Ian Melin-Jones

Domtar Corporation announces commencement of tender offer for certain outstanding Notes

Domtar Corporation announced that it is commencing a cash tender offer for an aggregate principal amount of its outstanding 5.375% Notes due 2013 (the "First Priority Notes").

7 1/8% Notes due 2015 (the "Second Priority Notes"), 7.875% Notes due 2011 (the "Third Priority Notes") and 10.75% Notes due 2017 (the "Fourth Priority Notes" and together with the First Priority Notes, Second Priority Notes and Third Priority Notes, the "Notes") such that the maximum aggregate consideration for Notes purchased in the tender offer, excluding accrued and unpaid interest, will not exceed $350,000,000 (the "Maximum Payment Amount") and the maximum aggregate consideration for all Fourth Priority Notes purchased in the tender offer, excluding accrued and unpaid interest, will not exceed $75,000,000 (the "10.75% Notes Payment Cap"). The terms and conditions of the tender offer are described in an Offer to Purchase, dated May 21, 2010 (the "Offer to Purchase"), and a related letter of transmittal, which are being sent to holders of Notes.

<<

Aggregate Early Total

Acceptance Principal Tender Consi-

CUSIP Title of Priority Amount Purchase Payment dera-

Number Security Level Outstanding Price(1) (1) tion(1)

-------------------------------------------------------------------------

257559 AB0 5.375% Notes 1 $310,431,000 $1,000 $50 $1,050

due 2013

257559 AC8 7 1/8% Notes 2 $399,723,000 $1,020 $50 $1,070

due 2015

257559 AA2 7.875% Notes 3 $134,752,000 $1,035 $50 $1,085

due 2011

257559 AG9 10.75% Notes 4 $400,000,000 $1,160 $50 $1,210

due 2017

------------------------

(1)Per $1,000 principal amount of Notes accepted for purchase.

>>

Holders of Notes must validly tender and not validly withdraw their Notes on or prior to 5:00 p.m., New York City time, on June 4, 2010, unless extended or earlier terminated (the "Early Tender Time") in order to be eligible to receive the applicable Total Consideration, as set forth in the table above. Holders of Notes who validly tender their Notes after the Early Tender Time and on or prior to the Expiration Time (as defined below) will be eligible to receive only the applicable Purchase Price, which is equal to the applicable Total Consideration minus the Early Tender Payment.

As set forth in the table above. In addition to the applicable Total Consideration or Purchase Price, as the case may be, holders whose Notes are accepted for purchase by the Company in the tender offer will receive accrued and unpaid interest on their purchased Notes to, but not including, (i) in the case of First Priority Notes accepted for purchase on the Early Acceptance Date (as defined below), the Early Payment Date (as defined below), and (ii) in the case of all other Notes accepted for purchase, the Payment Date (as defined below).

The tender offer is scheduled to expire at 12:00 midnight, New York City time, on June 18, 2010, unless extended or earlier terminated (such date and time, as the same may be extended, the "Expiration Time"). As set forth in the Offer to Purchase, validly tendered Notes may be validly withdrawn at any time on or prior to 5:00 p.m., New York City time, on June 4, 2010, unless extended.

Upon the terms and subject to the conditions of the tender offer, the Company expects to accept for purchase any First Priority Notes validly tendered (and not withdrawn) on or prior to the Early Tender Time promptly after the Early Tender Time (the "Early Acceptance Date") and expects that it will pay the Total Consideration for such First Priority Notes on the business day after the Early Acceptance Date (the "Early Payment Date"). Upon the terms and subject to the conditions of the tender offer, the Company expects to accept for purchase all other Notes validly tendered (and not withdrawn) on or prior to the Expiration Time promptly after the Expiration Time and expects that it will pay the Total Consideration or Purchase Price, as applicable, for such Notes on the business day following the date that the Notes are accepted (the "Payment Date").

