Displaying items by tag: Arctic Paper

Rottneros and Arctic Paper will invest in a fiber tray factory

The boards of Rottneros and Arctic Paper have decided to invest 15 million euro in a moulded fiber tray factory at Arctic Papers premises in Kostrzyn, Poland. The factory will be operated in a separate legal entity and as a 50/50 joint venture, in line with the LOI that was signed by the parties on October 22nd, 2021.

“We are seeing a rapidly growing demand for moulded fiber trays, and we are pleased to announce that we are now ready to move forward with our plan to launch the first industrial scale production of high barrier fiber-based packaging. The collaboration of the two parties combines Arctic Papers favorable location and existing infrastructure with Rottneros technological know-how and will bring benefits to both companies”, said the CEOs of Rottneros and Arctic Paper, Lennart Eberleh and Michal Jarczyński, in a joint statement.

The production of moulded fiber trays will be suitable for high barrier packaging, modified atmosphere packaging with extended shelf life as well as for packaging with lesser functional demands, all based on Rottneros primary fiber. The products can withstand heat and are excellent for ready-made food - both frozen and chilled dishes - which constitutes a rapidly growing market. The start-up of the new factory is planned for the end of 2023.

The investment is expected to amount to 15 million euro and will produce around 80 million trays per year, with an estimated annual revenue of 9 – 11 million euro and an EBIT margin of more than 20 percent when fully operational.

The joint venture will be a Polish registered company and financed through a combination of bank loans and equity contribution from the shareholders.

Rottneros is an independent producer of market pulp. The Group comprises the parent company Rottneros AB, listed on Nasdaq Stockholm, and its subsidiaries Rottneros Bruk AB and Vallviks Bruk AB with operations involving the production and sale of market pulp. The Group also includes Rottneros Packaging AB, which manufactures fibre trays, the wood procurement company Rottneros Baltic SIA in Latvia and the forest operator Nykvist Skogs AB. The Group has about 316 employees and had a turnover of approximately 2,3 billion SEK in the 2021 financial year.

Arctic Paper: Appointment of Auditors

The Management Board of Arctic Paper S.A. (STO:ARP) (“Company”) herewith informs that on the 28th of July 2015 the Company received a resolution adopted by circulation by the Supervisory Board dated 22nd July 2015 appointing Ernst & Young Audyt Polska sp. z o.o. sp.k., as Company’s auditors authorized to audit the Company’s financial statements. The Supervisory Board is the eligible body to adopt such resolution pursuant to article 15, clause 15.2, item e of the Company’s Articles of Association.

The Management Board of Arctic Paper S.A. (STO:ARP) (“Company”) herewith informs that on the 28th of July 2015 the Company received a resolution adopted by circulation by the Supervisory Board dated 22nd July 2015 appointing Ernst & Young Audyt Polska sp. z o.o. sp.k., as Company’s auditors authorized to audit the Company’s financial statements. The Supervisory Board is the eligible body to adopt such resolution pursuant to article 15, clause 15.2, item e of the Company’s Articles of Association.

The appointment has been made according to generally applicable provisions and professional standards.

Ernst & Young Audyt Polska sp. z o.o. sp.k., seated in Warsaw (00-124), Rondo ONZ 1, has been entered on the list of chartered auditors of financial statements maintained by the National Chamber of Chartered Auditors with the number 130.

Ernst & Young Audyt Polska sp. z o.o. sp.k. shall:

1) review mid-year standalone financial statements of the Company and mid-year consolidated statements of the Arctic Paper S.A. Capital Group, as of June 30, 2015;

2) audit of annual standalone financial statements of the Company and annual consolidated statements of the Arctic Paper S.A. Capital Group for the trading year from 01 January 2015 through 31 December 2015 prepared according to MSR/MSSF principles.

The contract with the auditor will be concluded for the period necessary for the performance of the services.

The Company has already used services of the auditors to obtain audits of financial statements of Arctic Paper S.A. for years 2008-2014.

