Super User

Inside information: Stora Enso plans to divest its consumer board production site and forestry operations in China

Stora Enso has initiated a sales process for a possible divestment of its consumer board production site in Beihai, China. The divestment would also include the Group’s forestry operations in the surrounding region, which supply raw material to the Beihai site. The sales process supports Stora Enso’s strategy to focus on long-term profitable growth within the areas of renewable packaging, building solutions and biomaterials innovations.

Stora Enso’s strategic ambition is to build on its leading position in the fiber-based packaging market. The divestment of the Beihai operations would allow Stora Enso to accelerate its strategy by focusing on cost-efficient sites serving the growing global packaging market, such as the recently announced investment in Oulu, Finland and the pending acquisition of De Jong Packaging Group. The aim is to find a sustainable alternative for the future of the operations in Beihai and for the people working there.

The divestment of the board mill and forestry operations would be conducted separately or as a combined unit. Stora Enso has not committed to a timeline for the conclusion of the process. The divestment plan has no immediate effect on Stora Enso's financials or on the Beihai site’s production. The site continues to serve its customers.

The divestment of the board mill and forestry operations would be conducted separately or as a combined unit. Stora Enso has not committed to a timeline for the conclusion of the process. The divestment plan has no immediate effect on Stora Enso's financials or on the Beihai site’s production. The site continues to serve its customers.

Stora Enso’s Beihai production site started operations in 2016. It has a modern mechanical pulp mill and a premium consumer board line serving the Chinese market. The annual production capacity is 250,000 tonnes of mechanical pulp and 550,000 tonnes of consumer board. Stora Enso also operates 70,000 hectares of land in the Guangxi region for eucalyptus plantations, established in 2003, for fiber supply. The combined operations employ approximately 1,000 people including the forest operations. Stora Enso owns approximately 80% of the production site and forest operations, and its local partners and International Finance Corporation (IFC) own the remaining share. Stora Enso will work together with all stakeholders to complete the divestment process.

Stora Enso has retained J.P. Morgan S.E to act as its financial advisor in the sales process.

Part of the global bioeconomy, Stora Enso is a leading provider of renewable products in packaging, biomaterials, wooden construction and paper, and one of the largest private forest owners in the world. We believe that everything that is made from fossil-based materials today can be made from a tree tomorrow. Stora Enso has approximately 22,000 employees and our sales in 2021 were EUR 10.2 billion. Stora Enso shares are listed on Nasdaq Helsinki Oy (STEAV, STERV) and Nasdaq Stockholm AB (STE A, STE R). In addition, the shares are traded in the USA as ADRs (SEOAY). storaenso.com/investors

Metsä Tissue’s UK Sustainability Awards – entry deadline approaching

Metsä Tissue in the UK, in partnership with the Cleaning & Services Support Association, is announcing the first of it’s kind Sustainability Awards competition to the hygiene industry in early 2023, with the goal to promote sustainable practices across the industry. The Awards are open for entries in several categories until 23rd December 2022.

We all recognise the growing importance of sustainability in every business sector and the cleaning & hygiene industry is no exception. It is with this in mind that Metsä Tissue, in partnership with the Cleaning & Services Support Association, has launched a Sustainability Awards competition to the hygiene industry. If you would like to showcase your proactive actions for more sustainable business, you have until close of play on 23rd December to submit your entry -– and to create fair and equal participation for all, the Awards are free to enter.

“With the glaring focus on sustainability, it is incumbent on all of us not just to do our bit, but also to recognise those who are leading the way in best practice and going above and beyond to promote and embrace sustainability. Our aim is to highlight and reward sustainability practices throughout our industry and thus create a positive, lasting impact on the environment”, says Mika Paljakka, Metsä Tissue’s Senior Vice president for Metsä Tissue Ltd, UK & Ireland .

Carefully planned to coincide with an event which will draw those in the industry to London – The Cleaning Show at London’s ExCeL, 14th – 16th March 2023, the black-tie Awards Ceremony will take place on Wednesday 15th at 19:00hrs just a short distance away, in Greenwich, at the iconic Cutty Sark.

