Displaying items by tag: Pöyry PLC

Skills gap provides foreign-born engineers with route into Swedish labour market

Sweden needs more engineers: over recent years, ÅF has worked actively to recruit newly immigrated and foreign-born engineers through standard recruitment channels as well as via the company’s own investment, New Immigrated Engineers.

Since 2016, 150 people have started work at ÅF within the framework of the initiative.

For the past three years, ÅF has offered hands-on coaching to foreign-born engineers and matched their skills with those sought by the company. Over the course of those three years, ÅF’s investment in New Immigrated Engineers has succeeded in attracting 150 new employees, almost half of them women.

In 2018 alone, ÅF recruited 53 newly arrived engineers. Of these, 16 were women, equating to 30% of recruitments, which is in line with ÅF’s goal for the proportion of women in the workforce.

- ÅF and the industry in general sees a continued high demand for engineers and we will need to take advantage of all available competences if we are to meet future needs and the social challenges we are currently facing. The pace of change is high and our strategic investment in newly immigrated and foreign-born engineers is crucial if we are to continue to be a leader in sustainable solutions.

- ÅF and the industry in general sees a continued high demand for engineers and we will need to take advantage of all available competences if we are to meet future needs and the social challenges we are currently facing. The pace of change is high and our strategic investment in newly immigrated and foreign-born engineers is crucial if we are to continue to be a leader in sustainable solutions.

Jonas Gustavsson, President and CEO.

At the start of the programme, those admitted were primarily newly immigrated engineers. Today, recruitment has been widened to include foreign-born long-term residents of Sweden who had difficulty establishing themselves in the Swedish labour market, overseas students and those recruited directly from abroad. In addition to addressing the skills gap, developing ÅF as a business and reflecting the needs of ÅF’s clients are also vital aspects of the project.

Since Amir Nazari took up the post of Diversity Coach in 2016, tasked with attracting and recruiting more engineers, the company’s recruitment of newly immigrated and foreign-born employees has gained momentum. In spring 2018, Sofia Klingberg joined as ÅF’s second Diversity Coach with responsibility for driving the project in the west and south of Sweden and together they will be developing and scaling up recruitment activities.

About ÅF Pöyry

ÅF Pöyry is a leading company within engineering, design and advisory services. We create sustainable solutions for the next generation through talented people and technology. We are more than 16,000 devoted experts within the fields of infrastructure, industry and energy operating across the globe to bring value to our customers and the society.

Making Future.

The hidden value on pulp and paper operations - Gabriel Sousa, Principal, Pöyry Management Consulting

The hidden value on operation execution for the pulp and paper industry – How big is it and why does it matter?

Pulp and paper companies are facing continuous pressure on their profitability as the markets get more competitive. Our experience tells us that there is a lot of money left on the table that is related solely to the intrinsic operational capability. Capturing this hidden value can make the difference between success and failure.

The main pillars for business success

There are plenty of business management theories that describe why some businesses are successful and others aren’t, but from our point of view, the success of any business relies on three main pillars: strategy, assets and execution.

Clearly, getting the business strategy right is paramount, as it will define the organisation’s direction and development. The basis of this strategy should be defining which products and services provide the most added value, and which geographies offer the best opportunities. This can then be supported by M&A, organic growth or other decisions.

The second pillar of any strategy is the organisation’s assets; in other words the physical equipment in which the products are manufactured. The type of technology, its technical age (new investments versus upgrades) and the level of automation will define the potential competitive edge that the company will have within the industry.

The final element of success is the way the people and organisation execute its strategy with the available assets. For this, adequate operational capability is needed to achieve target profitability in the prevailing market context.

The “asset quality” myth in the pulp and paper industry

In a capital intensive industry like pulp and paper, there is a tendency to believe that asset quality (technology, age and maintenance) is the main determinant factor of operational performance. If everything else is constant, then asset quality determines the competitiveness potential, but assets are just the hardware in an industry that has historically overlooked operational execution. Many pulp and paper mills have old assets but strong operating performance, while others have newer assets but trail on overall efficiency.

In a highly competitive industry, it is the companies that learn how to maximise the value of their assets, regardless of their age, that will achieve a competitive advantage. This can only be achieved with excellent operating practices that focus on process stability, optimisation and continuous improvement. Our experience shows that, by failing to optimise their processes, many organisations are effectively leaving money on the table. Capturing this hidden value is ever more important for the pulp and paper industry due to challenging market conditions, and can be the difference between success and failure.

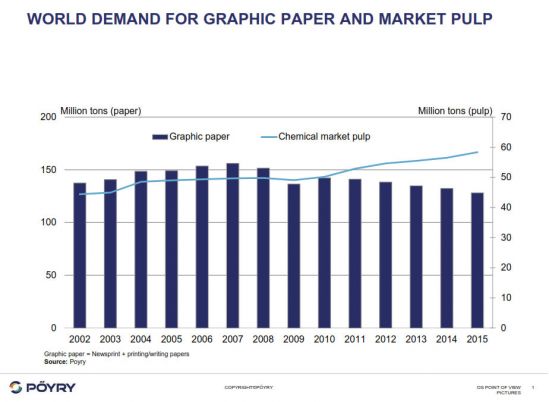

The pulp and paper sector - a mature and maturing industry

The pulp and paper sector is a mature industry that has very different segments and geographic realities. On the paper side, sales of industrial and hygienic grade papers are still growing globally, but graphic paper sales are declining due to the developed markets sunset. On the pulp side, emergent markets in Latin America have gained the upper hand due to several competitive advantages, related to lower cost base. In fact, this geographic shift from mature, fibre-rich western markets towards emergent markets has been the industry’s guiding force in the 2 decades. In turn, this has led to a gradual shift away from vertically integrated pulp and paper operations, towards a market pulp and recovered paper-driven industry. Also, the decline of non-wood supply in China and the tissue move into virgin fibre have supported virgin pulp markets.

The main result of this shift is that the developed markets will continue to mature, with some segments declining as a result. This will put additional pressure on existing pulp and paper players in Europe and North America, where improving the overall operating performance is now essential.

The tides are more favourable in emerging markets, but investment cycles prove that these markets are also maturing. With this, more focus needs to be given to the operational efficiency of current assets, rather than looking at new investments. The issues are common regardless of geography and the position on the investment cycle.