This information is disclosed pursuant to the Minister of Finance directive of February 19, 2009 on current and periodic information provided by issuers of securities, and on conditions of equivalence of information required to be provided under non-Member State law, §5, clause 1, item 19, and was submitted for publication on 29 July 2015 at 10:30 am CET, in reference to Arctic Paper’s current report no. 11/2015 filed with the Warsaw Stock Exchange

Arctic Paper

Wolfgang Lübbert

President of the Management Board of Arctic Paper

tel. +49 405 148 5310

Info from the Board of Directors of Rottneros AB (publ) regarding Arctic Paper’s bid for the company

On 7 November 2012 Arctic Paper S.A. announced its public offer to buy all of the shares in Rottneros AB. On the same day the Board of Directors of Rottneros recommended that the shareholders should accept the offer, subject to the conditions specified.

The Board of Directors of Rottneros has now been informed in writing by shareholders (including Skagen Vekst and Peter Gyllenhammar via companies, who taken together control more than 10 per cent of the capital and voting power in Rottneros), that these owners will not accept the bid announced by Arctic Paper.

In light of the above-mentioned new information - which means that Arctic Paper’s offer will not be accepted to such an extent that Arctic Paper would obtain over 90 percent and thereby be able to request the compulsory redemption of outstanding shares and consequently that a merger cannot be implemented - the Board of Directors of Rottneros makes the following comments.

The primary reason for the position adopted by the Board of Directors as referred to above is that a merger of the two companies may be expected to generate synergies of approximately SEK 80 million and also that, from the perspective of both results and cash flow, a merger would balance out the two companies' very strong dependency on fluctuations in pulp prices. A precondition for realising a substantial proportion of these synergies is that the companies are completely amalgamated and that one head office and one management group be phased out. In addition, synergies have been identified on the financial side, though this also presupposes that the companies join together. The other significant synergy comprises the optimisation of transport costs, which would probably be considerably more difficult to achieve if the companies continue to operate as autonomous businesses.

The Board of Directors’ recommendation remains unchanged, that is to say that the companies merge to enable these synergies to be realised. The fact that two major owners controlling more than 10 per cent of the capital and voting power have given notice that they will not accept the bid means in that event that a merger cannot be effected and that it would thus not be possible to secure most of these synergies.

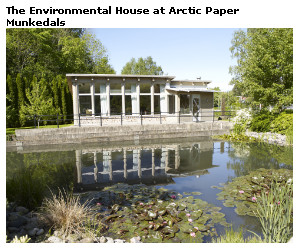

Arctic Paper Munkedals AB nominated for EMAS Awards 2012

Life is impossible without an adequate supply of clean water. Watercourses provide drinking water as well as process water for manufacturing. They are also habitats for a wide variety of flora and fauna and contribute to preserving biological diversity. Sound water management is vital. The European Commission is proud to accept Sweden's nomination for the EMAS Awards 2012 – Arctic Paper Munkedals AB. Together with 26 other companies and organizations, Arctic Paper Munkedals AB has been nominated for an award for “Water Management (including water efficiency and water quality)”, which is the EMAS Award topic for 2012.

Life is impossible without an adequate supply of clean water. Watercourses provide drinking water as well as process water for manufacturing. They are also habitats for a wide variety of flora and fauna and contribute to preserving biological diversity. Sound water management is vital. The European Commission is proud to accept Sweden's nomination for the EMAS Awards 2012 – Arctic Paper Munkedals AB. Together with 26 other companies and organizations, Arctic Paper Munkedals AB has been nominated for an award for “Water Management (including water efficiency and water quality)”, which is the EMAS Award topic for 2012.

The Swedish Environmental Management Council has nominated Arctic Paper Munkedals AB for the EMAS Awards 2012. An EMAS Award is the most prestigious award in environmental management and is only presented to top-performing companies and public authorities. According to an announcement from the European Commission, "The nominees have demonstrated their dedication in the field of water management". The winners for 2012 will be announced at the official EMAS Awards ceremony, which will take place on November 29, 2012 in Brussels, Belgium.

