Ianadmin

Resolute Reports Preliminary Fourth Quarter and 2012 Results

Resolute Forest Products Inc. reported a net loss of $2 million for the year ended December 31, 2012, or $0.02 per share, on sales of $4.5 billion. This compares with net income of $41 million, or $0.42 per diluted share, on sales of $4.8 billion in the year ended December 31, 2011. Net loss in the fourth quarter of 2012 was $36 million, or $0.38 per share, on sales of $1.1 billion, compared with a net loss of $6 million, or $0.06 per share, on sales of $1.1 billion in the fourth quarter of 2011.

Resolute Forest Products Inc. reported a net loss of $2 million for the year ended December 31, 2012, or $0.02 per share, on sales of $4.5 billion. This compares with net income of $41 million, or $0.42 per diluted share, on sales of $4.8 billion in the year ended December 31, 2011. Net loss in the fourth quarter of 2012 was $36 million, or $0.38 per share, on sales of $1.1 billion, compared with a net loss of $6 million, or $0.06 per share, on sales of $1.1 billion in the fourth quarter of 2011.

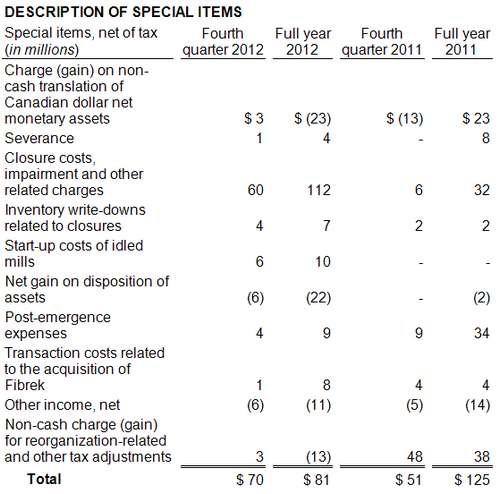

Excluding $81 million of special items, net income for the full year was $79 million, or $0.81 per diluted share. Excluding special items of $70 million, net income in the fourth quarter was $34 million, or $0.35 per diluted share. For the full year 2011, net income excluding special items was $166 million, or $1.71 per diluted share, and $45 million, or $0.46 per diluted share, in the fourth quarter 2011. All special items and non-GAAP financial measures, such as adjustments for special items and adjusted EBITDA, are described and reconciled below.

"We significantly improved the Company's competitiveness by optimizing our asset base, reducing costs wherever possible and strengthening our financial position this year," said Richard Garneau, president and chief executive officer. "We added pulp assets, committed to growth projects in lumber, invested in power cogeneration plants and further optimized our paper assets, steps that will position us well for the future. At the same time, we returned $67 million to our shareholders in share buybacks, reduced balance sheet working capital by a further $81 million from the end of 2011 and redeemed an additional $85 million of debt."

Operating Income Variance

The Company recorded an operating loss of $30 million in 2012, compared to operating income of $198 million in 2011. This reflects a $134 million increase in closure costs, impairment and other related charges, and $173 million of lower volume, in both cases because of additional market downtime and the Company's ongoing efforts to focus production in its most cost-effective mills and drive better efficiency by restructuring and reducing labor costs. As a result, and in addition to lower energy, recovered paper and fiber costs, manufacturing costs improved by $55 million, excluding the effects of lower volume. The effect of pricing changes in the year was neutral as the increase in lumber pricing offset declines in pulp, while gains in specialty paper offset declines in newsprint and coated papers.

In the fourth quarter, the Company recorded an operating loss of $46 million, compared to operating income of $26 million in the third. This reflects $82 million in closure costs, impairment and other related charges, mainly related to the idling of a pulp mill and specialty paper machine in Fort Frances, Ontario, the closure of a specialty paper machine in Laurentide, Quebec, and costs related to the sale of assets in Mersey, Nova Scotia. The variance also included the unfavorable effects of a $10 million non-cash inventory obsolescence charge for slow-moving spare parts, $10 million unfavorable pricing and $8 million due to lower volume. The Company's asset optimization and restructuring initiatives, as well as more favorable pricing for recovered paper, maintenance timing and a favorable wood products inventory adjustment, led to savings of $25 million in overall manufacturing costs, excluding the effects of lower volume.

