Ianadmin

NewPage Introduces Addition To TrueJet Digital Coated Papers For Book Publishing Market

NewPage, the leading producer of printing and specialty papers in North America, announced that the launch of TrueJet® Book, a new addition to its award-winning TrueJet® Digital Coated Papers for production inkjet presses.

TrueJet Digital Coated Papers enable high speed, short run and variable data printing on production color inkjet equipment or related hybrid applications with offset class print quality and reduced total operating cost for the printer or publisher. Unlike conventional coated offset papers, TrueJet Digital Coated Papers are made with a combination of materials that result in improved inkjet ink dry times, improved inkjet print quality and productivity while maintaining the capability for offset printability in hybrid applications.

TrueJet Digital Coated Papers enable high speed, short run and variable data printing on production color inkjet equipment or related hybrid applications with offset class print quality and reduced total operating cost for the printer or publisher. Unlike conventional coated offset papers, TrueJet Digital Coated Papers are made with a combination of materials that result in improved inkjet ink dry times, improved inkjet print quality and productivity while maintaining the capability for offset printability in hybrid applications.

"The inkjet publishing segment is rapidly growing as books that were traditionally printed web offset are converted to inkjet printing," said Steven J. DeVoe, vice president, Marketing for NewPage. "TrueJet Book is designed specifically for high-speed, book publication print runs, is Forest Stewardship Council™ (FSC®) certified and meets NASTA (National Association of State Textbook Administrators) specifications."

"TrueJet Book is offered in a 45 lb. matte finish and delivers offset-like quality for full-color variable inkjet presses to meet the requirements of our book publishing customers," added Dennis Essary, director, Digital Papers for NewPage. "Customers who are looking for a better value proposition from an inkjet grade have a new option for the book publishing market based on the award-winning TrueJet design."

TrueJet Digital Coated Papers is a result of several years of research and development and on-press testing with some of the top manufacturers of high-speed inkjet presses. NewPage was granted U.S. Patent 7803224 for the technology, which enables coated papers to be printed via multiple processes of inkjet, offset and laser. Additional patents are pending.

TrueJet Book has been awarded Kodak's 4 Diamond Rating for use on the Kodak Prosper™ press, and has also been recognized for HP Tseries presses without the need for a bonding agent.

NewPage and its TrueJet line of coated papers were recipients of a 2011 InterTech Technology Award. Bestowed by the Printing Industries of America, the award recognizes technological innovations expected to have a major impact on the graphic communications industry.

Endress+Hauser celebrates its 60th anniversary!

The specialist for measurement and automation engineering is in fine fettle in its 60th year: the family-owned company has just welcomed its 10,000th employee. In the last year alone, over 500 jobs were created worldwide.

A global network of companies, a range of high-quality products and solid family-based foundations: 60 years after its foundation, the measurement engineering specialist Endress+Hauser still continues to expand. This success is due to the continuity of a prudently run family-owned business whose first and foremost principle is to satisfy customers' needs and requirements. ‘First serve, then earn’ was one of the mottos of company founder Georg H Endress (1924-2008) – and it has lost none of its validity to this day!

Headquartered in Switzerland, the company is today the world leader in measurement and automation engineering, with products synonymous with precision and reliability. The company's independence, fully owned by the founder's family, has been laid down in a charter and is bound to be upheld in future. Firmly anchored are also the fundamental principles of the Endress+Hauser Group: a corporate culture resting on trust and a sense of responsibility is the solid groundwork for sustained growth and technological innovation. This ‘Spirit of Endress+Hauser’, filled with life by the company's leadership, makes values such as modesty, loyalty, commitment and fairness the compass points for entrepreneurial actions.

From the device to the system

The last 60 years have left their mark on the Endress+Hauser Group – in the positive sense: the vendor of devices and instruments became a full-range supplier who supports its customer in operating their plants reliably, efficiently and environmentally compatible throughout their entire life cycle. “Our strength is that we are entirely driven by the market,” says CEO Klaus Endress who manages the company in the second generation. “We learn from our customers and strive to create sustained and outstanding benefits and value for them.”

