Ian Melin-Jones

Domtar announces an increase to its share buyback program to one billion dollars

Domtar Corporation has announced that its Board of Directors authorized an increase to its share buyback program of $400 million. The original program announced on May 5, 2010 now has an aggregate authorization of $1 billion. The Company has previously repurchased approximately 6.6 million shares of common stock for a total cash consideration of $536 million pursuant to this program. Domtarhas returned in excess of $600 million of capital to shareholders through a combination of share repurchases and dividends since May 2010.

"With this additional authorization from the Board, we have the flexibility to continue to implement our share repurchase program as a key element of our disciplined capital allocation strategy. Our commitment remains to return a majority of future free cash flow to shareholders," said John D. Williams, President and Chief Executive Officer. "Since the inception of the program in May 2010, we have reduced Domtar's outstanding share count by 15 percent and we believe such repurchases continue to be an excellent means to return capital to our shareholders."

Under the share buyback program, the Company is authorized to repurchase from time to time shares of its outstanding common stock on the open market or in privately negotiated transactions in the United States. The timing and amount of stock repurchases will depend on a variety of factors, including the market conditions as well as corporate and regulatory considerations. The share repurchase program may be suspended, modified or discontinued at any time and the Company has no obligation to repurchase any amount of its common stock under the program. The Company intends to make all repurchases in compliance with applicable regulatory guidelines and to administer the plan in accordance with applicable laws, including Rule 10b-18 of the Securities Exchange Act of 1934, as amended.

The Company had a total combined number of common stock and exchangeable shares issued and outstanding of 36,805,300 shares at November 30, 2011.

Resolute Forest Products Commencement of Formal Take-Over Bid for Fibrek Inc.

AbitibiBowater Inc., doing business as Resolute Forest Products ("Resolute"), has announced that it has formally commenced its offer to purchase all the issued and outstanding common shares of Fibrek Inc.(the "Offer"). The Offer, which Resolute is making together with RFP Acquisition Inc., a wholly-owned subsidiary, is more fully described in the offer circular and other ancillary documentation (collectively, the "Offer Documents") the Company is filing today on the Canadian Securities Administrators' website ("SEDAR").

As disclosed on November 28, 2011, holders of common shares of Fibrek will have the opportunity to elect to receive, for each share:

|

(i) |

Cash and Share Option: C$0.55 in cash and 0.0284 of a Resolute share; or |

||

|

(ii) |

Cash Only Option: C$1.00 in cash (subject to proration, as described in the Offer Documents); or |

||

|

(iii) |

Share Only Option: 0.0632 of a Resolute share (subject to proration, as described in the Offer Documents). |

Based on Fibrek's most recent publicly disclosed number of 130,075,556 issued and outstanding Fibrek common shares, the maximum amount of cash consideration available under the Offer is C$71,541,556 and the maximum number of shares of Resolute common stock available to be issued under the Offer is 3,694,146.

As of November 28, 2011, the date on which Resolute announced its intention to make the Offer, the Offer price represented a premium of approximately 39% over the closing price of Fibrek's Shares on that date, and a premium of approximately 31% over the volume weighted average trading price of the shares on the Toronto Stock Exchange for the 20 trading days ending on that date. The acquisition of Fibrek will allow Resolute to expand its market pulp business and provide greater overall balance to its product offering. The Offer provides an opportunity for Fibrek shareholders to elect immediate liquidity or choose to participate in the future of Resolute, a financially strong company with a diversified asset and product base.

The Offer will expire at 5:00 p.m. (Eastern Standard Time) on January 20, 2012, unless it is extended or withdrawn by Resolute.

The Offer is subject to certain conditions including, among others, a 66⅔% minimum tender condition, waiver or termination of all rights under any shareholder rights plan(s), receipt of all regulatory, governmental and third-party approvals, consents and waivers, Fibrek not having implemented or approved any issuance of shares or other securities or any other transaction, acquisition, disposition, capital expenditure or distribution to its shareholders outside the ordinary course of business, and the absence of occurrence or existence of any material adverse effect or material adverse change. Subject to applicable laws, Resolute reserves the right to withdraw or extend the Offer and to not take up and pay for any Fibrek common shares deposited under the Offer unless each of the conditions of the Offer is satisfied or waived (at its sole discretion). The Offer is not subject to any financing condition.

Resolute is also filing today with the U.S. Securities and Exchange Commission (the "SEC") a registration statement on Form S-4 to register the Resolute shares that may be issued pursuant to the Offer. The registration statement has not yet become effective. Resolute may not complete the Offer and issue the Resolute shares until the registration statement is effective.