SEGMENT DETAILS

Newsprint

The newsprint segment generated operating income of $18 million in the fourth quarter, an $8 million decrease from the third. Average transaction price slipped $6 per metric ton and shipments fell 2% as a result of newsprint export markets pressured by the strong U.S. dollar. There was a $4 million non-cash provision for spare parts obsolescence recorded against operating income in the quarter, but it was offset by lower manufacturing costs and favorable recovered paper pricing.

An 11% reduction in operating costs led to a 9% increase in operating income for the year, to $97 million, despite a 10% reduction in shipments and a 1% decrease in average transaction price. The Company reduced shipments as part of its efforts to manage its exposure to markets affected by the strong U.S. dollar and its steps to optimize its asset base, including the closure and subsequent sale of its interest in the Mersey newsprint mill.

Coated Papers

Operating income in the coated papers segment was unchanged in the fourth quarter compared to the third, at $3 million. Average transaction price rose $18 per short ton, or 2%, but shipments were down 14% as a result of equipment failures, which pushed operating costs per unit up 3%.

Operating income in the coated papers segment was down $48 million in 2012, to $9 million, as a result of a 3% reduction in average transaction price and a 13% reduction in shipments. The Company continued to make progress in its efforts to improve equipment efficiency with a smaller labor force, but operating costs per unit rose by 6% in the year, as the Catawba, South Carolina, mill continues to work toward capturing the expected efficiencies.

Specialty Papers

The specialty papers segment generated operating income of $8 million in the fourth quarter, an $18 million decrease from the previous quarter. Average transaction price was stable but shipments dropped 3% on lower demand. The decrease in operating income includes $4 million in additional costs associated with the Dolbeau, Quebec, facility's ramp-up and a $3 million non-cash provision for spare parts obsolescence.

The restart of the Dolbeau facility is another step in the Company's strategy to optimize its asset base; in the last five quarters, three specialty paper machines, one in each of Laurentide, Fort Frances and Kenogami, Quebec, were closed or idled, and the Company continued its labor restructuring initiatives, most recently in Alma, Quebec. Despite a 16% drop in shipments, consistent with the industry average, operating income rose 23% from 2011 to 2012, to $76 million, as average transaction price increased 3% and the Company improved manufacturing costs, including a $7 million improvement in labor costs and $14 million of favorable power and steam costs.

Market Pulp

Operating income was breakeven in the quarter, a $22 million improvement over the third. Average transaction price dropped $23 per metric ton, or 3%, from its already low levels in the third quarter. Despite indefinitely idling the Fort Frances pulp mill in late November, shipments rose 8% as the Company ran Fibrek's Saint-Felicien, Quebec, facility throughout the quarter, except for four days of downtime to complete the dredging of many years of accumulated sludge in the lagoons. Manufacturing costs improved by $18 million as there was no major maintenance in the quarter.

Operating income in 2012 was $135 million lower than in 2011, reflecting primarily the $82 per metric ton drop in average transaction price (which includes, as of May 2012, the three Fibrek mills), but also an increase of $21million in operating costs on higher chemicals, maintenance and labor costs. The five-week outage at Saint-Felicien had a $16 million negative impact on operating income.

Wood Products

The wood products segment reported operating income of $14 million in the fourth quarter, $8 million higher than the third. Average transaction price was unchanged but shipments rose 1%. There was a $7 million favorable inventory adjustment as a result of increasing market prices for lumber products.

As a result of stronger market conditions and gradually improving North American housing starts, operating income increased $51 million in the year, to $26 million, and average transaction price rose $53 per thousand board feet, or 18%. Shipments were down 9% as a result of the closure of the Oakhill sawmill in Nova Scotia and downtime in Quebec sawmills. Manufacturingcosts rose $16 million mainly because of higher stumpage fees in Quebec, which is tied to lumber pricing.

CORPORATE & FINANCE

The Company used cash on hand to repurchase 1,946,205 shares of common stock during the fourth quarter under its previously announced share repurchase program, at a total cost of $22 million, and to redeem $85 million of its 10.25% senior secured notes due 2018. With $263 million of cash, the Company ended the quarter with $782 million of available liquidity, and $271 million in net debt.