Today, over 40 sales centers and over 70 representatives around the globe sell products, services and solutions delivered by Endress+Hauser and production sites in 12 countries are engaged in manufacture and development. Thanks to the global roots in various different regions and industries, the Endress+Hauser Group is well able to cope with cyclical fluctuations. The lean and highly networked organization guarantees flexibility and rapid response.

Almost coinciding with the 60th anniversary, another remarkable landmark has been reached - the company welcomed its 10,000th employee. Around 500 new jobs have been created worldwide in the last 12 months alone. Continuity is held high in the family-owned business: in spite of the finance and public debt crisis in 2009, no employees were laid off – with the result that a new sales record was promptly accomplished in the following year after the economy had begun to recover.

Outlook

With sales totalling 1.5 billion euros, the Endress+Hauser Group marked up another record year in 2011 – in spite of a strong Swiss franc and a flagging economy in Europe. “Although the market is extremely volatile today, 2012 will be an excellent year for us,” says CEO Klaus Endress. “We trust in our strength and look ahead with confidence, but we must stay alert.” With well-targeted acquisitions in biotechnology, gas analysis and energy management, Endress+Hauser has recently rounded off its product portfolio. With an equity ratio of over 70 percent, the company is largely independent of lenders and is well equipped to meet the challenges of the future

Endress+Hauser: 1953 to today

It all began rather small and inconspicuous: on 1 February 1953, Swiss engineer Georg H Endress and German banker Ludwig Hauser set up their company in a backyard in Lörrach, Germany. The first level measurement instrument was patented just two years later and these innovative measurement instruments soon enjoyed a good reputation in the industry. As early as 1957, sales exceeded one million Deutschmarks.

In the subsequent decades, the fields of operation were expanded to include flow, pressure, analysis and temperature, with new production sites built or bought for development and production. With a growing number of sales partners, Endress+Hauser gradually conquered first the European market and the Asian and the American markets soon followed. After Ludwig Hauser's death, the Endress family became sole shareholders in 1975. At that time, the company had around 1,000 employees. 15 years later, the headcount reached 4,000 with sales in excess of 500 million Swiss francs.

At the dawn of the digital transmission and communication era around 1990, Endress+Hauser was actively involved in various fieldbus initiatives. In early 1995, the company founder placed the business in the hands of his second eldest son Klaus Endress who runs it to this day. Responding to the challenges of globalization, Klaus Endress developed the international network of production and sales, while at the same time steadily expanding - and still expanding - the service range (project planning, maintenance, calibration) and extensive automation solutions (monitoring, control, system integration).

Cascades is adding a new basis weight to the Rolland Enviro100™ Satin offer

Cascades Fine Papers Group has once again improved its 100% recycled papers offering. The Rolland Enviro100™ Satin now allows you to choose a lighter basis weight for your print projects, with the addition of the 50 lb. Text.

Cascades Fine Papers Group has once again improved its 100% recycled papers offering. The Rolland Enviro100™ Satin now allows you to choose a lighter basis weight for your print projects, with the addition of the 50 lb. Text.

This new lighter basis weight is especially designed for brochures, magazines, annual report or can be used on any high-end document with colourful visuals. Rolland Enviro100Satin is the best choice for projects that require precision details. Its satin finish provides print quality attributes of a coated matte paper with the rich tactile feel and dazzling visuals.

Rolland Enviro100 Satin features a unique feel that is silky and smooth. In addition, true to its environmental nature, it is EcoLogo, Processed Chlorine Free and FSC® certified, as well as manufactured with locally sourced and renewable biogas energy. Truly the best of both worlds!

BTG at Tissue World 2013 in Barcelona, B600

BTG are the creping experts and at Tissue World Barcelona we are proud to present a wide range of solutions designed to increase the tissuemaker’s profit by reducing operational costs and increasing productivity. Our TTC – Total Tissue Capability – concept combines our world class creping solutions, Duroblade and CBC, with innovative wet-end measurement technologies. The complete range of newest Mütek lab instruments will be on the booth and experts will be on hand to give detailed accounts of how to use these tools to assess chemical additives in tissue applications.

