Ianadmin

Xerium Technologies Wins Cascades’ 2012 Sustainable Supplier Award

Cascades (TSX: CAS) released yesterday the name of the winner of the fourth edition of the Sustainable Supplier Award, a contest that aims to recognize best business practices in sustainable development among its suppliers. Created by the company's Corporate Procurement Department, this award enables Cascades to publicly acknowledge the efforts of its suppliers that have had positive repercussions on its products, processes or manufacturing methods. The projects undertaken were also assessed on their environmental, societal and economic impacts. This year, although many projects caught the attention of the jury, Xerium was the winner.

Cascades (TSX: CAS) released yesterday the name of the winner of the fourth edition of the Sustainable Supplier Award, a contest that aims to recognize best business practices in sustainable development among its suppliers. Created by the company's Corporate Procurement Department, this award enables Cascades to publicly acknowledge the efforts of its suppliers that have had positive repercussions on its products, processes or manufacturing methods. The projects undertaken were also assessed on their environmental, societal and economic impacts. This year, although many projects caught the attention of the jury, Xerium was the winner.

About Xerium Technologies

Xerium Technologies, with its Weavexx and Stowe divisions, have been working in the pulp and paper industry since the mid-1800s. The company is a leader in paper machine clothing and roll technology. In particular, it provides forming fabrics, press felts, dryer felts, roll covers and spreader rolls. The manufacturing of these products focuses on the reduction of total costs, the improvement of sheet quality and overall machine efficiency. The long standing business partnership between Cascades and Xerium has led them to integrate state-of-the-art rolls and fabrics in many Cascades Tissue Group plants in North America (Candiac, Eau Claire, Kingsey Falls, Mechanics, Memphis, Ransom, Rockingham, Scarborough, Whitby). Integrated projects on fourteen machines have helped increase efficiency of operations. This optimization has generated significant savings in costs as well as a reduction in the consumption of water and energy in the targeted plants. Xerium distinguished itself by providing a file that was exemplary, supported by figures and highlighting the positive environmental and economic repercussions of its project.

Harold Bevis, President and Chief Executive Officer of Xerium, thanked Cascades for this unique recognition: "I see this prize as one of the best incentives for encouraging suppliers like us to engage in a sustainable development approach with its clients. For the coming years, Xerium intends to continue developing paper machine clothing and rolls technology for the purpose of improving the performance of its clients.”

Suppliers play a major role in the value chain of a manufacturing company like Cascades. The Sustainable Supplier Award is a prime example of the importance that Cascades attaches to good relations. According to Alain Lemaire, President and Chief Executive Officer of Cascades, “if year after year we succeed in distinguishing ourselves and in bringing to market top quality products, it is partly thanks to our suppliers who bring us concrete solutions and that help us improve ourselves”.

The prize was awarded during the annual meeting of Cascades' plant managers in North America, in front of more than one hundred people. It was deemed the most appropriate time by Cascades because it made it possible to highlight the accomplishments of some plants as well as make known the supplier that is being honored and its expertise in other units of the company.

FPInnovations and CanmetENERGY announce MOU Collaborative Research in Bioeconomy to Help Transform Forest Sector

FPInnovations and Natural Resources Canada's CanmetENERGY have signed a memorandum of understanding which will formalize the collaborative efforts of the research teams from both organizations after years of informal cooperation.

FPInnovations and Natural Resources Canada's CanmetENERGY have signed a memorandum of understanding which will formalize the collaborative efforts of the research teams from both organizations after years of informal cooperation.

Speaking at PaperWeek Canada in Montreal, Pierre Lapointe, CEO of FPInnovations, said the agreement will facilitate the delivery of innovative solutions in areas such as energy co-generation, biorefining, and transformation of forest biomass to bio-energy and high value bioproducts.

Researchers from both organizations will work together to exchange scientific and technical information and collaborate on joint projects.

“This agreement formalizes the long-standing relationship between FPInnovations and Natural Resources Canada and provides a strong framework for future cooperation,” said Lapointe. “Such agreements are the cornerstone that will enable Canada’s forest sector to maximize the potential of the bio-economy and in doing so, help meet the targets outlined in the Forest Products Association of Canada’s Vision 2020, an ambitious plan that challenges us all to find innovative ways to further transform the sector.”

Natural Resources Canada's CanmetENERGY is is Canada's knowledge centre for scientific expertise on clean energy technologies. It encompasses more than 450 scientists, engineers and technicians, and more than 100 years of experience.