Resolute has requested Fibrek's shareholder lists in order to distribute the Offer Documents to Fibrek's shareholders. Once it receives the lists, which, pursuant to applicable law, are due within 10 days of the request, Resolute will mail the documents to Fibrek shareholders and will furnish them to brokers, dealers, banks, trust companies and similar persons whose names, or the names of whose nominees, appear on the lists.

Resolute has retained BMO Capital Markets to act as dealer manager for the Offer in Canada. Resolute has also engaged Georgeson Shareholder Communications Canada Inc. to act as information agent for the Offer and Canadian Stock Transfer Company Inc. (acting as administrative agent for CIBC Mellon Trust Company) to act as depositary and exchange agent for the Offer. Norton Rose OR LLP and Paul, Weiss, Rifkind, Wharton & Garrison LLP are advising Resolute with respect to the Offer.

UPM to establish competence centre for eucalyptus research in Uruguay

UPM will strengthen its research on eucalyptus fibre and build a competence centre at the Fray Bentos pulp mill in Uruguay. The new centre including expansion of the existing laboratory facilities will be operational during the first half of 2012.

The new competence centre will focus on the research of eucalyptus species and their impact on end product properties. The Fray Bentos competence centre will evaluate the aspects of the eucalyptus species growing in Uruguay with the aim to accelerate the process of selecting the best trees to be planted in the future.

“At the Fray Bentos mill site we can combine our expertise in the pulp process with the plantation forestry operations know-how in an innovative way. The new competence centre will also enable us to strengthen the cooperation with our customers in product development,” says Sami Saarela, Vice President for UPM’s pulp production.

The Fray Bentos competence centre will operate as part of UPM’s global R&D Network. The competence centre will increase research activities and training of the Uruguayan engineers in the development of eucalyptus fibers.

Verso Paper Corp. Partnership for More Certified Acres in Maine - an Impressive Success

Verso Paper Corp. has announced that their participation in a groundbreaking partnership involving Time Inc., Hearst Enterprises, National Geographic Society, the Sustainable Forestry Initiative® (SFI®), and another forest products company has led to 790,000 acres of additional forest lands being certified to the SFI Standard in Maine. The partnership was an extension of an earlier project in 2010 that led to 620,000 acres certified to the SFI Standard — bringing the total of additional lands certified to the SFI Standard over the two year period to 1.4 million acres.

"This is a huge accomplishment," said Craig Liska, Vice President of Sustainability for Verso. "This two-year effort not only resulted in a 20% increase in the amount of certified forestland in Maine but also demonstrated the success of this new SFI group certification process in Maine which we hope will encourage more forest land owners to also seek certification. We believe that forest certification can have a substantial role in encouraging responsible forest management practices and we're pleased to have been able to work together with SFI and an elite group of customers that share similar values in this topic."

"Verso is very excited about the success of this latest partnership and embraces our responsibility to support healthy, viable forests as a renewable resource for generations to come," Mr. Liska continued.

Source: Verso Paper Corp.

Weaker lumber markets causing global sawlog prices to fall

Weaker lumber markets are causing global sawlog prices to fall for first time since early 2009, reports the Wood Resource Quarterly

Slowing lumber markets throughout the world have resulted in declining sawlog prices in many of the major lumber-producing regions in Europe and North America, according to the Wood Resource Quarterly. The biggest price reductions occurred in Japan, Sweden, Poland and Russia.

With weaker demand for lumber around the world, sawlog prices fell in a majority of the 21 markets tracked by the Wood Resource Quarterly (WRQ). The Global Conifer Sawlog Price Index (GSPI) declined in the 3Q for the first time since the 1Q/09. With a few exceptions, prices fell in both local currencies and in US dollar terms.

The only region that saw any substantial price increase in the 3Q was British Columbia, where prices were up 5-7 percent from the 2Q. This region has benefited from higher lumber exports and production has gone up during 2011.The price for Coastal Hemlock rose over three percent in the 3Q, while the price for spruce-pine-fir (SPF) logs in Interior BC rose nearly seven percent. Prices in both regions were the highest they have been since the global financial crisis in late 2008.

The biggest price declines the past quarter occurred in Japan, Sweden, Poland and Russia; prices were down between 6-12 percent from the 2Q/11. The three latter

countries are major exporters of lumber, and shipments to European markets and Northern Africa have fallen this summer and fall.