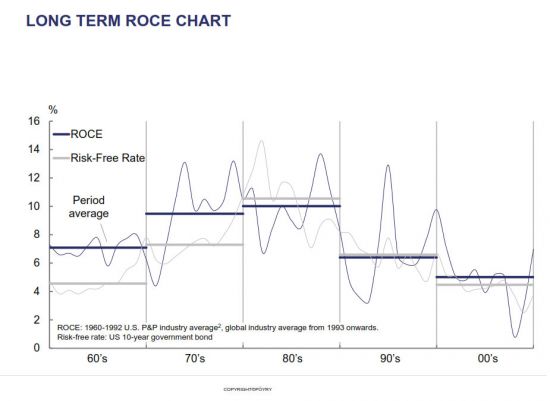

Pulp and Paper Industry has become a global competitive arena with ever tighter margins

Key market drivers are putting pressure on overall industry profitability

In recent years, pulp and paper producers have endured challenging conditions, resulting in unsatisfactory profitability. Although profitability varies from segment to segment, generally speaking this poor performance has been driven by poor capacity utilisation, declining demand, a low level of supplier concentration, poor sales prices and unfavourable exchange rates. The markets are complex, and the drivers vary from one industry sector to another and over time.

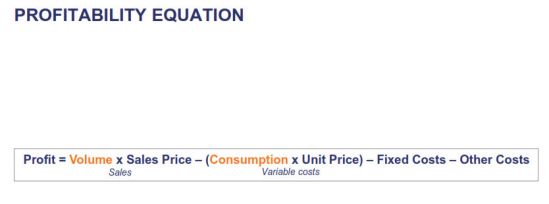

Profit margins are influenced by a number of factors but typically market forces cannot be controlled by companies. This means improving sales and reducing overall costs is necessary in a highly competitive environment.

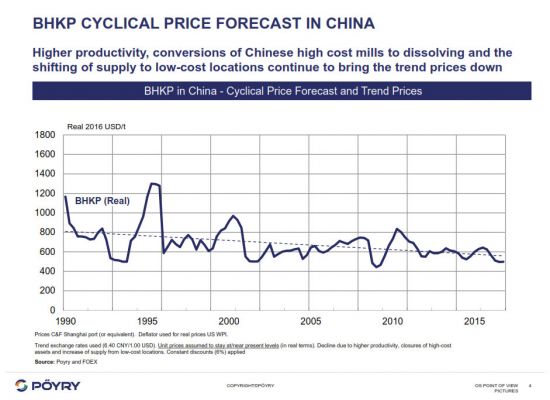

The pulp and paper industry has evolved into a highly competitive global arena where producers have positioned themselves on the lowest cost position possible while capturing relevant market shares.

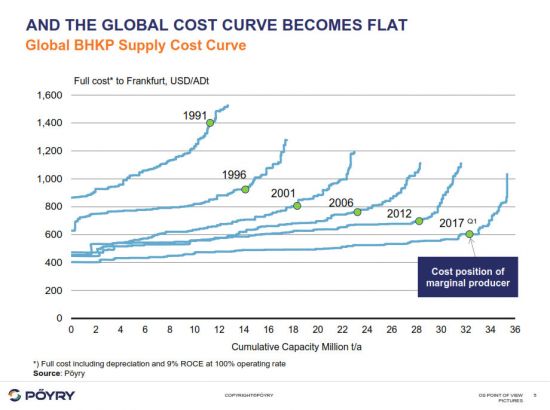

To illustrate this, the recent additional BHKP capacity responding to higher demand has positioned the new producers at the lower cost end. Production costs have declined as a result of highly-competitive raw material prices, growing economies of scale and declining transport costs, in turn forcing high- costs producers out of the market. As a consequence, the flattening BHKP market pulp supply curve increases competition for profitability, punishes inefficient producers and exposes players to price fluctuations.

In this context, companies have low degrees of freedom to affect the Sales Price Profitability Lever as this is fundamentally the result of market balance. To compensate for this reduced profitability that affects most of the pulp and paper grades, companies have looked at rationalising their production costs to keep profitability at acceptable levels. This might include consolidating the business, streamlining operations and reducing their overheads (including their number of FTEs). However cost- cutting can only do a limited amount for increasing profitability.

By necessity the next step must be improving operational efficiency, which is the lever that the company can actively control. Ultimately, this can positively impact production volumes or raw materials and utilities consumption, which has direct effect on the profit equation, regardless of market conditions.

Focus on what you can control - Execution Gap

Main internal levers for operations performance

Improving operational performance and efficiency is not straightforward. Plenty of companies find themselves unable to achieve significant improvements even though they expend significant resources on it. While continuous improvement initiatives have been a part of business culture for a long time, the pulp and paper sector has always been somewhat conservative in making it a common management practice.

When companies do apply continuous improvement initiatives, they often find they do not have the right operational capability to develop and implement effective and consistent performance improvement initiatives and harvest visible results.

Operations performance can be determined by the quality of three main factors: assets and process, people and organisation, and management systems.

- 1. Assets and processes – this is the way physical assets are run and optimised to create value, while minimising losses through improved stability. It is related to the design of manufacturing and business process, as well as to the subsequent ability to technically improve the business and physical proc

- 2. People and organisation – this is the way people organise, think, perform and conduct themselves in the workplace, both individually and collectively. It is related to the organisational structure, as well as people’s skillsets that can support the goals of an effective continuous improvement culture.

- 3. Management systems – this is the formal structure, processes and systems through which human and organisational resources are aligned to achieve shared go It can include elements such as process variable tool monitoring, KPI reporting, shift reports, action planning systems and standard operating procedures. These systems should be geared towards effective continuous improvement.

These levers can be used in a number of different ways to improve operations, but they all aim to change operating methods and procedures together with the use of modern technology in operational control. Several companies have applied different methods such as Lean Six Sigma, Lean Management, TPS, Kaizen and Deming’s Circle – PDCA. But, understanding the technical challenges of the pulp and paper industry when applying continuous improvement tools is key, as out of- context implementation can actually do more harm than good.

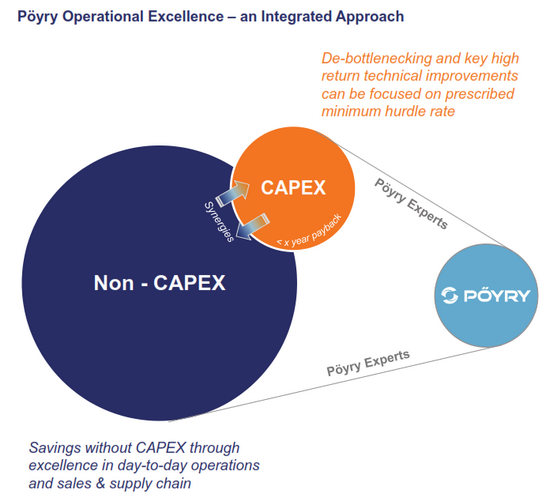

Having recognised this, Pöyry has developed a methodology that incorporates the best of different continuous improvement techniques, while bringing industry savvy experts that can understand the specific needs of pulp and paper mills and speak their language. Pöyry’s ExGapTM methodology is based on sound analytics and process insights into operations, supply chain and organisation.

