Super User

Focus on the potential of cellulose-based materials

The new ZELLCHEMING Conference "Cellulose Based Materials - From Science to Technology" reflects the growing importance of a bioeconomy strategy based on renewable raw materials. Cellulose, the main component of plant cell walls and thus the most abundant organic compound worldwide, will play a key role in the future. Therefore, the potential of cellulose-based materials and materials will be the focus of the event from June 26-29, 2022, at the RheinMain CongressCenter (RMCC) in Wiesbaden.

"With this conference, we intend to bridge the gap for the first time between innovative research on cellulose-based as well as cellulose-derived polymers and scientific work in the field of probably the best-known material built from cellulose: paper," explains Prof. Dr. Markus Biesalski, Professor of Macromolecular Chemistry and Paper Chemistry at TU Darmstadt and co-initiator of the event.

The conference is aimed at both interested scientists and colleagues from industry. It is a joint initiative of professors of the Technical University of Darmstadt and the University of Jena as well as the association ZELLCHEMING with its technical committees, based on two pillars: On the one hand, on the long-standing and close connection to the wood- and recycled fiber-based paper industry and, on the other hand, on the intensive contacts to companies and scientists in the field of cellulose chemistry and the use of cellulose polymers in sustainable products, which the association ZELLCHEMING has maintained for many years.

"The paper industry is intensively engaged in innovative applications for the fiber as well as for side streams of the production process, thus driving the further expansion of the bioeconomy strategy," explains Prof. Dr.-Ing. Samuel Schabel, Chair of Paper Technology and Mechanical Process Engineering (PMV) at TU Darmstadt. "An important focus is on innovative processes for the production as well as recycling of paper, in addition to producing innovative and conventional paper products as CO2-neutrally as possible."

Prof. Dr. Thomas Heinze, director of the Center of Excellence for Polysaccharides at Friedrich Schiller University in Jena, adds, "The active connection of both strands and thus the possibility to discover and leverage new, future potentials in the field of sustainable cellulose-based or -derived materials and materials is an important factor that led us to set up this international conference."

The event will bring together industry and research institutes in the fields of chemistry, physics, and engineering for an active exchange. The program includes lectures by internationally renowned representatives of science and industry. Young scientists will be actively involved and present their own work as a poster show.

"The international conference offers new opportunities for a close linkage and interaction between academia and industry with reference to the diverse applications for cellulose and cellulose-based materials. In addition, we are looking forward to a close connection with the ZELLCHEMING-Expo 2022, which will take place in parallel," summarizes Petra Hanke, Managing Director of ZELLCHEMING Service GmbH.

ZELLCHEMING Conference Website

Interested parties can find out more about the event on the website:

https://www.zellcheming.de/en/events/zellcheming-conference

LinkedIn Group

This group is a joint initiative of ZELLCHEMING Association with its technical committees and the Technical University of Darmstadt, Germany. International experts who work in the area of Cellulose Based Materials exchange views and are updated on current developments in this field. https://www.linkedin.com/groups/13829181/

Sulzer launches the world’s biggest medium-consistency pump

Sulzer announces the launch of the world’s biggest medium-consistency pump, the MCE93-400. The new MCETM pump size is Sulzer’s answer to the customers’ demand for bigger production rates in pulp mills.

The MCETM pump is being tested at Sulzer’s full-scale R&D center in Kotka, Finland.Pumping of liquids with a high dry solids content, referred to as medium consistency (MC), is essential for the processes in the pulp and paper industry. The proven MCE™ pumps from Sulzer achieve a unique and reliable performance level when it comes to the capacity range as well as to the temperature and pressure of the pumped medium.

The MCETM pump is being tested at Sulzer’s full-scale R&D center in Kotka, Finland.Pumping of liquids with a high dry solids content, referred to as medium consistency (MC), is essential for the processes in the pulp and paper industry. The proven MCE™ pumps from Sulzer achieve a unique and reliable performance level when it comes to the capacity range as well as to the temperature and pressure of the pumped medium.