FPInnovations is a not-for-profit organization that specializes in the creation of scientific solutions in support of the Canadian forest sector.

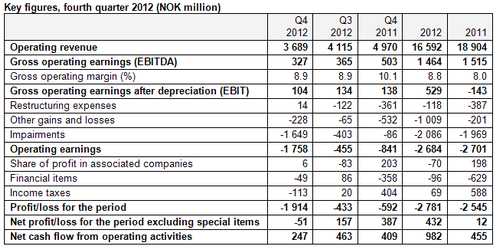

Norske Skog: Challenging market and lower debt

Norske Skog continues to reduce debt and fixed costs despite challenging markets. Net loss was significantly influenced by non-cash items such as impairments and change in value of energy contracts.

Norske Skog had gross operating earnings (EBITDA) in the fourth quarter of 2012 of NOK 327 million, down from NOK 365 million in the third quarter. This decline was due to weak seasonal effects and NOK appreciation. Gross operating earnings for the full year 2012 were NOK 1 464 million, a reduction of NOK 51 million from 2011, mainly due to lower production capacity after the closure of Norske Skog Follum, sale of Norske Skog Bio Bio and Norske Skog Parenco.

Net profit before special items were NOK 432 million in 2012 compared to NOK 12 million in 2011. The net loss of NOK 2.8 billion for 2012 was heavily influenced by NOK 3.2 billion in impairments, change in value of energy contracts and restructuring expenses. Impairments reflect increased uncertainty about sales price expectations. In addition, reassessment of Norske Skog's business in Australasia and reduction in the expected useful life of Norske Skog Walsum influenced impairments.

Cash flow from operating activities was NOK 382 million before net financial payments in the quarter. Underlying interest expenses in 2012 fell from 2011 in line with the reduction of net debt.

- Our operating earnings before special items have improved in 2012. Although our mill portfolio was reduced by three mills in 2012, we have made profitability improvements through cost input efficiencies and reduced working capital and fixed costs. We have actively managed capacity to counter market imbalances, says Sven Ombudstvedt, President and CEO of Norske Skog.

- The main task ahead is to create a better balance between supply and demand, improve productivity and cut expenses to improve margins, says Ombudstvedt.

Net interest-bearing debt was reduced by NOK 1.8 billion in 2012, totalling NOK 6.0 billion at the year end. Net interest-bearing debt was reduced by NOK 264 million in the fourth quarter. Net interest-bearing debt has been reduced from NOK 14 billion at the beginning of 2009 to NOK 6.0 billion in 2012, a decrease of NOK 8 billion over the last four years.

- We have strengthened the company's financial position considerably through a substantial reduction in our net interest bearing debt in recent years, says Ombudstvedt.

Markets

The prices for our products remained relatively stable throughout 2012.

Newsprint Europe

Year-to-date demand for newsprint in Europe declined by 9% in 2012 compared to 2011. Gross operating margin was relatively stable in Europe, but negatively impacted by exports and an appreciating NOK.

Newsprint outside Europe

Demand for newsprint in Oceania was weak, with a year-to-date decline of 13% in 2012 compared to 2011. Latin America saw a more modest decrease of 3%.

Magazine paper

An appreciating NOK adversely affected the export business. Year-to-date demand for magazine paper in Europe declined by 6% in 2012 compared to 2011. A somewhat better development for the smaller SC (uncoated) segment (minus 3%) compared to the larger LWC (coated) segment (minus 8%) was largely due to product substitution.

Active capacity management

Norske Skog ceased production at Norske Skog Follum in 2012 and one of two machines at Norske Skog Tasman in January 2013. Norske Skog sold Norske Skog Bio Bio and Norske Skog Parenco in 2012. As a consequence of these restructuring activities, the total annual production capacity is reduced from 4.4 to 3.7 million tonnes (18%).

Capacity utilisation for the group in the fourth quarter was 87% compared to 90% in the third quarter with active capacity management. For 2012, capacity utilisation was 88% (87% for 2011).

- The closures of five machines during 2012 have been difficult but necessary decisions due to declining demand for our products. Unfortunately, these decisions negatively affect the lives of our employees and their families. We believe in our industry. Therefore, we are investing AUD 84 million in the conversion of one machine at Norske Skog Boyer from newsprint to catalogue paper. In addition, we invest NOK 220 million at Norske Saugbrugs that will reduce energy consumption and fixed costs, says Ombudstvedt.