The Company may waive, increase or decrease the Maximum Payment Amount or the 10.75% Notes Payment Cap at its sole discretion. If the aggregate consideration, excluding accrued and unpaid interest, that would be payable for all Notes that are validly tendered and not validly withdrawn on or prior to the Expiration Time would exceed the Maximum Payment Amount, the Company will accept for purchase Notes that have been so tendered in accordance with the applicable Acceptance Priority Levels, subject, in the case of the Fourth Priority Notes, to the 10.75% Notes Payment Cap.

If the aggregate consideration, excluding accrued and unpaid interest, that would be payable for all tendered Notes of the Acceptance Priority Levels (as set forth in the table above) to be accepted for purchase exceeds the Maximum Payment Amount, Notes of the lowest Acceptance Priority Level to be accepted for purchase will be pro rated (with adjustments downward to avoid the purchase of Notes in a principal amount other than $1,000 or an integral multiple thereof), such that the aggregate consideration payable for all Notes accepted for purchase, excluding accrued and unpaid interest, does not exceed the Maximum Payment Amount and, in the case of Fourth Priority Notes, such that the aggregate consideration for all Fourth Priority Notes accepted for purchase, excluding accrued and unpaid interest, does not exceed the 10.75% Notes Payment Cap. The Company's obligation to consummate the tender offer is conditioned upon the satisfaction or waiver of certain conditions described in the Offer to Purchase.

The Company has engaged Banc of America Securities LLC and Goldman, Sachs & Co. to act as dealer managers in connection with the tender offer. Questions regarding the tender offer may be directed to Banc of America at (646) 855-3401 (collect) or (888) 292-0070 (U.S. toll-free) or to Goldman Sachs at (212) 902-5183 (collect) or (800) 828-3182 (U.S. toll-free). Requests for documentation may be directed to Global Bondholder Services Corporation, the information agent and depositary for the tender offer, at (212) 430-3774 (for banks and brokers) or (866) 470-3700 (U.S. toll-free).

This press release is neither an offer to purchase nor a solicitation of an offer to sell the Notes or any other security. The tender offer is being made only by the Offer to Purchase and the related letter of transmittal. The offer is not being made to noteholders in any jurisdiction in which the making or acceptance thereof would not be in compliance with the securities, blue sky or other laws of such jurisdiction. In any jurisdiction in which the offer is required to be made by a licensed broker or dealer, it shall be deemed to be made on behalf of the Company by the dealer managers or one or more registered brokers or dealers licensed under the laws of such jurisdiction.

About Domtar

Domtar Corporation (NYSE/TSX:UFS) is the largest integrated manufacturer and marketer of uncoated freesheet paper in North America and the second largest in the world based on production capacity, and is also a manufacturer of papergrade, fluff and specialty pulp. The Company designs, manufactures, markets and distributes a wide range of business, commercial printing and publishing as well as converting and specialty papers including recognized brands such as Cougar(R), Lynx(R) Opaque Ultra, Husky(R) Opaque Offset, First Choice(R) and Domtar EarthChoice(R) Office Paper, part of a family of environmentally and socially responsible papers. Domtar owns and operates Domtar Distribution Group, an extensive network of strategically located paper distribution facilities. Domtar also produces lumber and other specialty and industrial wood products. The Company employs over 10,000 people. To learn more, visit www.domtar.com.

Forward-Looking Statements

All statements in this press release that are not based on historical fact are "forward-looking statements." While management has based any forward-looking statements contained herein on its current expectations, the information on which such expectations were based may change. These forward-looking statements rely on a number of assumptions concerning future events and are subject to a number of risks, uncertainties, and other factors, many of which are outside of our control that could cause actual results to materially differ from such statements. Such risks, uncertainties, and other factors include, but are not necessarily limited to, those set forth under the captions "Forward-Looking Statements" and "Risk Factors" of the latest Annual Report on Form 10-K filed with the SEC as updated by the Company's latest Quarterly Report on Form 10-Q. Unless specifically required by law, we assume no obligation to update or revise these forward-looking statements to reflect new events or circumstances.