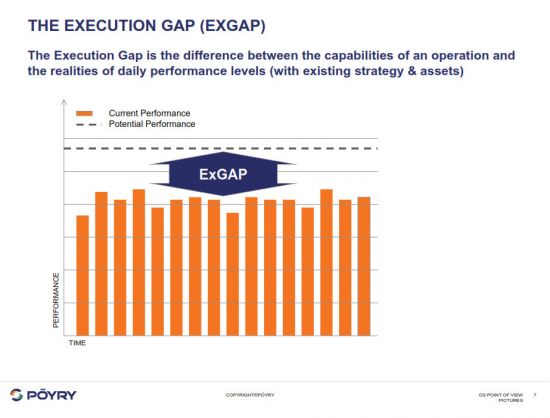

Execution Gap – how much value are we leaving on the table?

Fundamental to Pöyry’s ExGapTM methodology is qualifying and quantifying the Execution Gap (ExGap) of an operation. This can be defined as the difference between current performance and potential performance. It is the money that companies are leaving on the table by not being able to perform to their full potential with their current assets. This is a simple but powerful concept that is the first step on the long path towards sustainable performance improvement. Though a simple concept, the ExGap contains a powerful message:

- It is usually significant – all industries, all market conditions

- It is within our control

• It will never be captured until it is specifically identified and quantified

The first step towards establishing and quantifying the ExGap is undertaking a mill diagnostic. This entails a full management process and system diagnostic, together with a technical process diagnostic, combining both management and technical perspectives. The diagnostic focuses mostly on non-capex areas of opportunity, as most of the improvement can come from better process monitoring and control. This highlights how most process improvement is unrelated to asset investment. Nonetheless, in selected circumstances, rapid return investments can also be identified to accelerate the ExGap closure.

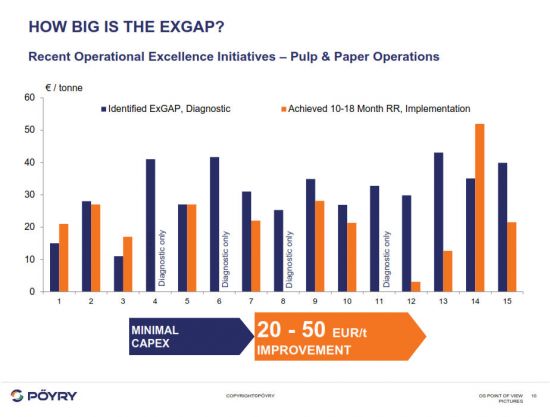

Typically, for the pulp and paper industry the ExGap on operations can reach between 20-50EUR/t of improvement opportunity. Roughly 55% is attributed to increased production (if it can be valued) and 45% is related to variable cost savings. This is a sizeable gap that has a high impact on the bottom-line and can make the difference between a company’s success and failure.

The Pulp and Paper players are facing common challenges preventing them of capturing the full value of their operations

Case Study - Taking operational improvements to the next level

- The client was a recycled graphic paper producer with modern assets who had already executed several improvement initiatives. Their goal was to improve production efficiency and stability. In addition to the technical issues in both paper machines and recycled plant, the mill had structural problems related to its management systems, hindering its performance.

- Pöyry’s team stepped in to conduct an ExGapTM diagnostic with detailed data analysis and technical interviews during a two week site visit. The team identified 20EUR/t of lost productivity in production areas OEE, raw materials and energy consumption. The low performance was clearly attributable to more than mere asset quality: for example, management systems for the production monitoring and control were inadequate. Other typical organisational shortcomings included management of departmental silos, as well as lack of diligent planning, action and accountability.

- The diagnostic phase was crucial to guide the next step on the performance improvement process. Next, Pöyry’s team and the client started to jointly bridge the execution gap, based on the first phase findings. The 12-month implementation project that followed included several changes in management and technical improvement initiatives. These were geared towards developing management system methods and tools for consistency of behaviour, actions and, ultimately, performance and results.

- Importantly, performance transparency was also established. This included visual means and regular reports, clear and manageable targets, as well as improved communication/information sharing through meetings at the mill and within department levels. Emphasis was put on diligence and actions were taken against negligent or unintentionally faulty work. Ultimately, motivation and team mentality improved due to increased accountability.

- By the end of the project, the mill achieved an annualized improvement level of about 4 MEUR on all aspects of the operation. The performance continued to rise further following the establishment of high performance culture. The main achievements included the following: 1) Technical downtime reduced by almost 50% on main PM’s; 2) Increased speed machine by 3%; 3) Break frequency was almost halved on one machine and stabilised on the second machine even with higher speeds; 4) Power consumption reduction of about 10%t; 5) Steam consumption reduction of about 10%.

What are the main challenges that industry faces in operations?

The root of an organisation’s ExGap lies in the three above-mentioned components of operations management – management systems, assets and process, and people and organisation. Issues and challenges that contribute to a company’s ExGap include:

Process variance and inconsistent results – inefficient use of assets together with lack of optimisation and limited standard operating procedures can lead to excessive process variability. Process variability leads to lower efficiencies and higher production costs.

Non-systematic management processes – incomplete or inconsistent management systems are a common cause of poor performance. This can be reflected in poor and incomplete management and process metrics, excessive and unfocused reporting, poor meeting and action structures, informal action planning, or the lack of a formal continuous improvement system. It’s typical to see different departments on the same mill using a different management process and tools.

Poor equipment availability due to sub-optimal maintenance practice – The ineffectiveness of maintenance function is more of an issue than the maintenance costs. Incomplete business processes and lack of management systems tend to generate low visibility and accountability of maintenance results, which reflects on poor equipment availability.

Lack of specific operational and industry skills – as a result of low industry profitability, investment in assets and people has been reduced. This results in a shortage of management and technical skills, which is exacerbated by an ageing workforce.