"At Arctic Paper Munkedals we have been working with water management and efficient water usage for many years as a part of our environmental strategy," says Anders Fransson, Group Technical and Environmental Coordinator at Arctic Paper. He continues: "We are honoured to receive this nomination in recognition of our efforts and achievements so far. We know our mill in Munkedal Sweden is one of most efficient mills in the world when it comes to efficient water usage. The nomination is an inspiration to us all to continue developing our way of working and set our sights even higher for the future."

All nominees for the Award can be found at the Facebook page of the Sustainable Production & Consumption Unit of the Directorate-General for the Environment at the European Commission, where the nominees in each category are announced.

You can also find a list of all nominees arranged according to category on the EMAS Awards website (http://ec.europa.eu/environment/emas/emasawards/nominees.htm). More information about the exemplary ways in which the nominees are managing their water use will also be presented on the website shortly.

Arctic Paper S.A.’s public takeover offer for Rottneros AB

This statement is made by the Board of Directors of Rottneros AB (publ) ("Rottneros" or the "Company") pursuant to the rules concerning public takeover offers on the stock market adopted by NASDAQ OMX Stockholm (the "Takeover Rules").

Arctic Paper S.A. ("Arctic Paper") has today, on 7 November 2012, announced a public offer to the shareholders in Rottneros to transfer all of their shares in Rottneros to Arctic Paper (the "Offer").

Arctic Paper offers 0.1872 newly issued Arctic Paper shares for each Rottneros share. The Offer values each Rottneros share to SEK 2.30 per share1 based on Arctic Paper's closing price on 6 November 2012, the last trading day prior to the announcement of the Offer.

In addition, Arctic Paper offers shareholders who as per 2 November 2012 held 2,000 shares or less in Rottneros a cash consideration of SEK 2.30 per share in Rottneros (the "Cash Offer"). For detailed terms and conditions regarding the Cash Offer, reference is made to Arctic Paper’s press release.

Arctic Paper is listed on the Warsaw Stock Exchange but will in relation to the Offer apply for a secondary listing on NASDAQ OMX Stockholm.

The Offer represents a premium of:

- 14.4 per cent compared to the last quoted price prior to the trading halt on 6 November 2012, of SEK 2.01 for the Rottneros share, the last trading day prior to the announcement of the Offer;

- 26.2 per cent compared to the volume weighted average price of SEK 1.82 for the Rottneros share during the last 30 calendar days up to and including 6 November 2012; and

- 27.3 per cent compared to the volume weighted average price of SEK 1.81 for the Rottneros share during the last 90 calendar days up to and including 6 November 2012.

The Offer values Rottneros at approximately SEK 351 million, based on 152,571,925 outstanding shares in Rottneros.

According to the preliminary timetable included in the press release in which the Offer was made public, the acceptance period is expected to run from around 22 November 2012 to around 12 December 2012.

Based on all shareholders in Rottneros accepting the Offer and no shareholders choosing to accept the Cash Offer, Rottneros shareholders will own 34 per cent of the shares in Arctic Paper after completion of the Offer.

Arctic Paper has for a longer period of time held discussions with the Board of Directors of Rottneros (the "Board") regarding a combination of the two companies. As part of this process, the Board has engaged Lenner & Partners as financial advisors and Setterwalls as legal advisors.

The Board has, upon request by Arctic Paper, allowed Arctic Paper to conduct a limited confirmatory due diligence in connection with the preparations of the announcement of the Offer. Arctic Paper has not received any non-public price-sensitive information regarding Rottneros.

Rottneros has conducted a limited confirmatory due diligence regarding Arctic Paper and Arctic Paper has informed Rottneros that no non-public price-sensitive information has been disclosed regarding Arctic Paper.