Negotiations to reduce personnel by 220 finalised in Speciality Papers business area

M-real Corporation, part of Metsäliitto Group, announced on 9 December 2009 plans to improve Speciality Papers business area's profitability. The main measures were stated to be the planned closures of two speciality paper machines in Reflex mill and the streamlining of the organizations in both Gohrsmühle and Reflex mills.

Negotiations to implement the planned measures started in January 2010. Negotiations have now been finalised resulting in a reduction of 220 jobs at the Gohrsmühle and Reflex mills. This represents an about 20 percent reduction of the total workforce. The implementation of personnel reduction is ongoing and it will be finalised by the end of 2010.

Annual production capacity of the Reflex mill will reduce by approximately 80 000 tonnes. The production of carbonless base papers will move to Gohrsmühle mill and the converting as well as the finishing remains in the Reflex mill. The Reflex mill will continue the production of premium fine and digital imaging papers. Product offering and supply capability of M-real Zanders will remain unchanged.

In the future, the Reflex mill will be developed based on a paper park concept. The target is to find industrial partnerships with other producers and thus create new jobs at the mill site. In Gohrsmühle the share of speciality papers of the total product portfolio will continue to increase.

Speciality Papers business area's operating result in the second quarter of 2010 will due to the above mentioned measures include approximately EUR 16 million non-recurring cost provisions. The expected annual profit improvement of these measures is approximately EUR 18 million fully from 2011 onwards.

For further information, please contact: Matti Mörsky, CFO, tel. +358 10 465 4913 Juha Laine, Vice President, Investor Relations and Communications, tel. +358 10 465 4335

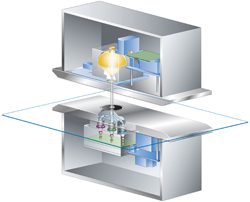

ABB's New Infrared Moisture Sensor

ABB, the pioneer in Quality Control Systems, introduces its new High-Performance Infrared (HPIR) moisture sensor for their QCS800xA Quality Control System (QCS). Intended as a replacement for the very popular HemiPlus moisture sensor, the HPIR is designed to improve the performance and reliability of both new and existing ABB QCS systems. It is the latest step in ABB’s 50-plus year history of providing innovation to the pulp and paper industry.

With HPIR, papermakers can have more confidence in the precision of their moisture measurement. They can achieve tighter CD control, and faster start-ups and grade changes. Papermakers can shift their moisture targets closer to acceptable quality limits, saving energy and reducing fiber costs while remaining within the paper grade’s quality specifications.

With HPIR, papermakers can have more confidence in the precision of their moisture measurement. They can achieve tighter CD control, and faster start-ups and grade changes. Papermakers can shift their moisture targets closer to acceptable quality limits, saving energy and reducing fiber costs while remaining within the paper grade’s quality specifications.

The increased precision comes from several technical breakthroughs in the design that significantly increase the signal-to-noise ratio and the measurement rate of the sensor. As a result, the sensor can resolve moisture streaks as narrow as 4 mm. With a measurement rate of 5000 per second, the sensor provides precision measurements, even as paper machines continue to become wider and faster.

New levels of reliability are also achieved through design simplicity. HPIR does not require liquid cooling, and it is the only moisture sensor on the market with no continuously-moving parts. The modular design allows for easy field replacement of modules, avoiding factory repairs and eliminating the need to stock a complete spare sensor.

To find out more contact your local ABB Account Manager and visit www.abb.com/pulpandpaper.

ABB (www.abb.com) is a leader in power and automation technologies that enable utility and industry customers to improve their performance while lowering environmental impact. The ABB Group of companies operates in around 100 countries and employs about 117,000 people.