BTG are the creping experts and at Tissue World Barcelona we are proud to present a wide range of solutions designed to increase the tissuemaker’s profit by reducing operational costs and increasing productivity. Our TTC – Total Tissue Capability – concept combines our world class creping solutions, Duroblade and CBC, with innovative wet-end measurement technologies. The complete range of newest Mütek lab instruments will be on the booth and experts will be on hand to give detailed accounts of how to use these tools to assess chemical additives in tissue applications.

Some examples of annual savings delivered to our customers:

€154,000 converting productivity improvement from improved bulk control

€400,000 savings thanks to chatter solution

€350,000 savings thanks to significant web break reduction thanks to BTG’s CBC™ blade holder

€175,000 in fiber savings through tissue bulk increase

Come and discuss these and other integrated solutions with our team of experts at our booth, No. B600.

BTG is present throughout the papermaking process and is committed to helping clients achieve significant, sustainable gains in business performance, accomplished through our world-wide experts, market-leading technologies and a passion for results.

Spanish Paper Industry Touts Regional Preference Law

In 2013, large retailers, banks, hotel chains, service companies, town councils and other large generators of scrap paper can “legally demand that their recyclable waste materials be [consumed] in Europe,” according to Spanish paper industry association Aspapel.

The Spanish Waste Act, which was passed in late November 2012, “upholds the legality of recycling ‘Made in Europe’ and gives Spanish generators of recyclable waste materials powers to decide on the final destination of their waste,” says David Barrio, director of recycling at Aspapel.

The newest legislation is a follow-up to the 2011 Waste Act, which gave town councils the option to give priority to recycling within the European Union. Now, with the recently passed law, which amends the previous Waste Act, the ability to state a preference for regional proximity is extended to private sector generators.

“Thanks to proximity recycling, the European recycling society turns the six metric tons of waste that each European citizen produces in a year into an opportunity to create wealth and green employment in Europe, in a sustainable, efficient and environmentally responsible manner, thereby giving value to the significant efforts made across Europe in recent years in terms of waste recovery,” states Barrio.

Exporters of recovered fiber and other materials are likely to view the measure as protectionist and hampering with established global trading patterns. Aspapel, in a news release endorsing the new law, says, “By developing a European Recycling Society through measures such as this new Spanish law, the EU estimates that over 400,000 jobs could be created in Europe between now and 2020.”

Aspapel says recycling paper, glass, metal and other materials “and turning them into new products manufactured by the European industry leads to the creation of a circular economy, which in turn builds up a larger industrial sector and creates wealth and employment precisely where the efforts and investments have been made to set up efficient waste collection systems. Furthermore, it guarantees that all recycling will be carried out in accordance with stringent EU environmental requirements.”

“The Spanish paper industry supports this initiative in favor of the circular economy with our own significant and expanding recycling capacity,” adds Barrio. “Nowadays, we are the second largest paper recycling industry in Europe—second only to Germany—a level that enables us to close our cycle by recycling all the used paper and board collected in the country.”

The new act, according to Aspapel, is phrased this way: “Producers and other initial holders of recyclable waste materials may give priority to their complete treatment within the European Union in order to prevent the environmental impact of transporting waste out of the EU, in accordance with applicable regulations.”

Source: http://www.recyclingtoday.com

Shaanxi Yanchang ChinaCoal Yulin selects Metso high-performance valves for Jingbian Energy and Chemical project

Metso has been selected as a primary supplier of ball and butterfly valves to Shaanxi Yanchang ChinaCoal Yulin Energy & Chemical Co., Ltd (Shaanxi Yanchang ChinaCoal). To ensure successful start up, Metso will deploy a technical service team on-site to assist with installation and training. This project has been listed as a UN Project Promoting Clean Coal Technology and a Model Project for Recycling Economy in Shaanxi Province. The goal of the project is to fully utilize the abundant resources, including oil, gas, coal and salt, found in Jingbian region to realize its economic transformation. Metso delivery will be completed before March 2013.

Metso has been selected as a primary supplier of ball and butterfly valves to Shaanxi Yanchang ChinaCoal Yulin Energy & Chemical Co., Ltd (Shaanxi Yanchang ChinaCoal). To ensure successful start up, Metso will deploy a technical service team on-site to assist with installation and training. This project has been listed as a UN Project Promoting Clean Coal Technology and a Model Project for Recycling Economy in Shaanxi Province. The goal of the project is to fully utilize the abundant resources, including oil, gas, coal and salt, found in Jingbian region to realize its economic transformation. Metso delivery will be completed before March 2013.