The Board’s Considerations

During 2008 and 2009 Rottneros went through an operational restructuring where the number of pulp mills was reduced from five to two. During 2009, a financial restructuring was performed in which the Company’s debt was reduced to zero. The ambition was to mitigate the Company’s high operational risk with a low financial risk and establish the preconditions for making necessary investments in the Vallvik Mill, and also to re-introduce dividends. The production capacity in the Vallvik Mill has since been expanded and dividends to shareholders have been re-introduced. The financial position is still sound, though Rottneros remains a rather small company with a market

capitalization of approximately SEK 300 million and net turnover of approximately SEK 1.5 billion. The Board has assessed several possible merger and acquisition opportunities during the last couple of years.

Considering the factors each shareholder has to take into account prior to their decision to accept, or not to accept, the Offer, the Board of Directors of Rottneros wish to make the following concluding comments:

- A merger will result in both shareholder groups gaining the benefits of a significant reduction in the volatility of earnings and cash flows with ensuing lower operating risk. Over time, this should entail a lower cost of financing and a higher valuation of the shares.

- The yearly synergies are estimated to be approximately SEK 80 million before tax and the costs to achieve these are rather limited. The estimated synergies are significant in relation to both companies’ current earnings. All things equal, this will substantially strengthen the new group’s future capacity for investments and dividends.

- The Offer to Rottneros shareholders implies a not insignificant premium compared to the current share price, but most of all the Offer implies that Rottneros shareholders will own 34 per cent of the new group and through that will have a share in the value of the synergies described above.

- For Rottneros shareholders the Offer represents an upstream integration in the value chain through them becoming owners of Arctic Paper’s current operations in fine graphic paper. In the view of the Board, this represents both a risk and an opportunity. It is a risk because the market for fine graphic paper is under a lot of pressure with limited or even declining growth. But it also means an opportunity to take part in developing one of Europe’s leading players in its field with a focus on bulky book paper and other paper products in the premium segment and with a presence in the growing Eastern European market.

For further information about the Offer, reference is made to Arctic Paper’s press release which was made public earlier today, and can be found at www.arcticpaper.com

The Board’s Recommendation

Arctic Paper has for a longer period of time shown interest in a merger between Rottneros and Arctic Paper. The Board has been positive to the proposal as in the Board’s view – given the right terms and conditions – it provides the right preconditions to create value for Rottneros' shareholders and that it will be to the benefit of employees.

The discussions that have taken place with Arctic Paper have resulted in the offer Arctic Paper is announcing today to the shareholders of Rottneros, which the Board is presenting to Rottneros’ shareholders for their final decision.

The Board requests shareholders to carefully read the press release that Arctic Paper has made public today, as well as the Offer Document that Arctic Paper will make public on or around 21 November 2012, in advance of making their final decision.

The Board has considered what is in the best interest of all shareholders with respect to the Offer consideration, the current position of Rottneros, the future development of the Company and the associated possibilities and risks. As the consideration comprises shares in Arctic Paper, the prospects for the combined company have been evaluated in particular.

As part of this evaluation, the Board has in particular taken into account:

- The premium the Offer implies for Rottneros’ shareholders;

- That Arctic Paper is controlled by a shareholder holding 75 per cent of the shares, who is also the largest shareholder in Rottneros with a 20 per cent stake;

- That Arctic Paper is a Polish company with a primary listing in Poland, but that Arctic Paper will have a secondary listing in Stockholm;

- That the liquidity in the Arctic Paper share is rather limited at present;

- The possibilities of realizing the estimated synergies; and

- That Rottneros’ shareholders with 2,000 shares or less are offered a choice of receiving a cash consideration.

Based on the information that Rottneros has received from Arctic Paper and the information that has been included in Arctic Paper’s press release, the Board is of the opinion that the Offer will not involve any material changes to the future operations nor for the overall strategy of Rottneros’ production units, and that it will not involve any major changes for employees (including terms of employment). However, some administrative functions in these units may be coordinated with Arctic Paper’s units in Sweden. The operations at Rottneros’ head office will be coordinated with Arctic Paper’s units in Sweden and its head office in Poland, which will result in some limited redundancies.