Obsolete instrumentation and automation – to maintain steady and stable processes, having the correct and most reliable measurements is essential. It is not possible to control a complex process of high inertia with infrequent lab measurements. At the same time, manually operated operations are fallible and prone to variability. Systems obsolescence is becoming a common issue in the pulp and paper industry.

Organisation silos and data overload – mill departments tend to be organised in silos where data and information doesn’t flow across borders. Holistic mill optimisation is thus more difficult. On top of this, pulp and paper mills are overloaded with too much data, and have insufficient time and tools to extract any valuable information or insights.

This is not a comprehensive breakdown of all the challenges the industry is facing, which varies between companies, segments and geographies. Rather, the challenges outlined above are consistently found across the pulp and paper industry and are the main causes of low operational performance.

What are the requirements to improve on operations?

Improving mill operations and achieving performance gains is not straightforward; different companies will have different levels of readiness for the long and sometimes difficult journey required. Ultimately, continuous improvement processes are about fundamental changes to a company’s culture.

There are two phases within Pöyry’s ExGapTM principles that drive continuous improvement processes: firstly, the diagnostic phase and secondly, the implementation phase.

The diagnostic phase is an intensive audit of the company’s operations, with the objective of identifying and quantifying the extent of the opportunities for improvement (ExGap), while also revealing clues about the causes of underperformance. This is a fundamental step, which any improvement initiative should start with. Typically, this can be developed within 1-2 months of intensive work, depending on the areas involved and the complexity of operation.

After diagnosing the state of operations, the next phase involves the implementation of new methods and practices that can help close the ExGapTM. This should be based on a 10-18 month initiative, in which all levels of the organisation are involved. Systematic processes are developed with a clear management structure that helps to unlock the operation’s true potential. At the same time, the development of people is promoted alongside efforts to change company culture. The result is a new approach and new system that is focused on continuous improvement.

In our experience, applying operational excellence methodologies is not enough to achieve tangible results in improving operations in the pulp and paper industry. It must be accompanied by deep technical knowledge of the industry and extensive technological expertise in order to challenge and change deep-rooted operating methods. The path to improvement can be both long and challenging, and companies must fully commit and dedicate all required resources to these initiatives. However, the reward is on the horizon and can be tangible.

Concluding – why all of this matters?

Given the cut-throat competition in the pulp and paper sector, it is imperative that producers extract the most out of their assets. There is typically a great deal of value hidden within underperforming operations. This money is left on the table by companies that are not able to capitalise the best of their operations.

These improvements should be a priority, as they are entirely within a company’s control. Companies can’t control market forces, so focusing on what they can control is essential, and can be the difference between survival and failure. Based on our experience, the potential benefits on production, maintenance and supply chain can yield savings as much as 20-50EUR/t. It is time for pulp and paper companies to claim back this hidden value – the ExGapTM.

Pöyry manages investor partnership process that results in Spinnova and Fibria joining forces

Innovative start-up company and leading eucalyptus pulp producer connected for new high-value bio-based products

Fibria, the leading producer of eucalyptus pulp, and Spinnova, a Finnish start-up developing wood to fabrics technology, recently announced that Fibria is to acquire 18% of Spinnova and partner in the development, production and marketing of new materials using Spinnova's technologies. The two companies were brought together in a partnership search process managed by Pöyry. This is an example of Pöyry's choice to work closely with the startup scene from bio to digital. Pöyry has also a long-standing relationship with Fibria through many project assignments.

Pöyry's role in Spinnova's partnership development assignment was to help find the right industrial partner for the company, the assignment including potential partner analysis, partner relationship development, negotiations and contractual advisory. At the end of the process, Spinnova and Fibria came together for new opportunities in technology development, testing and piloting in pre-commercial scale of new high-value products.

Pöyry's role in Spinnova's partnership development assignment was to help find the right industrial partner for the company, the assignment including potential partner analysis, partner relationship development, negotiations and contractual advisory. At the end of the process, Spinnova and Fibria came together for new opportunities in technology development, testing and piloting in pre-commercial scale of new high-value products.

In such a process, being able to support a startup necessitates a trusted position among global forest cluster companies from biomass to end users, extensive market understanding and knowledge of innovative technologies, all of which Pöyry has put much effort into developing.

Spinnova develops low-cost and environmentally sustainable technologies for making fabrics. The technologies use wood fibers to produce filaments and yarns that can replace cotton, viscose and other raw materials in both woven and nonwoven applications. Fibria is a Brazilian forestry company and the world's leading producer of eucalyptus pulp from planted forests.

"The new partnership with Fibria will help Spinnova grow our business faster and significantly enhance our global competitiveness. We value highly this win-win partnership with a lot of strategic level synergies and a shared vision. It was great to work with the Pöyry team. They are real professionals and their help was invaluable during the partnership search process," said Janne Poranen, CEO and founder of Spinnova.

"We are active in the start-up scene and continuously looking for new technologies and companies especially in bioindustries, energy and the digital space. Our global network and strong relationships with major forest cluster companies enable us to find the right partners for different needs and connect start-ups and investors for mutual benefits. We are the trusted partner to our clients and support them with our market and technical understanding covering the whole value chain from raw materials to end markets," said Petri Vasara, Vice President Management Consulting, Pöyry.

About Pöyry

Pöyry is an international consulting and engineering company that delivers smart solutions across power generation, transmission & distribution, forest industry, chemicals & biorefining, mining & metals, transportation and water. Pöyry's net sales in 2016 were EUR 530 million. The company's shares are quoted on Nasdaq Helsinki (POY1V). Approximately, Poyry has 5500 experts. 40 countries. 130 offices.

How is M&A activity shaping the European tissue industry?

Pirkko Petäjä, Principal at Pöyry Management Consulting, and Mikko Helin, Senior Consultant

Since 2000, the European tissue volume has grown from 5.7 million tons to almost 8.5 million tons. A clear trend connected to this growth has been consolidation of the largest players.

Consolidation is a clear trend in the European tissue industry

The large producers have been growing through sizeable acquisitions, as well as by organic growth. The most active acquirers have been SCA, Sofidel and WEPA, while all of the mentioned, and in addition ICTTronchetti, have also been active builders of new capacity. The capacity share of the three largest players has grown from approximately 40% to 50%.

The large producers have been growing through sizeable acquisitions, as well as by organic growth. The most active acquirers have been SCA, Sofidel and WEPA, while all of the mentioned, and in addition ICTTronchetti, have also been active builders of new capacity. The capacity share of the three largest players has grown from approximately 40% to 50%.

