Ianadmin

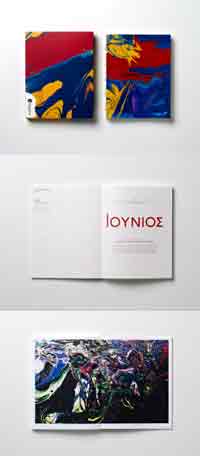

2013 Munken Agenda – promoting a common language!

In the 2013 edition of the popular Munken Agenda, Arctic Paper is aiming to uphold the value of a common language. On this theme, Arctic Paper continues to promote a common understanding as the single most important success factor when the paper producer, printer and designer work together to create new artwork.

Last year, the ‘Fika with Art Workers’ web initiative attracted a great deal of attention and was part of Arctic Paper’s endeavour to spread knowledge of paper and processes to a broader target group. This year, the ‘Art Workshop - Munken Guide to Uncoated Paper’, a real heavyweight comprising well over a hundred pages, was launched to further this knowledge.

In the coming year, yet another important step will be taken. When the popular Munken Agenda diary is released shortly – for the fourth year in succession – language, knowledge and common understanding will be central. Arctic Paper will offer interesting curios for the connoisseur as well as humorous – and far too common – misconceptions regarding paper.

Misconceptions pave the way for new knowledge

“There are many people with a deep knowledge of paper and processes but the market is also awash with popular misconceptions,” states Annika Andréasson from Market Communication at Arctic Paper.

She continues: “When working on the Munken Agenda, we wanted to showcase some common misconceptions, how they have arisen and what would be the best way to address them. Above all, it feels meaningful to talk about the value of a common language.”

Extra dimension on the desk

The Munken Design Range, with its wide range of grades, has taken the market by storm. And more and more paper lovers are choosing the Munken Agenda diary. Also this year, their desk will have an added dimension with exciting imagery, inspiration and anecdotes.

In the centre, as usual, is Munken paper from Arctic Paper Munkedals. All six design paper grades are represented in the 2013 edition of the Munken Agenda. Completely in line with tradition, it is also held together with the unusual, yet beautiful and highly practical, French open thread binding, which allows the agenda to remain open at exactly the page you want.

The Munken Agenda 2013 is available from Munken Shop, www.arcticpaper.com/munkenshopfrom November 2012.

Welcome to a new, successful design year with the Munken Design Range!

Ilim Group's Output of P&P Products in the First Three Quarters of 2012 Exceeds over 1.9 mln Tons

Over the first nine months of 2012, Ilim Group’s mills in the Northwest Russia and in Siberia manufactured 1,928,000 tons of pulp and paper products, which is slightly more than for the same period last year.

Over the first nine months of 2012, Ilim Group’s mills in the Northwest Russia and in Siberia manufactured 1,928,000 tons of pulp and paper products, which is slightly more than for the same period last year.

The output of market pulp reached 1,224,000 tons, which is a 2% growth against last year.

Market containerboard production totaled 525,000 tons, 2% less than in the first nine months of 2011.

Paper production has gained 5%, reaching 179,000 tons.

OAO Ilim Gofra, corrugated box business of Ilim Group in the Leningrad Oblast, increased its production volumes by 4.5% to reach 94,248,000 square meters of corrugated products.

Ilim Group's Mills in Siberia Produce 1.1 Mln Tons of Products in the First Nine Months of 2012

Over the first three quarters of 2012, Ilim Group’s Bratsk and Ust-Ilimsk Mills (Irkutsk Oblast) manufactured 1,099,000 tons of pulp and paper products. As compared to the January-September 2011, production output remained flat.

Over the first three quarters of 2012, Ilim Group’s Bratsk and Ust-Ilimsk Mills (Irkutsk Oblast) manufactured 1,099,000 tons of pulp and paper products. As compared to the January-September 2011, production output remained flat.

This includes 933,000 tons of market pulp, which is slightly better than the similar period performance in the previous year.

Market containerboard production totaled 166,000 tons, which is 5% below the first nine months of 2011. Decrease in production output is due to market demand for reduced basis weight board, which leads to output decrease in terms of tons produced.

Pulp cooking volumes have not changed significantly and amounted to 1,194,000 tons.

Ilim Group's harvesting operations in Siberia have increased by 6% as compared to the similar period in 2011 to reach 5,005 thousand cubic meters.

CellMark is introducing a new line of business!

The new business unit, CellMark Basic Chemicals, has commenced trading and distribution of a selected range of Basic Chemicals, such as Acetic Acid and Acetyls, Caustic Soda and other broadly used inorganic and organic commodity chemicals. The unit currently employs seven people.