Metso ball and butterfly valves have long enjoyed a good reputation in the Chinese market and rank among the top brands. Users recognize Metso as a producer of highly reliable and cost-effective valves solutions. Metso has continually gained market acceptance in China based on superior high-performance products, comprehensive technical support, and efficient professional services. Metso is also a leader in valve technologies that substantially improve plant safety and reduce emissions, which are growing concerns throughout the global manufacturing community.

Metso will deliver 300 on-off ball valves and control butterfly valves for low and high density polyethylene (LDPE and HDPE), stage 1 and 2 polypropylene (PP) and catalytic cracking (CC) installations, including PDS (Product Discharge System) valves for LDPE.

The Metso products to be delivered range in size from 1/2" to 18" soft and metal seated valves. Soft seated valves are used in stage 1 and 2 PP. Due to high temperatures and heavy wear conditions, metal seated valves with HVOF (High Velocity Oxygen Fuel) coatings will be used in the HDPE, LDPE, and 1.5 million ton PA deep catalytic cracking (DCC) applications.

Of particular interest are the 33 PDS Valves to be supplied to the LDPE installations. Soft-seated PDS valves are considered to be a weak link in processes seeking to improve output by using high-productivity catalyst. Metso's experience and valve selection knowledge in PDS application provide a competitive edge to chemical companies seeking to improve output for processes using high-productivity catalyst with superior metal seated PDS valves.

Shaanxi Yanchang ChinaCoal administers the Jingbian Energy and Chemical Integrated Utilization project, a key development effort for Shaanxi Province Initial stages of the project will focus on processing a combination of coal, oil-field gas and refinery dry gas to produce methanol, and olefin cracked from residual oils. In later stages the focus will shift to the development of downstream olefin industries and ultimately the creation an industrial chemical base.

Global valve technology leader

Metso is a leading global provider of valve services and solutions, including control valves, automated on/off and emergency shut-down valves, as well as smart positioners and condition monitoring systems. Metso's world-leading product brands are Neles®, Jamesbury® and Mapag®.

Service is a vitally important and growing aspect of Metso's business model. Metso supports its world-class valve solutions via a network of service centers. At present there are 32 strategically located Metso Valves Service Centers in operation throughout the world

Containerboard prices in Russia in 2013 will grow by 11%

Selenga pulp and board mill (located in Buryatia Republic, belongs to Continental Management holding) expects a 16% growth in containerboard sales in 2013. In value terms, growth would amount to 29%. This will be possible due to growing market capacity, replacement of closed mills and price growth, as the company said in a press release received by WhatWood.

Selenga pulp and board mill (located in Buryatia Republic, belongs to Continental Management holding) expects a 16% growth in containerboard sales in 2013. In value terms, growth would amount to 29%. This will be possible due to growing market capacity, replacement of closed mills and price growth, as the company said in a press release received by WhatWood.

According to predictions of Ministry for Industry and Trade, from 2013 to 2017 Russian containerboard market will grow by 4% annually.

Therefore, in 2013 its capacity will increase by 35,000 tons to 1.198 million tons. Demand growth will be driven by increase in consumption of food and non-grocery goods in Russia this year by 3% and 7.6% respectively.

Last year, Russian market experienced lack of containerboard due to ceased deliveries from Bratsk LPK mill and long technical shutdowns of several leading mills. In 2013, the market will also feel lack of board. Ceased deliveries from Bratsk LPK as well upgrades at Mariyskiy and Arkhangelsk pulpmills will lead to decline in containerboard and corrugated paper production by 1.6%. As Marketing Director of Continental Management holding company Nadezhda Ryazantseva said, growth of board output announced by major players will not cover growing demand in full.

All these factors will allow the company to increase its market share from 5% to 6.5%.

Undersupply of board on the market will lead to further growth in prices. Last year, prices grew by 17%, this year the growth will reach 11% at least, as Nadezhda Ryazantseva predicts. First price hikes (3%) are expected on February 01.

Recently WhatWood reported that several market players in North America announced price hikes for February deliveries.