OUTLOOK

Mr. Garneau added: "combined with softening demand and lower exports from North America, recent capacity restarts by competitors are putting pressure on pricing in newsprint and supercalender grades. We have focused our paper production in our most productive sites and drove better efficiency by restructuring mills and reducing labor costs. This gives us confidence in the competitiveness of our improved asset base as we face the challenges ahead. We expect to benefit in 2013 from investments in power cogeneration assets, with Saint-Felicien and Dolbeau now fully operational and Thunder Bay expected to come online by the end of the first quarter. Recent demand and pricing trends are giving us reason for cautious optimism that the pulp market is gradually coming out of its prolonged slump. Wood products should continue to show progress as housing starts build on recent improvements. Our ongoing growth projects - the capacity enhancement in Thunder Bay, in addition to the announced restart of the Ignace sawmill and construction of the new Atikokan sawmill to be completed in 2014 - further enhance our position in the lumber segment for the future."

SOURCE: Resolute Forest Products Inc.

Toscotec reaches its record starting up Ten Macahines in three months

Italian tissue machine supplier Toscotec S.p.a. has announced the achievement of a striking result starting up ten of its tissue machines in little more than three months. From 15 October 2012 to 31 January 2013 Toscotec has closed a tight schedule of complete TM start ups in three different continents: Africa, Europe and Asia.

Among these projects there are turnkey solutions, tissue plants equipped with AHEAD 1.5 M and MODULO Plus in Energy Saving configuration with different scopes of supply, but all including engineering and overall services for international customers as Vinda, Sipat S.A., C&S Paper and MP Hygiene.

Among these projects there are turnkey solutions, tissue plants equipped with AHEAD 1.5 M and MODULO Plus in Energy Saving configuration with different scopes of supply, but all including engineering and overall services for international customers as Vinda, Sipat S.A., C&S Paper and MP Hygiene.

Not only different markets, but different environments and cultures also make flexibility a prerequisite if a tissue machinery supplier such as Toscotec is to remain highly competitive.

The implementation of a reliable service structure has also contributed to the success of the Italian Company. Thanks to a worldwide structure, which include Toscotec Asia & Pacific in Shanghai and Toscotec North America in Green Bay, Toscotec has made its Service Team available to the customers for all ten tissue machines supplied with a comprehensive package of services aimed at increasing efficiency and output, including training, maintenance and process assistance.

Today Toscotec with its associate Milltech hold a leading position in fast delivery and installation combined with the state of the art technology, offering a wide range of products adapted to the constant evolution of worldwide tissue producers’ demands.

Expansion plans at Brigl & Bergmeister – Cooperation with Cham Paper Group

Brigl & Bergmeister, producer of 1-side coated paper for labels and flexible packaging has signed a cooperation agreement with Cham Paper Group. Once base paper production at the facility in Cham, Switzerland, has been shut down, B&B in Niklasdorf, Austria, will take over the production and marketing of their silicone base papers (Clay Coated Kraft paper). Cham will provide its highly specialized technical expertise. The first products will be available during the second half of 2013, giving the Niklasdorf plant an additional pillar to its successful, wet strength label papers. Following this, there are plans to make further investments in expanding capacity at Niklasdorf in 2014.

Brigl & Bergmeister, producer of 1-side coated paper for labels and flexible packaging has signed a cooperation agreement with Cham Paper Group. Once base paper production at the facility in Cham, Switzerland, has been shut down, B&B in Niklasdorf, Austria, will take over the production and marketing of their silicone base papers (Clay Coated Kraft paper). Cham will provide its highly specialized technical expertise. The first products will be available during the second half of 2013, giving the Niklasdorf plant an additional pillar to its successful, wet strength label papers. Following this, there are plans to make further investments in expanding capacity at Niklasdorf in 2014.

In September 2013, the PM5 in Vevce, Slovenia, will receive a new film press which will increase capacity by 20,000 tonnes. It will become possible to develop new products in the label paper and flexible packaging range thanks to an improved pre-coating process.

2012 was a successful year for Brigl & Bergmeister. The volume of sales increased by 5 % to 155,000 tonnes compared with the previous year, meaning that both plants in Niklasdorf and Vevce were running at full capacity. By acquiring the waste incineration plant ENAGES, B&B in Niklasdorf also has increased its independence from the volatile energy market and improved its carbon footprint.

Ilim Group made 2.58M tons of pulp & paper products in 2012

Ilim Group reported full-year 2012 production results. Company's mills in Siberia and the Russian Northwest manufactured over 2.58 million tons of pulp and paper products. Production at Koryazhma mill in Arkhangelsk region increased 4% year-on-year, in Bratsk and Ust-Ilimsk (Irkutsk region) output remained nearly flat.