In recent years, the production rates of the industry have increased remarkably. Sulzer developed the biggest MCETM pump size for a customer project with record-breaking values. The capacity of the pump reaches up to 10’000 ADMT/d (air dry metric tons per day), the flow up to 940 l/s and the head up to 180 m. The MCETM pump is designed for the common consistency range of 10-12% and a pressure rating of 25 bar.

“The new MCE93-400 medium-consistency pump size is an excellent addition to Sulzer’s MC equipment offering. It has been designed to operate very efficiently, thus saving energy, water, and chemical costs in the pulp and paper mill processes. The unique and innovative design features of the pump minimize its life cycle costs,” says Jussi Heinonen, Product Manager for MC equipment at Sulzer.

Sulzer’s reliable MCE™ centrifugal pumps are suitable for the most demanding process applications to pump medium-consistency fibrous suspensions, slurries with a high dry solid content, and media with a high gas content. They cover all medium-consistency applications for pulp, paper, and board as well as related biomass and biofuel applications.

The MCE93-400 pumps are manufactured at Sulzer’s factory in Kotka, Finland. The first big MCE™ pumps have been dispatched to a major pulp manufacturer in South America.

Read more about the Sulzer MCE™ pump range on our website

About Sulzer

Sulzer is a global leader in fluid engineering. We specialize in pumping, agitation, mixing, separation and application technologies for fluids of all types. Our customers benefit from our commitment to innovation, performance and quality and from our responsive network of 180 world-class production facilities and service centers across the globe. Sulzer has been headquartered in Winterthur, Switzerland, since 1834. In 2020, our 15’000 employees delivered revenues of CHF 3.3 billion. Our shares are traded on the SIX Swiss Exchange (SIX: SUN).

The Flow Equipment division specializes in pumping solutions specifically engineered for the processes of our customers. We provide pumps, agitators, compressors, grinders and screens developed through intensive research and development in fluid dynamics and advanced materials. We are a market leader in pumping solutions for water, oil and gas, power, chemicals and most industrial segments.

ANDRITZ to supply PrimeCal calenders and paper machine approach flow system to Henan Xinyaxin New Technology Packaging Material, China

International technology group ANDRITZ has received an order from Henan Xinyaxin New Technology Packaging Material, China, to deliver two calenders and a complete paper machine approach flow system for their new paper machine PM9 at the mill in Xinxiang City, Henan Province.

The PM9 has a design speed of 950 m/min with 5.7 m width at the pope reel. Start-up is scheduled for the end of 2022.

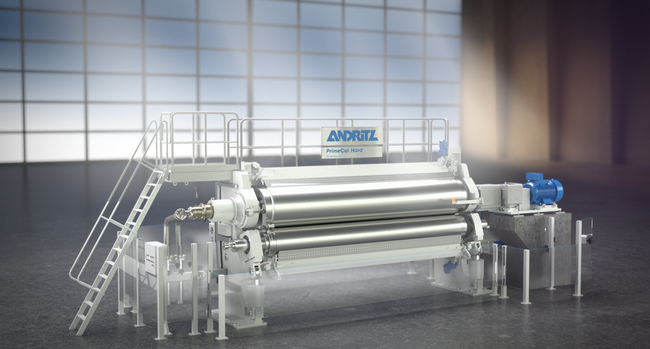

PrimeCal Hard calender for excellent paper surface properties © ANDRITZ

PrimeCal Hard calender for excellent paper surface properties © ANDRITZ

The ANDRITZ equipment will ensure production of high-quality folding boxboard paper (180 to 450 gsm):

- PrimeCal Hard calender with an advanced, zone-controlled PrimeRoll MHV will improve the surface properties of the paper and provide a consistent CD caliper profile.

- PrimeCal Soft calender featuring edge-controlled rolls with soft elastic covers will enhance the smoothness and gloss of the paper.

