Displaying items by tag: sweden

A PRINCESS, A WEDDING, CHOCOLATES –M-real's Carta Solida makes the perfect match

M-real’s Carta Solida paperboard has been chosen for a box of exclusive filled chocolates, produced by Sweden’s oldest and largest confectionery company, Cloetta, to commemorate the wedding of HRH Crown Princess Victoria of Sweden and Mr. Daniel Westling on 19th June 2010. Cloetta is one of 16 Swedish companies approved by the Royal Court to develop products for ‘The Official Wedding Series’ and has launched six new chocolate products including chocolate boxes and chocolate bars.

The excellent sensory properties and printability of Carta Solida make it an ideal choice for the chocolate box, which holds unwrapped chocolates and opens to reveal a full colour photograph inside the lid of the Princess and Mr. Westling. The outside of the box features the Official Wedding Series seal, a picture of the happy couple, and a luxurious gold foiled design based on a pattern from the Drottningholm Palace.

Cloetta, in consultation with the converter, approved Carta Solida for the chocolate box as the board fulfils all their criteria regarding, for example, the elimination of odour and taint.

Part of the revenue is donated to the Crown Princess Couple’s Wedding Foundation, which aims to prevent social isolation and promote good health among children and youth in Sweden.

Founded in 1862, Cloetta is the oldest and only major Swedish confectionery company in the Nordic region. It has a long tradition as a Purveyor to the Royal Swedish Court since 1922.

Carta Solida is a fully coated bleached paperboard (BCTMP) with a white back, recommended for the most

demanding and direct contact confectionery packaging. It is available in 185-320 gsm.

For further information please contact M-real Consumer Packaging:

Claus Kjaersgaard, Sales Director

Mobile +45 40 518781

E-mail: claus.kjaersgaard(at)m-real.com

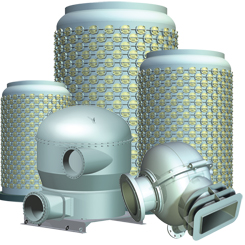

Stafsjö is 100% devoted to knife gate valves and customer satisfaction

Stafsjö develops, manufactures and globally markets knife gate valves that meet customer needs for shut-off and flow control in the process industry. We strive to be the most accessible, reliable and cost-effective supplier of valves. Stafsjö was founded in 1666 and is today one of Sweden’s oldest works still operating.

Since 2005 Stafsjö is part of the German family owned Bröer Group that also consist of Ebro Armaturen, which is a leading supplier of butterfly valves, pneumatic and electric actuators.

PRODUCT RANGE DEVELOPED FOR PROCESS INDUSTRIES WORLDWIDE Stafsjö’s knife gate valves are used within various process industries and there are several reasons to this. Proven operational reliability, excellent quality and the easiness to adapt our valves to required media, application and need are some reasons.

Traditionally pulp & paper and water & sewage have dominated, but we are expanding our business in biogas, mining and other industries. Solutions and products for the global pulp and paper industry have always been a cornerstone in our business and large proportion of our resources, both production capacity and research and development, are devoted to serve this industry.

Our engineering department is continuously, in cooperation with the industry, developing new products and solutions for general use or specific applications.

Our latest contribution, the HL valve, is primarily developed for pulp (concentration > 5%), caustic liquor, reject and waste. It is designed for similar applications as our well known HG and our high pressure valve HP, but in lower pressure classes. Our product range consists of 14 different models in sizes DN 50 up to DN 1600 and several are specifically developed for pulp and paper applications.

All valves are modular designed making them easy to be customised with gate, seats and box packings according to media and requirements, as well for actuators and accessories. The retainer ring concept making maintenance smooth and simple.

GLOBALLY ACTIVE AND LOCALLY COMMITTED The vast majority of our production is exported to markets in Europe, China, South East Asia, South Africa, South America, Canada and USA. We are working very closely with our sister company Ebro Armaturen and external sales partners in other countries in order to provide fast deliveries and high quality service and support to local markets worldwide.

For more info contact:

Johan Magnusson

+46 11 393 100

This email address is being protected from spambots. You need JavaScript enabled to view it.

Noss Ab get new order for approach flow systems to Zhejiang Jian Paper, CHINA

Noss will supply new approach flow systems to Zhejiang Jian Paper for its PM3/5 in Haiyan County, Jiaxing City, Zhejiang Province. PM3 start-up is scheduled in June 2011, PM5 start-up is scheduled in April 2011.