This Awards programme is open to all organisations involved in the cleaning & hygiene industry: companies large and small, membership and accreditation organisations and end users, whether commercial or public sector. So, if you, your organisation, your team, or your invention are making a difference - directly or indirectly, to people and the planet, you are eligible! You can nominate yourself, your suppliers or your customers (or a team of any combination if that is relevant). The Awards categories are:

- Carbon Reducer Award

- Social Value Impact Award

- Renewable Energy Performer Award

- Best Sustainability Marketing and Communication Initiative Award

- Team Sustainability Excellence Award

- Individual Sustainability Excellence Award

Initial entries will be reviewed by a team of specialists with focus on quantifiable, proven sustainability benefits. The top entries in each category will then be passed to a highly qualified and experienced judging panel who will review and score each entry, determining the winners.

To find out more and to enter the Awards, please visit: https://www.2023sustainabilityawards.com

Metsä Tissue

www.metsatissue.com

Metsä Tissue creates a cleaner everyday life. We are one of the leading tissue paper suppliers in Europe to households and professionals and one of the leading greaseproof paper suppliers globally.

Our brands are Lambi, Serla, Mola, Tento, Katrin and SAGA. With production units in five countries, we employ around 2,500 people. In 2021, our sales totalled EUR 0.9 billion. Metsä Tissue is part of Metsä Group.

Valmet's climate work recognized in CDP's climate listing

Valmet has been recognized for its climate work by receiving A- rating and reaching a leadership level in CDP's Climate ranking.

CDP's evaluation is based on the company's disclosure about its strategy, targets, governance, risks and opportunities, risk management and actions in the last reporting year related to climate change mitigation and development of low-carbon technology and solutions. CDP is a global non-profit environmental disclosure platform that drives companies and governments to reduce their greenhouse gas emissions, safeguard water resources and protect forests.

“We are pleased to be recognized for our efforts to mitigate climate change. We have been developing our processes and solutions on a continuous basis and in 2021 we initiated a specific Climate Program – Forward to a carbon neutral future. The program includes ambitious targets and concrete actions for the whole value chain, including Valmet’s supply chain, own operations and the use of Valmet’s technologies by its customers. Since most of Valmet’s value chain’s carbon footprint originates from the use phase of its technologies, the program emphasizes Valmet’s ability to create technologies that will enable 100 percent carbon neutral production for its customers”, says Anu Salonsaari-Posti, SVP, Marketing, Communications, Sustainability and Corporate Relations.

“We are pleased to be recognized for our efforts to mitigate climate change. We have been developing our processes and solutions on a continuous basis and in 2021 we initiated a specific Climate Program – Forward to a carbon neutral future. The program includes ambitious targets and concrete actions for the whole value chain, including Valmet’s supply chain, own operations and the use of Valmet’s technologies by its customers. Since most of Valmet’s value chain’s carbon footprint originates from the use phase of its technologies, the program emphasizes Valmet’s ability to create technologies that will enable 100 percent carbon neutral production for its customers”, says Anu Salonsaari-Posti, SVP, Marketing, Communications, Sustainability and Corporate Relations.

Already today, Valmet’s current bioenergy boiler offering enables 100 percent fossil free heat and power production for its customers, and the customers’ chemical pulp mills utilizing Valmet’s technologies are often over 100 percent bioenergy self-sufficient.

According to its Climate Program, Valmet targets to enable 100 percent carbon neutral production for all its pulp and paper customers by developing new process technologies and by improving the energy efficiency of its current offering by 20 percent by 2030. Respectively, Valmet targets to reduce 80 percent of CO₂ emissions in its own operations and 20 percent in its supply chain by 2030.

In 2022, Valmet has been recognized for its sustainability work also in other leading rankings. The company has been included in the Dow Jones Sustainability Index as one of the world’s sustainability leaders, Global Sustainability Yearbook 2022 by S&P Global (Bronze Class), EcoVadis sustainability assessment (Gold medal) and MSCI ESG Ratings (AAA).

About CDP

CDP is an international non-profit organization that drives companies and governments to manage their environmental impacts. CDP's list of all companies publicly taking part in its climate disclosure this year is available on CDP's website.

Valmet is a leading global developer and supplier of process technologies, automation and services for the pulp, paper and energy industries. With our automation systems and flow control solutions we serve an even wider base of process industries. Our 17,500 professionals around the world work close to our customers and are committed to moving our customers’ performance forward – every day.

The company has over 220 years of industrial history and a strong track record in continuous improvement and renewal. In 2022, a major milestone was achieved when the flow control company Neles was merged into Valmet. The combined company’s net sales in 2021 were approximately EUR 4.5 billion based on the respective company figures.