The scope of supply of the calenders includes drives, spare rolls, and auxiliaries. All components are based on the proven technology of ANDRITZ Küsters, Germany, the expert for finishing components, and will be delivered by ANDRITZ Foshan, China.

Henan Xinyaxin New Technology Packaging Material Co., Ltd. was founded in August 2015, mainly engaging in manufacture and sales of different kinds of paper, paper products and pulp. Its business also involves production and delivery of thermal power and energy, chemical products, and machinery.

ANDRITZ GROUP

International technology group ANDRITZ offers a broad portfolio of innovative plants, equipment, systems and services for the pulp and paper industry, the hydropower sector, the metals processing and forming industry, pumps, solid/liquid separation in the municipal and industrial sectors, as well as animal feed and biomass pelleting. Plants for power generation, flue gas cleaning, recycling, and the production of nonwovens and panelboard complete the global product and service offering. Innovative products and services in the industrial digitalization sector are offered under the brand name Metris and help customers to make their plants more user-friendly, efficient and profitable. The publicly listed group has around 26,800 employees and more than 280 locations in over 40 countries.

ANDRITZ PULP & PAPER

ANDRITZ Pulp & Paper provides equipment, systems, complete plants and services for the production of all types of pulp, paper, board and tissue. The technologies and services focus on maximum utilization of raw materials, increased production efficiency and sustainability as well as lower overall operating costs. Boilers for power generation, flue gas cleaning systems, plants for the production of nonwovens and panelboard (MDF), as well as recycling and shredding solutions for various waste materials also form a part of this business area. State-of-the-art IIoT technologies as part of Metris digitalization solutions complete the comprehensive product offering.

Metsä Tissue investigated the carbon footprint of toilet paper: high-quality and soft tissue paper is also environmentally friendly

In cooperation with AFRY, Metsä Tissue, a part of Metsä Group, has calculated the carbon footprint of toilet paper in its eight European mills, and explored also the differences in the footprints of toilet papers made of fresh and recycled fibres. The results for the products analysed by the company indicate that a roll of toilet paper made of fresh fibre has a carbon footprint that is approximately one fifth smaller than a roll made of recycled fibre.

Metsä Tissue is one of Europe’s largest tissue paper producers, having production in five countries at eight tissue paper mills, producing products from both fresh and recycled fibres. Fresh fibre based tissue papers and their production close to the markets are key elements of the company’s strategy and the use of fresh fibres in Metsä Tissue’s production will continue to increase. Currently, fresh fibres account for around half of the raw material.

“Our carbon footprint analysis was inspired partly by the fact that products made of recycled fibre are often considered a better alternative for the environment, and partly by the increasing challenges in availability and quality of recycled raw material. The biggest differences in the carbon footprints arise from the amount of energy and water needed to purify recycled fibre. To be suitable for hygiene use and food contact, recycled fibre requires effective purification, while fresh fibre is naturally suitable for hygiene use,” says Johanna Kesti, Senior Vice President, Marketing, Communications and Sustainability, at Metsä Tissue.

The carbon footprint analysis offers positive news to tissue paper consumers and producers. The average carbon footprint of tissue papers produced at Metsä Tissue’s mills was 1.4 t CO2 e per tonne of paper. The average European consumes around 12.8 kg of toilet paper a year, which is equivalent to approximately 17.92 kg of CO2. In turn, this corresponds to only around 0.27% of each European’s overall annual carbon footprint. When we use premium fresh fibre based products for hygiene purposes, we create a smaller carbon footprint than when using products made of recycled fibre. Because of its declining availability, recycled fibre will in the future be used in solutions that have lower hygiene and quality requirements than tissue papers, where material yield is higher and where the fibres stay longer in circulation. These include for example transport cardboard packaging.

“Fresh fibre is the hygiene material of the future. By using fresh-fibre products, consumers get sustainably produced tissues with high quality. The production of fresh-fibre paper consumes less energy and water at the tissue mill, and more than 90 per cent of the raw material can be utilised. The use of recycled fibre is less efficient, as only around 60 per cent of the raw material ends up in hygienic tissues and the rest is waste that needs to be processed. In other words, a responsible tissue consumer does not need to compromise on pleasant quality, product safety or sustainability,” Kesti adds.