The new business unit, CellMark Basic Chemicals, has commenced trading and distribution of a selected range of Basic Chemicals, such as Acetic Acid and Acetyls, Caustic Soda and other broadly used inorganic and organic commodity chemicals. The unit currently employs seven people.

Already at its inception, CellMark Basic Chemicals covers the markets of Europe, Mediterranean and Turkey with a business focused on international bulk trading and bulk distribution of both full truck and break bulk loads. The distribution business is supported by tank storage locations in Belgium (Antwerp), Spain (Tarragona) and Turkey (Istanbul).

CellMark has also recently established a legal entity in Turkey, CellMark Kimya AS, to capitalize on the vast opportunities in the fast growing chemical markets in the region.

Clariant progresses while global economy deteriorates further

CEO Hariolf Kottmann: “Given the further deterioration of the global economy, in which slower emerging markets growth could not offset anymore a weakening in Europe, Clariant achieved a solid performance in the last three months. This was driven by a stable development of most core businesses, manifesting the consequent execution of our profitable growth strategy. Although the short-term economic challenges are expected to persist, Clariant’s mid-term guidance until 2015 remains intact.”

CEO Hariolf Kottmann: “Given the further deterioration of the global economy, in which slower emerging markets growth could not offset anymore a weakening in Europe, Clariant achieved a solid performance in the last three months. This was driven by a stable development of most core businesses, manifesting the consequent execution of our profitable growth strategy. Although the short-term economic challenges are expected to persist, Clariant’s mid-term guidance until 2015 remains intact.”

- Stable profitability in the core businesses despite pronounced economic weakness in Europe. Good progress in portfolio management and the integration of Süd-Chemie.

- Q3 2012 sales increased 3% to CHF 1.923 billion from CHF 1.865 billion in Q3 2011.

- EBITDA before exceptionals fell 7% to CHF 201 million from CHF 216 million in Q3 2011, affected by lower volumes and investments into growth.

- Cash flow from operations rose to CHF 181 million, compared to CHF 127 million in Q3 2011.

- For the full-year 2012, Clariant expects flat sales growth in local currencies and an EBITDA margin before exceptionals slightly ahead of the level after nine months.

Third Quarter Performance

Muttenz, October 31, 2012 - Clariant, a world leader in specialty chemicals, today announced sales of CHF 1.923 billion in the third quarter 2012, up 3% compared to CHF 1.865 billion in the previous-year period. In local currencies, sales were 3% lower.

In the third quarter, the global economy has not stabilized as expected. While Latin America continued on a solid growth path and North America remained stable, the downturn in Europe spread from the Southern countries across the continent. At the same time, the major economies in Asia/Pacific and Middle East & Africa started to soften.

At group level, volumes decreased 5% year-on-year. Although volume reductions affected most businesses, the Catalysis & Energy, Functional Materials, Industrial & Consumer Specialties and Masterbatches Business Units performed solidly in this environment and are on track to achieve their full-year targets. The Oil & Mining Services Business Unit continued to grow double-digit in local currencies. On the other hand, the particularly pronounced weakness in the electronics, coatings and increasingly in the automotive industries severely affected the Additives and Pigments Business Units. Leather Services, Textile Chemicals and Paper Specialties recovered from the low previous-year’s levels and posted robust single-digit sales growth in local currencies.

At 26.3%, the gross margin was higher than the previous year’s 26.1%. Sales prices decreased sequentially by 1% but raw material costs also weakened significantly. Year-on-year, prices increased by 2% while raw material costs decreased by 1%. The positive contribution from pricing was partially offset by unabsorbed production costs due to lower volumes, and an unfavorable product mix development. In addition, the contribution from new production capacities for battery materials and flame retardants was much lower than expected earlier. Under the current economic conditions, a slower market adoption of these new innovative products and technologies has been observed, therefore leading to low capacity utilization rates in those two plants.

The EBITDA before exceptional items contracted to CHF 201 million from CHF 216 million in Q3 2012. Therefore the EBITDA margin before exceptionals stood at 10.5% compared to 11.6% in the previous-year period. While the underlying EBITDA of the Business Units was stable, the lower margin was the result of higher SG&A costs that were mainly related to the integration of Süd-Chemie, a lower positive contribution from one-time items and higher R&D costs, including start-up costs for the bioethanol plant near Munich. Restructuring and impairment costs were lower at CHF 9 million versus CHF 23 million in the third quarter 2011 and were mostly related to the integration of Süd-Chemie. Net income fell to CHF 49 million from CHF 81 million in the same period one year ago, mainly due to foreign exchange rate effects in the financial result and slightly higher financing costs.