The Board has been informed that Arctic Paper intends to offer certain individuals in the Rottneros management team an incentive arrangement, providing the Offer is completed. The payment is conditional upon the active participation of these key individuals in forming the new group and that they have not terminated their employment before 30 June 2013 and 31 December 2013, respectively. The incentive arrangement for all entitled employees amounts to a maximum of SEK 1.2 million in aggregate. The Board is of the opinion that the management incentive arrangement would be beneficial in relation to the shareholders’ interests and has thus approved Arctic Paper’s arrangement as well as its intention to offer this arrangement.

As part of the Board’s evaluation of the Offer and its recommendation, the Board has taken into account a fairness opinion from KPMG AB ("KPMG"). Rottneros engaged KPMG as an independent advisor to issue a fairness opinion on whether the Offer is deemed fair from a financial perspective. The Board has taken part of KPMG’s evaluation and its underlying materials.

KPMG has in its assignment, amongst other things, taken into consideration internal information from the management of both Arctic Paper and Rottneros concerning business descriptions, historical financial results, financial budgets and projections and other documentation. KPMG has also conducted interviews with the respective management teams of Arctic Paper and Rottneros and with the Chairman of the Board of Rottneros. KPMG has also conducted analyses of public information including competitors’ annual reports and general industry reports.

KPMG’s fairness opinion is attached to this press release and will also be published in the Offer Document.

KPMG’s opinion is that the Offer is to be considered fair for Rottneros’ shareholders from a financial perspective.

In conclusion, and based on the above, the Board of Directors of Rottneros unanimously recommends the shareholders of Rottneros to accept the Offer.

2013 Munken Agenda – promoting a common language!

In the 2013 edition of the popular Munken Agenda, Arctic Paper is aiming to uphold the value of a common language. On this theme, Arctic Paper continues to promote a common understanding as the single most important success factor when the paper producer, printer and designer work together to create new artwork.

Last year, the ‘Fika with Art Workers’ web initiative attracted a great deal of attention and was part of Arctic Paper’s endeavour to spread knowledge of paper and processes to a broader target group. This year, the ‘Art Workshop - Munken Guide to Uncoated Paper’, a real heavyweight comprising well over a hundred pages, was launched to further this knowledge.

In the coming year, yet another important step will be taken. When the popular Munken Agenda diary is released shortly – for the fourth year in succession – language, knowledge and common understanding will be central. Arctic Paper will offer interesting curios for the connoisseur as well as humorous – and far too common – misconceptions regarding paper.

Misconceptions pave the way for new knowledge

“There are many people with a deep knowledge of paper and processes but the market is also awash with popular misconceptions,” states Annika Andréasson from Market Communication at Arctic Paper.

She continues: “When working on the Munken Agenda, we wanted to showcase some common misconceptions, how they have arisen and what would be the best way to address them. Above all, it feels meaningful to talk about the value of a common language.”

Extra dimension on the desk

The Munken Design Range, with its wide range of grades, has taken the market by storm. And more and more paper lovers are choosing the Munken Agenda diary. Also this year, their desk will have an added dimension with exciting imagery, inspiration and anecdotes.

In the centre, as usual, is Munken paper from Arctic Paper Munkedals. All six design paper grades are represented in the 2013 edition of the Munken Agenda. Completely in line with tradition, it is also held together with the unusual, yet beautiful and highly practical, French open thread binding, which allows the agenda to remain open at exactly the page you want.

The Munken Agenda 2013 is available from Munken Shop, www.arcticpaper.com/munkenshopfrom November 2012.

Welcome to a new, successful design year with the Munken Design Range!

ARCTIC PAPER S.A. 3rd quarter of 2011

Arctic Paper S.A., the second-largest European producer of bulky book paper and one of Europe’s leading producers of high-quality graphic paper, generated revenues in the 3rd quarter of 2011 of over PLN 641.4 million, 2.3% higher than in the same period of 2010, and EBITDA of over PLN 43 million, 69.3% higher than achieved in the 3rd quarter of 2010. In the 3rd quarter of 2011 the company earned a net profit of almost PLN 34.1 million. This means that the company has made up a significant part of the loss generated in the 1st half of this year.