Outlook for 2013

Norske Skog expects that the operating environment will remain challenging, with weak demand in both Europe and Australasia. Relatively stable costs and already announced industry-wide capacity closures will be supportive. Active capacity management will lead to low utilisation rates in the short term. Further NOK appreciation remains an additional risk.

- The market is still challenging, but we maintain our efforts to improve the group's competitive position and financial headroom. We will also work on improving regulatory framework in Norway, says Ombudstvedt.

Follow these links to the full presentations

Q4 2012 Norske Skog quarterly report

Q4 2012 Norske Skog presentation

AF&PA Responds to U.S. Postal Service Eliminating Six-Day Mail Delivery

The American Forest & Paper Association (AF&PA) has issued its response to the United States Postal Service (USPS) announcement to eliminate six-day mail delivery service.

The American Forest & Paper Association (AF&PA) has issued its response to the United States Postal Service (USPS) announcement to eliminate six-day mail delivery service.

“The U.S. Postal Service’s decision to eliminate six-day mail delivery is a short-sighted solution with questionable financial savings and will only drive volume out of the system, stripping both the USPS and businesses that depend on the mailing industry of potential revenues,” said AF&PA President and CEO Donna Harman. “The greatest contributor to the record $15.9 billion USPS losses in 2012 was not the cost of Saturday delivery but the $11.1 billion in unrealistic benefit obligations. Reduction of service puts mailing industry jobs at risk and eliminates the Postal Service’s opportunities to leverage its network to find new revenue growth.”

The USPS is the essential component of a $1 trillion mailing industry that employs more than 8 million Americans in large and small businesses across the country such as advertising, printing, paper manufacturing, publishing, and financial services. Approximately one-third, or $6 billion, of printing and writing paper produced in the U.S. is delivered through the Postal Service.

“We urge Congress to take action to ensure the long-term stability of the Postal Service and to passing comprehensive postal reform that supports both long-term cost reductions and new revenue sources, not by cutting critical services needed for delivery of time sensitive information,” said Harman.

Rottneros' CFO is leaving the company

Tomas Hedström is leaving his post as Chief Financial Officer at Rottneros. He is taking up a corresponding position at PA Resources AB.

Tomas Hedström is leaving his post as Chief Financial Officer at Rottneros. He is taking up a corresponding position at PA Resources AB.

"Tomas Hedström has been employed by Rottneros since 2010. I wish to thank Tomas for the extraordinary contribution he has made to the company and at the same time wish him every success,” says Ole Terland, CEO and President of Rottneros.

The recruitment process has started.

WWF Welcomes APP Announcement to Halt Clearing, Urges Paper Buyers to Wait for Proof

WWF welcomed the announcement by the Sinar Mas Group’s Asia Pulp & Paper (APP) stopped clearing Indonesia’s tropical forests and peatlands to allow an assessment of their conservation and carbon values. But the conservation organization urged paper buyers to wait for confirmation of the claims through independent monitoring by civil society before doing business with APP.

“APP today committed to most of WWF’s calls. If the company follows through on this, it could be great news for Indonesia’s forests, biodiversity and citizens,” said Nazir Foead, Conservation Director of WWF-Indonesia.

“Unfortunately, APP has a long history of making commitments to WWF, customers and other stakeholders that it has failed to live up to. We hope this time the company does what it promised. WWF plans to independently monitor APP’s wood sourcing and forestry activities for compliance with its commitments and regularly update stakeholders on the findings,” Foead added.

APP runs two of the world’s largest pulp mills on Sumatra, where it produces the pulp for the toilet paper, tissue, copy paper and packaging that it sells worldwide. The company and its wood suppliers are responsible for clearing more than 2 million hectares of rain forest on the island since beginning operations in 1984, an analysis by the NGO coalition Eyes on the Forest found.

“WWF hopes that APP’s new commitments will do more than just stop its own bulldozers, including protecting the natural forests in its concessions from all illegal activities and mitigating the long-term negative impacts its practices have had on all the peat lands, forests, biodiversity and local people in Sumatra and Borneo for which these commitments have come too late,” Foead added.

“WWF has long called on responsible businesses to avoid sourcing from APP and until there is truly independent confirmation that APP has stopped draining peat soils and pulping tropical forests with high conservation value, we continue to urge paper buyers to adopt a wait for proof stance,” said Aditya Bayunanda, GFTN and pulp & paper manager of WWF Indonesia.