Operating cash flow was strong with CHF 181 million in the quarter compared to CHF 127 million one year ago, following the normal seasonality with a build-up in inventories in the first half of the year followed by a reduction in inventories and therefore cash flow generation in the second half-year.

Net debt stood at CHF 1.934 billion and was therefore lower compared to the CHF 1.984 billion at the end of June 2012, but higher than the CHF 1.740 billion reported at year-end 2011. Consequently, the gearing, reflecting net financial debt in relation to equity, improved to 64% from 67% recorded at the end of the second quarter 2012, but increased from 58% at the end of 2011.

Outlook 2012

In the third quarter, the expected stabilization of the global economy did not materialize. The European economy deteriorated further, with the Southern European weakness spreading to other countries, affecting various industries. Unlike in the second quarter, growth in the rest of the world was not able to offset the decrease in Europe with growth dynamics slowing mainly in Asia/Pacific and Middle East & Africa. The further path of the global economy remains uncertain. In this economic scenario, raw material costs are expected to be unchanged in full-year 2012 versus full-year 2011, while exchange rates should remain at the levels of the beginning of the year.

Clariant remains committed to its mid-term targets 2015 despite a softening of the global economy and the short-term impact from a massive volume reduction in Europe. The confidence in achieving those targets is based on the growth and performance of the core Business Units, a disciplined pricing approach, the progress in the integration of Süd-Chemie, further cost benefits, and successful portfolio management.

For the full-year 2012, Clariant expects flat sales growth in local currencies and an EBITDA margin before exceptionals slightly ahead of the level after nine months.

For more details, please download the PDF of the press release vis this link

KapStone Reports Record Third Quarter Results

KapStone Paper and Packaging Corporation has reported results for the third quarter ended September 30, 2012.

- Net sales of $310 million up $94 million, or 44 percent, versus prior year

- Net income of $18 million up $2 million, or 13 percent, versus 2011

- Adjusted EBITDA of $49 million up $7 million, or 17 percent, versus prior year

- Diluted EPS of $0.38 up $0.03 per share, or 9 percent, versus 2011

- Adjusted diluted EPS of $0.41 up $0.05 per share, or 14 percent, versus prior year

Roger W. Stone, Chairman and Chief Executive Officer, stated, "The announced $50 per ton containerboard price increase for mid-August shipments was implemented late in the third quarter and is expected to increase fourth quarter 2012 EBITDA by $7 million. Once fully implemented it should boost our EBITDA by approximately $45 million annually.

"Our mills produced 389,000 tons of paper for the quarter. Although this was below our expectations, our Roanoke Rapids mill was impacted by a flood in late August resulting from a rare deluge of rain which curtailed production and added flood clean-up and repair costs. In addition, our Charleston mill also encountered some productivity problems which temporarily impacted their operations. Fortunately, our mills are now performing well, and Roanoke Rapids has had the best start-up from its annual planned maintenance outage since we have owned the mill."

Third Quarter Operating Highlights

Consolidated net sales of $309.5 million in the third quarter of 2012 increased by $93.7 million, or 43.4 percent compared to $215.8 million for the 2011 third quarter. The increase is primarily due to the USC acquisition which contributed $99.1 million of additional revenue based on selling 1.56 billion square feet of corrugated products compared to none in 2011. In 2012's third quarter, 329,000 tons of paper were sold compared to 327,000 tons a year earlier. The Company's average selling price increased by $2 per ton compared to the second quarter of 2012, but was $14 per ton lower than the third quarter of 2011 due to lower export containerboard prices and product mix.

Operating income of $31.1 million for the 2012 third quarter increased by $1.0 million, or 3.2 percent, compared to the 2011 third quarter. The improved financial performance primarily reflects benefits from the acquisition and the timing of annual planned maintenance outages, partially offset by lower selling prices, unplanned downtime at our Roanoke Rapids, NC mill and unfavorable foreign exchange rates.

Unfavorable foreign exchange rates resulting from the strengthening of the U.S. dollar compared to the euro reduced operating income by $1.5 million.

Interest expense, net was $1.9 million for the third quarter of 2012, up $1.3 million from a year ago as a result of a higher debt balance associated with the acquisition. At September 30, 2012, the interest rate on the term loan was 1.97 percent. Amortization of debt issuance costs of $0.9 million for the third quarter of 2012 increased by $0.5 million from a year ago due to costs associated with the Company's new credit agreement.