Ilim Group reported full-year 2012 production results. Company's mills in Siberia and the Russian Northwest manufactured over 2.58 million tons of pulp and paper products. Production at Koryazhma mill in Arkhangelsk region increased 4% year-on-year, in Bratsk and Ust-Ilimsk (Irkutsk region) output remained nearly flat.

This includes 1.64 million tons of market pulp, which is 2% higher on-year, 708,000 tons of market containerboard, which is flat compared to 2011 and 235,000 tons of paper grades (+5% to 2011).

Ilim Gofra, corrugated box business of Ilim Group in Leningrad region, manufactured 129.5 million sq m of products, which is 6% more than in 2011.

Own logging of Ilim Group in Arkhangelsk region reached 2.3 million cu m, while in Siberia the company harvested 6.7 million cu m of wood.

Ed Galante Elected to Celanese Board of Directors

Celanese Corporation (NYSE: CE), a global technology and specialty materials company, today announced that Ed Galante has been elected to the company's board of directors. Galante is a former senior vice president, Exxon Mobil Corporation. Previously, Galante served as executive vice president, ExxonMobil Chemical Company. A 34-year veteran of Exxon Mobil Corporation, Galante has also held various leadership positions, including chairman and managing director, Esso Thailand, and chief executive and general manager, Esso Caribbean and Central America.

Celanese Corporation (NYSE: CE), a global technology and specialty materials company, today announced that Ed Galante has been elected to the company's board of directors. Galante is a former senior vice president, Exxon Mobil Corporation. Previously, Galante served as executive vice president, ExxonMobil Chemical Company. A 34-year veteran of Exxon Mobil Corporation, Galante has also held various leadership positions, including chairman and managing director, Esso Thailand, and chief executive and general manager, Esso Caribbean and Central America.

"Ed's leadership in the chemical and oil and gas industries, as well as the Asia Pacific and Central America regions, aligns with Celanese's strategic growth plans and will serve us well as we continue to create value for our shareholders. We are extremely pleased to have Ed join our board," said Mark Rohr, chairman and chief executive officer.

Galante received his bachelor's of science degree in Civil Engineering from Northeastern University.

Galante will serve on Celanese's board of directors until the company's annual meeting of stockholders in April 2013, at which time he will be a nominee for election by stockholders.

Cham Paper Group makes CCK technology available to Brigl & Bergmeister

The Cham Paper Group has entered into a cooperative venture with Brigl & Bergmeister (“B&B”), of Niklasdorf, Austria, a manufacturer of single-sided coated speciality papers. B&B is assuming the production and marketing of silicone-base papers (CCK or clay-coated kraft papers) for release liners at its production site in Niklasdorf. The Cham Paper Group will be contributing the specific technological expertise required to this end. The first products manufactured at this site will be available in the second half of 2013.

The Cham Paper Group has entered into a cooperative venture with Brigl & Bergmeister (“B&B”), of Niklasdorf, Austria, a manufacturer of single-sided coated speciality papers. B&B is assuming the production and marketing of silicone-base papers (CCK or clay-coated kraft papers) for release liners at its production site in Niklasdorf. The Cham Paper Group will be contributing the specific technological expertise required to this end. The first products manufactured at this site will be available in the second half of 2013.

The Cham Paper Group discontinued manufacturing these specialty papers in the course of transforming its production capacity in mid 2012. Cham produced inventory stocks for its customers in order to secure deliveries established under contract through 2013. Cham and B&B have agreed to maintain confidentiality pertaining to the details of this cooperative venture.

Norske Skog: recommendations of the election- and remuneration committee

Norske Skog's election- and remuneration committee recommends Ingelise Arntsen as a new member of the board of directors. Dag J. Opedal is recommended as new chair of the election- and remuneration committee, and Olav Veum is recommended as a new member of the election- and remuneration committee.

- The proposals of the committee regarding the new board member and new members of the election- and remuneration committee are unanimous. Ingelise Arntsen has extensive experience from industry and the energy industry, both through operational management and a number of directorships, says chair of the committee, Tom Ruud.

Board of directors

The committee proposes the re-election of Eivind Reiten as chair of the board. The committee also proposes the re-election of the remaining directors Eilif Due, Finn Johnsson, Siri Beate Hatlen, Jon-Aksel Torgersen and Karen Kvalevåg. In line with last year, no deputy chair is proposed.