Mr Teguh Widjaya, the patriarch of the family’s pulp and paper business, oversaw the announcement today that no member of his APP group operating in Indonesia or China will accept any tropical timber felled in Indonesia after 31 January 2013 until company consultants have completed a full “high conservation value” and a “high carbon stock” assessment of their forest concessions.

However, the company inserted a loophole in the commitment saying that for an indefinite period of time APP mills would accept trees felled before 31 January.

As a sign of good faith and the first demonstrable milestone, WWF calls on APP to have moved the supply of already-cut tropical timber its suppliers cleared before the self-imposed 31 January 2013 moratorium by 5 May 2013, the due date of its next quarterly forest policy report.

A fully implemented moratorium on pulping forests with high conservation and high carbon value would have a profound impact on Indonesia’s biodiversity, as well as on Indonesia’s carbon emissions. WWF urges all of the country’s pulp producers to stop using tropical forests.

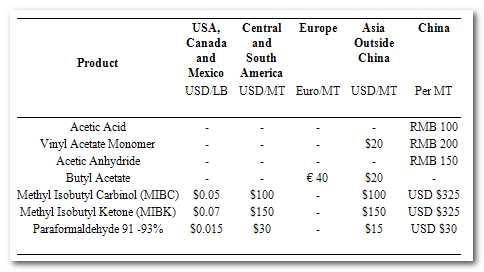

Celanese Announces Acetyl Intermediates Price Increases

Celanese Corporation (NYSE: CE), a global technology and specialty materials company, will increase list and off-list selling prices for the following products effective immediately, or as contracts allow. These increases are additive to the increases announced in January 2013.

Celanese Corporation (NYSE: CE), a global technology and specialty materials company, will increase list and off-list selling prices for the following products effective immediately, or as contracts allow. These increases are additive to the increases announced in January 2013.

Stora Enso CEO Jouko Karvinen comments on fourth quarter and full year 2012 results

“Strong cash flow, earnings stable in fourth quarter - clearly deteriorating paper outlook requires further permanent capacity reductions

“Stora Enso finished the fourth quarter with continued strong cash flow and operating earnings slightly up year-on-year, but slightly down on the previous quarter. This is the result of our ever-continuing focus on improving costs and working capital, and it demonstrates that we can and will continue on this path into the future as well. I want to give full credit for this to the Stora Enso people throughout the world.

“Stora Enso finished the fourth quarter with continued strong cash flow and operating earnings slightly up year-on-year, but slightly down on the previous quarter. This is the result of our ever-continuing focus on improving costs and working capital, and it demonstrates that we can and will continue on this path into the future as well. I want to give full credit for this to the Stora Enso people throughout the world.

“I also want to highlight that the first two of our growth investments – the investments at Skoghall and the new board machine at Ostrołęka – have been completed on time. In fact Ostrołęka's new light-weight container board machine started up six weeks ahead of schedule and the focus is now on successful ramp up, which is expected to take couple of months. In Uruguay everybody from Stora Enso and our partners is fully focused on hitting our mid 2013 start-up target and, even more important, a successful ramp-up after that.

“The darker side of our news today is that the decline in consumer demand in paper-based media in Europe has continued in the fourth quarter. Whereas the structural trend in total paper demand has been about -5% per year since 2007, we now read the demand in the two largest media-driven segments, newsprint and coated magazine paper, decreased in 2012 by about 9%. As before, the unfavourable supply and demand balance has led to further pressure on margins.

“That means we must accelerate capacity reduction plans to avoid running cash zero or even negative businesses. We plan to close one newsprint machine at Kvarnsveden and another one at Hylte, which just had to adjust to closure of a paper machine at the end of 2012. Separately, in the Building and Living Business Area we do not expect any significant improvement to the depressed European construction activity or high raw material costs. To combat the continued inadequate profitability in the very weak market environment, we are launching a cost improvement plan to adjust our cost structure and improve our competitiveness. These difficult actions are essential not only to safeguard the stronger parts of Printing and Reading and Building and Living, but also to be able to invest in our high-return growth-market businesses.

“After many years of restructuring, I do realise that the announced plans, which are all subject to local co-determination negotiations, will be very difficult for the employees to accept. I can only ask that we all try to understand that a reduction in consumer demand for printing paper and the impact of continued poor market conditions in Building and Living must be addressed. We will do our utmost to support the employees affected by these plans.