Despite continuing lower demand for graphic fine paper in Europe, the company increased its sales volume in the 3rd quarter of 2011 compared to the 2nd quarter of 2011 by 6.1%. Nonetheless, it was 1.4% below the volume recorded in the 3rd quarter of 2010.

Thanks to the increase in sales volume, use of the company’s production capacity returned to the high level of 95%.

Due to significantly better operating results in the 3rd quarter of 2011, the Arctic Paper Group made up a significant part of the loss generated in the 1st half of 2011. In the 3rd quarter alone, the group earned a net profit of almost PLN 34.1 million, which means that the net loss decreased from PLN 50.1 million in the 1st half of 2011 to PLN 16 million through the first 9 months of 2011. The high net result was influenced by increased sales revenue and positive development in exchange rates, mainly emanating from valuation of the intra-group loan by Arctic Paper S.A. to Arctic Paper Investment AB.

Sales revenue of the AP Group in the 3rd quarter was over PLN 641.4 million, representing a growth of 2.3% compared to the 3rd quarter of 2010 and a growth of 11.1% compared to the 2nd quarter of 2011. Year-to-date revenue through 9 months of 2011 was over PLN 1,853 million, an increase of 9.7% compared to the same period of 2010

Revenue per metric tonne of paper sold, expressed in PLN, was PLN 3,320 in the 3rd quarter of 2011, representing an increase of 4.7% compared to the result achieved in the 2nd quarter of 2011 and an increase of 3.7% compared to the 3rd quarter of 2010.

Sales volume in the 3rd quarter of 2011 was 193,000 metric tonnes, representing an increase of about 6.1% compared to the 2nd quarter of 2011. However, the total market demand for graphic fine papers in Europe continued to decline and demand of coated and uncoated wood free paper for the first 9 months remained below the levels observed prior to the economic crisis in 2008–2009.

In the first 9 months of 2011, sales volume was 574,000 metric tonnes, 3.2% higher than the volume achieved in the same period of the previous year.

Michał Jarczyński, CEO of Arctic Paper S.A., commented: “In the 3rd quarter of 2011 there was a visible break in the negative trend for Arctic Paper in terms of currency exchange rates and variable costs which we observed to have an impact on the financial results of the Arctic Paper Group in the 1st half of this year. Despite the summer holidays and the low demand for paper in Europe continuing from the beginning of the year, we achieved high sales volumes of over 193,000 tonnes, and the use of production capacity at our paper mills returned to a high level of almost 95%. In the 3rd quarter we generated substantially better operating results, thanks to which we made up a major part of the loss generated in the 1st half of this year.”

ARCTIC PAPER S.A. is the second-largest European producer of bulky book paper in terms of production volume, and one of Europe’s leading producers of high-quality graphic paper. The Group produces uncoated and coated wood-free paper and uncoated wood-containing paper for printers, book publishers, magazine publishers, the advertising sector and paper distributors. The Group’s product line includes such well-known brands as Amber, Arctic, G-Print, Munken, Pamo and L-Print.

The Group has four paper mills, in Kostrzyn, Poland; Munkedal and Grycksbo, Sweden; and Mochenwangen, Germany. The total production capacity of the four paper mills in the Group is over 800,000 metric tonnes of paper per year.

• Arctic Paper Kostrzyn has a production capacity of about 278,000 tonnes annually and produces chiefly uncoated wood-free paper for general printing uses, such as printing of books, brochures, forms, and envelopes.

• Arctic Paper Munkedal has a production capacity of about 160,000 tonnes per year and produces mainly high-quality uncoated wood-free paper chiefly used for printing books and advertising brochures.

• Arctic Paper Mochenwangen has a production capacity of about 115,000 tonnes per year and produces mainly uncoated wood-containing paper used primarily for printing books and flyers.

• Arctic Paper Grycksbo has a production capacity of about 265,000 tonnes per year and produces high-quality coated paper, used for printing maps, books, magazines, posters and direct mail materials.

Munken – Paper worthy of a Nobel prize winner!