The business environment is better in a consolidated market. The impact of consolidation is also reflected in the performance of individual companies; after the consolidation steps in Europe, SCA’s tissue business experienced evidently higher and more stable margins. While large companies have been becoming even larger, there has been a continuous stream of new entrants to the tissue business, as barriers to entry are relatively low. The Eastern European industry especially is still fairly fragmented, and consolidation could significantly improve this business environment.

European tissue M&A over the last 15 years

The leading European tissue companies have targeted major strategic acquisitions, such as SCA’s acquisition of P&G and G-P, Sofidel’s acquisition of LPC and WEPA’s of Kartogroup. These deals have resulted in significant synergy benefits and positively impacted the business environment. There is, however, a limited number of opportunities for large acquisitions. Finding one buyer for all, or the majority of, assets has become difficult. This has led K-C to actively divest its less profitable units and locations, where it does not have ‘number 1 brand position’. Since 2000, K-C has divested some 300,000 t/a tissue capacity as individual mills to different buyers.

In the same time period, most of the largest companies in the industry have made a clear transformation through acquisitions. SCA, the clear leader in the M&A activity, has more than doubled its size in the last 15 years. Sofidel first expanded throughout Europe with new mills, and then through acquisitions. Sofidel has grown into a million ton company, and has recently started to expand outside of Europe. WEPA made one of the biggest leaps by first acquiring Kartogroup, and more recently through active organic growth and complementary smaller acquisitions. Kimberly Clark has been a clear exception - its capacity in Europe has reduced over 30%. Metsä Tissue has been stagnant. The last acquisition they made was ten years ago, and the company’s organic growth has been cautious, mainly replacing outdated capacity. Companies on the smaller end of this spectrum have grown steadily and have doubled their capacity since 2000. Lucart has made acquisitions and built mills in France and Italy, and Carrara in Italy.

Recent M&A ac tivities focused on small companies and individuals mills

In the last five years, since SCA’s G-P acquisition in 2012, European tissue acquisitions have been relatively small. Deals have included re-arrangements related to the aftermath of the G-P exit: Sofidel’s completion of its portfolio through purchase of selected targets, and WEPA’s strategic acquisitions in the UK and France, and divestment of two Italian mills. In addition, recent deals have involved acquisitions of individual single mills, or small companies, where the buyer is often a private equity fund and in many cases, the seller is K-C.

In some cases, there is distinct strategic benefit to the smaller deals. These are often concentrated to the CEE, currently a ‘hot’ area in European tissue. The Paloma deal, whereby the Slovenian company finally ended up with the Slovakian SHP, is one step towards Eastern European consolidation. Also, the Abris Capital acquisition of the Romanian Pehart Tec forms a future platform for further consolidation. In the Iberian Peninsula, strategic investments include Cominter acquiring Cellulosas de Hernani, and Portucel acquiring AMS. The acquisition by Portucel (now the Navigator Company) of AMS-Paper in Portugal anticipates a future significant move into the tissue sector. Other strategic acquisitions include purchase of independent converters or independent converters acquiring base paper mills.

Industrial buyers complement their portfolios with acquisitions and target stronger position, consolidation and synergy benefits. Financial investors have become more interested in tissue acquisitions than before. In many cases, there is a clear strategic intent behind these deals as well.

Characteristics of organic growth and new builds

A large share of the new tissue capacity in Europe has been built by larger companies that have renewed their assets or grown organically.

- Tronchetti has built 350,000 t/a new capacity in the last some fifteen years

- SCA has closed down 180,000 t/a obsolete capacity and built 275,000 t/a new

- Sofidel has grown outside Italian markets with 250,000 t/a new capacity WEPA has soon built 190,000 t/a new capacity, speeding up in the last few years

New capacity has also been built by small and medium size established players and by newcomers. The Iberian Peninsula specifically has seen many investments (AMS, Suavecel, Paper Prime, Renova) and more capacity increases are planned. Eastern Europe has also seen an increase of new investments. Part of these has been made by established large groups such as SCA and ICT. Russian companies such as Syassky and Syktyvkar Tissue Group have also grown to sizable players in a relatively short time. Pehart Tec investments have been supported by the new owner, Abris Capital.

There are various players adding single width machines to replace old capacity, or just to grow or start producing tissue. Only the largest industrial companies have added double width machines.

New Generation of Tissue Entry

Tissue capacity increase is not only by expansion of existing producers but there is versatile motivation for new entrants. This can be push or decline of their current businesses - for example, smaller pulp mills losing competitiveness and integrating to tissue or graphic paper sites, looking for new opportunity due to their declining market. There are also cost benefits for this type of entry in terms of both manufacturing and investment costs. For a newcomer the entry is often much easier to an existing site.

Entry into the tissue market often starts from converting. When capacity is high enough for a paper machine, many independent converters start to consider their own paper production. Margins are normally higher for an integrated player as the concept has many cost benefits, while the producer is also stronger and less vulnerable with its own base paper. Consequently, adding base paper production is attractive to sizable independent tissue converters.

Investors are currently active in the tissue sector making base paper additions possible, and enabling consolidation moves. Therefore, even investors can be considered a new entrant group.

Large family companies and financial owners increasing their share of the industry

In the 1990s large multinational paper or hygiene companies accounted for a large share of tissue companies in Europe. Family companies were small and more locally based. A significant share of tissue companies were private, local single mill companies. The number of large listed and multinational companies has reduced from those days. Current major ones include SCA, K-C and Metsä Group (Metsä Tissue). The exit of North American companies from Europe has reduced the presence of multinationals and non-European companies significantly.

Family-owned companies have grown significantly, spreading across and even outside of European regions. New family companies have also become more visible. In addition, the industry has seen the reincarnation of family companies, such as Carrara Group carrying the family name of former Cartoinvest owners and the independent converter Leicester Tissue Company owned by the Tejani family (former owner of LPC).

Financial owners are also becoming more common in tissue, especially in growth areas such as Iberia and Eastern Europe. Local funds have been common participants in smaller deals, while large international funds have always shown interest when anything significant has been for sale, as now related to the recent split of SCA into two companies.

There are investors behind several tissue companies, either full or partial. In addition, there are various small privately or even state owned companies. For many small companies the ownership structure is not known.

The European top 100 tissue base paper producers’ capacity is broken down into different ownership categories. Family and private companies account for approximately 40% of capacity. Listed, large, and often multinational companies are the second biggest group.