The EU’s product environmental footprint category rules (PEFCR) were used in the carbon footprint study to calculate the global warming potential (GWP) of base paper production. Product calculations were performed by AFRY in accordance with the ISO 14067:2018 standard and based on the data supplied by Metsä Tissue’s mills.

Metsä Tissue

www.metsatissue.com

Metsä Tissue creates a cleaner everyday life. We are one of the leading tissue paper suppliers in Europe to households and professionals and one of the leading greaseproof paper suppliers globally.

Our brands are Lambi, Serla, Mola, Tento, Katrin and SAGA. With production units in five countries, we employ around 2,500 people. In 2020, our sales totalled EUR 1 billion. Metsä Tissue is part of Metsä Group.

Metsä Board minimises environmental impact of packaging with Dassault Systèmes’ simulation platform

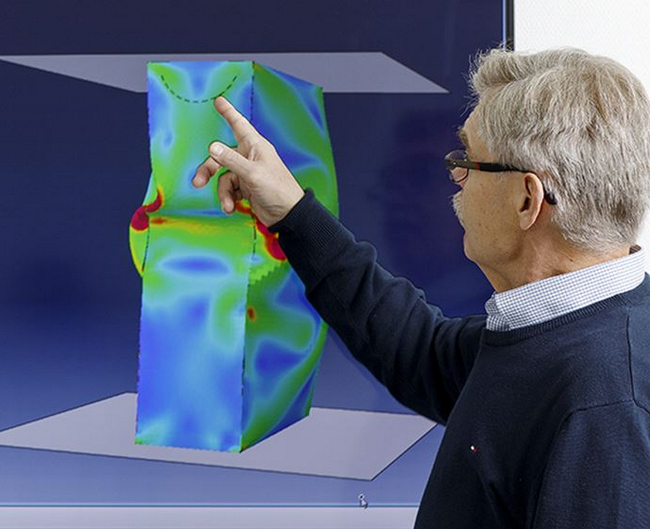

Metsä Board, the leading European producer of premium fresh fibre paperboards and part of Metsä Group, has successfully started to deploy Dassault Systèmes’ 3DEXPERIENCE platform in development and testing of packaging solutions at its Excellence Centre. With packaging simulation Metsä Board can notably speed up packaging development and reduce carbon footprint of packaging.

Simulation enables 85% faster development compared to the traditional way of making multiple tests with physical prototypes. Simulation technologies help manage the development of the entire product life cycle, from material selection to delivery. The new technology helps Metsä Board recommend optimal packaging materials as well as packaging structures to its customers.

“We wanted to accelerate our rate of innovation to help our customers – packaging manufacturers as well as brand owners – with optimal packaging solutions and reduce their carbon footprint. For example, box compression as well as drop tests can now be made in hours compared to several days or even weeks with traditional physical testing methods,” says Markku Leskelä, SVP Development, Metsä Board.

The state-of-the-art solution of Dassault Systèmes and their expertise from past engagements in the aerospace and automotive industry has helped deploy new technologies to the manufacturing of fibre-based packaging.

Metsä Board

www.metsaboard.com

Metsä Board is a leading European producer of premium fresh fibre paperboards. We focus on lightweight and high-quality folding boxboards, food service boards and white kraftliners. The pure fresh fibres we use in our products are a renewable resource, traceable to origin in sustainably managed northern forests. We are a forerunner in sustainability, and we aim for completely fossil free mills and raw materials by 2030.

Together with our customers we develop innovative packaging solutions to create better consumer experiences with less environmental impact. In 2020, our sales totalled EUR 1.9 billion, and we have about 2,400 employees. Metsä Board, part of Metsä Group, is listed on the Nasdaq Helsinki.