Valmet’s shares are listed on the Nasdaq Helsinki and the head office is in Espoo, Finland.

Follow us on valmet.com

Voith remains on a sustainable growth path

The Voith Group performed satisfactorily in the 2021/22 fiscal year (ending on September 30) and is proving to be in a robust condition with regard to its operations and finances. The Group’s orders received have further increased in comparison to the already high previous-year level. Sales rose perceptibly and both the operating result and the net income grew appreciably. The Company’s broad sectoral and geographical diversification and the solid market position of the three Group Divisions contributed to this development, as did regional supply chains. Voith is furthermore profiting from a sound financial strength that enables the Company to make substantial investments in the development of innovative technologies and in acquisitions to exploit strategic growth areas, even in a difficult economic environment.

- Further increase in orders received starting from the very high previous-year level, orders on hand reached record high

- Increase in Group sales of 15% in 2021/22 fiscal year;

appreciable increase in EBIT and net income - CEO Dr. Toralf Haag: “Our focus on sustainable technologies is paying off, the resilience of our business model has been proven once again.”

- Outlook 2022/23: Increase in sales and earnings expected once again despite further deterioration in the economic environment

President and CEO Dr. Toralf Haag said, explaining the situation in the 2021/22 fiscal year: “Voith saw profitable growth under demanding conditions. With this, we not only demonstrated that our clear strategic focus on sustainable technologies is paying off. We have also proven once again the resilience of our business model. For this reason, we are in a good position, even in an economic environment that is likely to remain difficult over the short term, to continue our sustainable growth path and to emerge stronger from these crisis-ridden times.”

2021/22 financial performance indicators: Profitability improved

The Voith Group’s key performance indicators improved over the 2021/22 fiscal year, also benefiting from recent acquisitions and currency effects. All three Group Divisions contributed to this development.

Orders received exceeded expectations at € 5.16 billion, having risen by 3% in comparison to the previous year’s very high level. At € 7.03 billion, orders on hand broke through the € 7 billion threshold for the first time; thus, the level seen at the reporting date was more than 12% higher than one year previously. With a rise of 15% to € 4.88 billion, Group sales likewise exceeded expectations. In particular, this effect came from the high level of orders received in previous years as the Covid restrictions that were phased out in large areas of the world allowed for better processing of backlog. With a rise of 21%, the operating result (EBIT) grew at a faster rate than sales to reach € 200 million – even though the earnings situation in Germany remains unsatisfactory. The return on sales increased slightly to 4.1% (previous year 3.9%), the return on capital employed (ROCE) reached a double-digit figure of 10.5% (previous year: 9.6%). The Voith Group’s net income, which had been only slightly positive at € 1 million in the previous year, rose to € 30 million.

Once again in the past fiscal year, Voith invested substantially in its future business performance. Expenditure on research and development (R&D) increased by 11% to € 213 million. The Group is in a good financial position to keep its future R&D expenditure at a high level. At the reporting date, the equity ratio was once again sound at 24.1%. The cash flow from operating activities was clearly positive once again at € 93 million. Net debt remains at a very low level. Dr. Toralf Haag: “Even after the substantial acquisitions made in the recent past, we still have the necessary financial leeway to invest in growth along our strategic focus areas.”

Group strategy consistently driven forward

Voith continued to drive forward its Group strategy aligned with the megatrends of decarbonization and digitalization over the past year. In both the expansion of the core business and in the opening up of new business segments and markets, the specific focus is on sustainable technologies. In this way, Voith is positioning itself as a pioneer for industry in the post-carbon age – being itself net climate neutral at all locations worldwide since the beginning of this year.

One important objective for Voith is to also use its expertise in the areas of hydropower, paper making, mobility, and industrial applications beyond the current product portfolio. In this respect, Voith has identified hydrogen technology, electrical drive systems, cargo rail, and energy storage as growth areas.

In all fields, Voith made progress on the way to the market maturity of innovative solutions over the past year. For example, using contributions from all Group Divisions, Voith is developing, a complete hydrogen tank system that will be easy to integrate into vehicles. This is an area where Voith can apply its experience gained over many years with the processing of carbon. Great importance is also attached to the ongoing development of electrical drives for means of transportation such as buses, trucks and ships, as well as for industrial applications. In order to contribute to the automation of rail freight transport, Voith has developed an automatic freight coupler including digital solutions. In the growth area of energy storage, Voith is currently focusing on the development of a redox flow battery that enables performance peaks of, for example, solar or wind farms to be stabilized.