For help with any technical terms in this release, please go to: www.abb.com/glossary

For more information please contact:

Eamon Devlin

Global Marketing & Communications Manager

Quality Control Systems Pulp & Paper

Dundalk, Ireland

Phone: +353 42 939 3818

This email address is being protected from spambots. You need JavaScript enabled to view it.

www.abb.com/pulpandpaper

NewPage Presents New On Paper Podcast Featuring Maria Rodale

NewPage Corporation announced today a new On Paper podcast series episode featuring Maria Rodale, chairman and CEO of Rodale Inc., the world's leading multimedia company with a focus on health, wellness and the environment. As the author of four books, including the recently released Organic Manifesto: How Organic Farming Can Heal Our Planet, Feed the World, and Keep Us Safe, Rodale has won numerous awards for her leadership in ensuring a healthy environment for future generations.

In this On Paper episode, available for download at OnPaperSeries.com, Rodale shares her extensive research and family business's documented history as an organic pioneer, to illustrate why chemical-free farm systems are important to healthy environments and strong economies.

“We're not deciding for ourselves about the chemicals in our environment and in our bodies, unless we're choosing organic,” Rodale states.

Discussing recent trends in organic including small company start-ups, younger female farmers entering the field, and big businesses developing organic product lines, Rodale notes that organic is ready for the big time, adding “It's where the action is.”

While organic may be where the action is today, for Rodale Inc., understanding the relationship between the health of earth's soil and people's health is a part of the company's rich history. Almost thirty years ago, Rodale's father started a side-by-side comparison of organic versus chemical agriculture, entitled the Farming Systems Trial, the results of which garnered attention from scientists around the globe.

With On Paper, Rodale shares, “Organic farming is more productive, more profitable, more fuel efficient. And the surprise finding {from the Farming Systems Trial} was that organically farmed soil actually sequesters huge amounts of carbon, which means that it actually is one of the primary solutions to global warming.”

Rodale Inc.'s commitment to studying and responsibly cultivating earth's resources continues today in two new programs that NewPage Corporation is proud to partner, entitled “Tree as a Crop” and “eco4 the planet TM ”. The “Tree as a Crop” partnership is designed to educate farmers and small forest landowners about the environmental, social and economic rewards of properly growing and harvesting trees as a crop. “eco4 the planet TM ” is a demonstration project on a working farm designed to implement “Tree as a Crop”, by teaching communities to plant organically grow trees, to promote new sources of local economic and environmental sustainability.

In addition to OnPaperSeries.com, this new episode is available for download at iTunes.com and Zune.net by searching for “NewPage Corporation”. To receive notification of new On Paper series releases, subscribe free of charge at OnPaperSeries.com. Sponsored by NewPage Corporation, On Paper is now in its third season.

About On Paper Podcast Series

The On Paper Podcast Series, presented by NewPage Corporation, is an ongoing solutions-based dialogue that provides a platform for professionals to share how their organizations implement sustainable practices. With dozens of episodes featuring representatives from the most innovative of corporate America, across a variety of industries, On Paper has garnered more than one million downloads. Visit www.onpaperseries.com to listen to individual episodes and subscribe to receive notices of new episode releases.

About NewPage Corporation

Headquartered in Miamisburg , Ohio , NewPage Corporation is the largest coated paper manufacturer in North America , based on production capacity, with $3.1 billion in net sales for the year ended December 31, 2009 . The company's product portfolio is the broadest in North America and includes coated freesheet, coated groundwood, supercalendered, newsprint and specialty papers. These papers are used for corporate collateral, commercial printing, magazines, catalogs, books, coupons, inserts, newspapers, packaging applications and direct mail advertising.

NewPage owns paper mills in Kentucky , Maine , Maryland , Michigan , Minnesota , Wisconsin and Nova Scotia , Canada . These mills have a total annual production capacity of approximately 4.4 million tons of paper, including approximately 3.2 million tons of coated paper, approximately 1.0 million tons of uncoated paper and approximately 200,000 tons of specialty paper. To learn more, visit www.NewPageCorp.com

Media Contact:

Shannon K Semmerling

NewPage

001-715-422-4023

Kruger Inc. cuts back production at its two Trois-Rivères mills

Kruger Inc. and its subsidiaries today announced that they will cease coated and supercalendered paper production at the Trois-Rivières Mill and extend the interruption of directory paper production at the Wayagamack Mill for an indefinite period of time.