Wood costs have gone down for many sawmills throughout the European continent in the 3Q, mostly due to slowing lumber sales and an expectation of lower lumber production levels during the winter months. In the Nordic countries, there were a number of announcements of curtailments for the 4Q/11 and the first quarter of 2012. Although sawlog prices fell in a majority of the ten countries in Europe covered by the WRQ, they were still higher than the third quarter last year. For most markets, log prices have come up between $15-25/m3 during the past 12 months, with only Western Russia and Norway seeing minor price increases.

Many of the continent’s sawmills are currently paying close to the highest sawlog prices seen in at least 17 years, and this is occurring at a time when lumber prices are far from any record highs, and are even declining in some markets. Because of the weakening lumber demand, it can be expected that log prices will soften in the coming months.

Metso to deliver the first commercial LignoBoost plant to Domtar

Metso will supply the world’s first commercial installation of LignoBoost technology to Domtar in North America. The equipment will be intergrated with the Plymouth North Carolina pulp mill. The LignoBoost process separates and collects lignin from pulping liquor. This order is an important breakthrough for Metso’s patented LignoBoost technology and provides the Plymouth NC mill with numerous benefits. The value of the order is not disclosed.

Separation of a portion of the mill’s total lignin production off-loads the recovery boiler and allows an increase in pulp production capacity. The lignin recovered will be used for internal and external applications.

“This project is a potential game changer for the Pulp & Paper industry because it will allow pulp mills to have a new more profitable value stream from a product that was traditionally burned in a recovery boiler,” says Gene Christiansen, General Manager – Business Development Innovations at Metso’s Power Business Line for North America in Charlotte, NC.

The LignoBoost project is based on the 24 ton per day demonstration plant in Bäckhammar in Sweden. The Bäckhammar plant is owned and operated by Innventia since 2006. In 2008 Metso acquired the LignoBoost Technology from Innventia and the companies have since then been working together on the commercialization of the process.

The LignoBoost plant will be in commercial operation in early 2013.The order is included in the Energy and Environmental Technology’s fourth quarter 2011 orders received.

Domtar Corporation is the largest integrated manufacturer and marketer of uncoated freesheet paper in North America and the second largest in the world based on production capacity, and is also a manufacturer of papergrade, fluff and specialty pulp. The Company designs, manufactures, markets and distributes a wide range of business, commercial printing and publishing as well as converting and specialty papers including recognized brands such as Cougar®, Lynx® Opaque Ultra, Husky® Opaque Offset, First Choice® and Domtar EarthChoice® Office Paper, part of a family of environmentally and socially responsible papers. Domtar also produces a complete line of incontinence care products and distributes washcloths marketed primarily under the Attends® brand name. Domtar owns and operates ArivaTM, an extensive network of strategically located paper distribution facilities. The Company employs approximately 8,800 people. To learn more, visit www.domtar.com.

Metso’s Board on a new long-term incentive plan

The Board of Directors of Metso has decided on a new share-based incentive plan for the Group’s top management. The aim of the new plan is to combine the objectives of the shareholders and the management in order to increase the value of the company, to commit the management to the company, and to offer them a competitive reward plan based on long-term shareholding in Metso.

The plan includes three performance periods, which are calendar years 2012, 2013 and 2014. Metso’s Board of Directors shall decide on the performance criteria, targets and participants in the beginning of each performance period. The plan is targeted to approximately 100 persons in Metso management for the performance period 2012.

The potential reward of the plan from the performance period 2012 is based on the net sales growth of the services business, return on capital employed (ROCE) before taxes and earnings per share (EPS).

The potential reward of the plan from the performance period 2012 will be paid at the end of an approximately two-year vesting period in 2015, partly in the company’s shares and partly in cash. The proportion to be paid in cash is intended to cover taxes and tax-related costs arising from the reward to the participants. If a participant’s employment or service ends for reasons relating to the participant before the reward payment, no reward will be paid. The reward for each performance period of the plan may not exceed 120 percent of a participant’s annual total base salary.

The potential rewards to be paid on the basis of the performance period 2012 will correspond to a maximum total of approximately 450,000 Metso shares. Final allocations and the maximum total number of shares will be decided in January 2012. The Metso shares to be transferred in possible rewards will be obtained in public trading, and therefore the incentive plan will have no diluting effect on the share value.