In addition, further targeted acquisitions contributed to extending the Company’s portfolio of offerings also in the past fiscal year. In this context, Voith has entered the promising off-highway market with the acquisition of the majority of shares in Argo-Hytos. Argo-Hytos develops and produces hydraulic components and system solutions with a focus on agricultural machinery, construction equipment and vehicles.

Voith also signed an agreement in the reporting year to purchase IGW Rail that came into effect as of October 4, 2022, once all official approvals had been granted. IGW Rail is a globally operating, high-tech company that specializes in customized gear unit and coupling solutions for the rail vehicle industry. The acquisition perfectly complements Voith’s existing activities.

One important milestone in its strategy of strengthening the core business in the field of sustainable technologies was the acquisition of the remaining 35% shares in Voith Hydro Holding GmbH & Co. KG from the previous joint venture partner, Siemens Energy, that was completed March 1, 2022. The transaction makes Voith the sole owner of the Group Division Hydro and therefore of this business that is important for the energy transition.

Looking back at 2021/22 in the Group Divisions: Increase in sales and good level of orders received at Hydro, Paper and Turbo

The Group Division Hydro increased its orders received and sales in the 2021/22 fiscal year in a market environment that had recovered slightly after the pandemic. However, the operating result fell short of expectations. EBIT declined as a result of sharp increases in materials and transport costs and the processing of orders posted in weak market phases under high price pressure.

The Group Division Paper was once again the strongest sales and earnings driver for Voith. In light of ongoing strong investment activity in the paper machine market, orders received nearly reached the high level of the previous-year, and orders on hand rose to an all-time high. Sales grew by just under a quarter, and EBIT increased perceptibly despite a massive rise in material prices and transport costs. Voith Paper’s contribution of € 131 million made up two thirds of the Group’s EBIT.

Driven by the recovery in the Industry division, among other factors, the Group Division Turbo saw robust development in the reporting year increasing its orders received and sales. Voith Turbo’s EBIT was appreciably higher than previous year’s level but fell short of expectations in light of the unforeseen steep rise in materials and transport costs, and a changed sales mix.

Outlook 2022/23 fiscal year: Slight decline in high level of orders received expected, further increases in sales and earnings anticipated

The outlook for the current 2022/23 fiscal year is subject to great uncertainties. These include but are not limited to: the war in Ukraine and its consequences; extraordinarily high inflation rates worldwide – potentially with further significant price increases for materials, personnel and energy – and the associated restrictive monetary policy on the part of most central banks; the Covid-19 pandemic that has not yet been overcome; and ongoing disruptions to supply chains. The growth prospects for the global economy are continuing to deteriorate. All regions relevant to Voith are affected by at least some of these factors.

However, Voith has proven its resilience over past years. In this context, Voith made a conscious decision to continue investing even in times of crisis: in research and development, business acquisitions, training and in the ongoing strategic and organizational development of the Company. By doing so, Voith has put itself into a good starting position to continue to generate sustainable and profitable growth in the future.

For 2022/23, Voith expects the Group’s orders received to be at a good level but slightly down from the high level of the reporting year. The high level of orders on hand will be reflected gradually in increasing sales over the coming years. In the 2022/23 fiscal year, Voith anticipates a slight increase in Group sales. Despite the implications of inflation, the Company intends to further improve its profitability, with efficiency gains from structural measures taken in previous years becoming increasingly apparent. For 2022/23, a perceptible further increase in EBIT is planned. All three Group Divisions are expected to contribute to this. The ROCE is expected to rise, in line with the development of the operating result.

About the Voith Group

The Voith Group is a global technology company. With its broad portfolio of systems, products, services and digital applications, Voith sets standards in the markets of energy, paper, raw materials and transport & automotive. Founded in 1867, the company today has around 21,000 employees, sales of € 4.9 billion and locations in over 60 countries worldwide and is thus one of the larger family-owned companies in Europe.

The Group Division Voith Paper is part of the Voith Group. As the full-line supplier to the paper industry, it provides the largest range of technologies, services, and products on the market, and offers paper manufacturers integrated solutions from one source. The company’s continuous stream of innovations facilitates resource-conserving production and helps customers minimize their carbon footprint. With its comprehensive automation products and leading digitalization solutions from the Papermaking 4.0 portfolio, Voith offers its customers state-of-the-art digital technologies to improve plant availability and efficiency for all sections of the production process.