“The past six years have been persistently challenging in some of our markets, with both structural deterioration and cyclical economic weakness. We are determined to stay on our path, a continuing path of strong cash generation financing transformation into a global renewable materials company.”

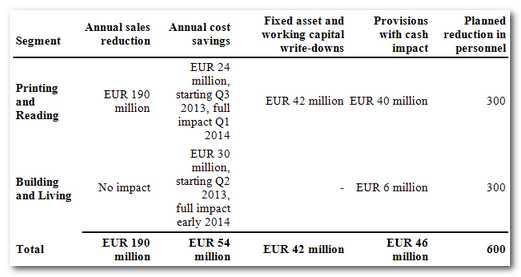

Stora Enso plans restructuring and profitability improvement actions

Permanent shutdown of 475 000 tonnes of newsprint capacity planned

Stora Enso plans to restructure its operations through the permanent shutdown of two newspaper machines in Sweden. Stora Enso also plans efficiency improvements in the Printing and Reading customer service and the Building and Living Business Area. The profitability improvement actions are planned to reduce annual costs by EUR 54 million and reduce the number of employees by approximately 600 altogether.

Printing and Reading plans to close capacity in Sweden and reorganise its Customer Service Centres

Printing and Reading plans the permanent shutdown of paper machine (PM) 2 at Hylte Mill in Sweden with annual capacity 205 000 tonnes of newsprint and PM 11 at Kvarnsveden Mill in Sweden with annual capacity 270 000 tonnes of newsprint in the second quarter of 2013. This represents 3.4% of European newsprint capacity. The plans to shut down capacity are due to continuing structural weakening of newsprint demand in Europe.

In addition, Stora Enso plans to create a common platform for all its Printing and Reading sales desk, order handling and logistic services in Europe to improve customer service. These processes currently handled at seven customer service centres, mills and logistic service centres will be centralised into five customer service centres located in Finland, Sweden, Germany, Belgium and the UK. It is planned to establish a separate Logistics Service Centre for overseas business in Gothenburg, Sweden to serve all Stora Enso’s Business Areas.

Building and Living to streamline operations throughout the whole Business Area

Building and Living plans to reduce costs, increase productivity and find sustainable improvement in all operations to overcome continued poor profitability. The plans announced include downsizing of Sollenau Sawmill in Austria, transfer of some production from the high-cost Pfarrkirchen Mill in Germany to the low-cost Zdírec Mill in the Czech Republic and efficiency improvement actions at Kitee and Honkalahti sawmills in Finland. In addition, Building and Living is planning cost reduction measures in all other units and in sales and general administration, as well as in support functions throughout the whole business area.

Financial impacts

Stora Enso will record a restructuring provision and a fixed asset and working capital write-down as non-recurring items related to the restructuring plans described above with a negative impact of approximately EUR 88 million on the operating profit in its first quarter 2013 results.

No decisions regarding closures and employee reductions will be taken until the local co-determination negotiations have concluded. Stora Enso would make every effort in co-operation with local communities to help the affected personnel find new employment opportunities, and all job openings in other Stora Enso units would be available to those affected.

STORA ENSO OYJ

NewPage Names Patrick Buchenroth Controller and Chief Accounting Officer

NewPage Holdings Inc. has announced that on February 1, 2013, Patrick Buchenroth, age 45, accepted the position of controller and chief accounting officer for NewPage Holdings Inc. and NewPage Corporation, effective February 25, 2013.

From May 2012 through January 2013, Mr. Buchenroth served as senior vice president of finance at ACCO Brands Corporation, a global supplier of branded office products, following the company's acquisition of the Consumer and Office Products Division of MeadWestvaco Corporation, a global packaging company. Prior to the acquisition, from August 2005 through April 2012, he served as chief financial officer for MeadWestvaco Corporation's Consumer and Office Products Division. In 2005, he was part of a team that orchestrated the sale of MeadWestvaco Corporation's Paper Division to form NewPage Corporation. Prior to these roles, Mr. Buchenroth was an audit partner for Deloitte & Touche, a public accounting firm.

Mr. Buchenroth is a CPA and a graduate of Wright State University with a double major in Accountancy and Finance. He is also the treasurer of the United Way of the Greater Dayton Area.

SOURCE NewPage