood chips in China and Japan plummeted in the 2Q/20 as a result of reduced consumption of pulp and paper in the two countries

The world’s two largest purchasers of wood chips China and Japan drastically reduced their chip importation in the 2Q/20. With the Covid-19 taking a toll on pulp and paper consumption in the two countries, demand for wood fiber was down substantially from the first quarter of the year.

Over the past seven years, Japan has consistently imported just over 2.5 million odmt of hardwood chips per quarter. This changed in the 2Q/20, when the import volume fell 18% q-o-q to slightly less than two million odmt, reports the Wood Resource Quarterly. In June this year, a record low of only 490,000 odmt arrived at Japanese ports, down 30% from the same month in 2019. Shipments from South Africa, Brazil and Vietnam declining the most.

Although import volumes to Japan fell during the spring, import prices increased slightly in the 2Q/20, averaging $193/odmt, up from the 1Q/20 price of $191/odmt.

In the 2Q/20, the volumes of chip imported to China fell more q-o-q than they did in Japan. The decline was driven by two main causes: reduced pulp production in China, and an increase in the importation of market pulp at record low prices. These market pulp imports came as a substitute for domestically produced pulp. The import volume was down from 3.6 million odmt in the 1Q/20 to 2.7 million odmt in the 2Q/20, the lowest level in almost three years.

Most of the larger pulp mills in China rely almost exclusively on imported wood chips to supply their wood fiber needs. A closer look at the import data (by port) indicates that the pulp mills in the southern provinces of China, including the APP’s and Chenming’s plants, reduced imports of Eucalyptus chips the most from the 1Q/20 to the 2Q/20. This was also the region where chip import prices fell the most during the first half of 2020.

Interested in wood products market information from around the world? The Wood Resource Quarterly (WRQ) is a 67-page report, established in 1988 with subscribers in over 30 countries. The report tracks prices for saw log, pulpwood, lumber & pellets worldwide and reports on trade and wood market developments in most key regions around the world. For more insights on the latest international forest product market trends, please go to www.WoodPrices.com

Forisk Acquires the North American Wood Fiber Review, the Leading Price Reporting Service for Pulpwood and Biomass in North America, from Wood Resources International

Forisk Consulting, a leader in North American forest industry and timber market research, has acquired the North American Wood Fiber Review from Wood Resources International of Bothell, Washington. The Review, which tracks wood fiber markets in all major regions of the United States and Canada, will be published by Forisk as the Forisk Wood Fiber Review beginning in Q1 2020.

Dr. Brooks Mendell, President and CEO of Forisk, says, “Adding the Review and 35 years of price data to our research portfolio strengthens our ability to serve the forest industry in the U.S. and Canada, as well as international firms with North American assets. Also, current subscribers can remain confident in the trusted price reporting, as we are thrilled to announce that Tim Gammell, the current Executive Editor of the Wood Fiber Review, will join our team.”

Dr. Brooks Mendell, President and CEO of Forisk, says, “Adding the Review and 35 years of price data to our research portfolio strengthens our ability to serve the forest industry in the U.S. and Canada, as well as international firms with North American assets. Also, current subscribers can remain confident in the trusted price reporting, as we are thrilled to announce that Tim Gammell, the current Executive Editor of the Wood Fiber Review, will join our team.”

Mr. Håkan Ekström, President and CEO of Wood Resources International, adds, “This transition builds on our long-standing working relationship with Forisk, and provides further opportunities to cooperate on forest industry research and analysis in North America and globally. We are excited with this match and look forward to our continued work together.”

The Wood Fiber Review is the only publication that covers both the pulpwood and biomass markets in North America. The market report includes prices and market commentary for a dozen regions. It is an essential source for anyone that needs to track pulpwood, wood chips, and biomass prices in the largest and most dynamic wood fiber market in the world.

Contact: Brooks Mendell, This email address is being protected from spambots. You need JavaScript enabled to view it.