Metsä Group

www.metsagroup.com

Metsä Group leads the way in the bioeconomy. We invest in growth, developing bioproducts and a fossil free future. The raw material for our products is renewable wood from sustainably managed northern forests. We focus on the growth sectors of the forest industry: wood supply and forest services, wood products, pulp, fresh fibre paperboards, and tissue and greaseproof papers.

Metsä Group’s annual sales is approximately EUR 5.5 billion, and we have around 9,200 employees in 30 countries. Our international Group has its roots in the Finnish forest: our parent company is Metsäliitto Cooperative owned by 100,000 forest owners.

ANDRITZ successfully starts up pressurized refining system at Biyang Huifeng, China

International technology group ANDRITZ has successfully completed the start-up of a pressurized refining system supplied to Biyang Huifeng Wood Industry Board Co., Ltd. at its MDF production plant in Biyang, Henan province, China.

With the new ANDRITZ pressurized refining system, the customer is capable of processing poplar wood chips as raw material. The heart of the new system is the innovative ANDRITZ 54-1CP refiner, which features high energy efficiency. The scope of supply also included a maintenance-friendly 20” discharger with the latest C-feeder concept, a compensator and a proven 20” ribbon feeder.

Weng Duansheng, Vice General Manager at Biyang Huifeng, says, “The excellent operation of our first pressurized refining system installed by ANDRITZ in our Jiangsu mill convinced us to trust once more in the know-how of ANDRITZ’s panelboard experts. The successful and timely start-up of our new line has proven that our decision was the right one.”

From left to right: Huang Yongli, MDF Technology Manager, ANDRITZ; Li Xingfeng, Vice General Manager, Biyang Huifeng; Weng Duansheng, Vice General Manager, Biyang Huifeng; Yu Hongsheng, Process Control Engineer, ANDRITZ; and Wang Hongren, Workshop Manager, Biyang Huifeng.

From left to right: Huang Yongli, MDF Technology Manager, ANDRITZ; Li Xingfeng, Vice General Manager, Biyang Huifeng; Weng Duansheng, Vice General Manager, Biyang Huifeng; Yu Hongsheng, Process Control Engineer, ANDRITZ; and Wang Hongren, Workshop Manager, Biyang Huifeng.

Michael Rupp, Vice President for Panelboard Systems at the ANDRITZ Paper, Fiber and Recycling Division, adds, “We always aim to continuously optimize our technology and services for our customers. Thus, it’s a pleasure to work with a forward-thinking customer like Biyang Huifeng, who values our efforts.”

Successful start-up of the new pressurized refining system in Biyang once again demonstrates ANDRITZ’s strong position in the Chinese panelboard industry, with more than 180 installations.

Biyang Huifeng Wood Industry Board was established in 2017 and is mainly active in the wood-working and panelboard industry.

ANDRITZ GROUP

International technology group ANDRITZ offers a broad portfolio of innovative plants, equipment, systems and services for the pulp and paper industry, the hydropower sector, the metals processing and forming industry, pumps, solid/liquid separation in the municipal and industrial sectors, as well as animal feed and biomass pelleting. Plants for power generation, flue gas cleaning, recycling, and the production of nonwovens and panelboard complete the global product and service offering. Innovative products and services in the industrial digitalization sector are offered under the brand name Metris and help customers to make their plants more user-friendly, efficient, and profitable. The publicly listed group has around 26,800 employees and more than 280 locations in over 40 countries.

ANDRITZ PULP & PAPER

ANDRITZ Pulp & Paper provides equipment, systems, complete plants and services for the production of all types of pulp, paper, board and tissue. The technologies and services focus on maximum utilization of raw materials, increased production efficiency and sustainability as well as lower overall operating costs. Boilers for power production, flue gas cleaning plants, plants for the production of nonwovens and panelboard (MDF), as well as recycling and shredding solutions for various waste materials also form a part of this business area.

ANDRITZ to supply a complete OCC line, including reject treatment, to Alizay Papier, France

International technology group ANDRITZ has received an order from Alizay Papier SASU to supply a complete OCC line – including a reject treatment system – with a capacity of 1,400 bdmt/d to the mill in Alizay, France.