‘’The situation will change in 2014, when we expect a 190,000-200,000 tons growth in Russian production of containerboard. This will offset demand rise. However, in 2014 the market will face another problem, which is undersupply of wastepaper. This will retain production growth and result in wastepaper price hikes. All these factors as well as coming of another large market player, SFT Group, will lead to falling market shares of small companies. Therefore, producers of non-recycled board, including Selenga mill, will have a chance to boost sales’’, Ms. Ryazantseva said.

Last year, the company invested over 240 million Rubles into upgrades

(€5.9 million). Coal boilers #5 and #7 were replaced which decreased environmental pressure and boosted energy generation. Boardmaking machine #1 was upgraded as well in order to improve board quality.

International Paper Reports Fourth-Quarter and 2012 Earnings

International Paper (NYSE: IP) reported preliminary full-year 2012 net earnings attributable to common shareholders totaling $794 million ($1.80 per share) compared with $1.3 billion($3.03 per share) in full-year 2011. In the fourth quarter of 2012, the company reported net earnings of $235 million ($0.53 per share) compared with $281 million ($0.65 per share) in the fourth quarter of 2011. Amounts in all periods include special items and non-operating pension expense.

International Paper (NYSE: IP) reported preliminary full-year 2012 net earnings attributable to common shareholders totaling $794 million ($1.80 per share) compared with $1.3 billion($3.03 per share) in full-year 2011. In the fourth quarter of 2012, the company reported net earnings of $235 million ($0.53 per share) compared with $281 million ($0.65 per share) in the fourth quarter of 2011. Amounts in all periods include special items and non-operating pension expense.

Full-year 2012 Operating Earnings were $1.2 billion ($2.65 per share) compared with $1.4 billion ($3.12 per share) in 2011. Operating Earnings in the fourth quarter of 2012 totaled $305 million ($0.69 per share) compared with $319 million ($0.73 per share) in the fourth quarter of 2011.

Annual sales totaled $27.8 billion in 2012 compared with $26.0 billion in 2011. Quarterly net sales were $7.1 billion in the fourth quarter compared with $6.4 billion in the fourth quarter of 2011.

Full-year 2012 business segment operating profits were $2.0 billion compared with $2.2 billion in 2011. Business segment operating profits in the fourth quarter were $528 million compared with $577 million in 2011, both of which included special items.

"Our success capturing merger benefits from the Temple-Inland acquisition contributed to our fourth quarter results and IP's record cash generation from operations in 2012," said John Faraci, Chairman and Chief Executive Officer. "Given our runway levers and ability to execute, we are positioned to deliver a step-change in earnings as we move through 2013."

SEGMENT INFORMATION

The performance of the company's business segments are measured quarter to quarter without variations caused by special items, as management focuses on business segment operating profits excluding those items. Fourth quarter 2012 business segment operating profits and business trends compared with the prior quarter are as follows:

Industrial Packaging operating profits in the fourth quarter of 2012 were $368 million ($336 million including special items) compared with $342 million ($255 million including special items) in the third quarter of 2012. The profit increase in North America was the result of improved pricing, partially offset by higher planned outage-related maintenance expenses and input costs. Profits for the segment also benefited from seasonally higher sales volumes in Europe and an insurance settlement related to the earthquake that occurred in Northern Italy.

Printing Papers operating profits were $147 million (before and after special items) in the fourth quarter of 2012 versus $201 million ($202 million including special items) in the third quarter of 2012. North American operations were impacted by higher planned outage-related maintenance expenses, seasonally lower sales and lower average sales price for paper, particularly in export markets. Europe's results were stronger quarter over quarter mainly from lower planned maintenance expenses.

Consumer Packaging operating profits were $39 million ($41 million including special items) in the fourth quarter of 2012 compared with $67 million (before and after special items) in the third quarter of 2012. Earnings were impacted by higher outage-related maintenance expenses and lower average sales price primarily due to mix, along with cost associated with the start-up of the coated paper machine in China.

xpedx, the company's North American distribution business, reported operating profits of $11 million ($4 million including special items) in the fourth quarter of 2012 compared with $24 million ($15 million including special items) in the third quarter of 2012, reflecting higher operating expenses in the fourth quarter.