About Forisk Consulting: Forisk delivers forecasts and analysis of forest industry markets and timberland investments. Firms participate in Forisk’s research program by subscribing to the Forisk Research Quarterly (FRQ) or Wood Fiber Review, supporting benchmarking studies related to forest operations and mill capacities, and attending educational workshops and the annual Wood Flows & Cash Flows conference. www.forisk.com

About Wood Resources International: WRI is an international forest industry consulting firm that has completed consulting assignments in over 35 countries since 1988. In addition, WRI publishes the market report Wood Resource Quarterly (WRQ), which has published quarterly sawlog, pulpwood and wood chip prices, market information and forest products trade, for all major regions in the world for over 30 years. www.woodprices.com

Pulpwood prices in North America were 5-10% higher in the 1Q/19 than the 1Q/18

Pulpwood prices in North America were 5-10% higher in the 1Q/19 than the 1Q/18, with prices in the US South having increased the most due to challenging weather conditions, as reported by the North American Wood Fiber Review

The winter weather impacted availability and costs for pulplogs and wood chips in both Canada and the US in late 2018 and early 2019, according to the North American Wood Fiber Review. Slowing lumber production throughout North America led to reduced supplies of residual chips and slightly higher prices in early 2019.

The winter weather impacted availability and costs for pulplogs and wood chips in both Canada and the US in late 2018 and early 2019, according to the North American Wood Fiber Review. Slowing lumber production throughout North America led to reduced supplies of residual chips and slightly higher prices in early 2019.

Seattle, USA. Prices for pulplogs and wood chips moved up slightly in the US in the 1Q/19 while they were unchanged or slightly lower in Canada, as compared to the 4Q/18, according to the latest issue of the North American Wood Fiber Review. For several regions in North America, the year began with higher fiber prices due to harvesting slowdowns after some inclement weather. In the US South Central and Southeast regions, there was particular demand for hardwood fiber, which resulted in an uptick in prices. These were also the regions that saw the highest quarter-to-quarter (q-o-q) increases on the continent in the 1Q/19.

US South

Pulpmills along the US Atlantic coast saw their wood fiber costs rise almost 10% over the past year both because of higher transportation costs and tighter log supplies due to difficult weather conditions. The harsh weather continued into the second half of 2018 as the region was hit with hurricanes and extreme rain. Hurricane Florence in the third quarter and Hurricane Michael in the fourth quarter led to wet ground conditions that slowed harvest operations and interrupted of the hauling of logs across the region.

With the tight supply of wood fiber, wood chip and pulplog prices in the 1Q/19 reached their highest levels in almost seven years in both in the South Central and Southeastern states.

Softwood sawlog prices remained unchanged in the 1Q/19 from the previous quarter and were practically the same as they were in 2017 and 2018.

US Northwest

Prices for both wood chips and pulplogs in the US Northwest increased by a few percent q-o-q in the 1Q/19, continuing the upward price trend seen over for the past two years. Log supply for both sawmills and pulpmills tightened during the rainy season and when fires restricted logging and hauling during the summer months. The latest price increases took chip and pulplog prices to their highest levels in seven years.

Prices for both wood chips and pulplogs in the US Northwest increased by a few percent q-o-q in the 1Q/19, continuing the upward price trend seen over for the past two years. Log supply for both sawmills and pulpmills tightened during the rainy season and when fires restricted logging and hauling during the summer months. The latest price increases took chip and pulplog prices to their highest levels in seven years.

Sawlog prices have fallen substantially in Washington and Oregon over the past six months as lumber demand fell in the domestic market, and lumber prices in April reached their lowest levels in over four years. In the 1Q/19, average sawlog prices in the Northwest were over 20% lower than in the 1Q/18.

US Lake States

Rain and snow in early 2019 made logging and hauling challenging in the Lake States. Low inventories of wood fiber resulted in modest price increases of both pulplogs and wood chips in the 1Q/19. Prices were up 2-3% for hardwood fiber q-o-q, partly because of longer hauling distances. One interesting development was that during the first few months of the year, fiber buyers from Alabama purchased from as far away as the Lake States, transporting hardwood pulplogs down to their mills as local supply became tight.

US Northeast

Snowstorms disrupted harvesting and trucking in Maine during the 1Q/19, which negatively affected fiber inventory levels in the region. With no promise of a longer winter season before breakup, fiber prices for both softwood and hardwood pulplogs rose to incentivize timely harvesting and deliveries. Prices for softwood and hardwood pulplogs were up 5% and 7% respectively, from the 1Q/18 to the 1Q/19, reaching their highest levels since early 2016.