Start-up is scheduled for the end of 2022.

ANDRITZ PrimePulping LC system for lowest fiber loss in slushing and reject removal © ANDRITZ

ANDRITZ PrimePulping LC system for lowest fiber loss in slushing and reject removal © ANDRITZ

ANDRITZ’s scope of supply comprises the entire equipment from pulping to the storage tower and features several technological highlights:

- PrimePulping LC system with innovative design for lowest fiber loss in slushing and reject removal

- Multi-stage fine screening with PrimeScreen X screens for highest efficiency and low power consumption

- PrimeFilter D disc filter with bagless sectors offering significant benefits in terms of thickening performance, energy consumption and maintenance

- State-of-the-art reject treatment with ADuro shredders and Reject Compactors processing the rejects from pulping and coarse screening as well as the pulper rags. A space-saving, automatic rag operation process will feed the rags directly into an ADuro C primary shredder. This eliminates the need for intermediate storage and transport and thus saves space, time and manpower.

ANDRITZ will also provide full detailed engineering as well as start-up and commissioning services.

Alizay Papier SASU is part of the VPK Group, a major international packaging supplier with more than 6,500 employees in over 70 plants operating in 20 countries.

ANDRITZ GROUP

International technology group ANDRITZ offers a broad portfolio of innovative plants, equipment, systems and services for the pulp and paper industry, the hydropower sector, the metals processing and forming industry, pumps, solid/liquid separation in the municipal and industrial sectors, as well as animal feed and biomass pelleting. Plants for power generation, flue gas cleaning, recycling, and the production of nonwovens and panelboard complete the global product and service offering. Innovative products and services in the industrial digitalization sector are offered under the brand name Metris and help customers to make their plants more user-friendly, efficient and profitable. The publicly listed group has around 26,800 employees and more than 280 locations in over 40 countries.

ANDRITZ PULP & PAPER

ANDRITZ Pulp & Paper provides equipment, systems, complete plants and services for the production of all types of pulp, paper, board and tissue. The technologies and services focus on maximum utilization of raw materials, increased production efficiency and sustainability as well as lower overall operating costs. Boilers for power generation, flue gas cleaning systems, plants for the production of nonwovens and panelboard (MDF), as well as recycling and shredding solutions for various waste materials also form a part of this business area. State-of-the-art IIoT technologies as part of Metris digitalization solutions complete the comprehensive product offering.

Ilkka Hämälä, President and CEO of Metsä Group is the new Chairman of Cepi, the Confederation of the Paper and Pulp Industry

As of January 2022, Ilkka Hämälä takes over from his predecessor Ignazio Capuano as Chairman of Cepi, one of the leading and most influential trade association representing the forest and bio-based industry sector in Brussels, the capital of the European Union. His mandate will last for two years.

Mr. Hämälä has since 2018 been the President and CEO of Metsä, a forest industry group originated in Finland and operating in about 30 countries. The Group's annual sales is roughly EUR 5.5 billion and it employs some 9,300 people worldwide. Metsä Group’s parent company is Metsäliitto Cooperative, which is owned by approximately 100,000 Finnish forest owners representing almost half of Finland's private forests, which are some of the largest in the European Union. During his career, Mr. Hämälä has held various high-level positions within Metsä Group, starting his career in the company in 1988.

Mr. Hämälä has since 2018 been the President and CEO of Metsä, a forest industry group originated in Finland and operating in about 30 countries. The Group's annual sales is roughly EUR 5.5 billion and it employs some 9,300 people worldwide. Metsä Group’s parent company is Metsäliitto Cooperative, which is owned by approximately 100,000 Finnish forest owners representing almost half of Finland's private forests, which are some of the largest in the European Union. During his career, Mr. Hämälä has held various high-level positions within Metsä Group, starting his career in the company in 1988.