Investor ownership of tissue base paper producers accounts for approximately 7% of ownerships. This analysis does not include independent converters, which are mostly private companies, but can also be owned by investor funds (e.g. Accrol Paper). Minority ownerships, such as the case of Syktyvkar Tissue Group (30% Venture Investments & Yield Management), are also excluded from this estimate. Considering all of this, it is fair to say that some 10% of the European tissue business is in the hands of financial owners. There are no large groups involved in this type of ownership at the moment, although in Eastern Europe this kind of players are developing.

Tall Oil: Unlocking opportunities for pulp mills in the bioeconomy

Thanks to renewable energy regulations, the demand for tall oil is increasing. The by-product of the kraft pulping process industry can improve the efficiency of a pulp mill and be sold as a commercial product to processing industries.

The EU’s ‘Renewable Energy Directive’ requires all EU countries to ensure that at least 10% of their transport fuels come from renewable sources by 2020. The EU is also planning even more ambitious targets for greenhouse gas emission reductions to fulfill its pledges towards the Paris Agreement of which decarbonisation of the transport sector is a cornerstone.

This regulatory nudge has increased interest in tall oil as a biofuel feedstock.However,this emerging demand for the raw material competes with the use for more traditional tall oil derivatives, such as resin and fatty acids produced in distilleries. Whilst the price for crude tall oil has been slowly increasing to around 400-500 EUR/t, due to biodiesel competition and increase of the distillates product prices, the regulatory pull increases the competitiveness of tall oil as a biofuel feedstock from a biofuel manufacturer’s perspective.

What is tall oil?

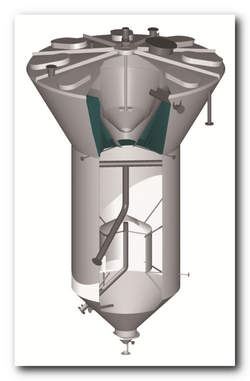

Tall oil is a commercially important by-product of softwood (i.e. pine or spruce) from pulp production. It is produced by first separating ‘tall oil soap’ from the ‘black liquor’ that is formed in the pulping process. The tall oil soap can then be reacted with acid to product ‘crude tall oil’.

Pulp mills burn the black liquor to generate heat and electricity. As soap removes some capacity of burning the black liquor and hinders the operation of the evaporation plant , it makes sense for the mills to separate the soap from black liquor.

Besides producing tall oil of the separated soap, soap can alternatively be sold or burned for additional electric power but this is often not so profitable.

So in addition to bringing income to the mill as a commercial product (even more than selling the soap as such), separating tall oil from soap improves the overall efficiency and operations of the mill as primary processes are not compromised.

Capacity expansion potential

As the price of crude tall oil increases, coupled with more modern techniques for extracting this raw material at existing softwood pulp mills, it is becoming more and more lucrative for pulp producers.

As the price of crude tall oil increases, coupled with more modern techniques for extracting this raw material at existing softwood pulp mills, it is becoming more and more lucrative for pulp producers.

The key factors impacting the profitability of tall oil production are:

- the local market environment and demand

- the scale of pulp production

When the softwood pulp production capacity is roughly 100,000 tons per year or more, tall oil separation for commercial purposes is usually more profitable than the alternative use of soap.

Currently, there are an estimated 40 softwood pulp mills globally that could utilise tall oil separation based on their annual pulp production capacity but are yet to capitalise on the opportunity. In Northern and Central Europe, tall oil separation is already quite common but the biggest untapped potential with current pulp production assets lies in the US.

Tall oil business case

Investment in a new tall oil plant is a feasible option both for mills with too small or outdated tall oil plants as well as for mills without an existing plant. For mills that sell tall oil soap and do not have a tall oil acidulation plant, the investment payback time is usually between 1-3 years.

In case the mill burns the soap in the recovery boiler, commercial benefits are further improved by the fact that the mill can increase pulp production when recovery boiler capacity can be utilised for black liquor combustion instead of soap burning. If a too small or outdated tall oil plant is renewed with the aim of increasing tall oil production by 25%, the investment payback time varies between 2-5 years.

Based on pulp production growth forecasts up to 2030, an additional 300,000 tons p/a of crude tall oil could enter the market. These capacity expansions would help supply the growing demand for crude tall oil and would mark significant growth opportunities for tall oil applications.

Did you know?

Pöyry provides complete, value adding service offering to pulp mills, from developing raw material sourcing strategies and conducting market research and business case analysis to delivering HDS® (Hydro Dynamic Separator) tall oil plants and providing operational support and performance improvement. Over the past 30 years, we have delivered more than a third of the world’s tall oil plants and helped several mills to design or improve their soap and tall oil separation processes in order to increase profitability and efficiency to drive growth.

Jarno Peltonen Director, Pulp Technology, Industry Business Group, Pöyry World Fibre Outlook 2030: Global consumption of papermaking fibre and specialty pulps has grown by 125% since 1980

The new global pulp market study “World Fibre Outlook up to 2030” by Pöyry Management Consulting details how global consumption of papermaking fibre and specialty pulps has grown from 185 million tonnes in 1980 to 416 million tonnes in 2014 – representing a growth of 125%.

The new global pulp market study “World Fibre Outlook up to 2030” by Pöyry Management Consulting details how global consumption of papermaking fibre and specialty pulps has grown from 185 million tonnes in 1980 to 416 million tonnes in 2014 – representing a growth of 125%.

The past 35 years have witnessed major changes in the paper industry’s fibre furnish. The recovered paper industry has seen a 28% increase in its share of the market, with global consumption levelling at 233 million tonnes in 2014. During the same period, the share of wood pulp has declined by 27% with global consumption amounting to 167 million tonnes in 2014.

According to the Pöyry study which looks at ten geographic regions and ten product areas including papermaking and specialty fibre grades, global demand for paper and paperboard is forecast to grow by 1.0%/a in the long term, from about 400 million tonnes in 2014 to 467 million tonnes by 2030. This growth is driven by the emerging markets with Asia accounting for 95% of global incremental paper and paperboard consumption during 2014-2030.

The global papermaking fibre market is facing profound changes with China’s economy starting to slow down and uncertainty growing in other parts of the world. The study by Pöyry provides insights into this increasingly turbulent market and notes that with paper market slow-down, coupled with the combination of several new pulp lines coming on stream at close intervals to each other, the global pulp industry is facing a real risk of value destruction.

Pöyry forecast that maintaining equilibrium despite the evolving new large-scale supply will be one of the key challenges for the pulp industry towards the 2020s. The report highlights that there is a strong need for restructuring within the global pulp industry and supply/demand balances will inevitably then be restored over time.