Stora Enso invests to strengthen focus on specialised pulp grades

Stora Enso strengthens its focus on specialised pulp grades by investing EUR 38 million in unbleached kraft pulp (UKP) production at its Enocell site in Finland and EUR 42 million in fluff pulp production improvement at its Skutskär site in Sweden. These investments will support the growing consumer demand for non-bleached renewable packaging materials and hygiene products respectively.

By increasing the share of UKP in the pulp portfolio, Stora Enso continues on its strategic path to develop more specialised Nordic pulp grades while optimising its share in standard market pulp. The long-term trends point towards consumer preference for less bleached or brown fiber-based renewable packaging products. Following the investment, the Enocell site will be able to flexibly produce UKP and Nordic Bleached Softwood Kraft (NBSK) pulp. Due to the reduced use of bleaching chemicals, the carbon footprint per tonne of produced UKP will be more than 20% lower than the equivalent amount of bleached pulp produced at the Enocell site. The investment is expected to be completed during the last quarter of 2024.

The investment in fluff pulp production improvement at the Skutskär site strengthens Stora Enso’s position as the leading fluff pulp producer in Europe. Due to the upgrades made with the investment, the Group can meet customer demand for specific roll sizes, improve work safety, and grow fluff pulp production at the Skutskär site. The investment is expected to be completed during the second quarter of 2024.

“Through optimising our pulp portfolio, we advance the more specialised pulp offering, while also improving production and sustainability performance. This will allow us to meet the rapidly growing demand for using unbleached and less bleached pulp in packaging and hygiene applications,” says Johanna Hagelberg, Executive Vice President, Biomaterials division at Stora Enso.

Both investments fall within the Group’s capital expenditure guidance.

Stora Enso’s Enocell site’s annual capacity is 630,000 tonnes of softwood and hardwood pulp. The site employs approximately 280 people. Stora Enso’s Skutskär site’s annual capacity is 545,000 tonnes of fluff, softwood and hardwood pulps. The site employs approximately 420 people.

Part of the global bioeconomy, Stora Enso is a leading provider of renewable products in packaging, biomaterials, wooden construction and paper, and one of the largest private forest owners in the world. We believe that everything that is made from fossil-based materials today can be made from a tree tomorrow. Stora Enso has approximately 22,000 employees and our sales in 2021 were EUR 10.2 billion. Stora Enso shares are listed on Nasdaq Helsinki Oy (STEAV, STERV) and Nasdaq Stockholm AB (STE A, STE R). In addition, the shares are traded in the USA as ADRs (SEOAY). storaenso.com

Metsä Board recognised again with triple CDP ‘A’ score for transparency on climate change, forests and water security

Metsä Board, part of Metsä Group, has been recognised for leadership in corporate transparency and performance on climate change, forests and water security by global environmental non-profit CDP, securing a place on its annual ‘A List’. Based on data reported through CDP’s 2022 Climate Change, Forests and Water Security questionnaires, Metsä Board is one of only 12 companies that achieved a triple ‘A’ – out of nearly 15,000 companies scored. This was the second consecutive year that Metsä Board scored the outstanding triple ‘A’.

“We have ambitious sustainability targets including 100% fossil free production and raw materials by the end of 2030. In order to follow our way towards the goals it is essential that we report our sustainability work comprehensively, transparently and openly. These ‘A List’ positions are a recognition of our systematic work," says Mika Joukio, CEO of Metsä Board. Earlier this year Metsä Board published new detailed, interactive roadmaps to help visualise the measures it will take to achieve its 2030 sustainability targets regarding climate change and water use.

This is the seventh year that Metsä Board achieved the position on the CDP Climate A list and the CDP Water A list, and the second time on the CDP Forest A list.

CDP’s annual environmental disclosure and scoring process is widely recognised as the gold standard of corporate environmental transparency. The full list of companies that made this year’s CDP A List is available here, along with other publicly available company scores:

https://www.cdp.net/en/companies/companies-scores

Metsä Board

https://www.metsagroup.com/metsaboard

Metsä Board is a leading European producer of premium fresh fibre paperboards. We focus on lightweight and high-quality folding boxboards, food service boards and white kraftliners. The pure fresh fibres we use in our products are a renewable and recyclable resource, that can be traced back to sustainably managed northern forests. We are a forerunner in sustainability, and we aim to have completely fossil free mills and raw materials by the end of 2030.