The outgoing Chairman Mr. Capuano, a strong supporter of the modernisation of the paper and pulp industry, oversaw during his tenure the alignment of the sector with the objectives of the EU Green Deal, now at the stage of a legislative proposal by the European Commission and the EU’s main instrument in reaching the Union’s climate objectives. He saw the Green Deal as an opportunity for an industry which everyday products are meant to offer sustainable options and alternatives to more carbon-intensive goods.

Mr. Hämälä will be taking over in what is a challenging global economic and political environment. As the face of an industry which is often seen as a role model for its commitment to sustainability, he will continue the work of his predecessor, working hand-in-hand with EU Institutions in support of the European Green Deal, while ensuring that the industry remains competitive and that a safe regulatory environment enables the investments necessary for it to further transform, innovate and achieve its emission reductions targets, in line with the EU’s climate ambitions.

About Cepi :

Cepi is the European association representing the paper industry. We offer a wide range of renewable and recyclable wood-based fibre solutions to EU citizens: from packaging to textile, hygiene and tissue products, printing and graphic papers as well as speciality papers, but also bio-chemicals for food and pharmaceuticals, bio-composites and bioenergy.

We are a responsible industry: 92% of our raw materials are sourced in Europe and certified as sustainable, 91% of the water we use is returned to the environment, in good condition. We are the world champion in recycling at the rate of 72%. At the forefront of the decarbonisation and industrial transformation of our economy, we embrace digitalisation and bring 20 billion value addition to the European economy and €5.5 billion investments annually.

More information about our sustainability performance here.

Through its 18 national associations, Cepi gathers 500 companies operating 895 mills across Europe and directly employing more than 180,000 people.

New Alfa Laval PlusClean cleaning nozzle revolutionizes tank cleaning with 100% coverage

With the introduction of the new Alfa Laval PlusClean® cleaning nozzle, Alfa Laval’s broad tank cleaning portfolio is set to take a giant leap forward. The PlusClean delivers unprecedented 100% tank cleaning coverage, up to 80% savings in water and cleaning media costs, and no product contamination. Paired with a top-mounted tank cleaning device and installed flush with the tank wall or bottom, the PlusClean raises productivity and lowers total cost of ownership.

No shadows areas, no risk of contamination

“Integrating Alfa Laval PlusClean cleaning nozzles into any tank and tank cleaning process means there’s nowhere for contaminants to hide,” says Janne Pedersen, Global Portfolio Manager, Tank Cleaning, Alfa Laval. “Now the promise of optimal tank cleaning is truly a promise that we can keep. No shadow areas and no risk of product contamination. Period.”

Easy to install, simple to use

With its optimized, high-impact spray pattern, the PlusClean delivers 100% cleaning coverage in shadow areas that other tank cleaning spray nozzles miss. Installed flush with the tank wall or bottom, the cleaning nozzle has a revolutionary, built-in adjustment function that makes installation easy and operation effective, providing cleaning coverage in shadow areas, such as beneath agitator blades. This ensures thorough tank cleaning, unmatched by other tank cleaning devices.

Competitive advantage

Perfect for the pharmaceutical, dairy, food, beverage, and home-personal care industries, this innovative cleaning nozzle provides even more efficient cleaning and improves process efficiency and safety as well as product quality. This translates into higher productivity and increases competitive advantage for those who choose to add the PlusClean to their tank cleaning processes.

Sustainability at the core

At Alfa Laval sustainability is at the core of our business, and the PlusClean is no exception. This revolutionary cleaning nozzle delivers significant water and cleaning media cost savings, minimizing the impact on the environment.

For demanding hygienic applications

The standard Alfa Laval PlusClean is supplied as a media spring-activated cleaning nozzle for hygienic process tank cleaning. A special pneumatic-driven version is also available. For sterile and aseptic process tank cleaning, there’s the Alfa Laval PlusClean UltraPure, which is backed by Alfa Laval Q-doc documentation package to ensure full traceability across the entire supply chain.

Discover how 100% cleaning coverage from the Alfa Laval PlusClean boosts yield and cuts costs. To learn more, visit www.alfalaval.com/plusclean.