Canada West

In the 1Q/19, residual chip price trends in the western provinces were mixed. As prices fell from the previous quarter in British Columbia’s Coast and North Interior regions, they rose in the Southern Interior of BC and in Alberta. Year-over-year, chip prices in the Interior of BC have gone up almost 15% in Canadian dollar terms, while price increases in US dollar terms have been quite modest. The tightening supply of sawmill chips over the past six months has increased demand for pulplogs and resulted in higher prices for pulplogs throughout British Columbia.

Canada East

Challenging weather conditions during the winter months affected harvesting operations in Eastern Canada, from Ontario in the west to the Maritime provinces in the east. Slowing operating rates at the region’s sawmills reduced the availability of sawmill residuals, and increased the demand for pulplogs. The highest increases in wood fiber prices in Eastern Canada the past year were seen in hardwood pulplogs, which were about 5% higher in the

1Q/19 than the same quarter in 2018. Softwood sawlog prices in Ontario and Quebec have been quite stable for over a year, holding at their lowest levels since 1999.

About the North American Wood Fiber Review (NAWFR): The newly revamped market report has tracked wood fiber markets in the US and Canada for over 35 years and it is the only publication that includes prices for sawlogs, pulpwood, wood chips and biomass in North America. The 36-page quarterly report includes wood market updates for 15 regions on the continent in addition to the latest export statistics for sawlogs, lumber, wood pellets and wood chips. To learn more about the NAWFR, please go to www.WoodPrices.com

Hardwood pulp manufacturers in Europe have the highest wood fiber costs in the world despite price declines the past six years

Hardwood pulp manufacturers in Europe have some of the highest wood fiber costs in the world despite prices for hardwood pulplogs having trended downward in most key markets on the continent over the past six years. In the second half of 2017, this trend reversed, with fiber prices going up in both the local currencies and in US dollar terms. In the 4Q/17, prices for hardwood logs in Spain and Finland were the highest on the continent, while French and Swedish prices were on the lower end of the hardwood cost spectrum, according to the Wood Resource Quarterly.

Hardwood fiber supply in Sweden tightened in late 2017 because of an unusually wet and mild early winter season. The tight supply resulted in odd importations of Eucalyptus chips from both Brazil and Uruguay in late 2017 and early 2018 at prices reported to be that was substantially higher than those for domestically sourced wood fiber. The limited availability of logs resulted in higher prices for hardwood pulplogs during most of 2017 ( after being at an 11-year low in the 4Q/16). Despite the recent price rise in the 4Q/17, birch pulplog costs were about 15% lower than their 10-year average (in US dollar terms).

Prices for softwood chips and pulplogs were also up in Sweden during 2017 because of an imbalance between domestic supply and demand. The higher domestic fiber prices resulted in an increase in importation of softwood chip to Sweden in 2017, which reached almost double the volume imported five years ago. In the last quarter of the year, imports reached the second highest quarterly volume on record.

Historically, most imported chips have been destined for the country’s pulpmills, but over the past two years there has been an increase in imported chips to be used for energy. Latvia, Norway, Estonia and Finland, in ranking order, are the major suppliers of softwood chips, accounting for 95% of the total import volume in 2017. With a higher percentage of lower-cost energy chips over the past few years (predominantly from Norway), the average value for imported chips has declined by about 40% 2013 to 2017, according to the WRQ in its 4Q/17 issue. Of the four major supplying countries, Finland supplied the highest cost chips, while Norway was the lowest cost supplier in 2017.

Modest increases in wood fiber costs and a substantial rise in market pulp prices have improved profitability for many market pulp manufacturers worldwide

Modest increases in wood fiber costs and a substantial rise in market pulp prices have improved profitability for many market pulp manufacturers worldwide during the second half of 2017, reports the Wood Resource Quarterly

Pulp manufacturers in many countries have seen their wood fiber costs go up during 2017, with the biggest increases in US dollar terms occurring in Western North America, Europe, Russia and Australia, according to the Wood Resource Quarterly (WRQ). The Global Softwood Fiber Price Index(SFPI) increased for the third consecutive quarter to reach $89.08/odmt in the 4Q/17, 4.0% higher than in the same quarter in 2016.