Noss will supply new approach flow systems to Zhejiang Jian Paper for its PM3/5 in Haiyan County, Jiaxing City, Zhejiang Province. PM3 start-up is scheduled in June 2011, PM5 start-up is scheduled in April 2011.

PM3 is the fastest and biggest 3-ply coated white top linerboard machine in the world and will produce 1,900 ADMTPD coated white top liner board. Noss’ delivery scope includes all main equipment for the 3 approach systems equipped with a RADICLONE hydrocycloning system and PERISCREEN machine screening systems.

PM5 will produce corrugating medium with a production capacity of 700 ADMTPD. Noss’ delivery scope includes all main equipment for a PERISCREEN machine screening system.

Zhejiang Ji’An Paper Packet Co., Ltd. currently produces containerboard. Noss supplied approach systems for their PM2 and also did the rebuilding for PM1. The company’s annual production capacity is around 750,000 ADMTPY. The production capacity will increase to around 1,600,000 ADMTPY after PM3/5 have been put into operation.

picture details: NOSS APPROACH FLOW SYSTEM

For more info contact:

Marketing Manager: Mr. Nils Wikdahl

Phone: + 46 11 23 15 00

Fax: + 46 11 13 59 23

This email address is being protected from spambots. You need JavaScript enabled to view it.

Metso’s tissue pilot plant in Karlstad, Sweden, hit by fire

The Tissue Technology Center of Metso, situated in Karlstad, Sweden, was hit by fire on April 28, 2010.

The fire caused damages to the roof of the Technology Center building. The personnel was not endangered, nor were the tissue pilot machine itself or any other vital systems affected by the fire. Cleaning up and repairs were started immediately after the fire was extinguished.

The company now focuses on minimizing downtime of the tissue pilot machine due to the roof repair. At the moment the machine is expected to be back in operation within a few weeks.

Metso is a global supplier of sustainable technology and services for mining, construction, power generation, automation, recycling and the pulp and paper industries. We have about 27,000 employees in more than 50 countries.www.metso.com

For further information, please contact:

Anders Björn

President, Metso Paper Karlstad AB

Cell phone +46 705 1713 38

Jan Erikson

Vice President, Sales, Tissue business line, Metso

Cell phone +46 70 517 14 90

Södra Cell Värö: the world's first fossil-fuel-free pulp mill

Södra Cell has now completed the investments which make its Värö mill the world's first fossil-fuel-free pulp mill.

Södra has made extensive energy investments at Södra Cell Värö over the past few years. These investments mean that the pulp mill will now be free from fossil fuels.

Of late, we have spent SEK 600 million building:

. New evaporation plant - for a more energy-efficient mill

. Feed water preheating - to produce more electricity

. Flue gas cooling - for more district heating

. Bark drying - for optimum fuel for district heating supplies

These investments have just been completed this spring and form part of an investment programme which has been ongoing since 2002, worth SEK 1.7 billion to date.

For further information, please contact:

Gunilla Saltin, CEO Södra Cell, +46 (0) 470 894 26

Jonas Eriksson, Site Manager, Södra Cell Värö, +46 (0) 340 62 81 02

Per Braconier, Director of Information Södra, +46 (0) 70 534 51 66

Södra announces 20 dollar price increase for pulp

Södra today announces an increase of USD 20 per tonne for softwood pulps in Europe. New price valid from June 1st is thus USD 980 per tonne.

"Pulp market remains solid. With strong demand and low stocks", says Ulf Edman, president of Södra Cell International.

For further information, please contact:

Ulf Edman, President of Södra Cell International, +46 70 677 8769

Per Braconier, Director of Corporate Communications, Södra, +46 70 534 5166

Press release from the Annual General Meeting of Billerud AB held on 4 May 2010

Decisions made at the meeting

Dividend

The meeting decided, in accordance with the Board's proposal, that SEK 0.50 per share should be distributed to the shareholders and that the record date for the dividend should be 7 May 2010. The dividend is estimated to be delivered from Euroclear Sweden AB on 12 May 2010.

Election of Board members and Chairman of the Board

The meeting decided to re-elect Ingvar Petersson, Gunilla Jönson, Michael M.F. Kaufmann, Per Lundberg, Ewald Nageler, Yngve Stade and Meg Tivéus as ordinary Board members and that no deputy members were to be elected. The meeting also decided to re-elect Ingvar Petersson as Chairman of the Board and Michael M.F. Kaufmann as Deputy Chairman of the Board.

