In this stock exchange release Vacon is publishing information included in the interim report that has a significant impact on the value of securities. The full interim report is in the appendix to this release and can be downloaded from the company's website in Finnish at www.vacon.fi and in English at www.vacon.com.

July-September summary:

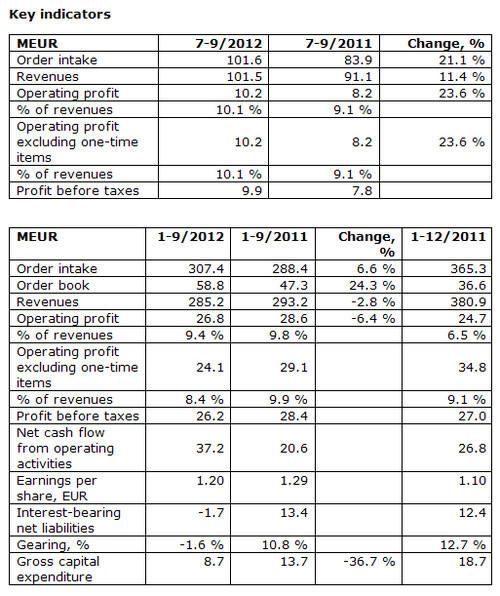

- Order intake totalled MEUR 101.6 (MEUR 83.9), an increase of 21.1 % from the corresponding period in the previous year.

- Revenues totalled MEUR 101.5 (MEUR 91.1), an increase of 11.4 %.

- Operating profit was MEUR 10.2, or 10.1 % of revenues, (MEUR 8.2 and 9.1 %), growth of 23.6 %.

- Net cash flow from operating activities was MEUR 17.4 (MEUR 19.8).

- Earnings per share were EUR 0.45 (EUR 0.36), an increase of 25.8 %.

January-September summary:

- Order intake totalled MEUR 307.4 (MEUR 288.4), an increase of 6.6 % from the corresponding period in the previous year.

- Revenues totalled MEUR 285.2 (MEUR 293.2), a decline of 2.8 %.

- Operating profit was MEUR 26.8, or 9.4 % of revenues (MEUR 28.6 and 9.8 %), a decline of 6.4 %.

- Net cash flow from operating activities was MEUR 37.2 (MEUR 20.6).

- Earnings per share were EUR 1.20 (EUR 1.29), down 7.1 %.

General review

Vacon's business developed positively during the third quarter of 2012. Orders, revenues and operating profit increased considerably from the corresponding period in the previous year. The company's profitability, measured in terms of the operating profit percentage, also improved. During the year, Vacon has succeeded in increasing sales to several industrial sectors and consequently succeeded in compensating the sharp fall in the sales of products for renewable energy production.

Growth in Vacon's orders and revenues was strong in the third quarter and in the January - September period especially in China and North America.

Orders received in July - September totalled EUR 101.6 (83.9) million. Orders in the first nine months of the year totalled EUR 307.4 (288.4) million. The order book rose by EUR 22.3 million from the beginning of the year, standing at EUR 58.8 (47.3) million at the end of the period.

Vacon had revenues in the July - September period of EUR 101.5 (91.1) million. Revenues increased 11.4 % from the corresponding period in the previous year. Revenues in January - September were EUR 285.2 (293.2) million, a decline of 2.8 % from the corresponding period in the previous year.

Vacon's revenues rose during the third quarter in line with expectations. January - September revenues were lower than in the period for comparison, which was due to weak demand for products designed for the generation of renewable energy. During the year the company has however succeeded in raising its revenues in other industrial sectors, such as building automation and the marine industries.

Operating profit in July - September was EUR 10.2 million, or 10.1 % of revenues (EUR 8.2 million and 9.1 %). Factors contributing to the improvement in profitability were the increase in revenues in the third quarter, control of costs and savings in material costs. Growth in profitability was restricted however because sales focused on low power equipment.

The operating profit in January - September totalled EUR 26.8 million, or 9.4 % of revenues (EUR 28.6 million and 9.8 %).

The company's balance sheet remained strong and the net cash flow from operating activities was EUR 17.4 million in the third quarter, a decline of EUR 2.4 million from the corresponding period in the previous year. Net cash flow from operating activities in the January - September period totalled EUR 37.2 (20.6) million. Interest-bearing debt at the end of September totalled EUR 22.9 million, but the net debt was negative, EUR -1.7 million. Thanks to the strong net cash flow from operating activities the company's gearing was -1.6 % (10.8 %).

Prospects for 2012

In Vacon's estimation, there are still uncertainties relating to general growth prospects in the economy, and these may affect demand for AC drives in Europe and possibly globally as well. However, Vacon expects demand for products to control electric motors to remain at a good level in many industrial sectors in the final quarter of 2012. Vacon estimates that orders for products for wind power generation will improve slightly in the second half of 2012 from the first half of the year, but order volumes for the whole year will be clearly below their level in 2011.

Market guidelines for 2012

Vacon is retaining the market guidelines for 2012 that it published earlier. Vacon estimates that its revenues will increase and the operating profit percentage excluding one-time items will improve from 2011. In 2011 revenues were EUR 380.9 million and the operating profit percentage excluding one-time items was 9.1 %.

Vacon's target is to achieve revenues of EUR 500 million in 2014. The profitability targets for 2014 are an operating profit of 14 % and a return on equity of more than 30 %.

Formal statement

This release contains certain forward-looking statements that reflect the current views of the company's management. Due to the nature of these statements, they contain risks and uncertainties and are subject to changes in the general economic situation and in the company's business sector.