Arctic Paper congratulates Tomas Tranströmer, this year's recipient of the Nobel Prize in literature. Tranströmer, one of our era's most important poets, is receiving the prize "because through his condensed, translucent images, he gives us fresh access to reality".

For Arctic Paper, the selection of Tranströmer is a gratifying event from several perspectives. Ever since the attention garnered by his debut in 1954 with the poetry collection, 17 poems, a large portion of his work has been published on design and book paper from Arctic Paper Munkedals. With the approaching new publication of his works, an additional order has been placed for a total of approximately 100 tons of Munken Premium Cream 13.

- Tranströmer is without a doubt one of the world's greatest poets. Many of his popular works have been printed on Munken paper, which feels like a confirmation of the committed work that has been carried out at the plant in Munkedal in order to deliver a truly environmentally-adapted quality paper. It is quite an honour that they are also making the same selection for the new publication," says Martin Folkelind, Business Development Manager within the Arctic Paper Group.

At the publishing house, Bonnier, in Stockholm, it is naturally a great joy to see Tranströmer, who has been one of the top contenders regarding speculations about who will receive the prize, to finally be awarded this prestigious honour.

Paper in three shades - choice of selection an advantage in the Arctic Volume Range

Graphic design often requires both finesse and surprise. Small details, such as a paper surface and the shade of the paper, can make a huge difference.

Shade, volume and dimension are cornerstones in the new campaign for the Arctic Volume Range - Explore the Volume, where photographer Vincent Skoglund and set designer Tobias Allansson have played with scale, form and perspective in new and unexpected ways.

The fifth colour

The shade of the paper is an important characteristic to take into consideration in choosing paper. What do you want to achieve? Is it the best possible printing quality, colour reproduction, contrast or good readability and a feeling of exclusivity? In three playful motifs, the paper choice and design of the campaign varies in order to show the different possibilities that are offered with the Arctic Volume Range.

- "Different shades provide different printing results and colour temperatures, which contribute to the last, important finishing touches or the feeling you want to convey," says Annika Andréasson, project manager at Arctic Paper's marketing department.

Ingenious team behind the campaign

Vincent Skoglund is known for his unexpected details within fashion and product photography. Sports products are a speciality. In his photos, the commonplace is mixed with extreme sports – here, a snowboard hangs on a clothesline while the piste is cleared with a vacuum cleaner. Tobias Allansson is often responsible for ingenious concepts, which have been successfully used by Burton and Adidas.

In the new campaign for the Arctic Volume Range, the details are well-known, but the perspectives distorted. The sewing needle is gigantic while the garment is tiny...or?

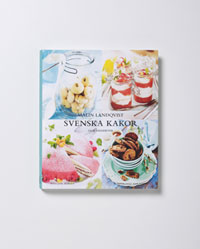

Swedish cookies on Arctic Volume Ivory

Someone who has recently used Arctic Volume Ivory is Susanne Reali, assistant publisher at the publishing company Max Ström. The book is called Swedish cookies and has become very popular. Recipe books should have a long lifetime since they are often passed down from generation to generation. In addition, it is important that the photographs are inspiring and do the recipes justice.

- "Together with our designer, we put a lot of thought into the paper choice. She wanted to see an uncoated paper to see the feeling it conveyed. I preferred coated paper where the photographs could be shown more distinctly. In the end we agreed on Arctic Volume Ivory, which we felt combined both the feeling and printing characteristics. It has a wonderful paper feeling and also a shade that we liked, a tone that adds a little warmth to the photos," says Susanne Reali.

Arctic Paper price increase of 5‐8% for uncoated and coated fine papers.

Increasing input costs like raw materials and transportation have had a strong negative impact on the profitability of all paper producers. Arctic Paper now announces to its customers a price increase on all UWF and CWF paper grades, both in folio sheets and reels. The price increase will range from 5‐8% and will differ from the current price levels per country and paper grade.

The price increase will be implemented for all markets and deliveries from 15 September 2011 will be affected.

The local sales teams of Arctic Paper will give customers further details and information.