International Paper recorded Ilim joint venture equity earnings of $8 million in the fourth quarter of 2012, compared with equity earnings of $33 million in the third quarter of 2012. Fourth quarter results were lower as modestly higher average prices did not offset increases in input costs. In addition, the after-tax impact of favorable foreign exchange gains was $15 million less in the fourth quarter compared with the third quarter. The gains in both quarters were due to non-cash adjustments associated with the Ilim joint venture's U.S. dollar denominated debt.

Net corporate expenses, excluding non-operating pension expense, for the 2012 fourth quarter were $15 million compared with $1 million in the third quarter of 2012 and $20 million in the fourth quarter of 2011.

Discontinued Operations

Discontinued operations in both the fourth and third quarters of 2012 included the Operating Earnings of Temple-Inland's Building Products business. Also included are pre-tax charges of $13 million ($8 million after taxes) and $2 million($1 million after taxes) in the fourth quarter of 2012 and the third quarter of 2012, respectively, for expenses associated with pursuing the divestiture of this business.

For the full Press release with figures follow this link.........>

Ashland Inc. reports preliminary financial results for first quarter of fiscal 2013.

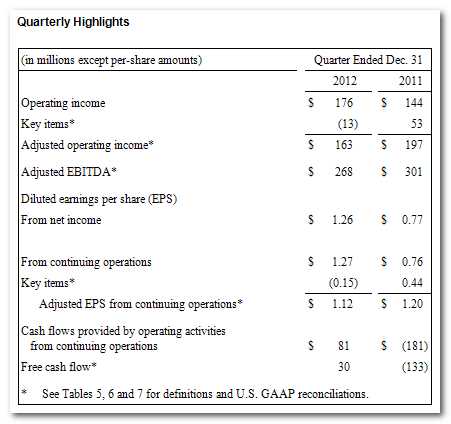

Ashland Inc. (NYSE: ASH), a global leader in specialty chemical solutions for consumer and industrial markets, today announced preliminary(1) financial results for the quarter ended December 31, 2012, the first quarter of its 2013 fiscal year.

Ashland reported income from continuing operations of $102 million, or $1.27 per diluted share, on sales of $1.9 billion. These results included three key items that together had a net favorable impact on continuing operations of $12 million, net of tax, or 15 cents per diluted share. The largest key item was a $13 million after-tax benefit related to a business interruption insurance settlement. Excluding the three key items, Ashland's adjusted income from continuing operations was $90 million, or $1.12 per diluted share, a decrease of 7 percent from the year-ago quarter.

Ashland reported income from continuing operations of $102 million, or $1.27 per diluted share, on sales of $1.9 billion. These results included three key items that together had a net favorable impact on continuing operations of $12 million, net of tax, or 15 cents per diluted share. The largest key item was a $13 million after-tax benefit related to a business interruption insurance settlement. Excluding the three key items, Ashland's adjusted income from continuing operations was $90 million, or $1.12 per diluted share, a decrease of 7 percent from the year-ago quarter.

For the year-ago quarter, Ashland reported income from continuing operations of $60 million, or 76 cents per diluted share, on sales of $1.9 billion. The year-ago results included two key items that had a combined negative effect of $35 million, net of tax, or 44 cents per diluted share. Excluding these items, adjusted income from continuing operations was $1.20 per diluted share. (Please refer to Table 5 of the accompanying financial statements for details of key items in both periods.)

For the remainder of this news release, financial results exclude the effect of key items in both the current and prior-year quarters. On this basis, Ashland's results as compared to the year-ago quarter were as follows:

· Sales were $1.9 billion; normalizing for currency, divestitures and joint ventures, sales were flat;

· Operating income decreased 17 percent to $163 million;

· Earnings before interest, taxes, depreciation and amortization (EBITDA) decreased 11 percent to $268 million; and

· EBITDA as a percent of sales declined 130 basis points to 14.3 percent.

"Our financial performance in the first quarter - which is Ashland's seasonally weakest period of the year - reflects soft demand in some key markets and regions. It also includes $31 million in losses on straight guar, primarily reflecting a discrete write-down of inventory to current market value," said James J. O'Brien, Ashland chairman and chief executive officer. "Without this loss, adjusted earnings per share would have increased 14 percent when compared to a year ago. Ashland Consumer Markets turned in a strong quarter, as higher margins led to a 34-percent increase in EBITDA compared to a year ago. In addition, we generated $30 million of free cash flow in the first quarter, a significant improvement compared to the year-ago quarter."