Metso DNA automation system for pulp mill in India

Metso will supply a Metso DNA automation system, various measurement solutions and analyzers to BILT Graphic Paper Products Limited’s (BGPPL) pulp mill in Ballarshah, India. The main process equipment was relocated from Metsä-Botnia’s Kaskinen pulp mill that was closed down in Finland in 2009. The pulp mill in India will be started up in 2012. As part of a mill modernization plan at Ballarshah, a new fiber line and new recovery island area are being installed.

“We have a long association with Metso. They have recently upgraded our cooking and fiber line at our SFI plant in Malaysia and are now working with us in our pulp mill modernization project in Ballarshah,” says R.R. Vederah, Managing Director & Executive Vice Chairman, BILT.

Relocating a paper or pulp production line and replacing its old automation system with modern technology requires profound expertise and experience. Metso is the only supplier in the world able to combine automation, process and machinery know-how in-house. The offering covers everything from pre-surveys and integrated automation solutions to process startup support.

Metso’s deliveries will take place in two phases. In the first one, Metso will supply a Metso DNA automation system, which will control the entire pulp mill. The delivery will also include Metso Brightness Measurements, Metso Residual Measurements and Metso Cooking Liquor Measurements.

In the second phase after the startup, Metso will conduct an audit to define the potential for performance improvement, in addition to supplying a Metso Cooking Optimizer and a Metso Kappa Analyzer.

BILT Graphic Paper Products Limited (BGPPL) is a subsidiary of Ballarpur Industries Limited (BILT), which is part of the US$ 4 billion Avantha Group. BILT is India’s largest manufacturer of printing and writing paper, and focuses on the wood-free and fine papers segment. BILT and BGPPL have six manufacturing units across India, giving the company geographic coverage of most of the domestic market. The company has a dominant share of the high-end coated paper segment in India and ranks among the global top 100.

PMP brought another Intelli-Tissue™ 2100 on stream

PT Graha Cemerlang Paper Utama (GCPU), a subsidiary of Kompas Gramedia Group, has brought its second brand-new Intelli-Tissue™ 2100 machine on stream at its Cikampek mill in Indonesia. PMP tissue machine started-up smoothly and easily (plug & play philosophy) and as a result the first paper at reel appeared on 11th November at 15.15. Project team members were proud to celebrate both the great result of common efforts as well as the Polish Independence Day. According to the common tradition machine receive the name: “Natalia”.

GCPU is one of the market leaders in manufacturing and converting tissue in Indonesia. Recently the company was rewarded the Top Brand Award and the Indonesia Original Brands Award 2011 for innovations. Tessa brand by GCPU was recognized as a combination of premium quality and environmentally – friendly attitude.

PMPoland S.A. – member of PMP Group supplied a new 3650 mm crescent former Intelli-Tissue™ 2100 machine with a maximum capacity of 140 tpd and the maximum operating speed of 2000 mpm. It is important to underline that it is a repeated order of the machine supplied in 2005, however the Intelli-Tissue™ 2100 machine is of higher maximum operating speed and also approx 5% higher capacity. The new machine is be able to produce tissue in a basis weight range of 12-42 gsm for conversion into facial tissue, toilet rolls and towels from 100% virgin pulp both hardwood and softwood. The scope of supply covered stock approach, entire tissue machine (Intelli-Jet V™ headbox, Intelli-Former™ Crescent Former, Intelli-Press™, Intelli-Reel™ and 15’’ YD with high efficiency gas hood) including auxiliary systems like DCS for the entire technological line, lubrication system, steam & condensate and vacuum systems, dust & mist removal systems.

The project for GCPU is another significant step of partnership between GCPU and PMP. Mr. Bambang Dwi Setiawan, Project Director of GCPU says: “We were currently pursuing the greatest possible extent of the first paper at reel on 11th November 2011. Thanks to the efforts, team work and highly dedicated people; we completed the TM#2 project earlier than the target. We are grateful that Grace Paper is able to run the TM#2 and produce the high quality paper in a short period of time.”

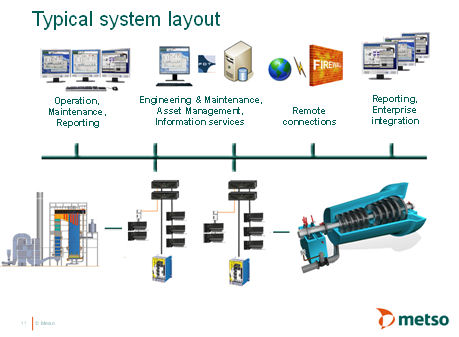

The Metso DNA automation system has now been strengthened

Metso's New DNA applications for power generation industries: Using automation to increase efficiency, operational knowledge and control

Metso is again breaking new ground by introducing advanced power plant applications that enhance both efficiency and environmental performance.