At the Trois-Rivières Mill, the No. 1 (coated paper) and No. 6 (supercalendered paper) Paper Machines, and the No. 8 Coating Machine will be shut down indefinitely, effective June 11, 2010. This measure will affect approximately 320 employees in Production, Maintenance and Administration. The mill, however, will continue to produce newsprint with close to 300 jobs maintained.

The No. 3 Machine at the Kruger Wayagamack Mill, which had stopped making directory paper on December 31 and was to resume operations in June, will be idled indefinitely. The extended shutdown will affect approximately 120 employees. However, the mill will maintain coated paper production, which means continued employment for over 350 employees.

Kruger came to these decisions due to persistently unfavourable market conditions and the strong Canadian dollar.

Founded in 1904, Kruger Inc., directly and through its subsidiaries, is a major producer of publication papers, tissue, lumber and other wood products, corrugated cartons from recycled fibres, green and renewable energy and wines and spirits. It is also a leader in paper and paperboard recycling in North America. Kruger operates facilities in Quebec, Ontario, British Columbia, Newfoundland and Labrador and the United States.

INFORMATION:

Jean Majeau

Senior Vice President

Corporate Affairs and Communications

Tel.: (514) 343-3213

E-mail: This email address is being protected from spambots. You need JavaScript enabled to view it.

Website: www.kruger.com

First Heidelberg Speedmaster CX 102 for German Customer

The first press of the Speedmaster CX 102 series, introduced by Heidelberger Druckmaschinen AG (Heidelberg) as a world premiere on the occasion of IPEX in Birmingham, has been sold to German commercial printshop Kern GmbH, located in Bexbach, Saarland. The new machine is designed for industrial offset printing and joins the ranks between the Speedmaster SM 102 / CD 102 and the Speedmaster XL 105. André Kern, Managing Director of Kern GmbH, outlines the company's philosophy: "We have always been fascinated by innovations. With the Speedmaster CX 102 we have been provided with the XL 105 peak performance technologies plus a considerably increased productivity, which however allows us to stick to the familiar and proven format."

The first press of the Speedmaster CX 102 series, introduced by Heidelberger Druckmaschinen AG (Heidelberg) as a world premiere on the occasion of IPEX in Birmingham, has been sold to German commercial printshop Kern GmbH, located in Bexbach, Saarland. The new machine is designed for industrial offset printing and joins the ranks between the Speedmaster SM 102 / CD 102 and the Speedmaster XL 105. André Kern, Managing Director of Kern GmbH, outlines the company's philosophy: "We have always been fascinated by innovations. With the Speedmaster CX 102 we have been provided with the XL 105 peak performance technologies plus a considerably increased productivity, which however allows us to stick to the familiar and proven format."

Convincing versatility

In the forefront of the investment, André Kern and his team also had evaluated medium-format presses of different manufacturers. "Asian suppliers in particular are currently offering rock-bottom prices that are very tempting at first glance," says Kern. "However, our job portfolio and three-shift operation require a press, which delivers excellent productivity, consistent print quality and high availability from start to finish. In addition, we print on an extremely wide range of substrates, running the gamut from 50 gsm flimsy paper to board weighing over 300 gsm. We are certain that the Speedmaster CX 102 is the best solution for our diversity of requirements. The smooth running of the press and its ergonomic operation are convincing. Ever since we made the decision to invest in the Speedmaster CX 102, everyone is excitedly anticipating the world's first in its kind. As a long-term customer, we know that we can always rely on the well-proven quality and performance in regard to Heidelberg innovations."

