Ian Melin-Jones

Changes to the Executive Board of Endress+Hauser

Luc Schultheiss is to be the Group’s new Chief Financial Officer – Fernando Fuenzalida is moving to the Supervisory Board

Changes to the top management of the Endress+Hauser Group: Dr Luc Schultheiss (49) is moving to the Executive Board from 1 January 2012 as the new Chief Financial Officer. His predecessor, Fernando Fuenzalida (68), is transferring to the Group’s Supervisory Board after 13 years as CFO.

Luc Schultheiss joined Endress+Hauser Flowtec – the Group’s competence center for flow measurement technology in Reinach, Switzerland – as Director of Controlling in 1999. As Chief Financial Officer (CFO) of Endress+Hauser AG he will now take on new tasks for the whole of the group of companies. He sees a particular challenge in the handling of currency exchange risks: “The volatility of the markets with regard to the economic situation and exchange rates will intensify further,” Luc Schultheiss is convinced. Klaus Endress, CEO of the Endress+Hauser group, expects a smooth transition for this internal succession.

Luc Schultheiss was born in 1962 in Morges on Lake Geneva, Switzerland. He studied business administration with a focus on finance and accountancy at the University of St Gallen where he also gained a doctorate. Before joining Endress+Hauser, Schultheiss was employed at the Controller Center in St Gallen. He also held a teaching position at the University of St Gallen as a lecturer in business administration. Luc Schultheiss is married and a father of three.

Knowledge and experience retained in the Endress+Hauser Group

After 13 years as CFO, Fernando Fuenzalida is moving to the Supervisory Board of Endress+ Hauser AG, which is expanding from six to seven members. “We are happy that Mr Fuenzalida will continue to incorporate his knowledge and experience,” emphasizes CEO Klaus Endress. He appreciates Fernando Fuenzalida’s work, which has been instrumental in ensuring that Endress+ Hauser operates on a sound basis and increases equity capital even in difficult years.

Fernando Fuenzalida, born in Chile in 1942, completed a Masters degree as industrial engineer at Columbia University in the City of New York. From 1968 he was working as a consultant and manager for various international companies until joining Endress+Hauser in 1998 as Financial Director. Since 2002 he has been a member of the newly formed Executive Board of the Group. Fernando Fuenzalida is married and has two adult daughters.

The new Director of Controlling of Endress+Hauser Flowtec will be Marcel Ziltener (born 1969), who will join the company as of 1 October 2011. He holds a licentiate (Master’s degree) from the University of St Gallen in business administration and a financial auditor diploma.

Siemens equips Chinese paper board greenfield mill

Shandong Bohui Paper Industry Co., Ltd., China, selected Siemens to provide drive technology for its new board paper mill at Dafeng, Yancheng city, in Jiangsu province, East China. The new mill is scheduled to produce 750,000 tons board paper per year based on wood pulp. With the new manufacturing base, Bohui Paper will become China’s biggest board paper mill. The project has a total volume of around 3.8 million euros and is scheduled for completion by end of 2012.

Shandong Bohui Paper Industry Co., Ltd is engaged in the research, development, manufacture, and sale of paper products and paper pulp in China. To increase the production capacity of high-end packaging boards the company is to build a new mill in Yancheng. Siemens will provide the motors for the new board paper machine and for two winder machines.

They are supplied with power via power inverters and rectifiers of the type Sinamics S120. A Sipaper Drives Controller based on Simatic PCS7 is responsible for open-loop and closed-loop control of the machines. The board paper mill will thus have a uniform operator control and visualization platform for all the drive and automation equipment. All together Siemens will install 205 motors, 207 drive loops, and automation and control systems. The company will also be responsible for the engineering and commissioning of the supplied equipment. The drive system application to be used is part of the Sipaper solution specially developed for the pulp and paper industry.

Metso Paper and Fiber Technology’s new organization

“Working as one to be number one in pulp and paper”

Metso’s Paper and Fiber Technology segment (PFT) will have a new organization. From October 1, 2011, PFT will comprise geographical areas and global businesses: the areas will be North America, South America, EMEA (Europe, Middle East, Africa), China and Asia Pacific and the business lines will be Paper, Fiber and Services.

“The new organization is essential for putting PFT’s new strategy into effect. With these arrangements we can work effectively as one to strengthen our position as supplier of the most competitive technology and services for the pulp and paper industry globally,” says Pasi Laine, President of PFT.