Together with our customers we develop innovative packaging solutions to create better consumer experiences with less environmental impact. In 2021 our sales totaled EUR 2.1 billion, and we have around 2,400 employees. Metsä Board, part of Metsä Group, is listed on the Nasdaq Helsinki.

Metsä Group

https://www.metsagroup.com

Metsä Group leads the way in the bioeconomy. We invest in growth, developing bioproducts and a fossil free future. The raw material for our products is renewable wood from sustainably managed northern forests. We focus on the growth sectors of the forest industry: wood supply and forest services, wood products, pulp, fresh fibre paperboards, and tissue and greaseproof papers.

Metsä Group’s annual sales is approximately EUR 6 billion, and we have around 9,500 employees in 30 countries. Our international Group has its roots in the Finnish forest: our parent company is Metsäliitto Cooperative owned by nearly 100,000 forest owners.

Valmet retains its position in the Dow Jones Sustainability Index among the world's sustainability leaders

Valmet has been included in the Dow Jones Sustainability Index (DJSI) for the ninth consecutive year. The company was listed again both in the Dow Jones Sustainability World and Europe indices.

The Dow Jones Sustainability Index evaluates companies’ ESG (Environmental, Social, Governance) performance and the capability to continuously improve. In the latest assessment, the focus was increasingly on companies’ climate strategies and plans to decarbonize their operations.

As part of its continuous development, Valmet renewed its Sustainability360º Agenda in 2022. The agenda covers Valmet’s entire value chain including the supply chain, own operations and the use phase of Valmet´s technologies. In addition, in 2021 Valmet launched its Climate Program with ambitious CO2 reduction targets by 2030.

"Valmet has consistently implemented its Sustainability360º Agenda which has been the backbone for the company’s sustainability work over the years. The agenda takes a comprehensive approach to environmental, social and governance aspects and all the material topics have concrete targets and action plans integrated into our annual planning process. We are also strongly focusing on and contributing to a carbon neutral future. In our Climate Program – Forward to a carbon neutral future – we have set ambitious targets and concrete action plans for the entire value chain and aim at enabling fully carbon neutral production processes to our customers by 2030", says Anu Salonsaari-Posti, SVP, Marketing, communications, sustainability and corporate relations at Valmet.

"Valmet has consistently implemented its Sustainability360º Agenda which has been the backbone for the company’s sustainability work over the years. The agenda takes a comprehensive approach to environmental, social and governance aspects and all the material topics have concrete targets and action plans integrated into our annual planning process. We are also strongly focusing on and contributing to a carbon neutral future. In our Climate Program – Forward to a carbon neutral future – we have set ambitious targets and concrete action plans for the entire value chain and aim at enabling fully carbon neutral production processes to our customers by 2030", says Anu Salonsaari-Posti, SVP, Marketing, communications, sustainability and corporate relations at Valmet.

Valmet has been recognized for its sustainability work also in the Global Sustainability Yearbook 2022 by S&P Global (Bronze Class), EcoVadis sustainability assessment (Gold medal) and MSCI ESG Ratings (AAA).

About the Dow Jones Sustainability Indices

The DJSI is a sustainability index family, which includes the global sustainability leaders across industries. The company inclusion is based on a best-in-class approach, which means that the indices only include the top-ranked companies within each industry. The index serves as a benchmark for investors, who are committed to ethical investing and review companies' ESG performance as part of their analyses.

Valmet is a leading global developer and supplier of process technologies, automation and services for the pulp, paper and energy industries. With our automation systems and flow control solutions we serve an even wider base of process industries. Our 17,500 professionals around the world work close to our customers and are committed to moving our customers’ performance forward – every day.

The company has over 220 years of industrial history and a strong track record in continuous improvement and renewal. In 2022, a major milestone was achieved when the flow control company Neles was merged into Valmet. The combined company’s net sales in 2021 were approximately EUR 4.5 billion based on the respective company figures.

Valmet’s shares are listed on the Nasdaq Helsinki and the head office is in Espoo, Finland.

Follow us on valmet.com

Toscotec to supply first tissue line to Indian Paper and Board manufacturer Gayatrishakti

Toscotec will supply a complete AHEAD 1.8 tissue machine to Gayatrishakti Tissue to be installed at their paper mill in Vapi, Gujarat. The Indian manufacturer is entering the tissue market with this new line slated for start-up in 2024.