The Metso DNA automation system has now been strengthened to include new control applications for steam and gas turbines, pulverized coal-fired combustion optimization, and overall machine condition monitoring. The DNA system is also pioneering usability applications in process control work.

"With Metso DNA, you can now have one system for power producers that includes energy management, plant information management, controls for the boiler, turbine and Balance of Plant, as well as safety integrated systems and emissions management," said Edward Coll, regional vice president for Metso Automation Energy and Process Systems.

Turbine control for steam and gas turbines

The integration of applications for turbine control, protection and management into the Metso DNA automation system provides customers with an easy and cost-efficient method to get all turbine functionality in one common system, Coll said.

Functions included for turbine control are auto turbine startup, full arc to partial arc transition, MW control, and several protection features, including over-speed and power load imbalance. Further, an operator training simulator and turbine performance monitoring are also available in the integrated DNA package.

"This level of integration will improve plant responsiveness and lower maintenance and spare parts costs," Coll said.

Pulverized coal-fired combustion optimization

Metso DNA Pulverized Coal Combustion Manager optimizes control reactions to dynamic upsets, such as changes in pulverizer configuration, load demand, or fuel variability, ensuring correct fuel and air flow into the entire furnace. This optimization of the fuel and air mix maximizes combustion efficiency while minimizing emissions. Metso further enhances the reliability of this application by housing it in rugged, and easily redundant, real-time process controllers, rather than a network-based PC.

Overall, plants using the DNA Coal Combustion Manager consume less fuel and decrease emissions and emission adsorbents usage, Coll said.

Machine condition monitoring

Another new DNA application is machine condition monitoring, and Metso is the first to integrate this function within the process controls. The application provides real-time condition monitoring of rotating machines, such as fans, pumps and turbines, and it allows the operator to see condition monitoring alarms in the same interface with process alarms. Condition monitoring has traditionally been a separate system, mostly utilized by maintenance specialists. Now, with the Metso DNA Machine Monitoring application, both monitoring and process alarms can be shared with operators in the control room. This "advance warning system" reduces the likelihood of unscheduled outages and improves maintenance efficiency by alerting operators to potential problem areas before a breakdown occurs.

Sootblowing optimization

The Metso DNA Sootblowing Manager calculates, stores and displays boiler heat transfer characteristics that indicate fouling and deposit accumulation on heat transfer surfaces. It also defines the economically optimal sootblowing sequence and location. By optimizing the sootblowing process, a plant can improve efficiency by lowering soot losses, and also improve reliability by reducing unnecessary sootblowing cycles.

Enhancing usability by increasing operator knowledge and control

Metso is also pioneering "usability" in process control work, providing operational information in both real time and retrospectively, which allows system operators to have much greater insight into processes over time which, in turn, enhances their control.

"Despite being fact-based by its nature, process control work at power plants also includes a lot of interpretation and real-time problem-solving," said Jaakko Oksanen product manager for the Metso DNA automation business line. "When all the aspects of business and production processes are visible and under control, stress is reduced, and people make better decisions because they are in control of their work. It's the perfect combination of artificial and human intelligence coming together to solve problems."

An example of usability: Metso DNA is the only system in the world from which the user receives process data in real time and retrospectively, from the same user interface, using the same graphic displays, with one push of a button.

"The user can easily access all the data collected during his or her absence, for example, over the weekend," Oksanen said. "Traditionally, the history of this information required separate applications, and data analysis was difficult. Here, we have taken usability into consideration to enhance operator control and create a more knowledgeable, positive user experience."

Lower operating costs based on Metso life cycle support

Metso DNA is supported by a global network of local experts who provide customer service on-site and through remote connectivity. In addition to product support, the portfolio of Metso services includes training, process improvement services and assured upgrade capability. The single system architecture of Metso DNA enables lifelong compatibility and upgrading options. As a result, Metso customers have confidence that their investment will pay dividends for the long-term because the system provides step-by-step upgrade paths that facilitate future system improvements according to changing process and functionality needs.

One system for all

The Metso DNA system enables power plants to integrate all operations into a single plant-wide, or even corporate-wide entity, enabling easy access to information for comparing and combining process data. Operators only need to know one system, and customers also benefit from having a single source for global system support, updates and spare parts. The result is a power plant that has lower fuel costs, reduced emissions and higher availability.