“By strengthening our area operations we can get closer to our customers and be able to serve the pulp and paper industry even better. With the new, dedicated Services business line we can offer a full range of services from one organization, enabling the other businesses to focus on providing even more competitive ranges of capital products.”

Appointments

Jari Vähäpesola, head of Paper business line

Mikael Sundqvist, acting head of Fiber business line

Jukka Tiitinen, head of Services business line

Bill Bohn, acting head of North America

Celso Tacla, head of South America

Hannu Mälkiä, head of EMEA (Europe, Middle East, Africa)

Jari Koikkalainen, head of China and coordination of Asia Pacific.

PFT’s support functions will continue to be:

Finance, HR, IT and now also the Legal function, headed by Kari Saarinen

Strategic and Operation development, headed by Mikko Siiteri

Marketing and Communications, headed by Ilkka Hiirsalmi

Quality and Environment, headed by Kari Karhama

IPR and Technology coordination, headed by Jouko Yli-Kauppila

Effective date

The effective date for the new organization and the appointments is October 1, 2011.

Domtar Broadly Expands Its Range of FSC-Certified Papers to Include Unique Specialty and Book Papers

Already a Leader in Offering Environmentally and Socially Responsible Products, Domtar Will Increase Its Annual Sales of FSC-Certified Paper by More Than 150,000 Tons

Marking a new milestone in environmental responsibility, Domtar Corporation (NYSE: UFS) (TSX: UFS) announced today a broad expansion of its paper products that are certified to the standards of the Forest Stewardship Council™ (FSC®).

Beginning today, Domtar's EarthChoice® product line - the broadest collection of environmentally and socially responsible papers available - will now include specialty products used for bandage wraps, popcorn bags, candy wrappers, sugar pouches, hamburger wrap and a wide range of other everyday applications. Domtar produces these specialty papers at mills in Espanola, Ontario; Port Huron, Michigan; and Rothschild and Nekoosa, Wisconsin, all of which are certified to FSC standards by the Rainforest Alliance.

Domtar also announced today that all production of its Domtar Tradebook paper will now be FSC-certified and renamed EarthChoice® Tradebook. The product, specifically designed for book publishers who are committed to sustainability and providing an environmentally responsible choice, had previously been FSC-certified only on request.

As a result of this expansion, Domtar will annually sell more than 150,000 additional tons of FSC-certified paper.

"We have worked with Domtar for over a decade now," said Tensie Whelan, president of the Rainforest Alliance, whose SmartWood program audits forests and companies to FSC standards. "With these new FSC-certified products, Domtar continues to move the industry forward when it comes to environmental responsibility."

FSC certification ensures that forests are managed in a way that protects nature and the people who live and work there. Auditors perform a thorough assessment, checking a range of criteria such as:

- The steps taken to protect soil and water;

- Safeguards that provide protection to fish and wildlife; and

- Whether the number of trees harvested is less than the number that either regrow naturally or get planted.

The announcements mark the latest steps by Domtar, a long-time promoter of FSC certification, to demonstrate its environmental leadership. In June, for instance, Domtar launched an online tool called the "Paper Trail," providing unmatched transparency among today's industry calculators. The tool allows customers to view the environmental impacts of specific paper grades, helping businesses and consumers measure their impact on the environment whilst providing guidance in their choice of paper product.

"In 2009, we were proud to be the first company to sell one million tons of FSC-certified EarthChoice paper, and we're excited that today, we can expand that line even further to include specialty products and book papers," said Lewis Fix, Domtar Vice-President of Sustainable Business and Brand Management. "This is going to help provide more ways for our customers to put their commitment to sustainability on paper. After all, we're more than just a paper company, we're the Sustainable Paper Company."

North American wood pellet capacity set to increase to serve markets in Europe and Asia

European demand for wood pellets has to a large extent, driven the expansion of pellet capacity in both the US and Canada the past five years. The North American Wood Fiber Review reports that in coming years, it is likely that demand for pellets will increase not only in Europe, but also in Asia and North America, which will generate new opportunities for pellet producers, particularly in Western Canada and Eastern US.