The AHEAD 1.8 tissue machine has sheet trim width of 2,850 mm, an operating speed of 1,800 m/min, a production of over 35,000 tpy.

It features Toscotec’s best-in-class drying configuration including an upgraded design shoe press TT NextPress, a third-generation design TT SYD Steel Yankee Dryer and high-efficiency TT Hood. The supply comprises key stock preparation and fiber recovery equipment, Toscotec’s patented TT SAF® DD (Short Approach Flow System with Double Dilution) for superior energy efficiency, and two OPTIMA 2200 slitter rewinders. The service package includes erection supervision, commissioning, training programs, YES-CONNECT-VISION Augmented Reality on remote assistance system, and start-up support.

Shri G. N. Agarwal, Managing Director of Gayatrishakti Paper & Board, says, “We selected Toscotec because we wanted to invest in state-of-the-art tissuemaking technology. We value their solid experience in guiding and sharing their expertise with newcomers in tissue. Gayatrishakti is a well-established board manufacturer in India and based on our strong background in Paper and Board, we understand the importance of choosing the right partner for this new market entry.”

Marco Dalle Piagge, Sales Director of Toscotec, says, “Toscotec is committed to providing Gayatrishakti with first class support to ensure their successful penetration of the Indian tissue market. Thanks to Voith’s global presence, they can also benefit from local services offered by Voith Paper India. With this new project, Toscotec strengthens its presence in Southeast Asia where we received two new orders of complete tissue lines in 2022.”

About Gayatrishakti Tissue Pvt Ltd

Gayatrishakti Tissue is a subsidiary of Gayatrishakti Paper & Board Ltd (GSPBL). GSPBL is a leading a manufacturer of a range of premium grades of duplex packaging boards and kraft paper. Established in 1996, it has a head office in Mumbai and three manufacturing facilities with a combined installed capacity of 300,000 mta in Vapi & Sarigam GIDC, Gujarat state, India.

For further information, please contact:

Fabio Bargiacchi, Sales Manager, Toscotec Tissue division, This email address is being protected from spambots. You need JavaScript enabled to view it.

ANDRITZ to supply VIB moisturizing technology for Xianhe Group in Hubei Province, China

International technology group ANDRITZ has received an order from Xianhe Co., Ltd., in Hubei Province, China, for the supply of VIB moisturizing technology for two new paper machines.

The plants will supply 300 t/day décor paper with a machine speed of 1,000 m/min and a paper width of 3,860 mm. The equipment installation is expected to be completed during the second half of 2023.

The air water spray will be installed below the last cooling cylinder to increase the paper moisture up to 3.5% with a 2-sigma value below 0.1%. The VIB MoistureTech will be installed before the machine calender to ensure highest paper quality standards. Precise steam application and the unique design comprising dwell zone provide best paper parameters for efficient calendering. The VIB MoistureTech is not only used for decor paper but also for conditioning and curl control on laminated grades and silicone papers.

The scope of supply also comprised spray boom with 80 nozzles, air and water supply, edge trim control, VIB MoistureTech with 2 x 30 zones, steam supply including desuperheater system as well as the corresponding CD control hard- and software and control cabinets. ANDRITZ will execute installation supervision, start up and performance optimization.