For further information, please contact:

Janne Pedersen

Global Portfolio Manager, Tank Cleaning Equipment, Alfa Laval

Phone: +45 22 77 84 52

E-mail: janne.pedersen(at)alfalaval.com

This is Alfa Laval

Alfa Laval is active in the areas of Energy, Marine, and Food & Water, offering its expertise, products, and service to a wide range of industries in some 100 countries. The company is committed to optimizing processes, creating responsible growth, and driving progress – always going the extra mile to support customers in achieving their business goals and sustainability targets.

Alfa Laval’s innovative technologies are dedicated to purifying, refining, and reusing materials, promoting more responsible use of natural resources. They contribute to improved energy efficiency and heat recovery, better water treatment, and reduced emissions. Thereby, Alfa Laval is not only accelerating success for its customers, but also for people and the planet. Making the world better, every day. It’s all about Advancing betterTM.

Alfa Laval has 16,700 employees. Annual sales in 2020 were SEK 41.5 billion (approx. EUR 4 billion). The company is listed on Nasdaq OMX.

Stora Enso’s Sustainability Report receives award

Stora Enso’s Sustainability Report 2020 was chosen as the best in Finland in a competition organised by an independent group of expert organisations. In addition, for the fourth consecutive year, Stora Enso’s report has been included in the top ten sustainability reports globally, according to the World Business Council for Sustainable Development (WBCSD).

Stora Enso’s Sustainability Report won the award for Finland’s best sustainability report of the year. The report was particularly recognised for being comprehensive, strongly linked to the company’s core business, and it excelled in all areas of the competition. In addition, Stora Enso’s report was the winner of the stakeholder category, this year chosen by the Finnish Climate Fund.

“Sustainability performance is high on the agenda for all our stakeholders and we are proud to be acknowledged for our reporting. In addition to being informative and transparent, good reporting needs to be engaging and compelling, while easy to absorb. We constantly develop our reporting to reflect sustainability contributions, as well as pursuing our ambitions and meeting new challenges,” says Annette Stube, EVP Sustainability at Stora Enso.

“Sustainability performance is high on the agenda for all our stakeholders and we are proud to be acknowledged for our reporting. In addition to being informative and transparent, good reporting needs to be engaging and compelling, while easy to absorb. We constantly develop our reporting to reflect sustainability contributions, as well as pursuing our ambitions and meeting new challenges,” says Annette Stube, EVP Sustainability at Stora Enso.

In WBCSD’s Reporting matters publication, Stora Enso’s report is recognised as an example of best practice in how it outlines the materiality assessment process to identify and prioritise significant sustainability impacts.

The Stora Enso Annual Report 2020 consists of Strategy, Financials, Sustainability, Governance and Remuneration. The Annual Report is available at storaenso.com/annualreport.

The sustainability report review has been organised since 1996. This year it was carried out in cooperation with Aalto University, Climate Leadership Coalition, Finland's Sustainable Investment Forum (Finsif), Hanken, Nasdaq, the Finnish Association of Auditors, the Association for Environmental Management, the Ministry of the Environment and the corporate responsibility network FIBS. This year, a total of 47 sustainability reports from different organisations were evaluated.

The WBCSD produces Reporting matters to help improve the effectiveness of non-financial corporate reporting. The publication lists Stora Enso’s Sustainability Report as one of the top ten in the world out of the 168 reviewed within the scope of the publication, without disclosing the exact rankings.

Part of the bioeconomy, Stora Enso is a leading global provider of renewable solutions in packaging, biomaterials, wooden construction and paper. We employ some 23 000 people and our shares are listed on the Helsinki (STEAV, STERV) and Stockholm (STE A, STE R) stock exchanges. Our fiber-based materials are renewable, recyclable and fossil free. Our solutions offer low-carbon alternatives to products based on finite resources. We believe that everything that is made from fossil-based materials today can be made from a tree tomorrow. storaenso.com