The study proposes that investments made ahead of demand in low cost areas will inevitably lead to exits of higher cost suppliers. Meanwhile, over-capacity in the lower sections of the supply curve will result in declining equilibrium prices and lowered producer surplus, thus affecting all players in the market.

The “World Fibre Outlook up to 2030” study provides a strategic platform and essential business information for all business participants, including pulp and paper companies, chemicals, machinery and related suppliers, investors, financiers, institutions, pulp traders, logistics companies and other interest groups.

Link to order form:

http://www.poyry.com/sites/default/files/wfo_up_to_2030_brochure_web.pdf

What pain relief can be administered to declining paper markets?

A Pöyry Point of View examining whether it is possible to actively change paper pricing through a strategic acquisition and consolidation strategy

Whilst world demand for paper and paperboard is forecast to grow, the graphic paper market is facing huge challenges in Europe. Pöyry proposes a different attitude to consolidation strategy to save the declining industry.

Whilst world demand for paper and paperboard is forecast to grow, the graphic paper market is facing huge challenges in Europe. Pöyry proposes a different attitude to consolidation strategy to save the declining industry.

The graphic paper industry and newspapers in particular, have never really recovered from the recession of 2001-2002. Overcapacities remain in the graphic paper market and prices of newsprint have reached a historic low of around 450 EUR/t and below in the first and second quarter of 2015. At this price level even cost leaders are not able to cover their capital costs anymore.

Whilst world demand for paper and paperboard is forecast to grow, the graphic paper market is facing huge challenges in Europe. The current response from industry figures has been rapid reductions in capacity. In Europe more than 20% of capacity has been reduced, with shutdowns in the first quarter of 2015 already equating to 650,000 tonnes of annual capacity. Pöyry forecasts further demand reductions of approximately 3 million tonnes by 2025 – a deep cut to the industry

The recent spate of shutdowns of the least competitive plants has flattened and lowered the cost supply curve and thereby lowered the price for paper. Marginal producers have reacted by lowering their prices in a bid to regain market share.

Christoph Euringer, Senior Consultant, Pöyry Management Consulting, said, “Bottom lines in the newsprint and other graphic paper markets are taking a hit and demand decline in many grades is expected to continue. Businesses need to button down the hatches and make smart strategic decisions to weather the storm. The solution lies in an intelligent consolidation – companies must ensure they review their and competitors’ portfolios smartly to buck the decline trend.”

Pöyry experts argue that the closing of the least competitive plants will further deteriorate the situation whereas strategic closings will help to stabilize and even increase prices. While the same amount of capacity exits the market, in both cases the effect is different. Rather than flattening the supply curve the slope of the curve increases and inaction will just allow market forces to further depress prices and challenge the viability of every company’s operations.

Download the Point of View: What pain relief can be given to declining paper markets?

For further information contact:

Metin Parlak

H+K Strategies

This email address is being protected from spambots. You need JavaScript enabled to view it.

+44 207 413 3771

About Pöyry

Pöyry is an international consulting and engineering company. We serve clients globally across the energy and industrial sectors and provide local services in our core markets. We deliver management consulting and engineering services, underpinned by strong project implementation capability and expertise. Our focus sectors are power generation, transmission & distribution, forest industry, chemicals & biorefining, mining & metals, transportation and water. Pöyry has an extensive local office network employing about 6,000 experts. Pöyry's net sales in 2014 were EUR 571 million and the company's shares are quoted on NASDAQ OMX Helsinki (Pöyry PLC: POY1V).

Changing patterns in the global tissue market: private label versus brands

A Pöyry Point of View on the key trends shaping the international tissue market

The global tissue market as we know it is a moving target. Pöyry Management Consulting forecasts shifts in consumer purchasing patterns challenging the dominance of legacy brands in established markets, while China represents medium-term growing pains but long-term optimism.

The global tissue market as we know it is a moving target. Pöyry Management Consulting forecasts shifts in consumer purchasing patterns challenging the dominance of legacy brands in established markets, while China represents medium-term growing pains but long-term optimism.

A new Point of View by Pöyry argues that the dominance of legacy brands in the tissue market is under threat from shifts in consumer purchasing behaviour. The North American tissue market is traditionally characterised by strong legacy brands but private labels have closed the gap in market share by 9% in the past ten years – now standing at 27% (in Western Europe, private labels hold 63% market share).

‘Changing patterns in the global tissue market: private label versus brands’ details how the increase has been driven by recession awakened frugality, increased availability of high quality private label tissue and the emergence of a new force shaping the consumer market – the millennials. Private label preference and consumption is higher among millennials than more mature consumers. Significantly, millennials’ will make up 46% of consumers by 2025, an increase of 15% from the 2014 level.

Millennials have grown up in the middle of a multitude of private labels across a range of sectors. For them, a private label does not appear as suspicious as it might for their parents. Frugality has encouraged them to take the leap of faith and they haven’t been let down by product quality. Brand status for many just appears as an unnecessary premium. This mentality has significant implications for manufacturers. They need to adapt to cater to this ever growing consumer group - Sanna Kallioranta from Pöyry Management Consulting

Tissue brands have been fighting back by introducing more affordable, less fluffy or strong “basic” versions of the branded products. They are also reaching into their deep pockets for promotional strategies to sway the price sensitive tissue market having realised that millennials have significantly higher price sensitivity than mature consumers.

The key driver for high private label penetration in Europe - in addition to general higher consumer value orientation, a challenging recent economic situation and the cultural challenges associated with building a pan-European brand - is the highly consolidated nature of the retail sector in many markets. For example, in Germany, the market is controlled by the top five retailers and private labels enjoy over 80% of market share.

Discount stores, as well as super and hypermarkets with a focus on economy products, have gained in popularity in Europe. These stores have strong private label programs and hence, developing and driving private label program growth has been a key strategy for the largest European retailers to counter their growth. The major chains, such as Carrefour and Tesco, have been developing private label lines with more upmarket positioning to attract higher income consumers.

Growth in tissue demand in China since 2008

China is still a young tissue market – both for brands and especially for private labels. Tissue demand in China has grown by 8.4% per year since 2008, yet it still only represents 22-50% of the per capita consumption levels in the West. Momentum in the Chinese retail sector structure bodes well for private label growth, however. The Chinese retail sector has been very fragmented and international chains have struggled. The sector has therefore entered an era of active mergers and acquisitions. As European markets demonstrate, a more consolidated retail sector typically brings better opportunities for private label market growth.