Seattle, USA. A number of new wood pellet plants in the US and Canada are set to commence operations during 2011, with more plants planned in the coming years. With the additional capacity coming on line, the industry is eyeing the growing demand in four regions – Europe, Asia, and to a lesser extent the Maritime Provinces of Eastern Canada and Northeastern US. The existing coal-fired energy sector in the US South remains a potent, yet unrealized market to date. Federal policies in the US that restrict the emissions of CO2 gases would ultimately benefit the pellet industry in North America, as many coal plants would likely begin using pellets for co-firing as is the case in Europe. These changes would drastically alter existing pellet flows and production plans.

Europe has, by far, been the largest export market for North American pellet producers for a number of years, shipping nearly 1.5 million metric tons in 2010, as reported in the North American Wood Fiber Review. The most significant potential for increased wood pellet utilization, both short and long term, will continue to be in this region, as the European Union's 27 member countries have a goal of sourcing 20 percent of the Union's total energy needs with renewable sources by 2020. In 2008, biomass utilized in the EU provided 80 million tons of oil equivalents (mtoe), and the European Commission estimates that this consumption may increase to 140 mtoe by 2020. In addition, Germany's recently declared goal to totally eliminate its nuclear power industry by 2022 will increase the country's demand for renewable energy, including woody biomass in the future. Other countries, including Italy, Finland, Poland and Switzerland are starting to question the viability of nuclear power as a future source of energy.

Asian demand for biomass energy is finally beginning to emerge, and shows signs of significant potential growth. South Korea has recently announced policies to increase the portion of energy consumption from renewable sources, including woody biomass. The country's new Renewable Portfolio Standard calls for reducing green house gases by 30 percent by 2020, while concurrently increasing its use of wood pellets to five million tons in ten years. Japan's confidence in nuclear power has continued to plummet since the Fukushima nuclear plant crisis in early 2011, which will likely result in an increase in woody biomass usage as a portion of a larger renewable energy portfolio in the next few years.

The growing European and Asian demand for wood bioenergy is being answered by a number of US and Canadian companies already engaged in or moving towards an expanding export market. Besides British Columbia, which has been the major supplier of pellets to Europe, the US South has recently witnessed the opening of a few large pellet plants with plans to ship a majority of their production to European consumers.

There is much uncertainty regarding future energy policies worldwide but one thing is undeniable – pellet demand in Europe, Asia and perhaps also in the US will be experiencing dramatic growth over the next five years.

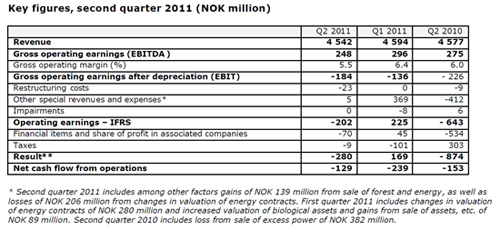

Improved debt situation, weak operations in Europe

Norske Skog’s gross operating earnings were NOK 248 million in the second quarter of 2011. This is somewhat weaker than in the first quarter, mainly affected by the magazine segment. Newsprint shows an increase in revenues, while the gross operating earnings in this segment were little changed from the first quarter.

“This has been a mixed quarter for Norske Skog. We have completed a refinancing process and reduced the debt, but we still do not achieve acceptable margins in our operations,” says CEO Sven Ombudstvedt of Norske Skog.

“We expect gradual price increases for our products, but we cannot expect the market to do the job for us. Going forward, we will also evaluate all options for further internal efficiencies”, Mr. Ombudstvedt says.

Operating earnings (IFRS) were minus NOK 202 million in the second quarter, compared to a positive NOK 225 million for the first quarter of 2011 and negative NOK 643 million for the second quarter of 2010. Financial items contributed negatively with NOK 70 million. In the first quarter the financial items were plus NOK 45 million. The result was a net loss of NOK 280 million, compared to net earnings of NOK 169 million in the first quarter of 2011 and a loss of NOK 874 million in the second quarter of 2010.

The gearing ratio was 0.85 at the end of the second quarter, compared to 0.90 at the end of the first quarter.

Segment information

Revenues from the segment newsprint in Europe increased compared to both the first quarter of 2011 and the second quarter of 2010. Gross operating earnings for the segment were somewhat weaker than in the first quarter of 2011 but better than in the second quarter of 2010. Prices have increased, but earnings were negatively affected by high input prices and a strong Norwegian krone.

The segment newsprint outside of Europe shows an increase in revenues compared to both the first quarter of 2011 and the second quarter of 2010. Gross operating earnings are marginally higher than in the first quarter of 2011 and somewhat lower than in the second quarter of 2010. The production volumes have increased in the second quarter.