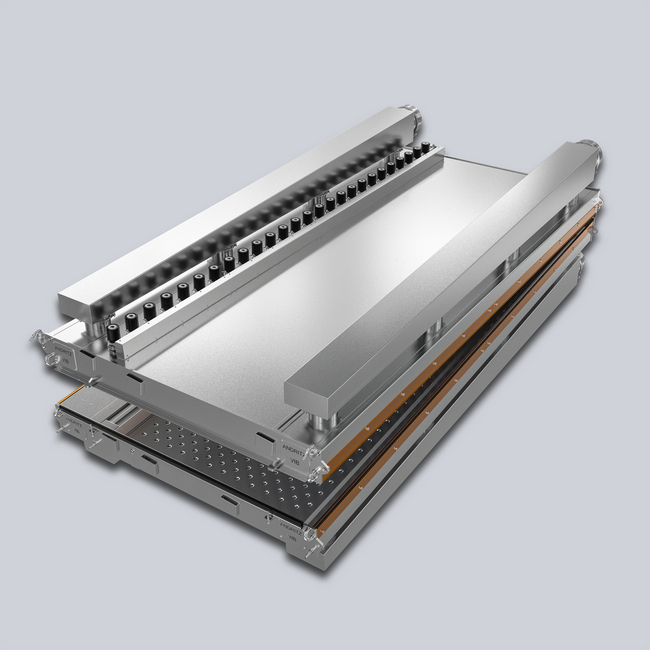

ANDRITZ VIB MoistureTech © ANDRITZ

ANDRITZ VIB MoistureTech © ANDRITZ

During the last decade, ANDRITZ has already supplied VIB technology successfully for several paper machines of Xianhe Group. Considering the experience with ANDRITZ VIB this new order placement was corollary to strengthen the long-lasting partnership between ANDRITZ and Xianhe Group.

As a world market leader, ANDRITZ offers steam-profiling solutions for the entire paper machine and paper moisturizing technology to improve the sheet’s cross-directional moisture profile.

Xianhe Co., Ltd. is the leading enterprise of specialty paper in China and one of the largest enterprises in the research and development and production of functional materials in China. It has the production capacity of the whole industrial chain including forest land, chemical industry, pulp making, energy, logistics, and paper products. The company invested 10 billion RMB in Shishou, Hubei Province with an annual output of 2.5 million tons of pulp and paper, so called "high-performance new material recycling economy" project.

ANDRITZ GROUP

International technology group ANDRITZ offers a broad portfolio of innovative plants, equipment, systems, services and digital solutions for a wide range of industries and end markets. ANDRITZ is a global market leader in all four of its business areas – Pulp & Paper, Metals, Hydro, and Separation. Technological leadership, global presence and sustainability are the cornerstones of the group’s strategy, which is focused on long-term profitable growth. The publicly listed group has around 27,900 employees and over 280 locations in more than 40 countries.

ANDRITZ PULP & PAPER

ANDRITZ Pulp & Paper provides sustainable technology, automation, and service solutions for the production of all types of pulp, paper, board and tissue. The technologies and services focus on maximum utilization of raw materials, increased production efficiency, lower overall operating costs as well as innovative decarbonization strategies and autonomous plant operation. Boilers for power generation, flue gas cleaning systems, various nonwoven technologies, panelboard (MDF) production systems, as well as recycling and shredding solutions for numerous waste materials also form a part of this business area. State-of-the-art IIoT technologies as part of Metris digitalization solutions complete the comprehensive product offering.

Kemira joins the Renewable Carbon Initiative

Kemira has joined the Renewable Carbon Initiative (RCI) to partner with leading companies and accelerate the industry shift from fossil carbon to renewable carbon and raw materials.

Becoming a member of the RCI demonstrates Kemira’s commitment to advancing innovative sustainability practices with focus on promoting circularity and a bio-based economy. RCI champions the transition from fossil carbon to renewable carbon for all organic chemicals and materials. The relevant sources of renewable carbon include biomass, CO2 and recycling.

Becoming a member of the RCI demonstrates Kemira’s commitment to advancing innovative sustainability practices with focus on promoting circularity and a bio-based economy. RCI champions the transition from fossil carbon to renewable carbon for all organic chemicals and materials. The relevant sources of renewable carbon include biomass, CO2 and recycling.

Sampo Lahtinen, SVP Growth Accelerator says: “In order to fight climate change, we need to curb our consumption of fossil resources. Collaboration with this unique network of experts and like-minded companies in the sustainable chemical industry supports Kemira’s long-term sustainability targets. We are gradually increasing our biobased and renewable product offering and thus reducing our own environmental impact. In turn, we also encourage our upstream value chain partners to lower the carbon footprint of products. Through partnerships and direct actions we can help our customers achieve their sustainability goals.”

The Renewable Carbon Initiative (RCI), founded in September 2020, is a group of more than 50 pioneering companies from the entire chemical value chain from raw material to end-of-life. Read more: www.renewable-carbon-initiative.com

Kemira is a global leader in sustainable chemical solutions for water intensive industries. We provide best suited products and expertise to improve our customers’ product quality, process and resource efficiency. Our focus is on pulp & paper, water treatment and energy industry. In 2021, Kemira had annual revenue of around EUR 2.7 billion and around 5,000 employees. Kemira shares are listed on the Nasdaq Helsinki Ltd.

www.kemira.com