Ingelise Arntsen (46) has extensive board and management experience from Norwegian and international activities in the industrial and energy sectors. She is currently CEO of Sway Turbine AS and a board member of Multi Consult AS, EAM Solar ASA and Grieg Seafood ASA. She has previous experience from companies including Kvaerner and Statkraft. She has a Bachelor of Science in Economics from the Copenhagen Business School.

In addition to the seven shareholder-elected board members, three board members will be elected by and among the employees of the company.

Election- and remuneration committee

Dag J. Opedal is proposed as new chair, replacing Tom Ruud. Olav Veum is proposed as a new member, replacing Ole H. Bakke. It is proposed that Helge Leiro Baastad and Kirsten Idebøen are re-elected as members of the election- and remuneration committee.

Dag J. Opedal is a graduated economist and has a Master of Business Administration (MBA) from INSEAD. He has previously held the position of CEO in Orkla ASA. He is Chairman of Vizrt Ltd. and Meltwater B.V. and a board member of Telenor ASA, Nammo AS and Norwegian Church Aid.

Olav Veum is a forest owner and has previously held positions including that of general manager in the Western Telemark Business Forum and business manager in Fyresdal municipality. He is currently chair of the Norwegian Forest Owners' Association, AT Skog SA and a board member of the Norwegian Agricultural Cooperative.

Overview

If the proposals of the election- and remuneration committee are adopted, the governing bodies in Norske Skog will have the following shareholder-elected composition following the annual general meeting:

|

Board of directors |

Election committee |

|

Eivind Reiten (chair) Ingelise Arntsen Eilif Due Finn Johnsson Karen Kvalevåg Jon-Aksel Torgersen |

Dag J. Opedal (chair) Helge Leiro Baastad Kirsten Idebøen Olav Veum |

BillerudKorsnäs Eventful quarter rounds off a historic year

CEO Per Lindberg comments on the development during Q4 2012:

“With the finalization of the historic combination between Billerud and Korsnäs, the fourth quarter was an unusually eventful one. We also completed the integration of our paper machines in Finland during the quarter. The integration process at BillerudKorsnäs progresses as planned, and from the next quarter on we will start to report the benefits of our synergies. The synergies for the two acquisitions are estimated at approximately SEK 330 million annually, with full impact from the end of 2015.

Our preferential rights issue was oversubscribed, and we greatly value the firm support we have received from our shareholders. The proceeds of the issue, approximately SEK 2 billion, strengthen our financial position and create scope for us to capture future business opportunities.

While our quarterly results have been charged with a number of extra costs, the underlying operational results for the Group are still stable. Most importantly of all, we remain highly optimistic regarding the future opportunities open to BillerudKorsnäs.”

Rottneros brings AGM forward to 22 March 2013

Arctic Paper S.A. presented a public takeover bid to shareholders of Rottneros AB in November 2012. The acceptance period has since been extended and is now open until 26 February 2013. Arctic Paper controls 51.3 per cent of the shares in Rottneros as of 7 February 2013 and as a consequence of its takeover bid has requested that Rottneros convenes an extraordinary general meeting of the company to elect a Board of Directors.

The election of the Board is an item of business that would be dealt with at the AGM, together with the other usual AGM business, and the Board of Directors of Rottneros consequently proposed that the extraordinary general meeting requested should be substituted by bringing the AGM forward.. Arctic Paper has accepted this proposal.

Rottneros asked the Swedish Securities Council to consider whether this procedure, of bringing the AGM forward, complies with good stock market practice in this context. The Council has confirmed this to be the case.

The AGM will be held on Friday, 22 March 2013 at 14.00 CET in World Trade Center, Klarabergsviadukten 70, Plan 4, Section D, World Trade Center Conference, New York Room, Stockholm, Sweden.

A shareholder who wishes to have an item of business dealt with at the AGM shall, no later than 12.00 CET, 19 February 2013, present their proposal to the company so that it will be possible to include the matter in the notice convening the meeting and consequently deal it with at the AGM.

Notice convening the AGM will be published in accordance with the provisions of the Swedish Companies Act.

Metsä Board Corporation’s operating result excluding non-recurring items was EUR 74 million in 2012

Metsä Board Corporation Financial Statements 1 January–31 December 2012, 7 February 2013 at 12:00 noon

Full year result for 2012

-Sales were EUR 2,108 million (Q1–Q4/2011: 2,485).