The magazine paper segment experiences a reduction of both revenues and gross operating earnings compared to the first quarter of 2011 and the second quarter of 2010. The weaker results are due to lower sales volumes, currency changes and a higher export share. Production volumes are lower, especially when compared to the second quarter of 2010. This is strongly influenced by the fire at Norske Skog Saugbrugs in Halden, Norway, on 2 February. Normal production was resumed at the end of June.

Divestments in Brazil

Norske Skog in the second quarter entered into an agreement to sell all its shares in the energy company Enerpar in Brazil to SN Power Invest for BRL 120 million, about NOK 410 million.

A forest area of 21 500 hectares in Brazil was also sold in the second quarter for USD 63.5 million, about NOK 335 million.

From these two transactions the company could book a profit of NOK 139 million before tax in the second quarter, which contributed to the company being able to reduce net interest-bearing debt from NOK 9.0 billion at the end of the first quarter to NOK 8.4 billion at the end of the second quarter.

Refinancing

Norske Skog in the second quarter refinanced the company’s debt in two steps. First, a threeyear bank facility of EUR 140 million was arranged. Subsequently, a bond issue of EUR 150 million was completed. An existing bank facility of EUR 400 million was cancelled and repaid. Norske Skog continues to work on the financing situation, for instance through further asset sales.

“We now have sufficient funds through cash, asset sales and new financing to cover the maturities in 2011 and 2012. Our next big maturities will be in 2017 and later,” says the CEO, Mr. Sven Ombudstvedt. Following the refinancing, Standard & Poor’s adjusted the outlook for Norske Skog’s debt from “Negative” to “Stable”. The long-term rating is upheld at “B-“.

Outlook for 2011

Newsprint prices are expected to increase somewhat in the second half of the year. Within magazine, volumes are expected to increase in the second half. The volume increase is partly due to normal operations at Norske Skog Saugbrugs. The cost of most input factors will remain high, but the prices of energy and recovered paper show signs of moderating. Underlying gross operating earnings for all of 2011 are expected to improve somewhat from 2010.

Organisational change

Mr. Trond Stangeby has been engaged as Senior Vice President for Organisational Development from 15 August. He has extensive experience from the chemical industry through several leading positions in Norsk Hydro, Yara and INEOS. He currently works as an independent consultant. Mr. Stangeby will be a member of Norske Skog's Corporate Management team, and will be responsible for development of leadership and working processes in the company.

Verso Paper Holdings LLC and Verso Paper Inc. Announce Extension of Exchange Offer for their 8.75% Second Priority Senior Secured Notes Due 2019

Verso Paper Corp. has announced that its indirect subsidiaries, Verso Paper Holdings LLC and Verso Paper Inc. (collectively, the "Issuers"), have extended the time and date of the expiration of their offer (the "Exchange Offer") to exchange up to $396,000,000 aggregate principal amount of the Issuers' 8.75% Second Priority Senior Secured Notes due 2019 that have been registered under the Securities Act of 1933 (the "Exchange Notes") for a like principal amount of the Issuers' outstanding 8.75% Second Priority Senior Secured Notes due 2019 (the "Old Notes") to 5:00 p.m., New York City time, on Thursday, August 4, 2011 (the "Expiration Date"), unless further extended. The Exchange Offer had been scheduled to expire at 5:00 p.m., New York City time, on Monday, August 1, 2011.

The terms of the Exchange Notes to be issued in the Exchange Offer are substantially identical to those of the Old Notes, except that the Exchange Notes are freely tradable by persons other than affiliates. Except for the new Expiration Date, all other terms, provisions and conditions of the exchange offer that are described in the Issuers' Registration Statement on Form S-4 declared effective by the Securities and Exchange Commission on June 30, 2011, will remain in full force and effect.

As of 5:00 p.m., New York City time, on August 1, 2011, the Issuers have been advised that holders of $395,248,000 aggregate principal amount of the Old Notes have tendered their Old Notes for exchange. The amount tendered represents approximately 99.8% of the outstanding Old Notes. Tendered Old Notes may be withdrawn at any time prior to the Expiration Date.

This press release is not an offer to exchange Exchange Notes for Old Notes, which the Issuers are making only through a prospectus. Copies of the prospectus and related documents may be obtained from Wilmington Trust Company, the exchange agent for the Exchange Offer, c/o Wilmington Trust Company, Corporate Capital Markets, 1100 North Market Street, Wilmington, Delaware 19890-1615.