Business Segment Performance

In order to aid understanding of Ashland's ongoing business performance, the results of Ashland's business segments are described below on an adjusted basis and EBITDA, or adjusted EBITDA, is reconciled to operating income in Tables 7 and 8 of this news release.

Ashland Specialty Ingredients' sales totaled $622 million, a decline of 1 percent when compared to a year ago. EBITDA declined 28 percent, to $116 million, while EBITDA as a percent of sales was 18.6 percent, down 690 basis points versus the year-ago quarter. This year-over-year decline is primarily due to the aforementioned $31 million loss on straight guar, as well as weak demand, particularly in the month of December, in our coatings and construction product lines in emerging markets. Specialty Ingredients' pharmaceutical, hair and oral care, non-guar energy and specialties businesses all generated sales and gross profit increases versus the prior-year quarter.

Ashland Water Technologies' sales totaled $421 million in the December 2012 quarter, a decline of 6 percent from the year-ago quarter. Normalizing for currency effects and adjusting for divestitures, sales would have been flat. EBITDA was $34 million, a 15-percent decline from the year-ago quarter. EBITDA as a percent of sales was 8.1 percent, down 80 basis points. During the quarter, Water Technologies continued to face soft demand in several markets, most notably industrial water treatment. Under a new leader, Luis Fernandez-Moreno, the team is focused on revenue growth and cost structure efficiencies.

Ashland Performance Materials reported sales of $345 million, a 9-percent decrease from the December 2011 quarter. Normalizing for currency and adjusting for divestitures, sales would have been down 4 percent over the prior year. EBITDA declined 38 percent to $28 million, while EBITDA as a percent of sales declined 380 basis points to 8.1 percent, primarily due to lower margins on elastomers, which benefited in the year-ago quarter from declining raw material costs.

Ashland Consumer Markets reported strong results versus the year ago period, with higher earnings driven by lower raw-material costs and a 13-percent volume increase within the international business. While overall sales increased 1 percent, to $481 million, EBITDA rose 34 percent, to $75 million. EBITDA as a percent of sales was 15.6 percent, an increase of 380 basis points versus the year ago quarter.

After excluding the effects from key items, Ashland's effective tax rate for the December 2012 quarter was 24 percent. Ashland continues to expect the effective tax rate for the full 2013 fiscal year to be in the range of 26-28 percent.

Summary and Outlook

"While our first-quarter financial results did not meet our expectations, we believe the biggest issues affecting our performance have been addressed," O'Brien said. "The inventory issue with straight guar is now behind us, and we have taken action to significantly reduce the risks going forward. In addition, the weak volumes we saw within certain parts of our Specialty Ingredients business in December appear to have been short-term, as order patterns through the first four weeks of January have improved to more normalized levels."

"Looking ahead, our strategic focus has not changed. We remain committed to achieving our fiscal 2013 objectives, which should put us in a good position to attain our 2014 overall financial targets and generate significant value for our shareholders," he said.

GL&V to deliver 600 t/d OCC-line to Ukraine

GL&V Sweden AB has received an order for a new OCC line based on the innovative TamPulping™ process technology, designed to produce high quality pulp with a minimum of energy usage.

GL&V Sweden AB has received an order for a new OCC line based on the innovative TamPulping™ process technology, designed to produce high quality pulp with a minimum of energy usage.

The TamPulper™ two-layer pulper enables the pulper and coarse screening stations to be combined, significantly simplifying the process and reducing the connected power requirements. The atmospheric secondary stage TamPulper™ station also has proven to be much more reliable than pressurized style pulpers operating on highly contaminated OCC furnishes.

Apart from the new pulping station, the system includes other innovative GL&V technologies which contribute to the low energy consumption:

- Celleco Twister® and Slidepac® high consistency fine cleaners

- TamScreen™ multistage screens

- High consistency fed CDI disc filters

- The DD®6000 refiner with EquaFlow™ technology