The effective tax rate for the third quarter of 2012 was 35.1 percent compared to 42.3 percent for the 2011 third quarter and increased diluted earnings per share by $0.04. The lower effective tax rate is due to a higher expected benefit from the domestic manufacturing deduction and $0.6 million of discrete tax adjustments related to prior years' tax returns. The 2011 effective tax rate included a discrete item for return to provision adjustment. For 2012, the Company estimates its cash tax rate to be about 10 percent reflecting utilization of net operating losses and the cellulosic biofuel tax credit.

Cash Flow and Working Capital

Cash and cash equivalents increased by $26.6 million in the quarter ended September 30, 2012, to $36.3 million reflecting $40.5 million of net cash provided by operating activities, $13.9 million of cash used by investing activities and $0.1 million of cash provided by financing activities.

Capital expenditures for the third quarter of 2012 totaled $13.9 million. The Company estimates $64.0 million of capital expenditures for the year.

At September 30, 2012, the Company had approximately $160.7 million of working capital and $142.8 million of revolver borrowing capacity.

Conclusion

In summary, Stone commented, "In September, we announced our plans to invest $29 million in our Charleston, South Carolina mill to improve our ability to produce ultra high performance lightweight linerboard grades positioning us well for future customer needs. Our balance sheet and cash flow generation is very strong, and we are well-poised to continue to grow this company profitably."

SOURCE KapStone Paper and Packaging Corporation

Melitta USA Converts to Sonoco's Paperboard Composite Container

As the world's largest producer of composite cans, Sonoco, is helping Melitta USA move from traditional metal cans to high-performance composite cans that deliver better shelf appeal and a reduced environmental footprint.

As the world's largest producer of composite cans, Sonoco, is helping Melitta USA move from traditional metal cans to high-performance composite cans that deliver better shelf appeal and a reduced environmental footprint.

Melitta, which has been roasting premium European-style coffee at its location in Cherry Hill, N.J., for over 40 years, has converted its 603- and 401-volume coffee cans to Sonoco's lighter weight paperboard composite container made from recycled and recyclable content. Sonoco's rigid paperboard containers weigh less than metal cans, making them less expensive to ship, and they perform as well as metal canisters in abuse resistance and shelf life.

"With the new cans, we're offering consumers the same premium product in a package that they can feel good about purchasing – a lighter weight option made from renewable and recyclable materials," said Jeff Bridges, vice president, Melitta USA.

"Additionally, we were very pleased with the conversion process," Bridges continued. "Over the past two years, Sonoco's team of dedicated quality and technical experts has provided us with the most seamless transition possible."

The can is spiral-wound from 100-percent recycled paperboard and includes a high-barrier liner that locks out moisture and locks in product aroma and taste. Because there are no ribs on the new can, the smooth surface provides superior graphic bill boarding and shelf appeal.

Howard Coker, vice president, Global Rigid Paper and Closures, noted, "Sonoco's composite coffee can provides Melitta not only with reliable product protection and superior branding, but also a smaller environmental footprint."

NewPage Supports WRI's Launch of New Forest Mapping Tools

NewPage Corporation (NewPage) announced today its support of the World Resources Institute (WRI) in releasing new groundbreaking web applications created to help ensure that palm oil production is pursued in a way that avoids deforestation. These two publicly available web tools–the Forest Cover Analyzer and the Suitability Mapper—are the first of their kind, designed to enable companies and governments to implement commitments to sustainable palm oil.

Since 2008, NewPage has supported WRI's Project POTICO, a project designed to divert oil palm development in Indonesia onto low-carbon, already-cleared lands and thereby avoid deforestation. Though NewPage sources fiber for its operations exclusively in North America under rigorous environmental and social criteria, NewPage believes strongly in supporting initiatives like Project POTICO that are working to improve forest product procurement practices across the globe.

Project POTICO's Forest Cover Analyzer tool allows users to identify and assess forest conditions in Indonesian Borneo, including the extent of forests, forest cover change, where oil palm and other concessions are located, and the suitability of land for sustainable palm oil development. Given the increased focus many corporations are placing on responsible procurement of forest and agricultural products, the Forest Cover Analyzer is designed to be an extremely valuable tool for corporate buyers, suppliers, and investors looking to avoid risks associated with deforestation concern and to locate plantations not associated with forest clearing.

The second tool, the Suitability Mapper, is an online mapping system designed for use by palm oil producers and spatial planners, allowing them to locate low-carbon degraded lands on Indonesian Borneo that are potentially suitable for sustainable palm oil production.

As Indonesia is one of the world's deforestation hotspots, developing tools that support responsible forest management, commodity production, and investment in this region is crucial. Now that these tools have been piloted and launched for Indonesian Borneo, WRI plans to apply this knowledge to developing similar web-based tools to inspire and enable responsible forest management on a global scale.