AkzoNobel strengthens leadership in key markets

In line with the company’s growth ambition and the recent announcement to drive global performance improvement measures, AkzoNobel has announced country leadership and several business unit appointments.

- Lin Liangqi has been appointed President AkzoNobel China, in addition to his role as Managing Director of Decorative Paints China and North Asia.

- Jaap de Jong, previously a Principal at McKinsey & Company, has been appointed Regional Director Latin America and President AkzoNobel Brazil.

- Amit Jain remains Group Managing Director for India, in addition to his role as Managing Director of Decorative Paints India and South Asia.

The appointment of the country leaders coincides with several leadership changes within the company’s businesses.

- Bob Taylor, currently Managing Director of AkzoNobel Marine and Protective Coatings (M&PC), will become Managing Director of Decorative Paints North America.

- Rob Molenaar will move from AkzoNobel Powder Coatings to become the new Managing Director of M&PC.

- AB Ghosh, currently Director of the Automotive and Aerospace Coatings Americas business, will succeed Rob Molenaar as Managing Director Powder Coatings.

“These appointments strengthen the company’s senior leadership in key markets. The leadership changes will capture growth and business opportunities, and will help drive a common agenda across AkzoNobel,” said Marjan Oudeman, AkzoNobel’s Executive Committee member responsible for Organizational Development and HR.

Mondi expands its ColorLok® papers to include NAUTILUS® SuperWhite, IQ appeal and MAESTRO® bulky

Inkjet users can look forward to more choice now when it comes to achieving printouts with vivid colours, bolder blacks and faster drying times. Global paper and packaging manufacturer Mondi has recently expanded their range of ColorLok® papers to include 100% recycled NAUTILUS® SuperWhite and office brands IQ appeal and MAESTRO® bulky. The ColorLok® logo can also be found on packages of IQ premium, IQ selection smooth, MAESTRO® extra, MAESTRO® supreme, DNS® premium, and NAUTILUS® ReFresh TRIOTEC.

Inkjet users can look forward to more choice now when it comes to achieving printouts with vivid colours, bolder blacks and faster drying times. Global paper and packaging manufacturer Mondi has recently expanded their range of ColorLok® papers to include 100% recycled NAUTILUS® SuperWhite and office brands IQ appeal and MAESTRO® bulky. The ColorLok® logo can also be found on packages of IQ premium, IQ selection smooth, MAESTRO® extra, MAESTRO® supreme, DNS® premium, and NAUTILUS® ReFresh TRIOTEC.

“There is a visible difference between inkjet printing on paper with and without ColorLok® Technology. Our investment in ColorLok® Technology for a broader range of  our uncoated fine papers is an added value for customers,” says Johannes Klumpp, Marketing and Sales Director for Mondi Uncoated Fine Paper.

our uncoated fine papers is an added value for customers,” says Johannes Klumpp, Marketing and Sales Director for Mondi Uncoated Fine Paper.

The primary benefits of ColorLok® Technology are realized with inkjet printing, resulting in richer, brighter images and graphics, crisp text with bolder blacks, and less smears due to rapid drying. With ColorLok® Technology the pigment remains at the paper surface while the ink penetrates deep into the paper, resulting in the crisp, vivid print quality.

To promote the extended paper range with ColorLok® Technology Mondi will launch a ColorLok® campaign toward the end of 2011.

SCA invests in incontinence care products in Turkey

SCA is acquiring 95 percent of the Turkish hygiene products company San Saglik, producer of incontinence care products, from the family-owned MT Group. The purchase consideration corresponds to SEK 95m on a debt-free basis.

San Saglik has rapidly captured market share since the company was founded in 2008, and is now the second largest player in incontinence care products in Turkey. The acquisition comprises local production and access to strong brands.

“The acquisition of San Saglik supplements the acquisition of Komili, producer of baby diapers, feminine care products and toiletries, which was announced recently. SCA will have a complete personal care product portfolio in Turkey. The strong distribution network in retail that we accessed through Komili is now also extended to healthcare. Turkey is an important growth market with 70 million inhabitants and a rapidly growing population,” says Jan Johansson, CEO and President of SCA.

San Saglik generates annual revenues of approximately SEK 100m. SCA has a purchase option on the remaining 5 percent of the company.

The transaction is expected to be completed during the third quarter of this year, following approval by the relevant authorities.