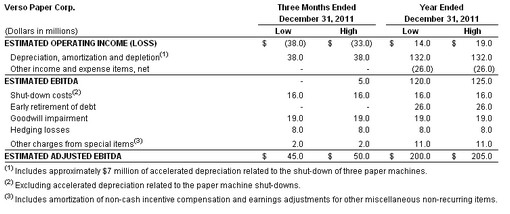

- For the three-month period ended December 31, 2011, we expect Adjusted EBITDA to be within the range of $45 million to $50 million, and for the year ended December 31, 2011, we expect Adjusted EBITDA to be within the range of $200 million to $205 million.

- Adjusted EBITDA for the three-month period ended December 31, 2011, excludes charges from special items of approximately $45 million primarily related to the shut-down of three paper machines, goodwill impairment, and hedging transactions. Adjusted EBITDA for the year ended December 31, 2011, excludes charges from special items of approximately $80 million primarily related to net losses on debt refinancing, the shut-down of three paper machines, goodwill impairment, and hedging transactions.

- For the three-month period ended December 31, 2011, we expect operating income before items to be within the range of $14 million to $19 million. Including approximately $52 million of charges primarily related to the paper machine shut-downs, goodwill impairment and hedging transactions we expect operating losses within the range of $38 million to $33 million for the quarter. For the year ended December 31, 2011, we expect operating income before items to be within the range of $74 million to $79 million. Including approximately $60 million of charges primarily related to the paper machine shut-downs, goodwill impairment and hedging transactions we expect operating income within the range of $14 million to $19 million for 2011.

- Cash and total debt at December 31, 2011 were approximately $95 million and $1.2 billion, respectively. At December 31, 2011, our existing $200 million revolving credit facility had no amounts outstanding, approximately $41 million in letters of credit issued, and approximately $159 million available for future borrowing.

- Capital expenditures for the three-month period ended December 31, 2011, are expected to be approximately $23 million.

Verso intends to release its financial results for the fourth quarter and the year ended December 31, 2011, in a news release to be issued before the market opens on Wednesday, March 7, 2012. Management will host a conference call at 9 a.m. (Eastern Time) on Wednesday, March 7, 2012, to discuss the fourth quarter and year-end results. Analysts and investors may participate in the live conference call by dialing 719-325-4795 or, within the U.S. and Canada only, 877-591-4959, access code 5749765. To register, please dial in 10 minutes before the conference call begins. The conference call and presentation materials will be made available on Verso's website at www.versopaper.com/investorrelations by navigating to the Events page, or at http://investor.versopaper.com/eventdetail.cfm?EventID=108162. The earnings release and Verso's annual report on Form 10-K for the year ended December 31, 2011, will be made available on Verso's website at www.versopaper.com/investorrelations by navigating to the Financial Information page. A telephonic replay of the conference will be accessible at 719-457-0820 or, within the U.S. and Canada only, 888-203-1112, access code 5749765. This replay will be available starting on March 7, 2012, at 12:00 p.m. (Eastern Time) and will remain available for 14 days.

Reconciliation of Estimated Operating Income to Estimated Adjusted EBITDA

The agreements governing our debt contain financial and other restrictive covenants that limit our ability to take certain actions, such as incurring additional debt or making acquisitions. Although we do not expect to violate any of the provisions in the agreements governing our outstanding indebtedness, these covenants can result in limiting our long-term growth prospects by hindering our ability to incur future indebtedness or grow through acquisitions.

EBITDA consists of earnings before interest, taxes, depreciation, and amortization. EBITDA is a measure commonly used in our industry, and we present EBITDA to enhance your understanding of our operating performance. We use EBITDA as one criterion for evaluating our performance relative to that of our peers. We believe that EBITDA is an operating performance measure, and not a liquidity measure, that provides investors and analysts with a measure of operating results unaffected by differences in capital structures, capital investment cycles, and ages of related assets among otherwise comparable companies. Adjusted EBITDA is EBITDA further adjusted to exclude unusual items and other pro forma adjustments permitted in calculating covenant compliance in the indentures governing our notes to test the permissibility of certain types of transactions. We believe that the inclusion of the supplemental adjustments applied in calculating Adjusted EBITDA are reasonable and appropriate in providing additional information to investors to demonstrate our compliance with our financial covenants. We also believe that Adjusted EBITDA is a useful liquidity measurement tool for assessing our ability to meet our future debt service, capital expenditures, and working capital requirements.

However, EBITDA and Adjusted EBITDA are not measurements of financial performance under U.S. GAAP, and our EBITDA and Adjusted EBITDA may not be comparable to similarly titled measures of other companies. You should not consider our EBITDA or Adjusted EBITDA as an alternative to operating or net income, determined in accordance with U.S. GAAP, as an indicator of our operating performance, or as an alternative to cash flows from operating activities, determined in accordance with U.S. GAAP, as an indicator of our cash flows or as a measure of liquidity.

The following table reconciles estimated operating income (loss) to estimated EBITDA and estimated Adjusted EBITDA for the periods presented.

Source: Verso Paper Corp.