Nominations Committee for 2011 Annual General Meeting

The meeting decided that the nominations committee shall comprise a maximum four members. The Chairman of the Board shall be the secretary of the Nominations Committee. During the autumn of 2010 the Chairman shall contact the major shareholders (judged by size of shareholding) regarding the formation of a Nominations Committee. The names of the members of the Nominations Committee, and the names of the shareholders they represent, shall be published six months at the latest before the 2011 Annual General Meeting and be based upon the known shareholding immediately before the announcement. Unless Committee members decide otherwise, the chairman of the Nominations Committee shall be the member representing the largest shareholder (judged by size of shareholding). The Committee forms a quorum when more than half of its members are present.

Transfer of shares due to the decision on Long Term Incentive Programme at the Annual General Meeting of 2007 ("LTIP 2007")

The meeting decided in order to fulfill its obligations under the LTIP 2007 on transfer of a maximum of 160,000 of the company's own shares to be transferred to participants in the LTIP 2007 in the form of so-called matching shares and performance shares and that the Board shall be entitled to transfer a maximum of 50,000 shares of the total own possession of shares in Billerud, in order to cover certain costs, mainly social security costs, relating to LTIP 2007. Transfer of the shares shall be affected on NASDAQ OMX Stockholm at a price within the price interval registered at each time for the share. The reasons for the deviation from the shareholders' preferential rights are that it is an advantage for Billerud to transfer shares in accordance with the proposal in order to meet the requirements of the approved incentive program.

The introduction of Long Term Incentive Programme 2010 and transfer of shares under the Long Term Incentive Programme ("LTIP 2010")

The meeting decided on the introduction of LTIP 2010 and of transfer of shares under LTIP 2010. LTIP 2010 comprises a total of maximum 90 managers and other key employees within the Billerud Group. To participate in LTIP 2010, the participants must purchase Billerud shares at market price on NASDAQ OMX Stockholm. Previously held Billerud shares may also be included in the required investment. Thereafter, the participants will, after a three year vesting period, free of charge, be alloted Billerud shares, provided that certain conditions are fulfilled, such as certain performance conditions relating to financial targets during the period 2010-2012.

Authorisation for the Board to decide on the transfer of the company's own shares

The Meeting decided to authorise the Board, during the period up to the next Annual General Meeting, on one or more occasions and with deviation from preferential rights for shareholders, to decide on transfer of Billerud own shares that the company holds at the time of the Board's decision, either to a third party as payment in connection with acquisition of companies, and/or as a transfer on the stock exchange in order to raise liquid funds for payment in connection with such acquisitions.

Other

Furthermore the meeting decided to adopt the income statement and the balance sheet as well as the consolidated income statement and consolidated balance sheet for 2009, on discharge from personal liability for Board Members and the CEO for their administration for the year 2009, on fees for Board Members and remuneration for Committee work and fees for the auditors, and to approve the Board's proposal for guidelines for remuneration to senior executives.

Billerud AB (publ)

Per Lindberg

President and CEO

For further information, please contact:

Per Lindberg, President and CEO, +46 8 553 335 01 or +46 70 248 15 17

Bertil Carlsén, CFO, +46 8 553 335 07 or +46 730 211 092

The Rottneros group interim report January - March 2010

ROTTNEROS: THE ROTTNEROS GROUP INTERIM REPORT JANUARY–MARCH 2010

• The result after net financial items for the first quarter of 2010 amounted to SEK 11 (-115) million. The operating result for the first quarter amounted to SEK 7 ( 110) million.

• The high price of electricity had a strong impact during the first few months of the year. Besides increasing the cost of electricity, the high price of energy also resulted in production stoppages with ensuing stoppage costs. Problems in the Swedish energy market had a negative impact on the overall result by approximately SEK 30 million.

• The cash flow from operating activities amounted to SEK 69 (29) million in the first quarter of 2010.

• On 22 January, Kjell Ormegard was appointed Chair of the Board up to and including the AGM in April 2010.

• In February, the Board of Rottneros approved an investment of SEK 45 million in a soda boiler at Vallvik Mill. This investment is a second step in the environmental and energy improvement measures being taken at Vallvik Mill.

• In February, Rottneros concluded an agreement with the Swiss packaging company SIG Combibloc regarding the transfer of intangible assets, primarily in the form of patents and patent applications, from Rottneros' subsidiary Rottneros Packaging AB. Rottneros Packaging's operation relating to food trays under the SilviPak brand does not form part of this agreement.