-The operating result excluding non-recurring items was EUR 74 million (59). The operating result including non-recurring items was EUR 220 million (-214).

-The result before taxes excluding non-recurring items was EUR 30 million (0). The result before taxes including non-recurring items was EUR 176 million (-281).

-Earnings per share excluding non-recurring items were EUR 0.13 (0.02) and including non-recurring items EUR 0.53 (-0.83).

-The Board of Directors proposes that a dividend of 0.06 euros per share be distributed for the financial year 2012.

Result for the fourth quarter of 2012

-Sales were EUR 509 million (Q3/2012: 532).

-The operating result excluding non-recurring items was EUR 25 million (25). The operating result including non-recurring items was EUR 41 million (22).

-The result before taxes excluding non-recurring items was EUR 12 million (10). The result before taxes including non-recurring items was EUR 27 million (8).

-Earnings per share excluding non-recurring items were EUR 0.08 (0.02) and including non-recurring items EUR 0.13 (0.02).

Events in the fourth quarter of 2012

-Delivery volumes decreased from the previous quarter mainly due to seasonal reasons.

-Average price of linerboard increased. Pulp price took an upward turn. The average prices of folding boxboard and papers declined slightly.

-The new biopower plant owned by Pohjolan Voima and Leppäkosken Sähkö was commissioned at Metsä Board Kyro mill.

Events after the period

The Alizay mill site in France, including machines, equipment and buildings, was sold to Conseil General de l’Eure for EUR 22 million.

“The operating result excluding non-recurring items in the last quarter of 2012 was at the third quarter level, as expected. Folding boxboard delivery volumes were at a normal level, although slightly lower than in the previous quarter due to seasonal effects. Demand for linerboard continued to be strong, and the price increase had a positive impact on the result in the last quarter of the year. The price of pulp also increased, and demand was good in the last quarter. Instead, demand for and price level of papers decreased in Europe, which weakened the profitability of our paper production.

The year 2012 was a significant milestone for our company. We successfully completed our strategic review, launched in 2006, which has resulted in the transformation of the company from a paper producer to the leading paperboard company. The measures to eliminate the last heavy losses of our paper operations were successfully completed. In the fall of 2012, we completed our EUR 120 million investment programme, related to which we increased our annual folding boxboard capacity by approximately 150,000 tonnes, modernized the Kemi linerboard mill, and increased the use of bioenergy in our production.

Our main targets for the year 2013 are the full utilisation of our expanded folding boxboard capacity, development and expansion of our current paperboard product portfolio and improvement of the profitability and cash flow of the paper and market pulp units”.

Mikko Helander, CEO

Near-term outlook

Folding boxboard delivery volumes in the last quarter of 2012 were at a normal level, although seasonally slightly lower than in the previous quarter. Folding boxboard order volumes are expected to gradually improve at the beginning of the year and delivery volumes to increase slightly in the first quarter of 2013, compared to the previous quarter. As a result of the completed annual folding boxboard contract negotiations the volumes are increasing in 2013 compared to 2012 and no material price changes are expected.

Demand for linerboard is expected to continue to be very strong, and delivery volumes are expected to increase slightly in the first quarter of 2013, compared to the previous quarter. No significant changes are expected in the price of linerboard in the coming months.

Delivery volumes of uncoated fine paper are expected to increase slightly in the first quarter of 2013, compared to the previous quarter, and delivery volumes of pulp are expected to be at the previous quarter level. No considerable changes are on the horizon in the price of uncoated fine paper. The currency-denominated price increase of long-fibre pulp is expected to continue at the beginning of the year.

The market situation of coated paper has weakened further since the year end, and delivery volumes and prices are expected to decrease slightly in the first quarter of 2013.

Production costs are expected to increase slightly in the first quarter of 2013, compared to the previous quarter, primarily due to increased energy costs.

Metsä Board’s operating result for the first quarter of 2013, excluding non-recurring items, is expected to improve slightly from the fourth quarter of 2012.

Disclosure procedure

Metsä Board Corporation follows the disclosure procedure enabled by Standard 5.2b published by the Finnish Financial Supervision Authority and hereby publishes its Financial Statements 2012 enclosed to this stock exchange release. Metsä Board's complete Financial Statements is attached to this release in pdf-format and is also available on the company's web site at www.metsaboard.com.