"These online systems bring the world another step closer to having its commodities and its forests too," stated Craig Hanson, director of WRI's People & Ecosystems Program. "And our long-term partnership with NewPage, the pioneer supporter of POTICO, helped make it happen."

"NewPage has always been committed to sustainability in its own operations, through responsible fiber sourcing, achievement of third-party certifications, running efficient manufacturing operations, and looking for ways to continually lower the environmental footprint of our products," stated David Bonistall, vice president, Environmental, Health and Safety for NewPage. "Since 2008, we have been proud to support WRI's work on global forestry issues, and congratulate them on the release of these groundbreaking forest monitoring tools. These tools will provide the necessary resources to improve sustainable oil palm production, reduce pressure on virgin rainforests and reduce greenhouse gas emissions from forest clearance and conversion."

By providing public access to up-to-date information on forestry activity in Indonesia, Project POTICO's new web tools mark a major step toward improving global forestry conditions. Information on Project POTICO, and links to access these two new web applications, are available at www.ProjectPOTICO.org.

SOURCE NewPage Corporation

Revolutionary innovation from Metso for Kraft Pulp Mill liquor cycle management

The new Metso Recovery Analyzer represents the latest generation of fully automatic titrators for chemicals recovery optimization. In addition to the well proven causticizing measurements, the new Metso Recovery Analyzer also features unique on-line reduction degree measurement technology which together with process optimizing controls enables more environmentally friendly operation, higher process throughput and maximum uptime and savings in cleaning chemical and fresh lime costs.

The new Metso Recovery Analyzer represents the latest generation of fully automatic titrators for chemicals recovery optimization. In addition to the well proven causticizing measurements, the new Metso Recovery Analyzer also features unique on-line reduction degree measurement technology which together with process optimizing controls enables more environmentally friendly operation, higher process throughput and maximum uptime and savings in cleaning chemical and fresh lime costs.

Using fully automatic real time sampling and standard titration methods, the new Metso Recovery Analyzer improves recovery boiler combustion and reduction efficiency. It consistently measures the absolute values of Sodium Hydroxide, Sodium Sulfide, and Sodium Carbonate, in addition to Sodium Sulphate. It calculates Reduction Degree, Effective Alkali (EA), Active Alkali (AA), Total Titratable Alkali (TTA), Causticizing Degree (CE%), and Sulfidity (S%).

Multiple benefits for operations

Offering more environmentally friendly recovery boiler operation, the new analyzer measurements can be utilized in advanced recovery boiler process controls for dissolving density tank control, combustion air control and liquor burning optimization for improved and consistent chemicals reduction. The advanced diagnostics and remote assistance possibility ensure the analyzer uptime can be maintained at the highest possible level at any location in the world.

Better control of chemical recovery and causticizing efficiency provides consistent high quality white liquor for the digester, while improved process stability enables higher process throughput and maximum uptime with reduced scaling and fouling. Harmful over- and under-liming is eliminated and white liquor filters require less frequent cleaning, resulting in increased causticizing output, savings in cleaning chemical costs and reduced fresh lime consumption.

Built on years of experience

"What we have developed is genuinely new and revolutionary, the addition of the reduction degree measurement opens new potential for recovery boiler operation," says Jarmo Koskinen, Business Manager.

Built on years of experience gained with the earlier causticizing analyzer, the new device incorporates the most up-to-date technology with well tested techniques to cover the wider needs of the whole liquor cycle. Metso has paid special attention to the clear and informative interface providing basic measurement data for process operators, tuning and diagnostic information for E&I technicians and detailed measurement data for process development engineers via an Ethernet link.

Metso has signed a Letter of Intent with Walpella Oy regarding transfer of certain businesses and contract manufacturing

Metso Paper Inc. has today signed a Letter of Intent with Walpella Oy regarding transfer of business and contract manufacturing concerning parts manufacturing, automation manufacturing, internal goods receiving logistics and warehouse functions at its Järvenpää unit in Finland. The target of the parties is to implement the transfer of business by November 30, 2012. The value of the deal (a transfer of business) is not disclosed. The deal will have no significant impact on Metso’s results.

The personnel of the respective operations, 87 persons in all, will transfer to the new employer under their existing employment contracts. Metso’s unit in Järvenpää has a total of over 900 employees.

The deal includes the machinery and equipment for manufacturing. The buyer will continue to operate in Metso’s premises as a contract manufacturer making equipment for Metso.

The sale is part of Metso Paper’s work to develop its production structure in order to improve customer service and competitiveness amid the toughening global competition.