For further information contact:

Metin Parlak

H+K Strategies

This email address is being protected from spambots. You need JavaScript enabled to view it.

+44 207 413 3771

James Townsend

External Communications Manager, Pöyry

//This email address is being protected from spambots. You need JavaScript enabled to view it.">This email address is being protected from spambots. You need JavaScript enabled to view it.

+44 7824 145091

About Pöyry

Pöyry is an international consulting and engineering company. We serve clients globally across the energy and industrial sectors and provide local services in our core markets. We deliver management consulting and engineering services, underpinned by strong project implementation capability and expertise. Our focus sectors are power generation, transmission & distribution, forest industry, chemicals & biorefining, mining & metals, transportation and water. Pöyry has an extensive local office network employing about 6,000 experts. Pöyry's net sales in 2014 were EUR 571 million and the company's shares are quoted on NASDAQ OMX Helsinki (Pöyry PLC: POY1V).

Website: www.poyry.com

Paper and paperboard market: Demand is forecast to grow by nearly a fifth by 2030

Insight study by Pöyry indicates challenges for producers of paper and paperboard

World demand for paper and paperboard is forecast to grow to 482 million tons in 2030. This equals an increase of 1.1 per cent per year. This is the result of the new global paper market study “World Paper Markets up to 2030” by Pöyry Management Consulting. The study forecasts the demand for over 80 countries and country groups, and ten product areas, including graphic, tissue and packaging papers.

World demand for paper and paperboard is forecast to grow to 482 million tons in 2030. This equals an increase of 1.1 per cent per year. This is the result of the new global paper market study “World Paper Markets up to 2030” by Pöyry Management Consulting. The study forecasts the demand for over 80 countries and country groups, and ten product areas, including graphic, tissue and packaging papers.

The demand for paper varies depending on type and region. The graphic paper market is facing huge challenges in particular, while increasing digitalisation is shrinking demand for newsprint and other printing papers, as well as uncoated and coated wood-containing and wood-free papers. According to the Pöyry study, the demand for tissue paper, containerboards and cartonboards will, however, grow up to 2030. This is driven by increasing packaging needs in emerging markets, booming eCommerce and the growing demand for convenience food and consumer goods brands. The annual consumption of packaging material and tissue/hygiene products will, thus, rise by up to 2.9 per cent.

Focusing on regional growth markets, it can be found that the demand for paper continues to grow in the emerging markets, such as China and India. This is due to the increasing population, urbanisation and the development of a new middle class. In Japan, North America and Western Europe, on the other hand, the demand will decrease by around 0.8 per cent per year up to 2030. “Since 1950 the production of paper has continually grown. But the last five to six years were extremely challenging for the global paper industry, in particular for companies in Western markets“, says Timo Suhonen from Pöyry Management Consulting.

As a result, Pöyry experts forecast a strong need for structural changes in the paper industry. “Especially in Western Europe we find an urgent need for further capacity reductions. After the markets in the emerging Asian regions have become more mature, the industry needs to take a more disciplined approach as to capacity expansions. Industry consolidation, acquisitions, mergers and alliances start making more sense there, too“, Mr. Suhonen adds. “In the past, exits from the graphic paper industry sometimes turned to entries into the packaging paper and paperboard sector through a conversion of the machines. However, this move would probably be the least painful one for multi-sector companies and always has to be decided on a case-by-case basis“.

The latest Pöyry Insight study “World Paper Markets up to 2030” addresses these and many other significant market issues that are of current strategic interest for all business participants, including pulp and paper companies, suppliers of machinery, equipment, chemicals and related inputs, investors, financiers, institutions, paper merchants and traders and logistics companies.

Additional information by:

Timo Suhonen

Pöyry Management Consulting

This email address is being protected from spambots. You need JavaScript enabled to view it.

Tel.: +358 103 322 600

About Pöyry:

Pöyry is an international consulting and engineering company. We serve clients globally across the energy and industrial sectors and provide local services in our core markets. We deliver management consulting and engineering services, underpinned by strong project implementation capability and expertise. Our focus sectors are power generation, transmission & distribution, forest industry, chemicals & biorefining, mining & metals, transportation and water. Pöyry has an extensive local office network employing about 6,000 experts. Pöyry's net sales in 2014 were EUR 571 million and the company's shares are quoted on NASDAQ OMX Helsinki (Pöyry PLC: POY1V).

Pöyry awarded engineering assignment for Metsä Board Husum new folding boxboard machine project in Sweden

Metsä Board has awarded Pöyry with the assignment for engineering consultancy, laser scanning, 3D modelling, detail engineering and site services for the new folding boxboard machine project at their Husum Mill in Sweden. The assignment is a continuation of the pre-feasibility and the pre-engineering services performed by Pöyry and it covers the majority of the required engineering services related to the implementation of the project.

Metsä Board has awarded Pöyry with the assignment for engineering consultancy, laser scanning, 3D modelling, detail engineering and site services for the new folding boxboard machine project at their Husum Mill in Sweden. The assignment is a continuation of the pre-feasibility and the pre-engineering services performed by Pöyry and it covers the majority of the required engineering services related to the implementation of the project.

The assignment will be executed during the autumn of 2015 and the new board machine scheduled to start up in the first quarter of 2016. The capacity of the new board machine is approximately 400 000 tonnes per year of folding boxboard.

"This project is a continuation of the long co-operation between Metsä Board and Pöyry, and strengthens Pöyry's position as the world's leading pulp and paper engineering consultancy, having delivered projects for 80% of the world's major pulp and paper companies", says Nicholas Oksanen, President, Industry Business Group.

The value of the order is not disclosed. The order will be recognised within the Industry Business Line order stock in Q4 2014.

Additional information by:

Nicholas Oksanen

President, Industry Business Group.

Tel: +358 10 33 22294

Johan Ehrnrooth

Vice President, Industry Pulp and Paper Europe

Tel: +358 10 33 22570

Pöyry is an international consulting and engineering company. We serve clients globally across the energy and industrial sectors and locally in our core markets. We deliver strategic advisory and engineering services, underpinned by strong project implementation capability and expertise. Our focus sectors are power generation, transmission & distribution, forest industry, chemicals & biorefining, mining & metals, transportation and water. Pöyry has an extensive local office network employing about 6,000 experts. Pöyry's net sales in 2013 were EUR 650 million and the company's shares are quoted on NASDAQ OMX Helsinki (Pöyry PLC: POY1V).