• As at 31 March 2010, an interest-bearing net receivable of SEK 54 million was reported compared with SEK 10 million at the beginning of the year.

• The pulp market remains strong, with a high level of demand. Global pulp stocks have remained at low levels. Further price increases have been announced for April and May 2010.

• The company is not providing a forecast for the full year 2010.

Rottneros in brief

Rottneros, a company that was originally established in the 1600s, is an independent and flexible supplier of customised paper pulp of high quality. Rottneros has been able to adapt in order to meet high customer expectations by continually developing its products and maintaining high levels of delivery reliability, technical support and service.

Rottneros has an annual production capacity of almost 400,000 tonnes of pulp at two mills in Sweden. Increasingly intensive product development in line with the requirements of customers will result in profitability that is higher and more stable throughout the business cycle.

SIGNIFICANT EVENTS

New Chair of the Board

On 22 January 2010, the Board of Rottneros AB appointed board member Kjell Ormegard to chair the Board of Rottneros up to and including the AGM in April 2010. This change was brought about by former chair Rune Ingvarsson asking to resign from the Board of Rottneros with immediate effect for personal reasons.

Rottneros investing in Vallvik

On 2 February 2010, the Board of Rottneros approved an investment of SEK 45 million in the soda boiler at Vallvik Mill. This investment is a second step in the environmental and energy improvement measures that were previously communicated. Improving the soda boiler will in turn increase its incineration capacity, which will increase Vallvik's production of bioenergy. Installation is scheduled for the fourth quarter of 2010 in conjunction with the annual maintenance shutdown.

Transfer agreement concluded

In February 2010, Rottneros concluded an agreement with the Swiss packaging company SIG Combibloc regarding the transfer of intangible assets, primarily in the form of patents and patent applications, from Rottneros' subsidiary Rottneros Packaging AB. Rottneros Packaging's operation relating to food trays under the SilviPak brand does not form part of this agreement. The transaction will have a minor impact on Rottneros' income statement and a positive impact on the Group's cash flow.

New Chief Financial Officer

Tomas Hedström was appointed as CFO for Rottneros AB starting 1 May 2010. Tomas Hedström was most recently employed by the SCA Group, where he was in charge of the Group's accounting staff. Tomas Hedström will replace Karl Ove Grönqvist, who decided to leave Rottneros to take up another position as CFO.

THE PULP MARKET

Market and products

There has been a strong demand for all grades of pulp, and global pulp deliveries showed positive growth at the start of the year. The market has been characterised by a good balance, which has enabled pulp price increases. There have also been disruptions to the supply of pulp, mainly due to significant production capacity in Chile being shut down on account of the earthquake in February.

The USD pulp price rose at the beginning of the year. Further price increases were announced during the second quarter of 2010. Statistics for the total global market for bleached chemical market pulp showed that deliveries for the period January to February 2010 amounted to 6.4 (5.8) million tonnes, which was 10.3% higher than the same period in 2009. Ninety-one per cent (84% for the same period in 2009) of the global supply capacity for bleached chemical pulp was used for the period January to February. An estimated 93% (86%) of production capacity was utilised for the same period.

The average price of bleached long-fibre chemical pulp during the first quarter of 2010 amounted to USD 844 per tonne (USD 595 per tonne), an increase of 42%. The price of long-fibre chemical pulp (NBSK) at the end of March 2010 was USD 889, an increase of 11% from the beginning of the year when the price was USD 799.

The price of short-fibre chemical pulp increased from USD 700 at the beginning of the year to USD 789 at the end of March, an increase of 13%.

Global producer stocks of bleached chemical pulp amounted to 2.8 million tonnes in early 2010 and were estimated at 3.0 million tonnes at the end of February.

Long-fibre chemical pulp (NBSK) (produced in Vallvik)

The price was USD 799 per tonne at the beginning of the year and USD 889 at the end of March. The market for long-fibre chemical pulp is strong. The level of producer stocks of pulp remains low.

Delivery capacity utilisation for the period January to February 2010 was 93% (84% for the same period in 2009), and production capacity utilisation was around 96% (85%).

Mechanical pulp and CTMP (produced in Rottneros)

The price of short-fibre CTMP was around USD 600 per tonne in the Western European market at the start of the year. The price and demand for CTMP grew more slowly at the start of the year compared with chemical pulp. A recovery materialised toward the end of the first quarter and in April.

Delivery capacity utilisation for the period January to February was 86% (74%) and production capacity utilisation was 97% (66%).