Lean processes and highly productive equipment as key to success

This state-of-the-art print shop runs a highly automated operation, and its central production processes are fully integrated via the Prinect Workflow. The new Speedmaster CX 102 five-color press with coating unit continues the tradition of the 70 × 100 cm format. To date, two Speedmaster SM 102 units were in operation - one six-color and one eight-color press. The six-color press has now been replaced by the new Speedmaster CX 102.

coating unit continues the tradition of the 70 × 100 cm format. To date, two Speedmaster SM 102 units were in operation - one six-color and one eight-color press. The six-color press has now been replaced by the new Speedmaster CX 102.

On a production area of some 2,200 square meters, a team of 35 works for manufacturers of branded goods, cosmetic suppliers, insurance companies, and consumer goods producers. The company produces items such as brochures, catalogs, and other marketing materials using offset and digital printing. Kern GmbH also uses its in-house mailing center to provide a wide variety of logistics services for direct marketing customers. The Kern GmbH is a family-run company in the fourth generation, managed by Juergen, Joachim, and André Kern. The Bexbach-based printshophas a subsidiary in Sarreguimines, France.

Picture 1:

Heidelberg introduced the Speedmaster CX 102 on the occasion of IPEX 2010. This marked the world premiere of a new printing press for industrial offset printing with a production speed of 16,500 sheets per hour. The new press, which manages flimsy papers, stiff board and a wide range of plastic materials as well, convinces by its high productivity and its versatility.

Picture 2:

The Speedmaster CX 102 provides André Kern with the XL 105 peak performance technologies the and considerably increased productivity- and allows the company to stick to the familiar and proven format.

For further information, please contact:

Heidelberger Druckmaschinen AG

Corporate Public Relations

Dirk Henrich

Phone: +49 (0)6221 92 5910

Fax: +49 (0)6221 92 5096

E-mail: This email address is being protected from spambots. You need JavaScript enabled to view it.

Design of innovative Blade Compressor™ released

Clean Tech developer Lontra has provided the first glimpse of the innovative Blade Compressor™, a technology that has been in development by the company since 2004.

The compressor, which was designed by Lontra’s Technical Director Steve Lindsey, is a rotary device with a wrapped toroidal chamber. The key features are a rotating blade, which passes through a slot in a rotating disc once per cycle. The unit is therefore a compact, double acting rotary compressor. An animation of the design, and an explanation of the technology, are at Lontra’s website www.lontra.co.uk

Prototypes demonstrate a 20% efficiency gain over traditional compressors, and has an innovative variable port design which allows it to meet changing application requirements whilst maintaining constant speed. The company has development projects underway with leading partners, including a development project for waste water compressors jointly funded by the Carbon Trust and Severn Trent Water.

The compressor is the core mechanical geometry of the range of Lontra’s applications, including the Blade Supercharger™, Blade Expander™ and Lindsey Engine®. technology.

Contact

Tel: +44 (0)20 7833 1611

Simon Hombersley

Business Development Director

This email address is being protected from spambots. You need JavaScript enabled to view it.

Subscription warrants in Rottneros AB

A decision was made at the AGM of Rottneros on 22 April 2010 to issue no more than 30 million subscription warrants to be used for a subscription warrant programme for eight senior executives.

The subscription period has now expired and 12 million subscription warrants will be assigned to those entitled to subscribe. The price per option amounts to SEK 0.10. Ten subscription warrants are required to subscribe for one new ordinary share. The issue price amounts to SEK 9.75 per share and it is possible to subscribe for shares during the period 17 May 2011 to 16 May 2013.

The company intends to cancel subscription warrants that have not been assigned. The dilution effect will amount to 0.8 per cent in the event that all the warrants are exercised.

For further information please contact:

Tomas Hedström, Chief Financial Officer, +46 8 590 010 00

Metso promotes sustainable development at the World EXPO in Shanghai

Metso and Chinese pulp and paper industry top executives gathered together on May 18 in an industry summit focusing on the promotion of sustainable development in the industry. The event, supported by China Paper Industry Chamber of Commerce, took place in the Finland pavilion at the Shanghai World EXPO, and was followed by an awards ceremony, hosted by Metso.