Hardwood fiber prices have also trended upwards over the past year, with the Global Hardwood Fiber Price Index(HFPI) reaching its highest level in almost three years during the 4Q/17. In US dollar terms, hardwood fiber prices have gone up the most in Europe, Russia and Indonesia during 2017. The only region that has experienced a decline in wood fiber costs has been the US South, where hardwood pulplog prices were 2.3 % lower in the 4Q/17 than in the 4Q/16.

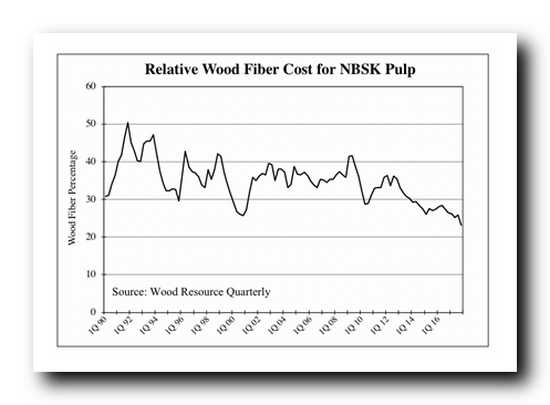

Wood fiber costs remain the single largest cost component in the manufacture of wood pulp, ranging between 40-60% of the total cash costs, depending on region and pulp grade. The wood fiber costs as a percentage of the price of Northern Bleached Softwood Kraft market pulp (NBSK) have been on a downward trajectory over the past eight years.

The substantial increases in market pulp prices during the 4Q/17 and only small upward price adjustments of pulpwood resulted in the wood fiber cost percentage reaching a record low of 23.2% in the last quarter of 2017 (down from 36% in 2012). Since wood fiber costs account for a majority of the pulp manufacturing costs, the low wood cost share has improved profitability for market pulp manufacturers throughout the world during 2017.

Wood raw-material costs for European pulpmills continued to slide in early 2017

Wood raw-material costs for European pulpmills continued to slide in early 2017 to reach their lowest levels in over five years, reports the Wood Resource Quarterly

The European pulp industry has become much more competitive in the international pulp and paper market the past five years with wood fiber costs, which account for 55-65% of the production costs, having fallen more than in most other regions of the world, reports the Wood Resource Quarterly. Some of the biggest price declines have been for hardwood pulplogs in the Nordic countries.

The European pulp industry has become much more competitive in the international pulp and paper market the past five years with wood fiber costs, which account for 55-65% of the production costs, having fallen more than in most other regions of the world, reports the Wood Resource Quarterly. Some of the biggest price declines have been for hardwood pulplogs in the Nordic countries.

Wood costs for the pulp industry in Europe were generally lower in the 1Q/17 than in the previous quarter, continuing a downward trend that, depending on the country, has lasted for 4-6 years. The biggest price declines for pulplogs and sawmill residues in early 2017 occurred in Germany and France, according to the Wood Resource Quarterly (WRQ). The price reductions occurred mainly because of an oversupply of pulplogs, unchanged demand for wood fiber from the pulp industry, and reduced usage of raw-material by the competing wood pellet sector.

In neighboring Austria, conifer pulplog prices have been very stable during most of 2015 and 2016 (in Euro terms) and prices did not change much in the 1Q/17. However, the weakening of the Euro against the US dollar has resulted in Austrian pulplog prices falling seven percent in two years.

In the Nordic countries, wood fiber costs in the 1Q/17 were at their lowest levels since 2006 (in US dollars). This was mostly thanks to the weakening of the local currencies in both Sweden and Finland. The wood fiber costs currently account for about 60% of the manufacturing cost when manufacturing pulp in the region, according to Fisher International, so a reduction in prices for pulplogs and wood chips has a major impact in improving the competitiveness of the pulp and paper industry when competing in the global market place.

The pulp sectors in Portugal and Spain, which are the third and fourth largest consumers of hardwood logs in Europe, have also enjoyed a period of declining wood costs with the price levels in early 2017 being 20-25% below the fiber costs five years ago.

Hardwood fiber costs for pulpmill in Europe have fallen more rapidly than in other parts of the world from 2012 to 2017, and the industry has become much more competitive with competitors in North America, Latin America and Asia, according to the WRQ. For example, the price discrepancy for hardwood pulplogs between Sweden and the US South has fallen from US$62/odmt in the 1Q/12 to only US$9/odmt in the 1Q/17.