PRODUCTION AND DELIVERIES

The Group's pulp mills in Rottneros and Vallvik have a combined production capacity of almost 400,000 tonnes per year. In 2009, a production level of 335,900 tonnes was achieved for the full year. Weak demand at the start of 2009 resulted in production restrictions of around 65,000 tonnes.

The level of production during the period January to March 2010 was lower than compared with the same period of the previous year and amounted to 81,400 (89,500) tonnes. The first quarter of 2009 included 11,100 tonnes that related to production at Rockhammar Mill, which has now been disposed of. The high price of electricity at the beginning of the year meant production disruptions and shutdowns corresponding to 6,000 tonnes at Rottneros Mill during the first quarter of 2010. During the first quarter of 2009, Group production was restricted by approximately 50,000 tonnes as a consequence of weak demand. Shutdowns for annual maintenance work will take place in the third quarter for Rottneros Mill and in the fourth quarter for Vallvik Mill. All costs relating to maintenance shutdowns are recognised in the period during which the shutdown takes place.

Deliveries during the first quarter of 2010 amounted to 87,300 (105,700) tonnes, corresponding to a reduction of 17%.

INVOICED SALES AND RESULTS

January to March 2010 compared with January to March 2009

The Group generated a net turnover of SEK 407 (433) million for the period January to March 2010.

The turnover for January to March 2010 was SEK 26 million less than for the corresponding period of the previous year. The main factors affecting turnover include: lower delivery levels, SEK 75 million; a weaker USD, SEK -69 million; higher pulp prices in USD, SEK 120 million; and other changes, SEK -2 million. The lower delivery levels are mainly the result of the sale of Rockhammar Mill and the closure of Rottneros Miranda in Spain.

The average price in USD of long-fibre sulphate pulp (NBSK) increased by 42% – from USD 595 to USD 844 – while the average price of NBSK pulp converted into SEK increased from SEK 4,997 to SEK 6,073 per tonne, an increase of 22%. The average price in USD of eucalyptus pulp (BEK) increased from USD 536 to USD 748 per tonne, or by 40%, while the corresponding average price converted into SEK rose from SEK 4,506 to SEK 5,380 per tonne, an increase of 19%.

As a result of the high price of electricity during the quarter, Rottneros Mill periodically stopped production, which had a strong negative impact on the results. The problems associated with the Swedish electricity market, including sharp increases in energy costs resulting in production stoppages, negatively affected the quarterly earnings by approximately SEK 30 million. The price of pulp in USD showed an increasing trend during the entire first quarter and further price increases have been announced. The stronger market and improved prices have created the necessary preconditions for profitability at the Group's pulp mills.

The average price of electricity on the Nord Pool exchange amounted to SEK 0.73 per kWh for the period January to March 2010, compared to SEK 0.42 per kWh for the same period of 2009. There is some uncertainty about the price trend for electricity. Electricity on Nord Pool will be traded at the current rate of SEK 0.40-0.45 per kWh for the remainder of 2010. For 2011 and beyond, electricity will be traded on Nord Pool at around SEK 0.40 - 0.41 per kWh.

The wood supply was reliable during the period. The cost of pulpwood increased during the first quarter of 2010 and a price increase of SEK 30 per m3 was announced with effect from 1 April. The Group's operating result for the period January to March 2010 amounted to SEK 7 (-110) million.

Hedging activities realised during the first quarter of 2010 resulted in a gain of SEK 3 (3) million.

The Group's result after net financial items amounted to SEK 11 ( 115) million, including net financial items totalling SEK 4 (5) million. Net financial items include financial exchange gains of SEK 6 (8) million. These amounts were largely countered by operating exchange losses on accounts receivable. Profit/loss after tax was SEK 11 (-115) million. Earnings per share after tax amounted to SEK 0.01 (-0.64). Cash flow per share was SEK 0.03 (0.09).

(For full report, including tables, see attached file)

SKF First-quarter report 2010

Tom Johnstone, President and CEO:

"SKF delivered a very strong result in the quarter with better volume and higher manufacturing levels resulting in an operating margin of 11.8%. Demand developed positively during the quarter particularly within the automotive business which adversely affected our price/mix. We saw a very positive development of our business in Asia and Latin America and some improvement in North America. However, Europe still remains weak if we exclude our automotive business.

Going forward into the second quarter we expect demand to be significantly higher than the same quarter last year and slightly higher sequentially. As a result of this demand picture we increased our manufacturing as the first quarter progressed which gave a good effect on our cost absorption, particularly in March. We will keep this manufacturing level during the second quarter.”