Metso and Chinese pulp and paper industry top executives gathered together on May 18 in an industry summit focusing on the promotion of sustainable development in the industry. The event, supported by China Paper Industry Chamber of Commerce, took place in the Finland pavilion at the Shanghai World EXPO, and was followed by an awards ceremony, hosted by Metso.

"Ever increasing energy costs and emissions regulations, as well as the need to decrease fresh water usage are major considerations for the process industry around the world today. Pulp and paper industry is no exception. Investment in the development and implementation of the best available technology is the only way to boost energy and materials efficiency, and to reduce emissions and water consumption", states Ari Harmaala, President of Metso Operations in China.

The event focused on two main themes: How to solve the contradiction between shortage of raw material supply and rapid growth in investments in China, and how to produce pulp and paper in a sustainable way. Today, carbon emissions and ecological sustainability are already of high concern in China, but they are expected to grow in importance as stricter policies are being implemented.

China is the world's leading producer of paper and board with its annual production of over 80 million tons. Due to rapid investment in the industry since 1990s, China has the most modern pulp and paper making fleet in the world. Metso has played a key role in this development by having supplied about 35 percent of China's paper and board machine capacity built since 2000, thus earning its position as the market leader in China.

Since the outset of its pulp and paper operations in China in the 1950's, Metso's scope of operations has expanded to include the mining, construction, energy and recycling industries. Today, Metso employs close to 3,000 professionals in 24 local subsidiaries and sales and service outlets in China. In 2010, two new locations will be inaugurated. One of them is the technology center to be opened in Shanghai on May 28 comprising a state-of-the-art valve factory and a supply center as well as assembly and testing facilities for process automation systems. In fall 2010, Metso will open its third service center in China, in Zibo, Shandong, for the pulp and paper industry.

Metso is one of the sponsors of the Finland pavilion at the World EXPO. During the EXPO, Metso will arrange several targeted customer events focusing on clean solutions that help overcome demanding process industry challenges regarding eco-efficient operations.

Metso is a global supplier of sustainable technology and services for mining, construction, power generation, automation, recycling and the pulp and paper industries. We have about 27,000 employees in more than 50 countries. www.metso.com

Further information for the press, please contact:

Ari Harmaala, President of Metso Operations in China, tel. +86 13911792766

Source: www.metso.com

Image © Partanen & Lamusuo Partnership/Anima Vitae/Finpro

UPM plants trees together with children and stakeholders

UPM has invited schoolchildren and other stakeholders to plant trees as part of the company’s annual tree planting day. UPM’s tree planting day, which was organised for the first time last year, takes place on May 21 in most locations. This year, the company organises tree planting day events in Finland, Russia, UK, USA and Uruguay.

At the events, stakeholders are taken to the forest, where they are guided by UPM’s forestry specialists.

”Tree planting is a concrete way of bringing issues related to forests closer to people. On the tree planting day, we want to emphasize the importance of native tree species, which many species of flora and fauna are dependent on for habitat”, says Timo Lehesvirta, Director, Sustainable Forestry, UPM.

”Tree planting concretely shows how we always have to think of actions related to forestry and forest regeneration in the long term, decades ahead. International environmental questions connected with tree planting include biodiversity, mitigating climate change and soil and flood protection,” Lehesvirta points out.

UPM is committed to carrying out its international biodiversity programme. The goal of UPM’s biodiversity programme is to secure biodiversity as a vital part of sustainable forestry, simultaneously promoting best practices in forestry. The United Nations biodiversity declaration signed by UPM is a natural part of the company’s long-lasting work in developing sustainable forestry practices. This year is the UN’s biodiversity year, and May 22 is UN’s biodiversity day.

For further information, please contact:

Timo Lehesvirta, Director, Sustainable Forestry, UPM, tel. +358 204 16 4650