Recovery after a year of crisis

Södra's interim report for the January-March 2010 period

|

Jan-March |

Jan-March |

|

| Net sales, SEKm |

4,575 |

3,773 |

| Profit before depreciation and amortisation, SEKm |

669 |

141 |

| Write-offs and write-downs, SEKm |

-298 |

-193 |

| Operating profit |

371 |

-52 |

| Net financial items |

11 |

-7 |

| Profit after net financial items |

382 |

-59 |

| Return on capital employed |

15 |

neg |

| Return on equity |

11 |

neg |

| Free cash flow after investments |

353 |

-156 |

| Equity ratio |

58 |

58 |

- The group reported an operating profit of SEK 371 (-52) million for the first three months of the year.

- Profit after net financial items amounted to SEK 382 (-59) million .

- Net sales increased to SEK 4,575 (3,773) million.

- Return on capital employed was 15 percent (neg).

- Profits in all business areas increased compared with the same period last year.

- Increases in the price of pulp and sawn timber products boosted figures.

- The drastic increase in sales of interior products stemmed from the effects of last year's acquisitions.

- Growth in the biofuel business boosted the profits of the forestry business.

- Real productivity grew by 2.1 percent.

The Group Chief Executive's comments

"2010 began with a continued recovery after a year suffering the adverse effects of the recession. Profits were boosted by increased deliveries and higher prices in the pulp and sawn timber products areas."

"In the course of a single year we have gone from the shadow of the recession and the dramatic events it entailed to a position where all our business areas comply with or almost comply with return requirements."

"Although we are not exactly in a boom, we have moved from recession to prosperity."

"Thus together we have navigated from extreme market conditions, which were at their most critical stage this time last year, to the situation today, one of recovery. Inhouse, we continue to focus on those things we can influence: customer care and productivity. It is a matter of some satisfaction to see that real productivity during the period increased by 2.1 percent year on year."

"Staff continue to be deeply involved in the development of new ideas. During the period, we implemented 743 improvement suggestions from Södra employees, which overall corresponded to a SEK 31.1 million improvement in annual profit."

Business areas

Pulp -Södra Cell

Net sales improved by 19 percent compared with the same period last year to SEK 2,615 (2,199) million. Operating profit amounted to SEK 322 (-24) million. Return on operating capital was 18 percent (neg).

The period was characterised by relatively low stock levels and high deliveries. Production increased compared with the same period last year, which was influenced by market-related stoppages at the Norwegian pulp mills. The market also strengthened as a result of the earthquakes in Chile, which reduced pulp supplies.

Sawn timber products - Södra Timber

Net sales improved by 40 percent compared with the same period last year to SEK 956 (684) million. Operating profit amounted to SEK 61 (3) million. Return on operating capital was 10 percent (1).

The long cold winter restrained demand for and also the production of sawn timber products. Price levels have recovered compared with the rock bottom levels prevailing during the recession at this stage last year. There is good demand in Sweden, North Africa and the Middle East. The US market has now stabilised at a low level. Price levels in China have almost doubled in a single year, and are starting to attract the interest of European producers.

Interior products - Södra Interiör

Net sales improved by 46 percent compared with the same period last year to SEK 301 (206) million. Operating profit amounted to SEK 3 (2) million. Return on operating capital was 3 percent (2).

The impact of acquisitions boosted sales and strengthened the position of all Södra Interiör's markets. The Swedish building and construction trade has been thriving despite a long and cold winter. The repairs and extension tax allowance (ROT-avdrag) has had a positive impact on sales. While sales in Sweden and Norway have thrived, sales in Denmark, where the building sector and the building trade are in a period of stagnation, have been considerably poorer.

Södra Skog

Net sales improved by 1 percent compared with the same period last year to SEK 2,325 (2,302) million. Operating profit amounted to SEK 19 (5) million. Return on operating capital was 7 percent (1).

The pulp wood market in Södra's district has been relatively calm, but with a decrease in the availability of deciduous pulp wood. The supply of standing forest timber and timber for delivery has decreased at the beginning of 2010, and there is still intense competition for clear cutting sites. Improved price levels and volumes are boosting Södra Skogsenergi profits.

For further information please do not hesitate to get in touch with:

Leif Brodén, CEO and Group Chief Executive

+46 470 894 35

Mikael Staffas, CFO

+46 470 892 20

Per Braconier, Director of Communications

+46 70 534 5166